Will DEXs Finally Kill CEXs?

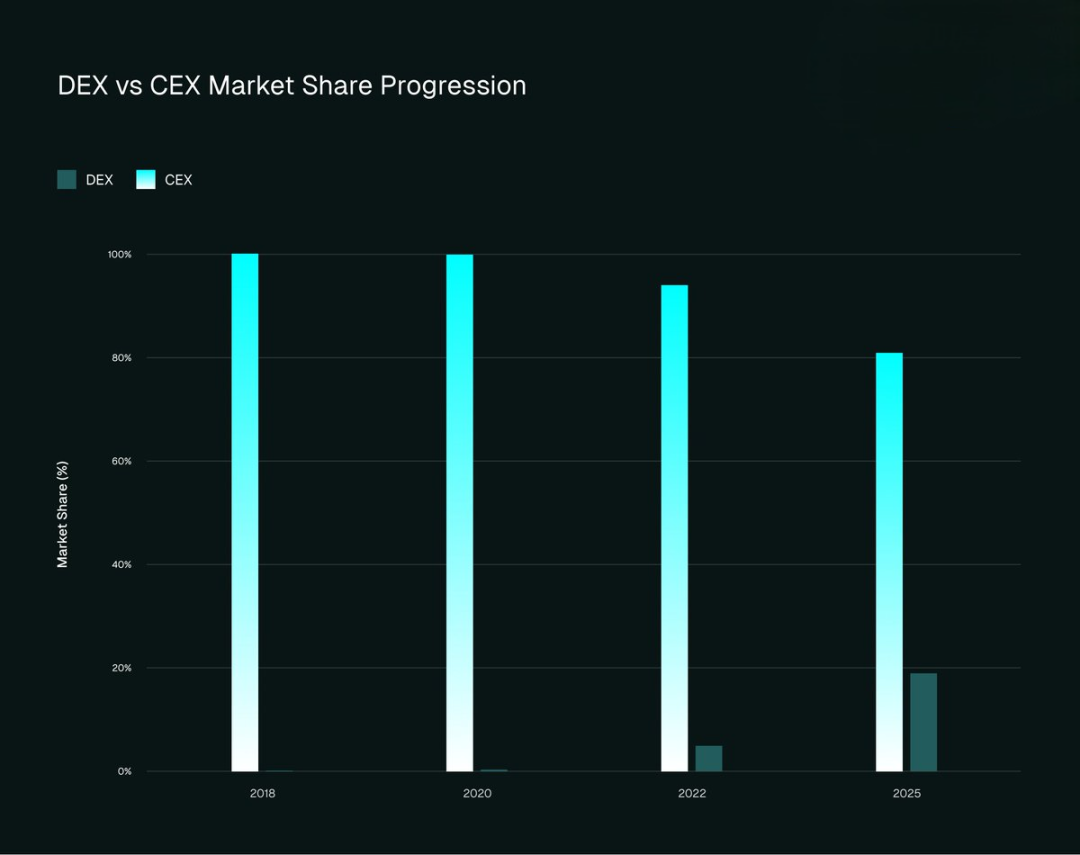

DEX market share is projected to surpass CEXs in the next 2-3 years, driven by structural maturity and the demand for self-custody.

Key Takeaways

- DEX market share is projected to surpass CEXs in the next 2-3 years, driven by structural maturity and the demand for self-custody.

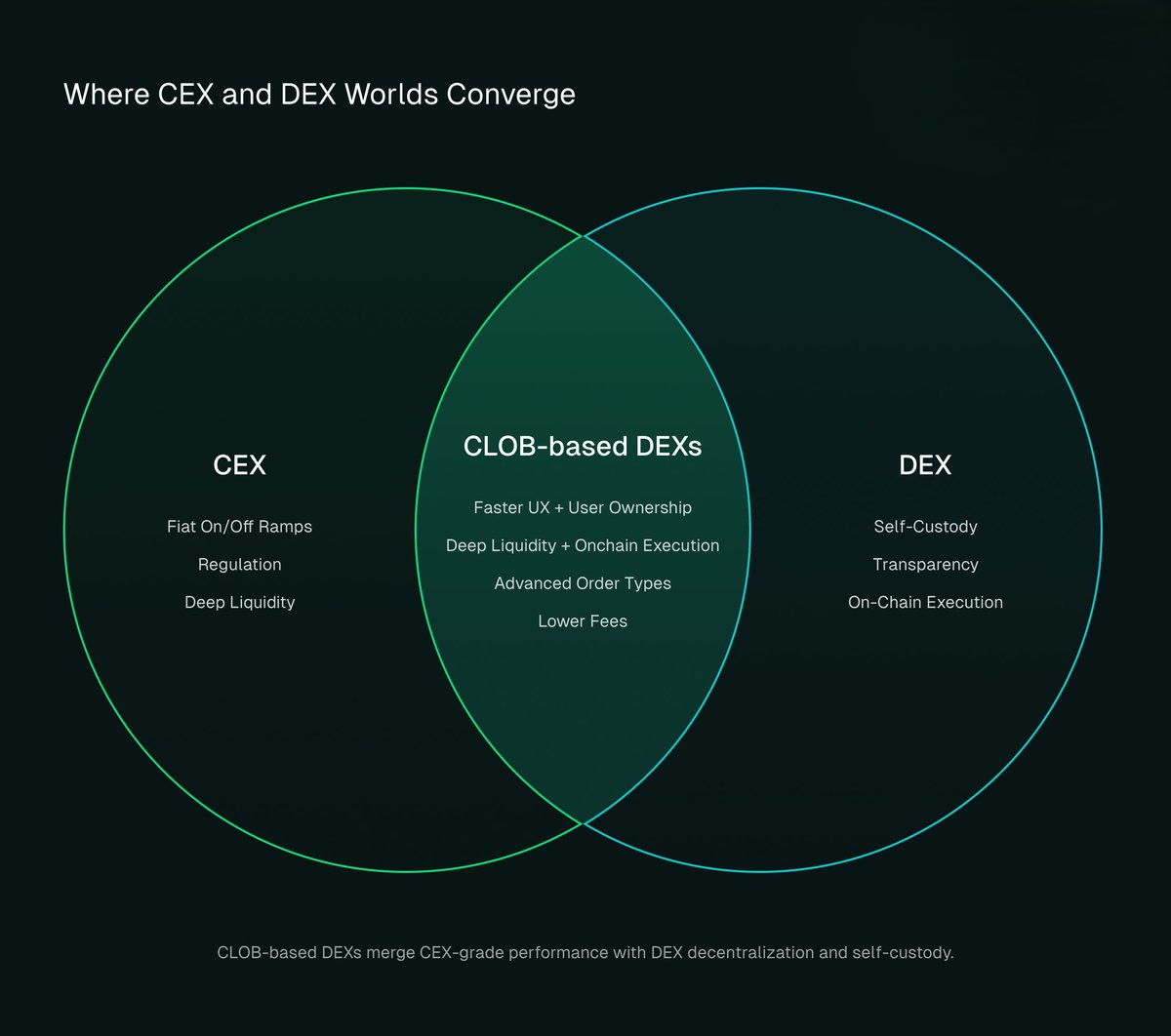

- The fundamental shift to the CLOB (on-chain order book) model has solved the performance gap, giving DEXs CEX-level speed and low latency.

- DEXs now hold an unmatchable competitive advantage: trust minimization and self-custody, making them resilient to the exchange failures that plague centralized platforms.

Decentralized finance (DeFi) has undergone a profound evolution. For years, the question was whether Decentralized Exchanges (DEXs) could even survive in the shadow of giants like Binance and Coinbase. Today, the question has shifted: Will DEXs finally replace Centralized Exchanges (CEXs)?

This is not a theoretical debate. The competition gap has narrowed to an unprecedented degree. This article analyzes the irreversible structural maturity of DEX infrastructure that has transformed them from an "experimental alternative" into a credible, direct competitor poised to capture a majority market share in the next 2-3 years.

The Historical Friction: Why DEXs Failed to Catch Up

To understand the current breakthrough, one must recognize the structural limitations that plagued DEXs for nearly a decade. For multiple cycles, the dominance of CEXs was rooted in one simple truth: Decentralization came with unacceptable friction.

Early Barriers (2017–2022)

The early history of DEXs was defined by failure to match the Web2-like speed of centralized platforms:

- High Cost and Latency: Early DEXs running on Ethereum Layer 1 required transactions that took minutes to settle, often incurring Gas fees soaring into the hundreds of dollars. This made high-frequency trading and even small swaps impractical.

