What's Behind the Drop While Solana Liquidity Crashes to Bear-Market Levels?

Solana liquidity just dropped to bear-market levels, with over $500 million in long positions at risk of liquidation.

Key Takeaways

- Solana liquidity just dropped to bear-market levels, with over $500 million in long positions at risk of liquidation — adding high downside pressure on the price.

- Most SOL holders are underwater, making the token vulnerable to further selling pressure if sentiment worsens.

- Tools like Cwallet help manage risk by giving clear oversight over holdings, enabling diversification or timely exits as conditions evolve.

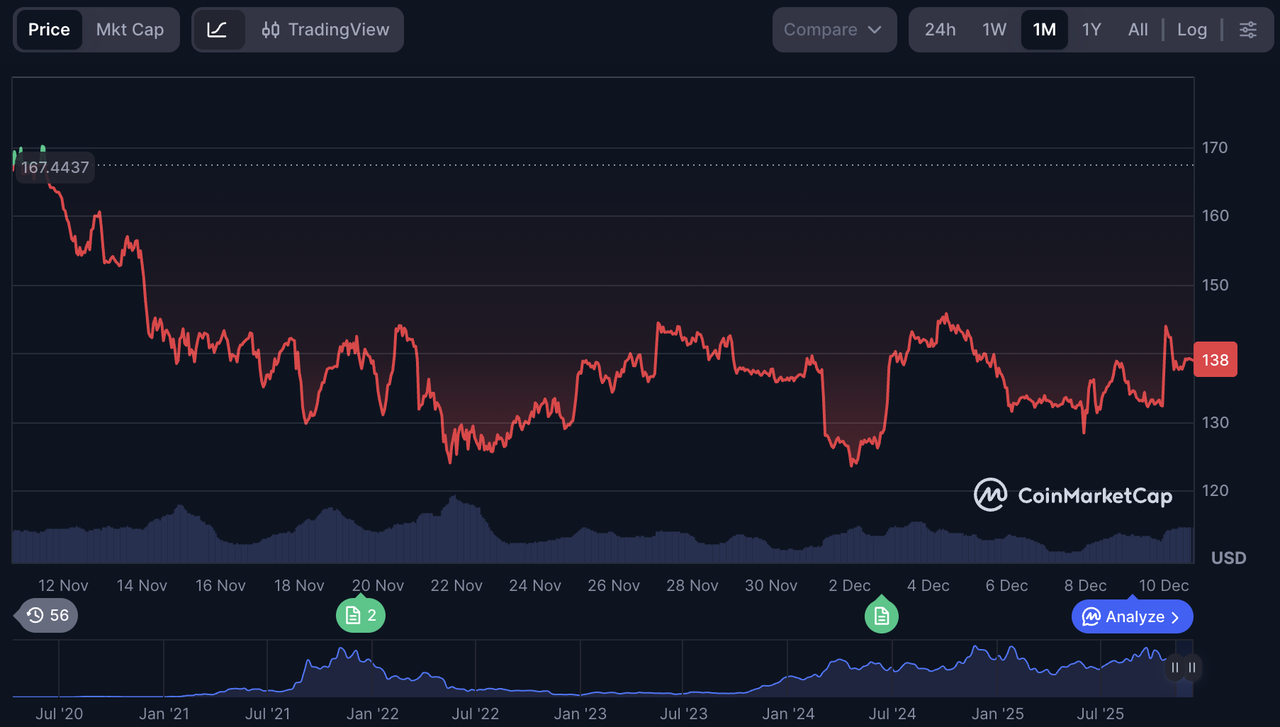

Solana is facing a serious shake-up: recent data indicates that liquidity on the network has plunged back to "bear market" territory. On-chain analytics show that over $500 million in SOL long positions could be liquidated if SOL falls just 5–6%.

For many traders and holders, that raises an urgent question: with liquidity drying up and selling pressure building, what does this mean for the price, risk, and future of SOL?

What's Happening With SOL Liquidity and Price

Liquidity Reset & Liquidation Overhang

- On-chain data shows Solana's 30-day realized profit-to-loss ratio has stayed below 1 since mid-November — meaning more traders are locking in losses than gains.

- Analysts describe the situation as a "full liquidity reset." Historically, such phases often precede deep troughs in price, but could also mark the start of a bottoming process.

- If SOL price drops to around $129, roughly $500 million in leveraged long positions might face forced liquidation. That’s a heavy overhang, raising the risk of a cascade of sell-offs.

Deep Losses Across Supply

- Recent data suggests nearly 80% of the circulating SOL supply may be underwater — meaning most token holders acquired at prices higher than current levels.

- When a majority is at a loss, selling pressure tends to increase if sentiment worsens, which can further amplify downward moves.

Technical & Market Pressure

- Recent price drops have broken key support zones: for example, $SOL recently dipped near $153–$152 despite inflows, showing that even modest demand couldn't stabilize the price.

- Broader crypto market volatility, macroeconomic headwinds, and increasing leverage across the board are adding to risk. SOL — like many high-beta crypto assets — tends to amplify these swings.In short: the conditions suggest a precarious balance — with high downside risk in the near term, and potential for volatility if liquidity doesn't recover quickly.

What This Means for Crypto Investors and Traders

For anyone holding or trading SOL now, the situation demands caution and awareness:

- High risk of sudden drops

With such a large liquidation overhang, weak sentiment or a broader market pullback could trigger steep losses.

- Volatility likely stays elevated

Prices may swing hard — both downward and upward — depending on how liquidity and market sentiment evolve.

- Not the time for large leveraged bets

Given the fragility, long-term holders or cautious traders might consider reducing leverage or holding off on aggressive positions.

- Need for diversified holdings and risk control

Spreading exposure and using tools to track assets becomes more important than ever.

How Cwallet Can Help Amid Solana's Turbulence

In volatile times like these, managing your crypto holdings carefully is crucial. That's where Cwallet can be especially useful:

- It allows you to track multiple holdings across different blockchains — handy if you hold SOL plus other assets.

- You get real-time portfolio visibility, so you can spot sudden value drops or liquidation risks early.

- If you choose to diversify out of SOL temporarily, Cwallet supports spot trades (Buy/Sell, or Swap), helping you act quickly without juggling multiple interfaces.

For traders and investors trying to ride out Solana's turbulence or switch strategies, a consolidated, secure tool like Cwallet can make a big difference.

What to Watch — Key Signals for the Next

As the market digests this liquidity reset, attention should go to:

- On-chain liquidity metrics & realized profit/loss ratios — improvement here could signal stabilization.

- Large liquidation clusters — if long-position liquidation triggers cascade events, prices could tumble fast.

- Exchange outflows vs inflows — persistent capital outflow from exchanges may stabilize supply pressure; inflows without liquidity replenishment may worsen risk.

- Overall crypto market environment — macro shocks, Bitcoin moves, or broad sentiment shifts will likely impact SOL especially hard now.

Cwallet: Your All-in-One Gateway to the Digital Economy

Cwallet is more than a crypto wallet; it's a complete ecosystem designed to make crypto trading accessible, intuitive, and rewarding. We've redefined what a wallet can be, transforming it into your ultimate hub for everything from securing your assets to exploring market opportunities.

Move beyond simple storage. Cwallet unlocks the power of smarter crypto trading right from your pocket. With features like Trend Trade and Market Battle, we empower both new and experienced users to engage with the markets in dynamic ways. Dive into the action with real-time trading across 1,000+ cryptocurrencies and 60+ blockchains, all while maintaining full control of your assets. It’s the simplicity of a crypto app combined with the power of a pro-level trading platform.We're building the bridge between the digital economy and your daily life. Cwallet seamlessly integrates essential crypto services, allowing you to easily store, swap, and earn from your digital assets. Looking ahead, our commitment to real-world utility continues with upcoming features like the Cozy Card, mobile top-ups, and gift cards.

Cwallet makes crypto not just a technology for the future, but a practical tool for today!

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.