Plasma's Zero-Fee Revolution: Building the Infrastructure for the Trillion-Dollar Stablecoin Market

Plasma is a purpose-built L1 designed to eliminate Gas fees for stablecoins, positioning it as the ultimate global settlement layer.

Key Takeaways

- Plasma is a purpose-built L1 designed to eliminate Gas fees for stablecoins, positioning it as the ultimate global settlement layer.

- The project's immediate market credibility is secured by its direct strategic alignment with Tether and Bitfinex.

- Plasma aims to move stablecoins from the realm of exchanges to everyday consumer utility via its neobank product, Plasma One.

The true launch catalyst for Plasma was not technology, but a massive viral phenomenon: the $0.10 Airdrop Myth. Participants in the pre-launch program found themselves entitled to $8,390 worth of XPL tokens, a stunning 8,000,000% return on a minimal initial deposit. This event was more than a windfall; it was a clear signal of intense underlying market demand.

This immense interest is rooted in a fundamental industry pain point: the high cost and friction of transferring value. Stablecoins, despite their popularity, are hindered by reliance on established Layer 1s (like Ethereum and TRON) that impose high Gas fees and congestion.

Plasma, a Stablecoin-First Layer 1, directly addresses this flaw. Its architecture is explicitly designed to eliminate transaction friction, and the market immediately validated this purpose by absorbing over $4 billion in committed capital on its Mainnet Beta launch. This is the context for the revolution: the race to build the essential, zero-fee infrastructure for global finance.

Speed and the Elimination of Transaction Friction

The widespread adoption of stablecoins is consistently hampered by the underlying blockchains they rely on. High Gas fees and network congestion on established Layer 1s (like Ethereum and TRON) are the primary enemies of mass adoption in payments and remittances.

The Zero-Fee Technical Solution

Plasma was explicitly designed to eliminate this friction. It achieves its competitive advantage, zero-fee USDT transfers, through a highly customized consensus layer. This architecture allows the network to process transactions at speed while entirely removing the need for users to pay for Gas.

This fundamental design shift transforms the economic viability of stablecoins, making them truly usable for frequent, low-margin transactions like daily payments and remittances.

Strategic Advantage in Settlement

The consequence of this zero-fee speed is strategic: it allows Plasma to compete directly with legacy settlement systems. A core pain point for corporations and institutions is the high cost and time delay in transferring large sums.

Using Plasma, a bank or corporate treasury can transfer millions of dollars in stablecoins in seconds, bypassing the traditional SWIFT process which often takes days and incurs high fees. This positioning transforms Plasma from a DeFi application into an essential global settlement layer.

