Cwallet Weekly Crypto Express | Is Bitcoin Stalling in a Key Supply Zone?

Bitcoin is pushing higher, but price has entered a historically dense supply zone

Executive Summary (Week 02, 2026)

- Bitcoin is pushing higher, but price has entered a historically dense supply zone

- Long-term holders are not aggressively selling, yet overhead supply remains active

- Short-term holder cost basis is becoming the key level to watch

- Volatility is compressed, suggesting a larger move may follow — direction still unconfirmed

Bitcoin Is Moving Up, Into Resistance

Bitcoin has started the year with impressive momentum, pushing toward key highs. However, as the price rises, it has entered a historically dense supply zone — a price level where many long-term holders accumulated their positions during previous market cycles.

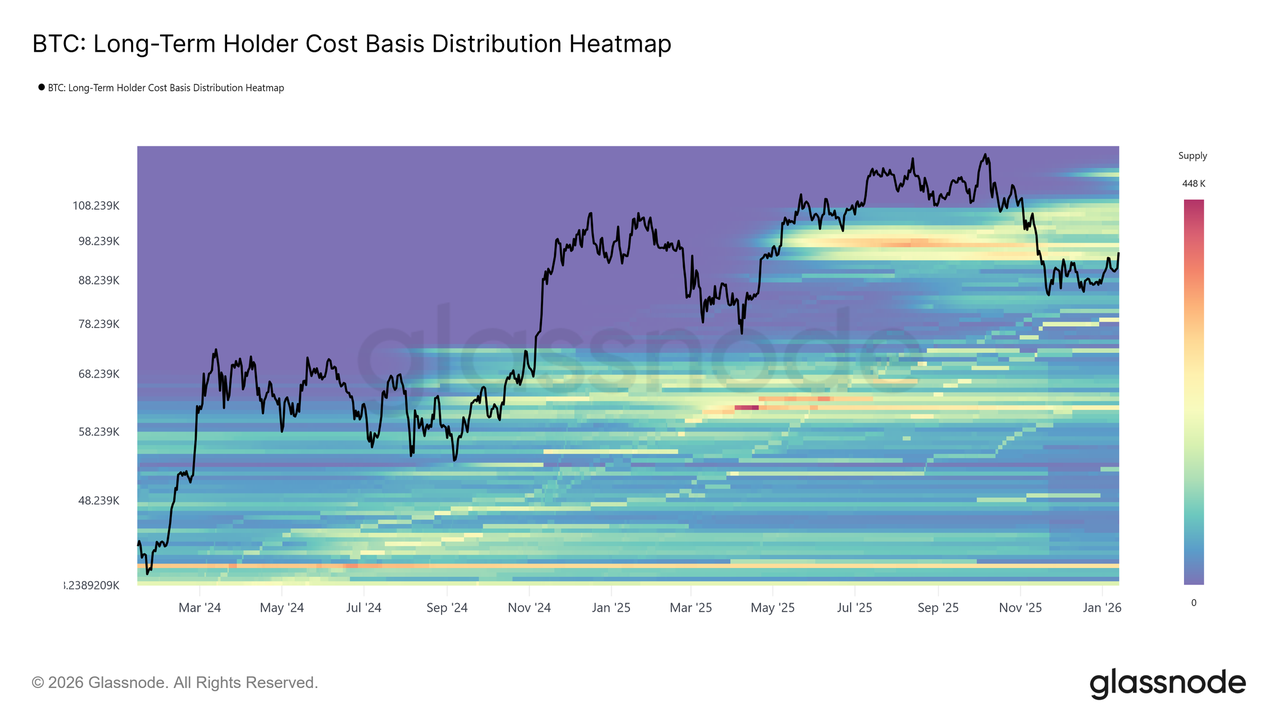

This supply zone, ranging from $93K to $110K, is significant because it marks a region where Bitcoin has previously encountered resistance. A large proportion of investors bought at these levels, and now, as Bitcoin approaches these prices again, the market faces a potential overhead supply wall. In other words, many long-term holders are in profit and might be looking to sell as prices revisit their breakeven points.

Earlier this week, Bitcoin was moving upward toward this critical $93K level, but it has since dropped below this threshold, causing some market uncertainty. The recent price dip below $93K signals a shift in market sentiment, and it suggests that the market may face increased selling pressure as it contends with this overhead supply. It remains to be seen whether demand will be strong enough to absorb this selling pressure or if we will see more downside in the short term.

