The Convergence Is Real: Why the Fed's Formal Welcome Marks a Turning Point for Crypto?

The Fed's formal welcome to crypto marks the end of the era of antagonism, accelerating the definitive shift towards financial integration.

Key Takeaways

- The Fed's formal welcome to crypto marks the end of the era of antagonism, accelerating the definitive shift towards financial integration.

- The proposal for a "Simplified Master Account" is a major structural concession by the Fed, directly easing the bottleneck for stablecoin issuers to access the U.S. payment system.

- TradFi is driven by a defensive mandate to devour its own inefficiency; tokenization (repo, MMFs) is the only viable solution to eliminate billions in frozen capital.

The world of finance recently witnessed a historic and surreal scene in Washington D.C. Inside the Federal Reserve headquarters, figures who were once viewed as disruptors—including the founders and CEOs of Chainlink, Circle, Coinbase, and BlackRock—sat down face-to-face with Fed Governor Christopher Waller to discuss stablecoins, tokenization, and AI payments.

This was no ordinary gathering; it was the Federal Reserve's first-ever payment innovation conference. The agenda focused on multi-trillion dollar markets: the convergence of TradFi and digital assets, the stablecoin business model, and the application of AI in payments.

The message delivered by Governor Waller was definitive: The era of antagonism is over. Waller stated that the DeFi industry should "no longer be viewed as suspect or ridiculed." This sentiment, coupled with his acknowledgment that "payment innovation is developing rapidly, and the Fed needs to catch up," marks a profound turning point. This article dissects the strategic signals from this formal welcome, revealing why the future of finance is now defined by integration, not conflict.

Regulatory Structural Concessions

The most powerful signal of change is the Fed's willingness to structurally adapt its own system to accommodate crypto finance. This is evidenced by the proposal for a "Simplified Master Account."

The Solution to the Access Problem

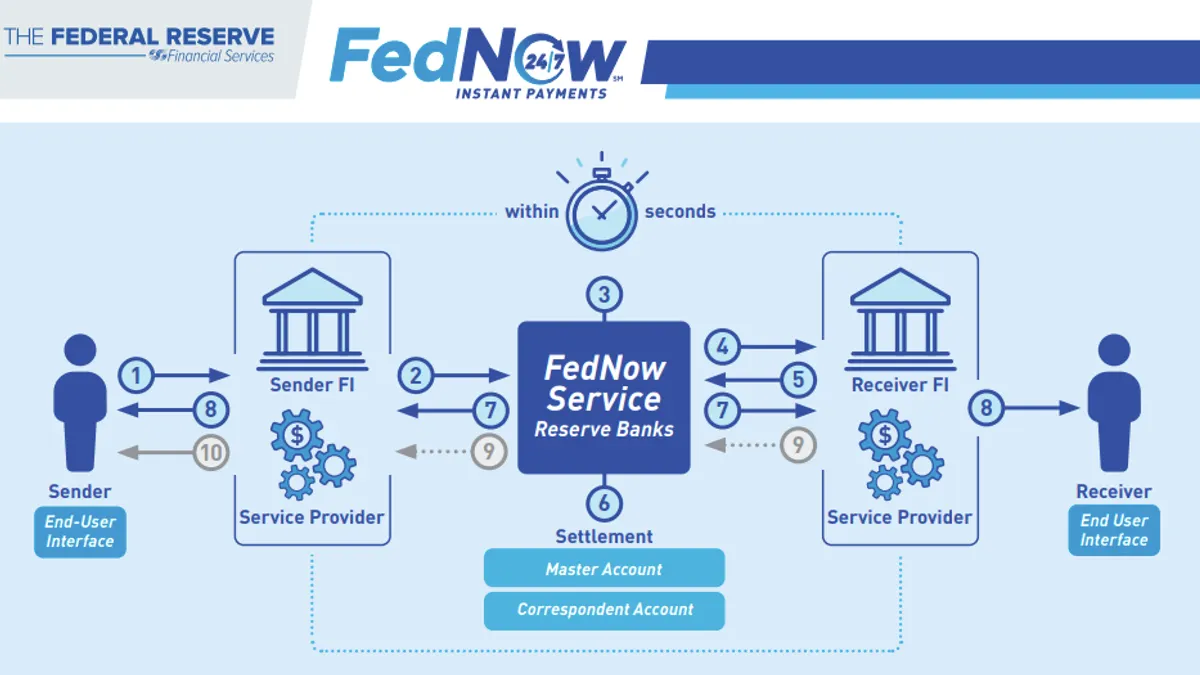

The Fed's Master Account is the ultimate "passkey" to the U.S. payment system. Historically, its high barrier and slow approval process (as seen with cases like Custodia Bank) have been a choke point for crypto companies. The Fed's proposal for a "Simplified Master Account" is a direct and targeted structural concession. This "slimmer version" would grant stablecoin issuers and crypto payment companies access to the Fed's core payment rails (Fedwire, FedNow) for basic services, without the need for full bank charter requirements. This single change immediately lowers costs, increases efficiency, and grants legitimate status to crypto payment firms.

