Why KYC Verification is Important for P2P Trading Platforms

KYC creates a traceable identity within the platform's community and guarantees they are who they say they are. For P2P transactions to remain transparent and accountable, traceability is essential. As a user, you can be sure that you are dealing with reputable people

Cryptocurrency trading can be compared to a bustling marketplace where buyers and sellers converge from every corner of the globe, united by a shared vision of financial freedom and autonomy. Peer-to-peer (P2P) trading platforms are decentralized exchanges that allow crypto enthusiasts to transact freely without the constraints associated with traditional financial intermediaries.

There has always been a looming, unanswered question in the hearts of many traders. How can I trust any of these P2P platforms? Know Your Customer (KYC) verification, a vital mechanism, provides a solution and an answer to this question, bridging the gap between decentralization and security.

In this article, we unravel the significance of KYC verification in P2P crypto trading platforms and why you, as a user, should embrace KYC verification with open arms.

What is KYC Verification In P2P Trading?

KYC (Know Your Customer) verification refers to the process through which businesses verify the identity of their customers to ensure they are who they claim to be. It involves collecting personal information and documents from customers to establish their identity and assess potential risks associated with conducting business with them. KYC procedures are crucial in various industries, particularly finance and online trading, to prevent fraud, money laundering, and other illicit activities.

In crypto P2P transactions, KYC verification is a measure put in place to ensure that buyers are assured of getting the cryptocurrency they pay for. Since P2P transactions involve two parties trading without any intermediary, the P2P platform, where the trade is happening, serves as an escrow for the value of the funds being transferred. Hence, in order to ensure that traders can trade without any issues, these platforms mandate KYC verification for their users.

Why KYC Verification is Important for P2P Trading Platforms

It ensures traceability and accountability

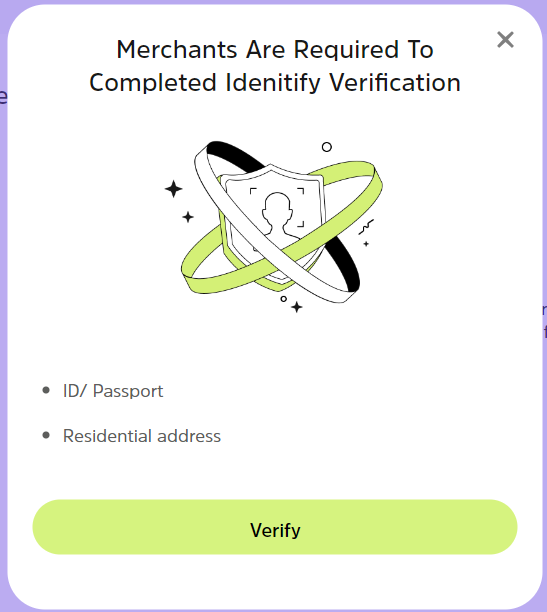

One essential procedure used by P2P trading platforms to confirm the identification of their users, especially merchants or sellers, is known as KYC verification. Merchants have to submit legitimate identification documents through this process, such as utility bills, passports, or government-issued identification cards. These documents allow the platform to validate their validity by providing evidence of their identity, address, and other relevant information.

By confirming merchants' identities, KYC creates a traceable identity within the platform's community and guarantees they are who they say they are. For P2P transactions to remain transparent and accountable, traceability is essential. As a user, you can be sure that you are dealing with reputable people or companies, which lowers the possibility of fraudulent activity. P2P platforms have increasingly become targets for criminals seeking to exploit the anonymity they offer to commit financial crimes and fraud.

It deters fraudulent behavior

Furthermore, the verification of financial data, including credit card or bank account information, is a common step in KYC procedures. This assists in confirming the validity of transactions and stops scammers from using fraudulent or stolen bank credentials to carry out illegal operations on the platform. P2P platforms are able to detect inconsistencies or anomalies that can point to fraudulent activity by comparing the data entered by users during KYC verification with databases and financial institutions outside of the platform.

Moreover, the implementation of KYC verification in peer-to-peer transactions serves as a deterrent to prospective fraudsters, since the possibility of enduring rigorous identification verification procedures dissuades persons with malicious intent from utilizing the platform for unlawful activities. In addition to aiding in the prevention of fraudulent transactions, this proactive strategy serves to uphold the general integrity and trustworthiness of the platform.