With the market reacting to these levels, traders must remain cautious as Bitcoin navigates this critical area. The $93K–$110K zone could prove pivotal in determining the direction of the next major move.

On-Chain Signals: Strength With Friction

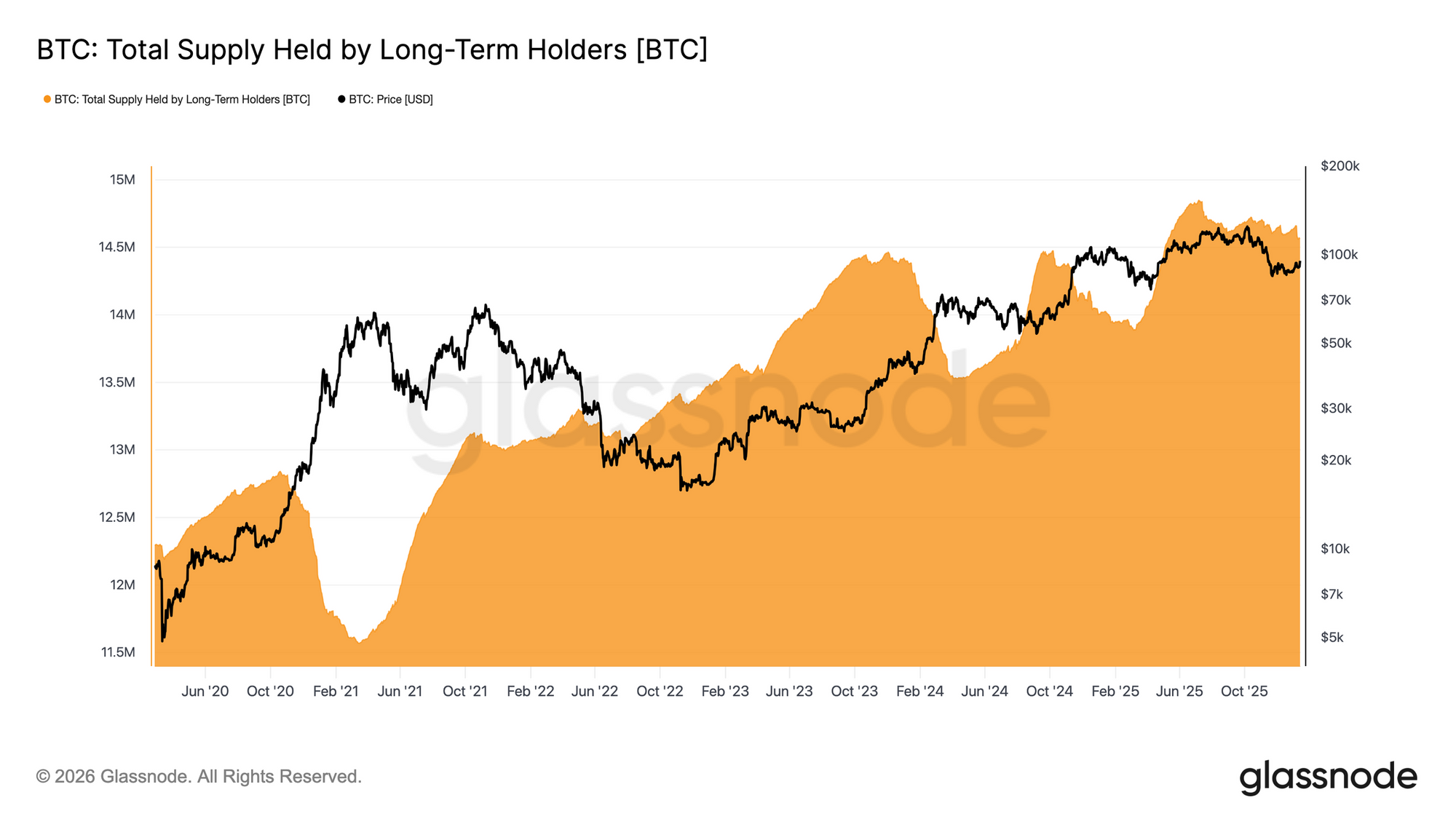

Looking deeper into the on-chain data, we see a mixed picture. Long-term holders (LTH) are showing no signs of panic selling, suggesting that many investors are confident in Bitcoin's long-term prospects. Their supply remains relatively stable, meaning they are not rushing to liquidate positions at current price levels.