- Poor User Experience (UX): Simple interfaces, fragmented cross-chain liquidity, and the constant threat of impermanent loss (IL) meant that professional traders overwhelmingly chose the speed and ample liquidity of CEXs.

The Crisis of Trust vs. Utility

Even after the FTX collapse in 2022 drove users to self-custody and saw DEX volumes surge, the gains were temporary. As the immediate panic subsided, users returned to CEXs because the core problems, poor UX and lack of low-latency execution—remained unsolved. The structural gap between decentralized ideals and practical performance was simply too vast.

The Structural Leap: The CLOB Revolution

The current, sustained expansion of DEX market share is fueled by a structural evolution in trading architecture: the shift from AMM (Automated Market Makers) to CLOB (Central Limit Order Book) models.

CLOB: The Fusion of Performance and Security

While AMM revolutionized permissionless liquidity (allowing anyone to provide funds), the CLOB model introduced CEX-level performance to the decentralized world. CLOB DEXs (like Hyperliquid and dYdX v4) represent the ultimate "convergence direction": they retain the decentralized core of self-custody and transparency while adopting the efficiency of traditional finance.

Eliminating Market Friction

CLOB-based DEXs have successfully eliminated the historic friction points:

- Sub-Second Latency: Through specialized Layer 1 and Layer 2 solutions, CLOB DEXs now achieve transaction confirmation in milliseconds (e.g., 0.07 seconds), making them functionally equivalent to top CEXs.

- Low Cost and Slip-Proof: Fees are drastically compressed, often rivaling CEXs (e.g., perpetual trading fees around 0.035%-0.045%). Crucially, the deep order book solves the high-slippage problem endemic to AMMs, allowing institutions and professional traders to execute large-volume trades efficiently.

How DEXs Surpass CEXs?

With the performance gap virtually closed, DEXs now compete on fundamental structural superiority in three key areas:

- Trust and Security (The Unassailable Advantage)

DEXs possess a strategic advantage that CEXs can never match: trust minimization. Chain-level settlement, transparent proof-of-reserves, and user self-custody mean that funds are immune to centralized exchange failure, hacking, or regulatory seizure. This resilience, especially after high-profile collapses, is the ultimate assurance for capital.

- Cost and Liquidity Innovation

The business model of trading is being actively disrupted. New CLOB models are introducing zero-fee structures—replacing traditional commissions with revenues from order flow payments (PFOF) or governance fees. This eliminates the largest cost barrier for high-frequency retail and quantitative traders, forcing CEXs to rapidly rethink their entire fee structure.

- Innovation and Composability

DEXs provide permissionless innovation. Any token can list instantly without paying a central exchange fee, and any financial product (perpetuals, options) can be built and instantly integrated with other DeFi protocols. This "composability" offers users complex trading and yield-generation strategies that are simply not possible within the rigid framework of a CEX.

The Inevitable Flippening

The data on market share expansion is conclusive. DEX market share has surged dramatically, reaching close to 19% of spot trading volume and 13.3% of perpetual volume in 2025. This structural acceleration confirms that the "turning point" has already passed.Based on current growth trajectories, the prediction is firm: DEX market share is projected to capture the majority of both spot and perpetual trading within the next two to three years. The question is no longer if decentralized finance will dominate trading, but when. The future belongs to platforms that can offer performance, security, and true self-custody simultaneously.

Cwallet: Your Secure, All-in-One Gateway to Global Crypto Finance

Cwallet redefines the digital wallet, offering a unified, high-performance platform to manage your entire portfolio, supporting over 1,000 cryptocurrencies across 60+ global networks. We combine top-tier security with unmatched utility:

Financial Control: Go beyond holding. Engage in dynamic market action with zero-fee Memecoin/xStocks trading, or join the fun with interactive prediction tools like Trend Trade and Market Battle.

Real-World Power: Instantly unlock the spending potential of your assets. The Cozy Card transforms your crypto into a flexible payment solution, enabling secure, real-world transactions online and offline.

Practical Tools: Boost efficiency with integrated, unique services. Leverage HR Bulk Management for business needs, or utilize Gift Cards and Mobile Top-ups for everyday utility.

Cwallet is where security meets utility and innovation in one powerful application.

Join millions who are transforming the way they manage their digital wealth!

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: This content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.