How To Spend Crypto Loans - Top 3 Things To Do With Your Crypto Loans

Day trading allows investors to take advantage of short-term price fluctuations in the cryptocurrency market, potentially generating profits within a single trading day. By executing well-timed trades and capitalizing on market momentum, day traders can achieve significant returns

Crypto and blockchain technology is constantly evolving, birthing innovations that make life easier for end users, and attract more traditional users to the world of Web3.

One such opportunity present in the world of cryptocurrency is the emergence of crypto loans, which allow you to commit collateral, typically in the form of cryptocurrencies, to get access to other cryptocurrencies.

This additional access to liquidity gives you room as a trader or investor to explore the market to maximize your profits, while your existing asset(s) can remain untouched as collateral, while you spread your tentacles in the crypto market.

Picture this: you hold a substantial amount of Bitcoin in your wallet, but you're hesitant to sell it outright due to its potential for future gains. You can utilize this Bitcoin as collateral to access additional liquidity without selling your prized holdings. But what exactly can you do with this newfound financial flexibility?

In this article, we'll explore the top three ways to spend your crypto loans, exploring strategies that can help you maximize your returns.

Top 3 Ways To Spend Your Crypto Loan

1. Buying and Holding Other Assets

A simple way to profit off crypto loans is to employ a Buy and HODL strategy for other low-cap cryptocurrencies with huge potential for increments.

With your primary cryptocurrency holdings as collateral, taking stablecoin loans enables you to access additional liquidity to invest in other assets beyond mainstream cryptocurrencies like Bitcoin and Ethereum.

Lower-cap coins and emerging projects often present investors with the potential for rapid price appreciation. These projects may have innovative technology, strong community support, or strategic partnerships that position them for future growth and adoption. You can capitalize on potential future gains by identifying promising projects and investing early.

To execute your buying and holding strategy, you must be conversant with the crypto spot market, where you can purchase assets and hold them in your crypto wallet, set a price target to sell, and take your profits when due. Do not get too greedy.

Typically, spot trading favors a long-term approach, so ensure that your loan is a long-term one so you can employ spot trading strategies like dollar-cost averaging, which will help mitigate short-term price fluctuations, and help you maintain profitability in the long run.

Risk Management Considerations

Lower-cap coins and emerging projects tend to be more volatile than established cryptocurrencies like Bitcoin and Ethereum. While this volatility presents opportunities for significant returns, it also carries higher risk; as a result, it is important to assess the risk-reward profile of each asset.

Before investing in lower-cap coins or emerging projects, evaluate factors such as the project's technology, team, community support, and market potential. Look for projects with strong fundamentals and a clear value proposition to mitigate investment risk.

2. Day Trading

For investors seeking more active engagement in the cryptocurrency market, day trading offers a strategy to capitalize on short-term price movements and generate profits within a single trading day. With crypto loans, users can develop a strategy to earn from the market using perpetual contracts and arbitrage trading.

Day trading allows investors to take advantage of short-term price fluctuations in the cryptocurrency market, potentially generating profits within a single trading day. By executing well-timed trades and capitalizing on market momentum, day traders can achieve significant returns on their investments every single day, accumulate this daily profit to repay their loans with interest, and still boast of profits.

- Day Trading With Perpetual Contracts: Perpetual contracts provide traders with flexibility and leverage to execute short-term trading strategies. These contracts enable traders to speculate on the price movements of cryptocurrencies without owning the underlying assets, allowing for both long and short positions with leverage.

Hence, with excellent technical analysis skills, you can identify short-term trading opportunities and develop entry and exit points for trades. By reading charts excellently, and finding support, resistance, and possible break-out positions, you can predict when to go long and when to go short, and regardless of the market direction, you can make profits.

- Day Trading via Arbitrage: Arbitrage trading presents opportunities to profit from price discrepancies across different cryptocurrency exchanges or markets. By buying assets at a lower price on one exchange and selling them at a higher price on another exchange, traders can capture the price differential as profit. With quick execution and careful monitoring, arbitrage traders can capitalize on market inefficiencies and generate risk-free profits.

Risk Management Considerations

- Leverage Risk: Trading perpetual contracts usually involves leverage, which is a two-edged sword; while leverage can amplify profits, it also magnifies losses. Hence, it is essential for day traders to use leverage cautiously and implement effective risk management strategies to protect their capital.

Remember that if you lose your capital, which is a loan, you may need to forfeit your collateral. - Technical Analysis Lags Fundamental Analysis: For perpetual contracts; technical analysis is key to success. However, even the most perfectly executed analysis can be outdone by fundamental news that changes the outlook of things.

As a result, traders must avoid over-leveraging, be prepared to adapt to changing market conditions, and remain disciplined in their trading approach. Most of all, traders must stay informed about market news and events that may impact prices, and be prepared to adjust trading strategies accordingly. - Execution Risk: Arbitrage trading requires quick execution and decisive decision-making. Hence, arbitrage traders must be conversant with all markets, the trading fees involved; how fast orders are settled, and everything else that helps in perfect execution.

