Stop Looking at the Price: The Real Crypto x AI Value Is Being Built Behind the Scenes?

Crypto is solving AI's biggest problem—the monopoly of computing resources—by building decentralized, incentivized GPU training networks.

Key Takeaways

- Crypto is solving AI's biggest problem—the monopoly of computing resources—by building decentralized, incentivized GPU training networks.

- Protocols like x402 and stablecoins are the only viable solution for Machine-to-Machine (M2M) payments, eliminating the high cost and friction of legacy finance.

- The market is actively working to transform data and compute power into verifiable, tradable financial assets, creating new liquidity and financing models for AI infrastructure.

The narrative surrounding the convergence of Crypto and Artificial Intelligence (AI) has completed a crucial, structural shift. The initial fever of speculative Meme coin launches and viral funding rounds has subsided. Now, as the spotlight fades, the real, enduring value is being meticulously built behind the scenes.

This article dissects the profound movement where AI is transitioning from being a tool for crypto trading to being Web3's most powerful use case. We argue that the biggest growth opportunity lies not in tracking token prices, but in understanding the new decentralized infrastructure being constructed to solve AI’s biggest problems: monopoly of computing resources, high data costs, and complex payment friction.

Decentralized Compute, Breaking the Monopoly

The most immediate and transformative role for crypto infrastructure is solving the centralized bottleneck of AI training and computing. Traditional AI development is dominated by a few major cloud providers who own the expensive A100/H100 chips, leading to market monopoly and exorbitant costs.

The Solution: Distributed GPU Infrastructure

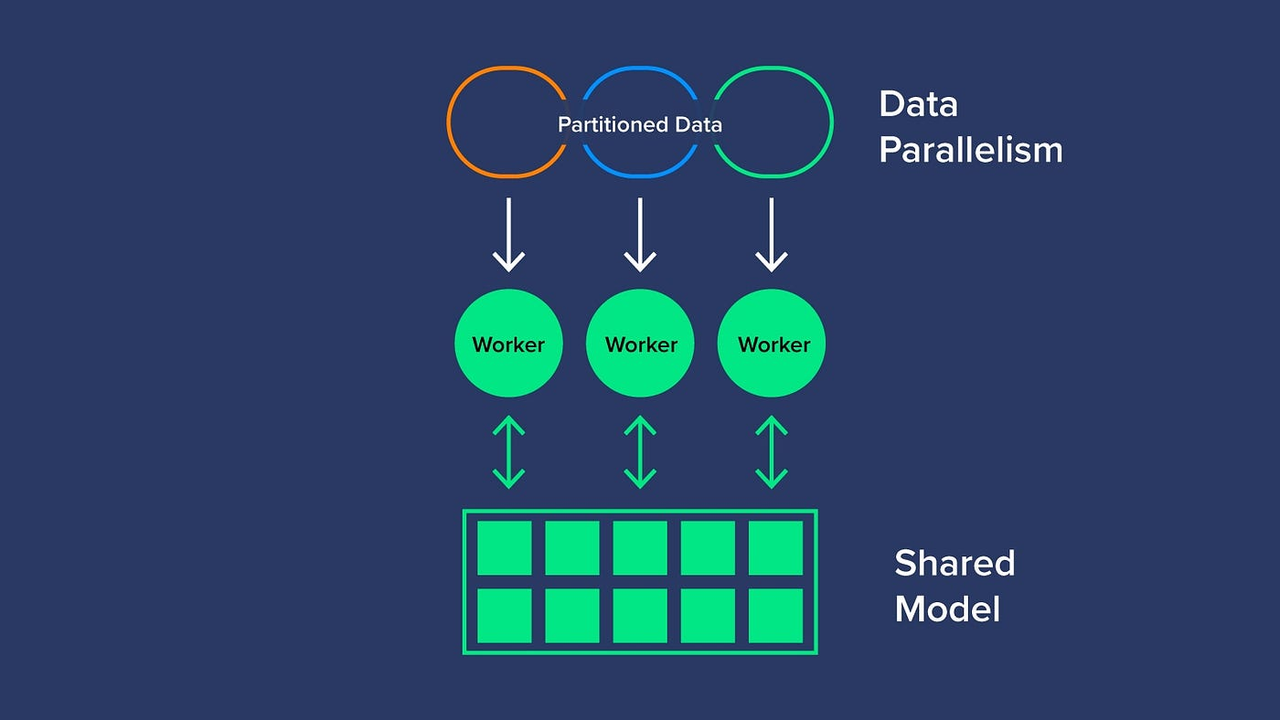

Blockchain technology offers an alternative by creating a global, open marketplace for computing power. This trend is driven by:

- Aggregating Supply: The use of crypto-economic incentives (tokens) to coordinate globally dispersed GPU resources. Projects are creating decentralized training clusters (e.g., Pluralis), demonstrating that it is economically viable to aggregate unreliable, fractional hardware into a strong, cohesive network for training advanced models.