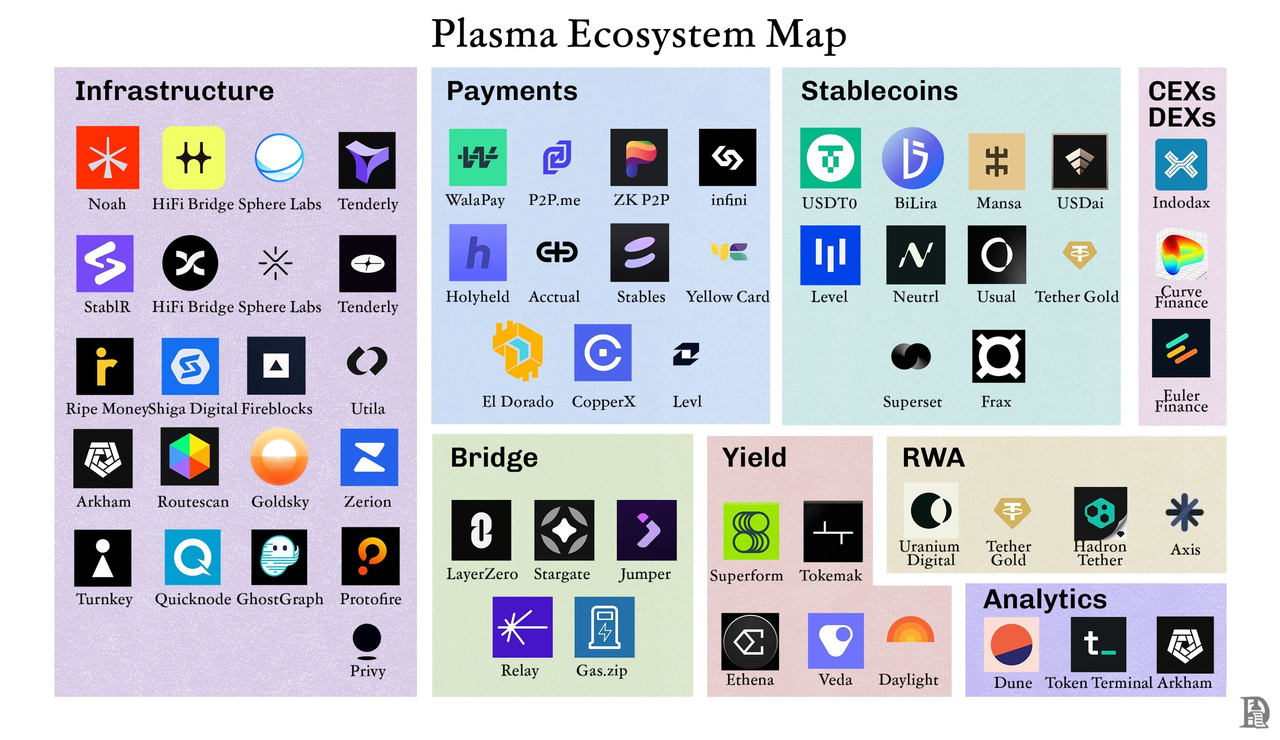

Strategic Layout: The Tether Factor and Competition

Plasma's strong backing and institutional focus set it apart from typical crypto startups, injecting immediate credibility and unparalleled market access.

The Tether Connection

The strategic alignment with Tether, the world's dominant stablecoin issuer, is Plasma's most significant competitive edge.Support from Tether CEO Paolo Ardoino and its parent company, Bitfinex, ensures the market views investment in Plasma as a direct, strategic bet on the continued dominance of USDT.

This relationship grants Plasma immediate institutional trust and deep access to the massive global USDT liquidity network, which no other nascent L1 can easily replicate.

Competing for Compliance and Utility

Plasma is not just competing with other blockchains; it is actively vying for institutional approval. The current market is seeing an influx of new stablecoin chains (like Circle's Arc and Stripe's Tempo).

Plasma's strategy to overcome this saturated field is twofold:

- Compliance Focus: The platform has received backing from major firms and has partnered with compliance providers like Elliptic. This readiness is essential for attracting banks and large financial institutions seeking a secure, compliant venue for stablecoins.

- Utility Focus: It solves a core economic problem for exchanges and payment providers, positioning itself as the trusted infrastructure layer for tokenized assets and cross-border settlement. By focusing on utility, Plasma aims to prove that specialized infrastructure wins the long-term adoption race.

Future Outlook: The Plasma One Integration

Plasma's ultimate goal is to transform the stablecoin from a crypto trading tool into a ubiquitous payment solution: a vision embodied by its new consumer product, Plasma One.This product is the final, essential step in converting Plasma's core technological efficiency into real-world market dominance.

The Stablecoin Neobank Model

Plasma One is positioned as the first native stablecoin neobank. This product directly targets consumers in emerging markets who have a high demand for the US Dollar, offering a comprehensive suite of consumer-friendly services built on top of the zero-fee infrastructure:

- Yield on Spend: Users can earn competitive interest directly on their stablecoin balances, even while actively spending—a unique feature that blurs the lines between a savings account and a checking account.

- Real-World Utility: The platform offers physical and virtual cards that enable global spending, along with generous rewards like cashback. This immediately provides real-world liquidity to digital assets.

- Frictionless Access: Features like instant, zero-fee USDT transfers to individuals and businesses, coupled with extremely quick onboarding processes, bypass the complexity and high fees of traditional banking systems.This comprehensive, consumer-facing strategy confirms that Plasma is aiming to become the indispensable foundation for global digital dollar transactions, moving stablecoins from the backend of exchanges to the front door of everyday finance.

The successful launch of Plasma and its integration via Plasma One confirm a critical market shift. The era of high fees and slow transactions for stablecoins is ending. By solving the core friction of value transfer with its zero-fee architecture and securing strong institutional backing, Plasma is positioned to become the indispensable foundation for global digital dollar transactions, moving stablecoins from the backend of exchanges to the front door of everyday finance.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.

In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.