Dispute Resolution Can Be Escalated With Law Enforcement For Fraudulent Merchants

In addition to its role in preventing fraudulent transactions, KYC verification facilitates collaboration between P2P trading platforms and law enforcement agencies for the effective handling of fraudulent activities. Platforms frequently have systems in place that allow users to report questionable accounts or transactions to the appropriate authorities, allowing for quick prosecution of offenders.

Platforms obtain comprehensive user data through KYC procedures, which can be very helpful to law enforcement in their investigations. The aforementioned data, which could comprise user identities, transaction histories, and communication records, can furnish law enforcement with vital leads and proof to prosecute individuals who commit fraud or breach their contractual obligations.

P2P Trading with Cwallet

Cwallet is an interactive cryptocurrency wallet used to buy, sell, and swap your cryptocurrency. With the aim of bridging the gap between traditional crypto wallets and holistic crypto exchange services, Cwallet has incorporated numerous features, including instant zero-cost swaps, community tipping and airdrops, and even, peer-to-peer trading.

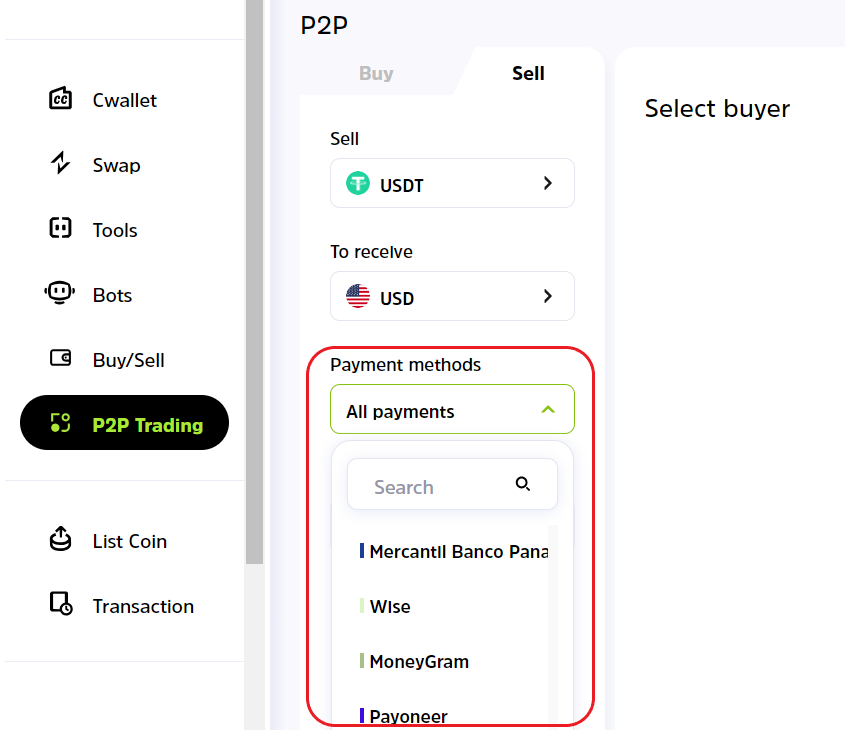

Cwallet's P2P platform is free. Whether you want to buy or sell, you can use your preferred payment methods to complete p2p trades without any fees.

Although Cwallet's system is fully automated, escrows are available in rare cases where intervention is needed to de-escalate possible conflicts. Traders are fully insured against fraudulent attempts to take payments without fulfilling the orders.

When a trade advertisement is submitted, a corresponding amount of cryptocurrency is reserved from the seller's wallet. This means that if the seller does not release your cryptocurrency and it escalates to a dispute, Cwallet customer support steps in as a mediator to examine your evidence and release the funds to you, ensuring that the platform is safe and no one loses their crypto assets.

More importantly, the KYC requirement is mandatory for all merchants; hence, without completing an ID and address verification, they are ineligible for trades.

Key Takeaway

KYC verifications are put in place for security reasons - to safeguard your assets as an investor and to mitigate every risk that may be associated with P2P trading.

Unregulated P2P trading can be risky due to the lack of escrows that can aid in the escalation of fraudulent transactions. However, with P2P platforms like Cwallet that prioritize KYC verification, you can trade safely and with confidence.

As a crypto investor, you need not fret; KYC verification is to help you trade safely. Start trading with Cwallet today!