How Institutional Capital Shapes Ethereum's Narrative: Community vs. Marketing Power

Institutional capital is reshaping Ethereum's narrative, often overpowering community-driven stories.

Key Takeaways

- Institutional capital is reshaping Ethereum's narrative, often overpowering community-driven stories.

- Fragmented marketing risks weakening Ethereum's long-term vision.

- Success depends on narrative clarity—a simple, compelling message that rivals Bitcoin's “Digital Gold.”

The ambitious vision of Web3 hinges on clear communication, yet a critical problem plagues the ecosystem: narrative chaos.

This dilemma is best illustrated by a famous advertising lesson: when a consumer is given too many selling points at once, they fail to grasp any of them. For years, the investment thesis for Ethereum has suffered this exact problem, pitching multiple, often contradictory, ideas simultaneously.

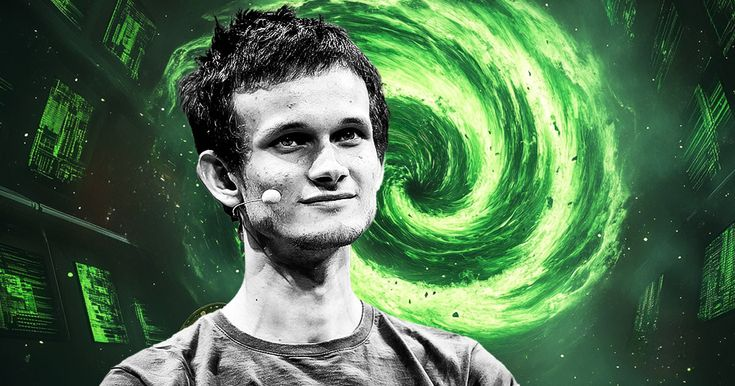

This article analyzes the crucial power struggle now underway: how the platform's decentralized community vision (the direction of Vitalik) is being drowned out by the strategic, marketing-driven demands of institutional capital (the direction of Wall Street).

This conflict determines who truly controls the message and, ultimately, the identity of Ethereum.

The Core Conflict: Vitalik's Dilemma Versus Capital's Demand

The Ethereum ecosystem is currently split by a fundamental tension that defines its identity crisis: the philosophical mandate for decentralized neutrality versus the capital market's relentless demand for simple narratives and immediate profit. This core conflict, the struggle to maintain community vision while simultaneously courting Wall Street's massive capital, is the driving force behind the narrative war.

Vitalik's Unifying Pitch, Searching for "Low-Risk DeFi"

The fragmentation of Ethereum's identity stems from its very success. As the network grew, its purpose became diluted across numerous, often contradictory, visions, from "World Computer" to "Hyper-Sound Money." Vitalik Buterin has openly acknowledged this challenge, noting the "disjointness" caused by the contradictory goals of generating revenue for token holders and maintaining the chain's neutrality.

His latest attempt to resolve this philosophical puzzle is the concept of "low-risk DeFi."This idea is a calculated move to find a single, unifying narrative, the "one paper ball", that can satisfy both sides of the debate. It promises applications that can create revenue for users while strictly maintaining the network’s core values of security and decentralization.

This pitch is crucial because it strategically differentiates Ethereum: it offers more utility than non-yielding Bitcoin, yet less operational risk than many high-velocity DeFi platforms.

By focusing on a safe, productive middle ground, Vitalik seeks to provide the platform with a single, compelling "elevator pitch" that the community can rally behind.

The Voice of Wall Street: The Competing Narratives

The moment Vitalik introduces a unifying pitch, it is immediately placed in direct competition with the louder, more aggressive demands of the capital markets. The firms now building massive Digital Asset Treasuries (DATs) are the new advertisers for Ethereum, and their goal is not philosophical consistency, but maximum capital acquisition.

Unlike the core community, which seeks a single story, institutional marketers are deliberately overwhelming the market with multiple, often contradictory, narratives.

For example, while Vitalik pitches "low-risk DeFi," DAT chairmen like Joe Lubin (SharpLink Gaming) and Tom Lee (BitMine) offer a bewildering mix of investment theses:

- A Trust Commodity: (A philosophical hedge against fiat)

- A Productive Asset: (Yield generation against inflation)

- RWA Exposure and AI Agents: (Future-proofing the portfolio)

This approach is the antithesis of the simple messaging principle. It is an intentional strategy to ensure that every traditional investor, regardless of their risk appetite or sector focus, hears a story tailored to their needs. The consequence is profound: it transforms the delicate process of setting Ethereum's vision into a chaotic marketing competition, where the voice with the most capital controls the dominant narrative.

How Capital Replaces Community Storytelling?

The conflict intensifies as DATs act less like communal contributors and more like competing advertisers. They are deliberately overwhelming the market with multiple, conflicting narratives to maximize capital inflow.

Marketing Power Trumps Vision

This competition has a profound consequence: it shifts narrative control away from the decentralized community and core contributors toward concentrated capital.

The experience of the Ethereum ecosystem highlights a critical truth: Tom Lee, a public-facing finance personality, has attracted significantly more institutional capital than even Ethereum co-founder Joe Lubin.This demonstrates a harsh reality: aggressive, well-funded marketing narratives, even if competing, can attract capital more effectively than years of patient community contribution.

The Final Consequence

This institutional push transforms the delicate process of setting Ethereum's vision into a chaotic marketing competition.

While Bitcoin succeeded by offering a single, unified value proposition, Digital Gold, Ethereum risks becoming a fragmented noise.

The future structural direction of the network may soon be dictated not by the philosophical consensus of its community, but by the investment thesis that best suits the profit models of the largest institutional treasuries.

The Final Mandate: Clarity in Ethereum's Vision

For Ethereum to succeed long-term, the community must learn from advertising's central lesson: complexity is the enemy of adoption.

The real challenge is whether Ethereum's voice can coalesce around a simple, powerful, and unified narrative—one strong enough to attract mainstream funds without compromising decentralization.

- For builders, this means protecting Ethereum's vision from being hijacked by short-term marketing cycles.

- For investors, this means looking beyond the “noise” and focusing on which narrative truly drives Ethereum's structural direction.

The ultimate success of Ethereum will be determined by whether the voice of the community can coalesce around a single, powerful narrative that is simple, compelling, and strong enough to attract mainstream funds without compromising the integrity of the network.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.

In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.