How to Buy Cryptocurrency on Spot Market as a Beginner

What exactly is a cryptocurrency spot market? How do you buy cryptocurrencies on the spot market? As simple as it sounds, buying cryptocurrency can be difficult, especially if you are a beginner who is unfamiliar with the complexities of cryptocurrency trading.

Cryptocurrency is disrupting every industry, with adoption at an all-time high, transforming how we (individuals and organizations) manage our investments, finances, and day-to-day transactions. One fantastic thing about cryptocurrency is that it can potentially x10 your investment quickly, especially during a bullish market.

With the potential for large returns, many cryptocurrency enthusiasts see it as an intriguing option for profit and wealth accumulation. As a result, many people seek guidance on building a cryptocurrency portfolio and buying their first cryptocurrency.

As simple as it sounds, buying cryptocurrency can be difficult, especially if you are a beginner who is unfamiliar with the complexities of cryptocurrency trading. When you buy and sell cryptocurrencies, you engage in cryptocurrency trading, which may be done anywhere in the world at any time.

However, several types of cryptocurrency trading and ways to buy cryptocurrencies exist. These various types of cryptocurrency trading are determined by various factors, including the investor's trading strategy, the type of cryptocurrency, and the optimal moment to buy. Regardless of trading strategy or other factors, buying cryptocurrencies on the spot market (spot trading) is one of the simplest and most popular methods, especially for beginners.

What exactly is a cryptocurrency spot market? How do you buy cryptocurrencies on the spot market? Don't worry; this post will cover the cryptocurrency spot market and how to buy cryptocurrencies through spot trading.

What is the Crypto Spot Market?

The crypto spot market allows for immediate buying and selling of cryptocurrencies at the current market price. The spot market transactions are settled on the spot, hence the term spot trading.

The spot market can be used to make your first cryptocurrency purchase to hold for the long term or can be used by day traders to make quick gains and benefit from real-time, continuous pricing that reflects the underlying market.

In the spot market, there is typically a seller and a buyer, with the buyer placing a buy order and being matched with a seller with the same sell order at the current market price. For example, if you want to buy $1,000 worth of BTC at a market price of $30,000, your buy order will be matched with someone else's sell order at the same market price, with the transaction opening and closing on the spot.

As a result, the crypto spot market is the most straightforward way for newcomers to buy cryptocurrency, even if they have little understanding of how cryptocurrency trading works. Unlike other cryptocurrency trading methods, such as futures or margin trading, the risk level with buying on the spot market is low because you can only lose money if you buy cryptocurrency at a high market price and sell it at a low market price.

How Can You Buy Cryptocurrency on the Crypto Spot Market?

The crypto spot market is accessible and can be completed through over-the-counter, centralized, or decentralized exchanges.

Over-the-counter (OTC)

An OTC market is unregulated peer-to-peer trading in which no third party (escrow, broker, automated market maker, or liquidity pool) is involved. It is entirely handled "offline." For example, if you want to buy $1,000 Bitcoin and your friend wants to sell the same amount, both sides agree on the rates and terms, and the transaction is done quickly (on the spot).

OTC transactions are frequently less expensive than exchange transactions, and the price is not always revealed to other parties except those involved. The disadvantage of OTC trading is that it takes some confidence to ensure you are not tricked. The advantage is that you can conduct modest transactions without being restricted by exchanges or charged exorbitant transaction fees.

Centralized Exchange (CEX)

Centralized Exchanges (CEXs) often use order books to match buyers and sellers. The order book holds a list of buy and sell orders and promptly matches a related buy order to a sell order for immediate delivery.

In addition to buying bitcoin on the spot market in CEX, you can store your cryptocurrency on the platform and benefit from increased liquidity to swap your cryptocurrency for another without worry of losing custody. Buying cryptocurrency on CEXs can be considered the most popular way to access the crypto spot market.

Decentralized Exchange (DEX)

Decentralized exchanges allow you to access the crypto spot market without the use of order books or intermediaries. In DEX, users often trade against liquidity, performing the transaction automatically by an automated market maker (AMM). An AMM is a protocol that uses an algorithm to determine asset prices. As a result, rather than connecting a buyer and a seller, the algorithm automatically determines the price using a predetermined formula. It completes the transaction instantaneously with the help of a liquidity pool.