- The Cost Advantage: This shift breaks the monopoly. By utilizing a distributed, open system, developers gain an essential alternative to relying on hyper-scale cloud providers, fundamentally lowering the cost and increasing the availability of compute resources.

Data Scarcity and Incentives

The second problem is data. Top-tier AI models require massive, proprietary, and highly specific datasets that are expensive to acquire.

- Incentivized Data Creation: Crypto infrastructure provides a unique solution by using tokens to coordinate and reward a global workforce. Companies like Sapien have leveraged this model to incentivize millions of contributors to generate and label the scarce training data required by advanced AI labs, effectively turning data creation into a monetized service.

Programmable Money: The Solution to AI's Payment Friction

The most practical application for crypto in the AI economy is solving the fundamental challenge of payments and micro-settlements. AI Agents are poised to become economic actors, but they lack traditional bank accounts.

The Friction of Machine-to-Machine (M2M) Payments

If a thousand AI agents need to pay each other two cents per API call or data query, the traditional financial system completely breaks down. Legacy banking and payment rails are too slow, too costly (with high minimum transaction fees), and require human-level KYC verification.

Crypto's Solution: Seamless, Zero-Friction Settlement

Programmable money and specialized protocols are the only viable solution:

- Stablecoins and x402: Stablecoins provide the digital dollar value, while protocols like x402 (spearheaded by Coinbase) act as the standardized language for payment. This mechanism allows AI agents to securely pay for services, data, and computation on the blockchain instantly and frictionlessly.

- New Financing Models: This capability goes beyond mere payment. Specialized DeFi components are emerging to turn the necessary AI resources into financeable assets. Protocols like USD.

AI are demonstrating how GPU hardware and computing resources can be collateralized to obtain instant loans—creating a new financing mechanism for capital-intensive AI infrastructure.

This structural ability to enable cheap, autonomous payments is the foundational layer that will allow the AI Agent economy to thrive without being throttled by traditional financial friction.

How Crypto Finance Unlocks Data and Compute Liquidity

The final layer of value being built behind the scenes is the transformation of AI's raw materials, data and computing power, into verifiable, tradable financial assets. This unlocks unprecedented liquidity and capital formation for infrastructure providers.

Data Scarcity and Incentivized Networks

Top-tier AI models are starved for specific, proprietary, and high-quality training data, which is prohibitively expensive to acquire through traditional means.

- Crypto's Solution: The utilization of crypto infrastructure allows for the creation of incentivized networks. Companies like Sapien leverage tokens to coordinate and financially reward millions of global contributors for generating and labeling the scarce training data required by advanced AI labs. This structural solution turns data creation into a monetized service, drastically lowering acquisition costs.

Financing Infrastructure with DeFi

The capital-intensive nature of AI hardware is also being solved by Web3:

- Collateralizing Compute: DeFi components are emerging to turn the necessary AI resources into financeable assets. Protocols like USD.

AI are demonstrating how expensive GPU hardware and computing resources can be tokenized and then collateralized to obtain instant loans—creating a new, highly efficient financing mechanism for infrastructure providers.

- New Investment Class: This transformation turns compute power into a liquid, tradable asset, creating a new, verifiable class of financial investment that did not previously exist.

Conclusion

The strategic alignment of Crypto and AI is not a fleeting trend; it is the structural necessity of the next digital economy. The value of this movement lies not in speculative gains, but in its ability to build a verifiable and efficient foundation for machines.

The final insight is this: AI has completed its transition from an analyst to an infrastructure driver. By solving the core problems of monopoly computing, data costs, and payment friction, Web3 is positioning itself as the essential financial backbone for all future AI applications. The race is on to construct this new, decentralized, and highly profitable intelligent economy.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.

In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset.Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary.All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.