AI and Stablecoins: The New Financial Infrastructure

The meeting revealed a strong consensus that the convergence is driven by the rise of AI Agents and their need for a native financial tool.

The Inevitability of Autonomous Agents

Leaders like Cathie Wood predict that AI agents will soon usher in an "Agent Economy," capable of autonomously making financial decisions (e.g., paying bills, investing). These agents, however, cannot easily open traditional bank accounts. Stablecoins are the natural solution. Google Cloud and Coinbase executives affirmed that stablecoins provide the perfect tool for machine-to-machine (M2M) settlements and micro-transactions—a high-volume, low-cost need that is impossible for traditional banks to handle efficiently.

The Structural Advantages of Programmable Money

This consensus is reinforced by the structural advantages of blockchain:

- Low Cost/High Speed: The efficiency of stablecoin transactions is essential for the rapid growth model of AI companies, which are scaling at 3-4 times the rate of traditional SaaS firms.

- Verifiable Security: The transparency of chain-based transactions provides essential anti-fraud tools, allowing AI to train anti-fraud models with verifiable data, a key security benefit for merchants and institutions.

Tokenization and TradFi's Defensive Strategy

The consensus on asset tokenization was unanimous: it is an irreversible trend driven by TradFi's inherent need for greater efficiency and liquidity. This widespread action is not an ideological shift; rather, it is a strategic, defensive pivot by traditional finance aimed at protecting its market dominance.

The Unstoppable Tokenization Wave

Leaders from BlackRock, JPMorgan, and Franklin Templeton all agree that the tokenization of assets is now a matter of when, not if. They are moving beyond theoretical discussion into active implementation, recognizing that blockchain technology offers a vital solution to legacy system bottlenecks.

The practical results of this commitment are already transforming core financial processes:

- JPMorgan's Kinexys platform is leveraging tokenized U.S. Treasuries for minutes-long overnight repo transactions.

- Franklin Templeton is running live, native on-chain money market funds (MMFs).This active implementation highlights the urgency: these firms are using tokenization to devour their own operational inefficiency. By adopting blockchain’s programmability and composability, they eliminate billions in frozen settlement capital and establish a critical competitive defense against disruptive native DeFi protocols.

Conclusion: Integration Defines the New Financial Normal

The Federal Reserve’s official welcome is the definitive confirmation that the era of antagonism is over. The U.S. is adopting a strategic model of formal integration, using private-sector stablecoins and institutional tokenization as the primary drivers of digital financial evolution.

This convergence is not about novelty; it is about structural inevitability. The core lesson from the Fed meeting is that traditional finance cannot afford to ignore the superior efficiency of the blockchain. The structural advantages of programmability and composability offer the only viable solution to eliminate billions in frozen capital and legacy inefficiency.

The future of finance is now defined by a federally-recognized, dual system. The industry’s focus will irrevocably shift from regulatory fighting to building compliant, transparent, and integrated financial infrastructure. This strategic alignment will accelerate stability, provide critical safeguards, and firmly cement stablecoins and tokenized assets as legitimate pillars of the global financial system.

Cwallet: Your Secure, All-in-One Gateway to Global Crypto Finance

Cwallet redefines the digital wallet, offering a unified, high-performance platform to manage your entire portfolio, supporting over 1,000 cryptocurrencies across 60+ global networks. We combine top-tier security with unmatched utility:

Financial Control: Go beyond holding. Engage in dynamic market action with zero-fee Memecoin/xStocks trading, or join the fun with interactive prediction tools like Trend Trade and Market Battle.

Real-World Power: Instantly unlock the spending potential of your assets. The Cozy Card transforms your crypto into a flexible payment solution, enabling secure, real-world transactions online and offline.

Practical Tools: Boost efficiency with integrated, unique services. Leverage HR Bulk Management for business needs, or utilize Gift Cards and Mobile Top-ups for everyday utility.Cwallet is where security meets utility and innovation in one powerful application.Join millions who are transforming the way they manage their digital wealth!

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: This content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.