Top Strategies You Can Use To Profit From The Crypto Market As A Beginner

Range trading depends on technical analysis knowledge, specifically support and resistance. It is a strategy that identifies the price range of an asset for a particular period and trades it within the range. Hence, when the price reaches support, the trader looks to buy

Cryptocurrency trading, from the outside, appears very lucrative and worth a try. Seeing people announce their huge wins on social media is definitely enticing, and you may have made the decision to venture into crypto trading. However, the truth is that cryptocurrencies are volatile, and this huge volatility means that traders are exposed to the possibility of significant losses just as they have the chance of making enormous profits. Many times, professional traders carefully strategize their trading actions so that they are insulated from huge losses, thereby maximizing their profits. Hence, as a beginner, it is important to add new strategies to your crypto trades.

What To Know Before Applying New Strategies To Your Crypto Trading Endeavor

- Understand Fundamental Analysis: Fundamental analysis is an approach that involves the evaluation of an asset based on available data; this enables you to predict the prices of crypto based on general news, project-specific news, and other on-chain metrics. Hence, you can estimate the intrinsic value of crypto assets and trade them based on this knowledge.

- Understand Technical Analysis: Technical Analysis co-exists with Fundamental analysis; because it depends on much more historical information than future insights, it lags behind Fundamental Analysis. Nevertheless, traders need to understand Technical analysis because financial markets move in trends, and history often repeats itself.

Understanding these types of analyses is an important prerequisite to crypto trading.

Best Crypto Trading Strategies For Beginners

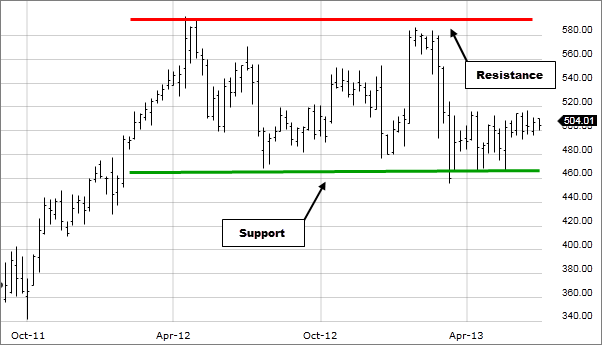

1. Range Trading: Range trading depends on technical analysis knowledge, specifically support and resistance. It is a strategy that identifies the price range of an asset for a particular period and trades it within the range. Hence, when the price reaches support, the trader looks to buy, and when the price reaches resistance, the trader looks to sell. The idea behind this strategy is that the price will remain in the range for a long while before breaking the support or resistance.

As long as the trader understands the basic laws of support and resistance, it is relatively safe and profitable. However, the trader must be wary of support becoming resistance, resistance becoming support, breakouts, and fakeouts, as these could impact trader psychology within these ranges.

2. Scalping: Scalping is another low-risk strategy that beginners can use to profit from the cryptocurrency market. Scalpers typically complete trades within minutes or even seconds. They never hold positions for more than one hour. Rather than focusing on a few profitable trades, they chase a high volume of small profits. For example, a scalper may target $10 profits 50 times a day instead of looking for a single trade profit of $200 or $500.

Scalpers do not enjoy volatility; they trade with low volatility so as to ride on smaller trends and enjoy small profits before moving to the next trade. During high volatility, scalpers hardly trade because an instant reversal could rip up their trading capital.

3. Reversal Trading: Reversal trading is a bit riskier than the first two methods but is still good enough for Beginners to attempt. Reversal trading notices a trend and attempts to catch it when it reverses. For example, if the market is in an upward trend, reversal traders will be on the lookout for signs that the market has lost buying momentum and is ripe for a reversal; hence, they will begin to enter “sell” trades and try to get ahead of the market. Similarly, if the market is in a downward trend, reversal traders look for reversal signals to enter a “buy” trade.

One common reversal trading tool is the Relative Strength Index (RSI) Indicator. The RSI indicator has an algorithm that computes the average gains and losses in the market for a 14-day period and uses it to judge the strength of the asset being traded.

The RSI chart moves from 0 – 100; when the RSI line is below 30, the asset is considered “oversold,” and with exhausted selling pressure, the trend is expected to reverse upwards. Conversely, when the RSI line is above 70, the asset is considered “overbought,” signaling a downward trend reversal.

Another trend reversal indicators include the “Stochastic Oscillator,” which also has a similar 0 – 100 chart, with the oversold and overbought points at 30 and 70, respectively.

It is important to note that many traders wait for assets to enter extreme overbought and oversold regions like 10 and 90; however, it remains important not to rely excessively on indicators when trading reversals, as they could provide false signals during lengthy trends. It is advisable to engage in some fundamental analysis, checking on-chain information, asset-specific news, and other related information to confirm the bias of a trend reversal.

Final Takeaway

It is important to note that regardless of any strategy you employ, market volatility could cause sudden upsets. Hence, whether you are a beginner trader or a veteran, practicing excellent risk management while engaging with cryptocurrencies is important. Do not enter trading positions above your emotional thresholds, as it may cause you to make irrational trading decisions, which could lead to heavy losses.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet Blog and follow our social media communities: