RWA Tokenization in 2026: What Really Signals Real Transformation?

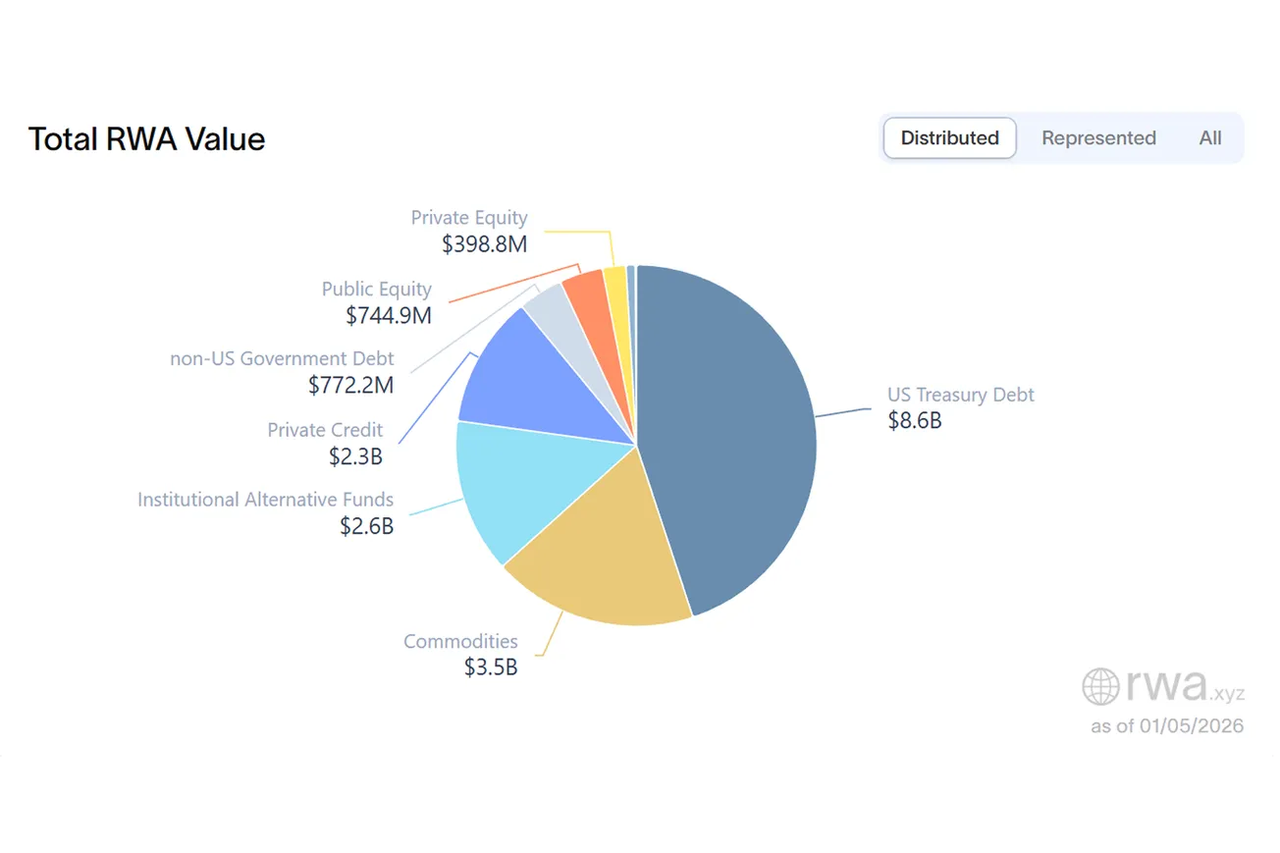

The $185 billion RWA tokenization number highlights interest but doesn’t itself prove structural transformation.

Key Takeaways

- The $185 billion RWA tokenization number highlights interest but doesn’t itself prove structural transformation.

- Real transformation depends on legal recognition, liquidity, and composability — not just custody totals.

- Tools like Cwallet help users manage tokenized assets alongside crypto portfolios, making it easier to participate in emerging financial models.

In 2026, Real-World Asset (RWA) tokenization — bringing traditional financial assets onchain — has grabbed headlines with a staggering figure: $185 billion in total tokenized value. At first glance, this number seems huge — and it is. But it's not the real signal of transformation.

Instead of fixating on totals, the deeper story lies in how tokenization changes ownership models, accessibility, and market structure. For users and traders alike, understanding this difference helps separate hype from meaningful adoption.

Why the $185 Billion Number Alone Doesn't Tell the Full Story

Headline numbers such as “$185 billion on-chain” are easy to digest — and easy to misuse. But simply having a large aggregate value under custody or tokenization does not guarantee:

- Actual economic activity

- Liquidity and tradability

- Verified ownership with legal enforceability

- Real user engagement

In other words, a large on-chain footprint may reveal interest, but it does not necessarily prove real transformation.

For example, if most tokenized value is concentrated in a few custodial contracts with limited trading markets, it can be "on-chain" in a technical sense but disconnected from real economic usage.

What Actually Signals Real RWA Transformation

Instead of total value, true tokenization transformation shows up in three key areas:

1. Legal and Institutional Integration

Tokenization needs more than smart contracts — it requires legal clarity. Assets that can be redeemed, settled, and enforced under existing legal frameworks unlock confidence from institutions. When tokenized assets behave like legally recognized assets (e.g., tokenized debt, tokenized equity), real transformation is underway.

2. Liquidity and Market Depth

A tokenized asset only matters if it can be bought, sold, or used in real markets. Tradable markets — whether onchain DEXs, CeFi venues, or hybrid systems — give tokenization real meaning. Tokenized real estate or credit that sits illiquid on wallets does not meaningfully expand economic access.

3. Cross-Chain and Composable Use Cases

Next-generation tokenization isn’t static. It integrates with DeFi primitives, lending protocols, and on-chain derivatives. Interoperability and composability — where tokenized RWAs can be used as collateral, packaged into structured products, or embedded into broader financial stacks — are true indicators of innovation.

How This Matters for Everyday Users and Traders

As a user or crypto investor, it's important to shift focus from value totals to meaningful engagement points:

- Can you trade or use the tokenized asset? Liquidity matters.

- Is legal ownership clear and enforceable? Legal risk is real.

- Does it connect to real economic flows? That's where utility lies.

Tokenization's promise is not in how many billions end up on chain, but in how that on-chain value interacts with real people, markets, and institutions.

Where Tools Like Cwallet Fit In

As markets grow more complex — with tokenized assets, DeFi activity, and on-chain derivatives — managing diverse holdings becomes more challenging. Platforms like Cwallet help users:

- Track assets across multiple chains and markets

- Manage tokenized assets alongside spot holdings and DeFi positions

- Access real-time balance and transaction insights from one secure interface

Rather than chasing every headline or trend, Cwallet allows users to maintain clarity while navigating RWA tokenization alongside traditional crypto holdings. This kind of consolidated visibility becomes especially valuable as tokenized assets multiply and new trading primitives take shape.

RWA Tokenization Is Evolving — Not Exploding

So what does the $185 billion figure really mean?

It means that interest and participation in RWA tokenization have grown. It means infrastructure for custody and token issuance exists. But the transformative phase of tokenization is judged not by how much value sits onchain, but by whether that value is actively backing market activity, enabling new financial behaviors, and reducing friction between traditional and digital finance.

The onchain number is a milestone — but not the destination.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, it's an all-in-one platform for secure crypto management and flexible trading.

Buy, swap, trade, earn, and spend 1,000+ cryptocurrencies across 60+ blockchains in one place. Spend your digital assets like cash with the Cozy Card, while tools like HR bulk management, mobile top-ups, and gift cards make everyday transactions smoother.

We are evolving into a comprehensive crypto finance hub. From Spot Trading, including Swap, Memecoins, and xStocks, to Futures Trading such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, Cwallet supports different trading styles with clarity and control.

Plus, built-in IM keeps users connected with friends and informed directly within the trading experience.Join millions reimagining what a crypto wallet can do. Stay cozy, trade smart, and explore the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.