If the tiny details are missed; an arbitrage trader can make significant losses in the process of arbitrage. If you can, utilize advanced trading tools and platforms with real-time data and analysis capabilities to make informed trading decisions.

3. Spending Crypto Loans In Traditional Finance

While the cryptocurrency market offers ample opportunities for profit and investment, diversifying your financial portfolio beyond digital assets can be a prudent strategy for long-term stability and growth.

A couple of ways to utilize crypto loans are by allocating the borrowed funds to traditional ventures like starting a business, expanding your existing business, or investing in real estate.

As a result, you can generate alternative streams of income and build wealth, without having to liquidate your crypto holdings. Moreover, it is way easier to get crypto loans than traditional loans, so you can get started easily, make profits, and gradually pay off your debts.

As your business grows and generates profits, you can allocate a portion of the revenue towards repaying the loan, reducing your debt burden and increasing your equity stake in the business. This approach allows you to leverage borrowed funds to boost your entrepreneurial journey while minimizing the financial risk and preserving your cryptocurrency holdings for future opportunities.

By choosing to allocate a portion of your crypto loans to ventures outside the crypto market, you can benefit from the stability and income potential of traditional assets while still maintaining exposure to the high-growth potential of digital assets. Additionally, diversification can provide resilience against market downturns and economic uncertainties, safeguarding your financial well-being and preserving your wealth.

Cwallet:Your Ideal Crypto Lending Platform

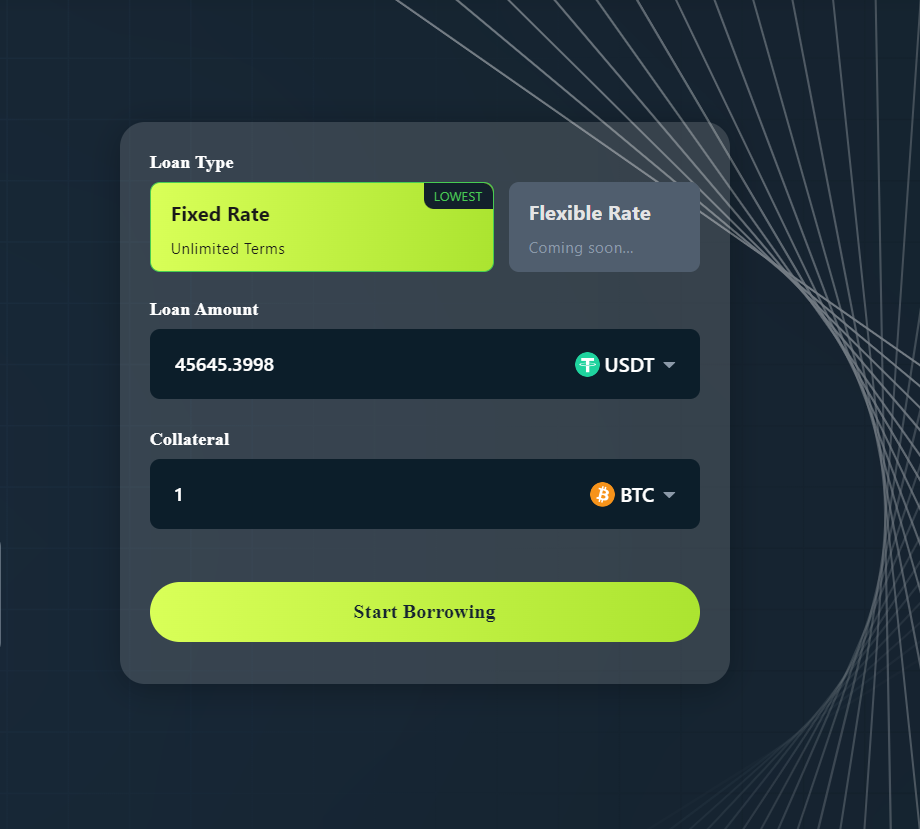

Cwallet is a one-stop crypto platform that combines the generic services of a crypto wallet with other important services, like a lending platform.

Cwallet supports lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral, while enjoying a whopping 65% LTV ratio.

At a fixed annual percentage rate (APR) of 13%, Cwallet offers the most competitive interest rates for borrowing in the market.

The APR is estimated based on the hourly value, so you can decide to repay your loan amount at any time. As a result, you can execute the long-term strategies listed above with Cwallet loans, as you know that crypto loans on Cwallet exist indefinitely and do not become overdue.

End Note

In conclusion, leveraging crypto loans offers investors a versatile toolset for financial growth and diversification. Whether through trading in the crypto market, venturing into traditional businesses, or exploring alternative investments, crypto loans provide avenues to increase financial capacity with increased liquidity.

By adopting a strategic approach and prioritizing risk management, investors can harness the power of crypto loans to unlock new opportunities and achieve their financial goals.

Cwallet is an excellent platform to get started with crypto loans, allowing you to access funding without liquidating your existing assets. Cwallet offers fixed-rate loans, allowing you to access long-term loans with an indefinite repayment date, suitable for any investment strategy.

Get started today! Sign up on Cwallet now!