How Smart Investors Use Time, Not Leverage, to Capitalize on Bitcoin's Long-Term Rise

The recent crash was a necessary adjustment that reinforces the mandate to avoid the leverage trap.

Key Takeaways

- Smart investors prioritize time and compounding over excessive leverage, viewing it as the superior tool for long-term wealth creation.

- Bitcoin's value is structurally guaranteed to rise because its fixed supply is the ultimate defense against the macro reality of ceaseless fiat currency printing.

- The recent crash was a necessary adjustment that reinforces the mandate to avoid the leverage trap, which otherwise prevents participation in the market's inevitable recovery.

The crypto market experienced a severe flash market crash last Friday, with Bitcoin's price plunging over $10,000 in minutes and triggering a massive $20 billion liquidation event. For many, the instinct was fear and the question was "Is the bull market over?"

This dramatic sell-off was merely a necessary "clearing event" that resets the system.

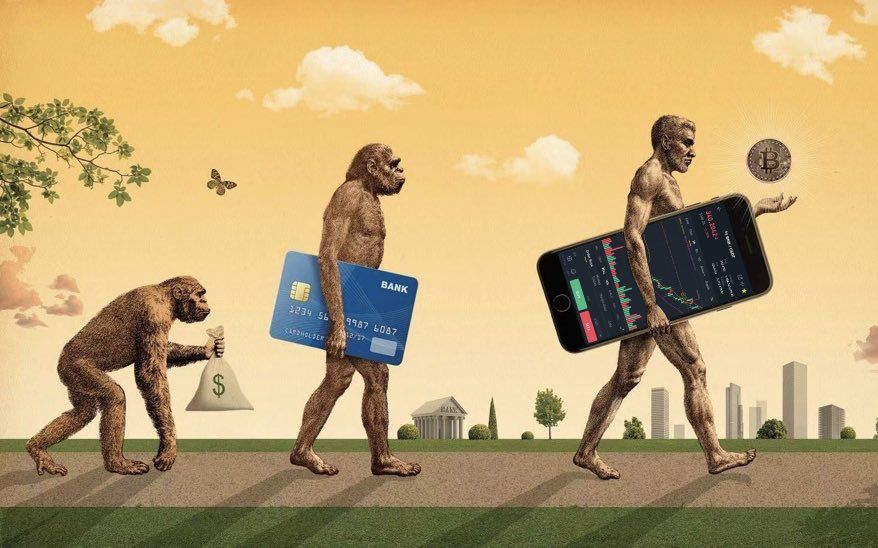

This article dissects the long-term investment philosophy that suggests the crash was a good thing, analyzing the three core lessons from the disaster: the inevitable power of Bitcoin, the structural need to clear excessive leverage, and the strategic superiority of time as a financial tool.

The Unassailable Thesis: Bitcoin as Resistance Money

The most profound lesson of the recent market panic lies in re-evaluating Bitcoin's core philosophical purpose. Bitcoin was not created as a volatile trading vehicle; it was designed as a decentralized digital currency, offering financial value free from the reliance on any single nation or political agenda. This makes it the ultimate Resistance Money.

Geopolitical Uncertainty as a Tail Wind

The impulse to sell Bitcoin amidst geopolitical turmoil, like the recent tariff shock, fundamentally misunderstands its long-term strategic value. As global political instability, trade wars, and fiscal chaos are projected to increase, the asset's value proposition as a non-sovereign, censorship-resistant reserve only grows stronger. The very macro instability that causes short-term panic provides the long-term fundamental reason to hold.

The Inevitable Ascent Against Fiat Debasement

The ultimate bull case rests on the structural certainty of fiat currency debasement.Central banks will never stop printing fiat money. This macroeconomic reality guarantees that the purchasing power of the U.S. dollar, Euro, and other fiat currencies will continue to decline.

- Fixed Supply Logic: In contrast, Bitcoin's hard-capped supply of 21 million coins ensures its scarcity is absolute. This structural guarantee means that, over any significant time horizon, its purchasing power must continue to rise against the backdrop of inflating money supplies.

- The Macro Mandate: The market volatility in the short term is noise; the unassailable signal is the unlimited inflation of central banks. Bitcoin is the solution to the world's most fundamental monetary problem, making its eventual success a near structural certainty.

Clearing Excessive Leverage is The Bull Market Health Check

The multi-billion dollar liquidation on October 11th was not a sign of Bitcoin's fundamental weakness, but a necessary systemic event that clears the path for future growth.

A Healthy Systemic Adjustment

The market correction was a "healthy adjustment" that served one primary purpose: eliminating excess leverage. Fundamental conditions, such as the technology, utility, and institutional adoption, did not change in the 72 hours of chaos. The crash simply wiped out over-leveraged speculators, restoring balance to the market and preventing a slower, more painful decline. This cleansing is essential, as too much leverage acts as sand in the gears of a sustainable rally.

The Superiority of Time Over Leverage

The biggest takeaway for smart investors is the structural superiority of using time over leverage. Leverage amplifies both gains and losses, frequently leading to forced liquidations that cut the investor out of the eventual upturn.

- Time Compounds, Leverage Liquidates: Time, in contrast, allows returns to compound while protecting capital from immediate systemic shocks. Volatility, when viewed through a multi-year lens, becomes merely noise within a clear upward trend.

- The Volatility Mandate: The rapid price swings serve as a potent reminder of the market’s energy. If Bitcoin can drop by $15,000 in a day, it proves it has the capacity to rise by $15,000 in a day when positive news arrives. The investor who uses time as their main tool remains in the game for those inevitable upside moves.

Discipline and Long-Term Vision are Needed for Trading

The ultimate takeaway for the retail investor is clear: the only factor that dictates your survival during a market shock is personal discipline.

Avoid the Fatal Mistake

The most crucial mandate is to avoid the leverage trap. Leverage transforms a philosophical investment in the future into a short-term gamble with an expiration date. By allowing borrowed capital to amplify your exposure, you risk forced liquidation, which cuts you out of the market right before the inevitable upturn.

The Conclusion of the Smart Investor

The recovery of Bitcoin and major markets following the political shock confirms that institutional conviction remains strong. The market operates at lightning speed, driven by the future, and investors are historically forgetful of short-term chaos. For smart investors, the path to financial peace is clear: focus on Bitcoin's unassailable long-term fundamentals, allow time to be your most powerful asset, and let the market's inevitable upward trajectory continue its course.

Cwallet: Your Secure Command Center for New Crypto Finance

Cwallet is built on the vision that digital asset management should be secure, effortless, and entirely in your hands. It provides a fortified, all-in-one platform designed to secure your entire portfolio, supporting over 1,000 cryptocurrencies across 60+ major blockchains.

Cwallet is dedicated to making crypto practical for today, ensuring your digital wealth maintains real-world liquidity. The revolutionary Cozy Card instantly transforms your secure holdings into a flexible payment solution, enabling global, secure spending everywhere cards are accepted. This commitment extends to engaging trading tools, including zero-fee Memecoin/xStocks and interactive Trend Trade/Market Battle, allowing you to actively participate in the market.

Cwallet provides unparalleled utility, from HR Bulk Management for corporate efficiency to easy Mobile Top-ups, proving it's designed for every use case. Cwallet empowers you to navigate the future of finance with confidence and control.

Join millions who are transforming the way they manage their digital wealth.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: This article reflects the strategic opinions of Anthony Pompliano, Founder and CEO of Professional Capital Management. And the content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.