Is the Great Rotation Finally Here? Why Capital May Be Shifting from Gold to Bitcoin

Smart investors should strategically sell euphoria to buy value, utilizing time and absolute scarcity as their main tools for long-term growth against fiat inflation.

Key Takeaways

- Technical analysis of the BTC/Gold ratio is flashing rare bottom signals, suggesting that the structural lag between the two assets is ending.

- While Gold is in a state of euphoria (low potential return), the historical performance gap means Bitcoin offers a superior risk-reward profile for the next phase of appreciation.

- Smart investors should strategically sell euphoria to buy value, utilizing time and absolute scarcity as their main tools for long-term growth against fiat inflation.

The global financial community is intensely focused on the performance divergence between Gold and Bitcoin. While both are positioned as "sound money" defenses against instability, Gold's multi-day ascent has finally given way to a sharp correction, triggering a crucial reassessment of its value.

This price action confirms that the structural lag between the two assets may be ending. This article analyzes the powerful data that indicates a "Great Rotation" is imminent, proving that Bitcoin’s risk-reward profile is now structurally superior to Gold’s precisely because Gold's euphoric rally is cooling.

Gold's Euphoria and the Geopolitical Engine

Gold's stellar performance in 2025, which saw it reach a nearly half-century high for annual gains, is not accidental. It is fueled by powerful macroeconomic instability, though its growth is reaching a state of euphoria.

Central Banks as the Demand Floor

The primary driver of Gold's exceptional performance is not retail enthusiasm, but powerful institutional demand from central banks. Gold now accounts for over 20% of global central bank reserves, the highest share seen in nearly three decades. This sustained buying is a direct result of ongoing geopolitical fragmentation and the desire to diversify reserves away from fiat currencies.

Specifically, this aggressive central bank purchasing successfully counteracted any net selling pressure from U.S. retail investors since 2024, creating an incredibly strong and stable demand floor for metal. Key facts underscore this structural shift:

- Global Reserves: Gold now holds over 20% of global central bank reserves.

- Historical Highs: This market share is the highest seen in nearly three decades.Gold has, therefore, cemented its role as the initial, necessary hedge against global fiscal and geopolitical uncertainty.

Bitcoin as Resistance Money

Bitcoin's core philosophy remains Resistance Money: a non-sovereign, censorship-resistant asset designed to store economic value free from the reliance on any state. The very macro instability that pushes central banks to buy gold provides the long-term fundamental reason to hold Bitcoin. The key difference is that Gold is a legacy defense asset, while Bitcoin is a digital defense asset with unparalleled structural advantages.

Bottom Signals and Risk-Reward Revaluation

The critical question for capital allocators now is not which asset is "better," but which offers the superior risk-reward profile for the next 12 months. Bitcoin’s current lag against Gold makes its positioning uniquely compelling.

The BTC/Gold Ratio Signals at Bottom

Technical analysis of the BTC/Gold ratio, a measure of Bitcoin's relative strength against the traditional reserve asset, is flashing rare bottom signals. Historically, these extreme signals appear after periods of high volatility and aggressive market shakeouts, marking the optimal, low-risk moment for tactical investment.

- Rarity of the Signal: These bottom signals are exceptionally rare. When the ratio reaches these extremes, it suggests that Bitcoin is oversold relative to Gold, creating a dislocated value opportunity.

- Historical Precedent: Past instances where this ratio has bottomed have preceded major upside rallies for Bitcoin, often offering the most lucrative risk-reward entry points of the cycle.

The Tactical Mandate: Pricing the Opportunity

The critical question for capital allocators now is not which asset is "better," but which offers the superior risk-reward profile for the next 12 months. Bitcoin's current lag against Gold makes its positioning uniquely compelling.

While Gold is now in a state of euphoria (high price, low potential return), Bitcoin's historical lag has created a substantial performance gap. The tactical mandate for smart investors is clear: they should aim to sell euphoria to buy value. The current risk-reward equation strongly favors Bitcoin, meaning investors can strategically sell into Gold's peak of "safe haven" sentiment and rotate that capital into Bitcoin, which is structurally positioned for the next phase of appreciation.