What Are the Benefits of Buying Cryptocurrency on the Spot Market?

- The spot market is straightforward to participate in, even without prior trading knowledge, because it's a market that relies on demand and supply.

- Buying on the crypto spot market is less risky because you can buy any cryptocurrency anytime without fear of losing your investment due to liquidation.

- The crypto spot market provides many trading pairs with increased liquidity where you can purchase and swap various cryptocurrencies.

How to Buy Cryptocurrency Anytime

You need a crypto wallet to buy the cryptocurrency of your choice at any time. A crypto wallet is an essential tool in your cryptocurrency investment journey, allowing you to buy cryptocurrency anytime.

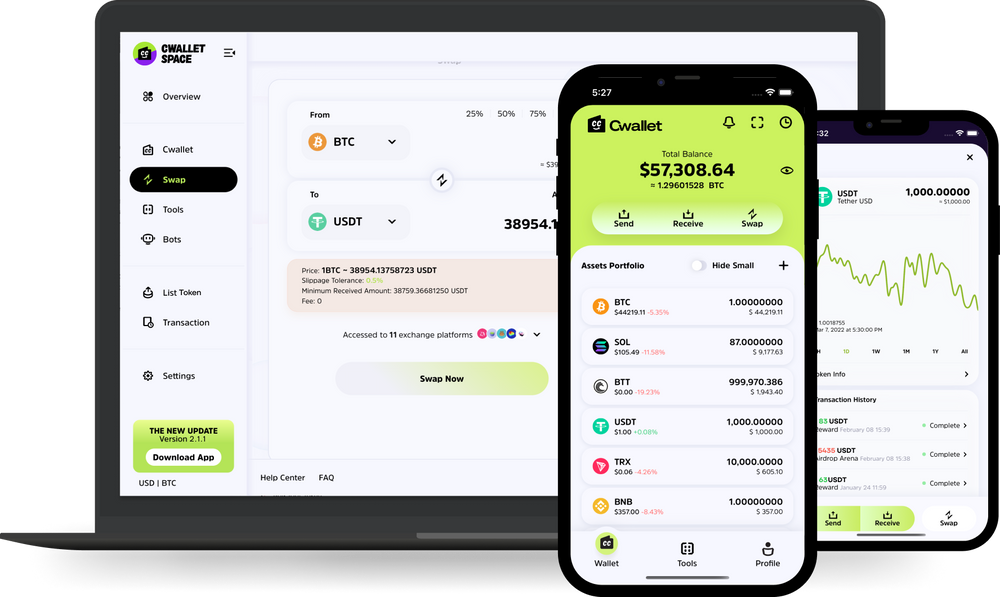

You can buy cryptocurrencies at any time on centralized and decentralized exchanges and crypto wallet providers such as Cwallet, which allows you to buy cryptocurrencies at any time, even if you do not have KYC verification. Cwallet is a one-of-a-kind cryptocurrency wallet that combines custodial and non-custodial functionality. This hybrid wallet combines on-chain and off-chain wallets, letting you manage and trade over 800 cryptocurrencies in one spot while retaining security, ease of use, and flexibility.

Cwallet lets you quickly deposit, withdraw, and swap cryptocurrency at the lowest possible cost. Tokens can also be exchanged for the 800+ cryptocurrencies accessible on Cwallet. Cwallet has the lowest transaction costs for cross-chain and "on-chain" swaps. As a result, you can freely swap these tokens within your wallet!

Cwallet's price charts are updated in real-time, allowing you to receive real-time updates on the top cryptocurrencies to invest in with Cwallet.

Get your free instant wallet now and start investing!

Conclusion

The spot market is the most common way for crypto enthusiasts, particularly beginners, to buy cryptocurrency because it is usually simple and free of technical jargon. While buying cryptocurrencies on the spot market is straightforward, it is critical to understand the fundamentals of cryptocurrency trading and do thorough research before investing in any cryptocurrency.