Furthermore, this rotation is backed by a long-term thesis that remains unassailable. Bitcoin offers superior long-term appreciation potential due to its absolute scarcity, while its structural position as a required asset for global portfolios ensures its inevitable ascent.

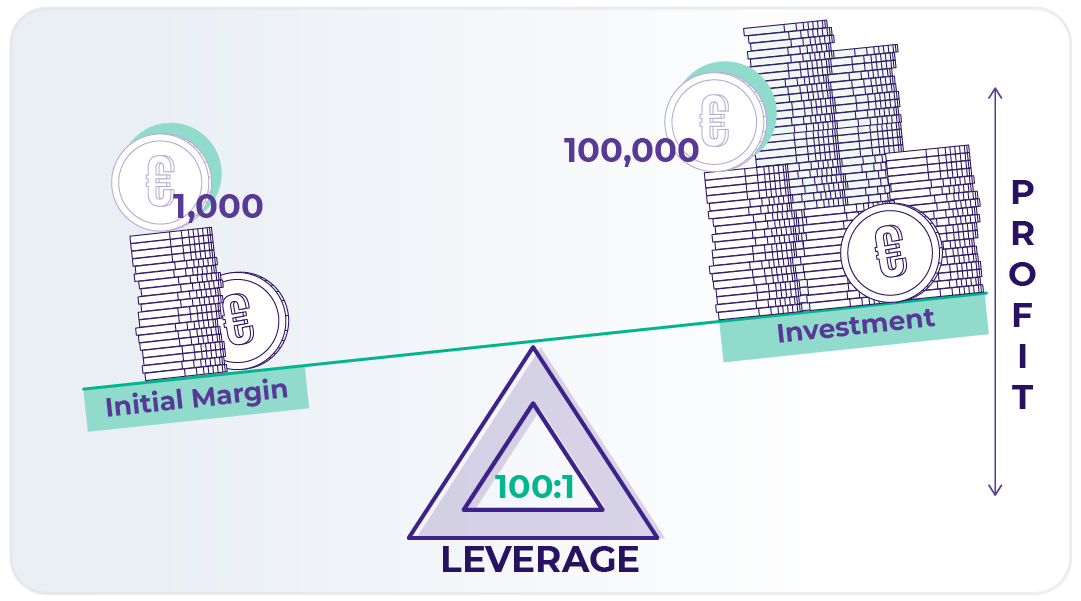

Discipline Over Leverage

The ultimate takeaway for the long-term investor is clear: successful navigation of the market requires discipline. The core lesson from the recent volatility is to avoid the leverage trap.Leverage transforms a philosophical investment in future scarcity into a short-term gamble with an expiration date. For smart investors, the path to financial peace is simple: understand the asset's unassailable long-term fundamentals, allow time to be the primary tool for compounding, and let the market's inevitable upward trajectory continue its course.

Cwallet: Your All-in-One Gateway to the Digital Economy

Cwallet is more than a crypto wallet; it's a complete ecosystem designed to make crypto trading accessible, intuitive, and rewarding. We've redefined what a wallet can be, transforming it into your ultimate hub for everything from securing your assets to exploring market opportunities.

Move beyond simple storage. Cwallet unlocks the power of smarter crypto trading right from your pocket. With features like Trend Trade and Market Battle, we empower both new and experienced users to engage with the markets in dynamic ways. Dive into the action with real-time trading across 1,000+ cryptocurrencies and 60+ blockchains, all while maintaining full control of your assets. It’s the simplicity of a crypto app combined with the power of a pro-level trading platform.

We're building the bridge between the digital economy and your daily life. Cwallet seamlessly integrates essential crypto services, allowing you to easily store, swap, and earn from your digital assets. Looking ahead, our commitment to real-world utility continues with upcoming features like the Cozy Card, mobile top-ups, and gift cards.

Cwallet makes crypto not just a technology for the future, but a practical tool for today!

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: This content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.