However, despite the relative stability of long-term holders, overhead supply remains a concern. As Bitcoin’s price rises into these zones, the large accumulation of Bitcoin by long-term holders presents a natural resistance point. If price breaches this resistance and moves higher, those who accumulated during earlier phases may decide to take profits, adding downward pressure on the price. This could create short-term volatility as sellers take advantage of current price levels.

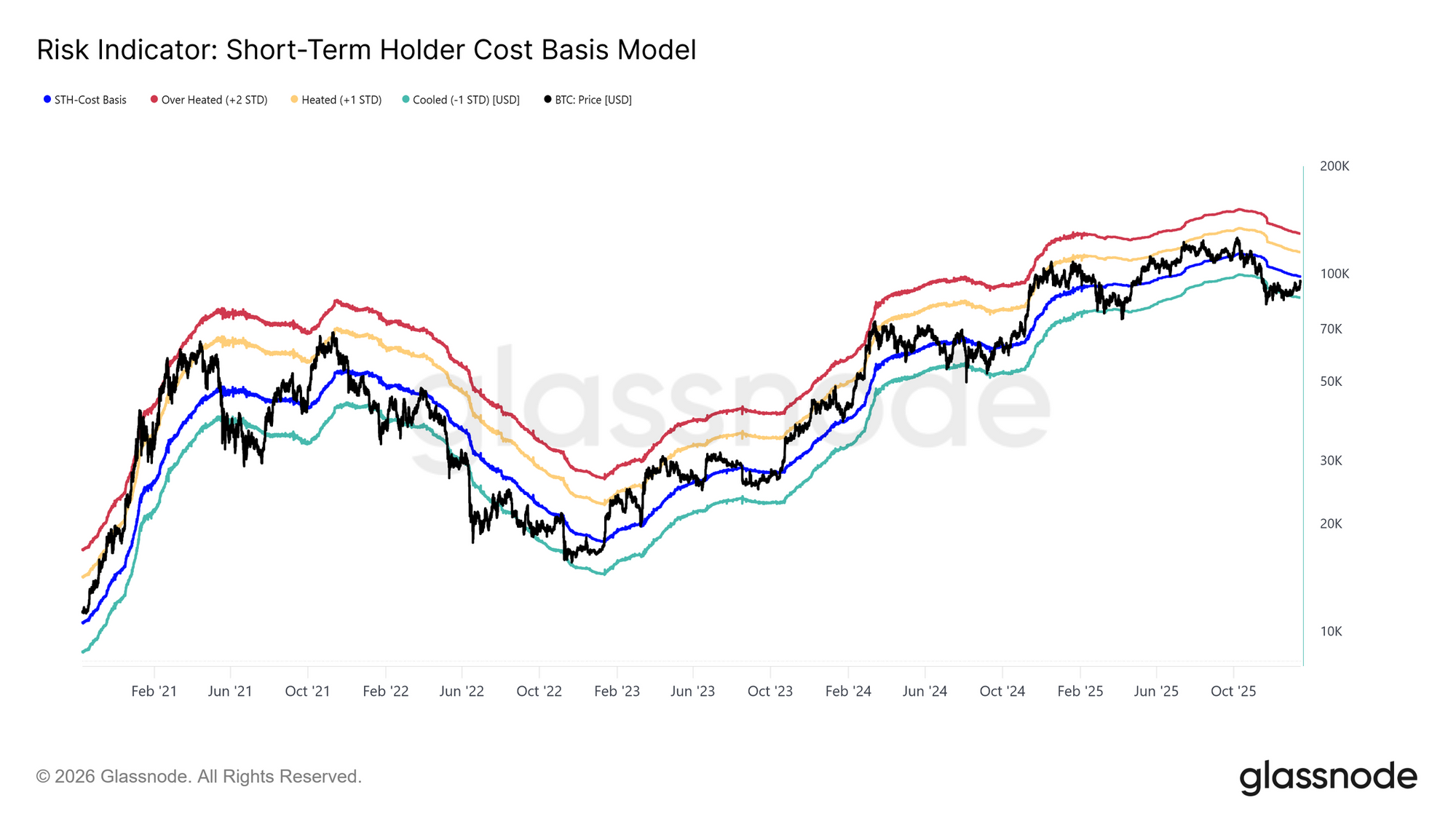

Recent on-chain metrics show that short-term holder cost basis is now a key point of interest. This is a critical level because short-term holders are more likely to act based on market sentiment and near-term price action. If Bitcoin cannot regain momentum above these levels, it may indicate that short-term traders are not confident in the market’s ability to break through the $93K resistance zone. This could lead to a correction or further consolidation.

With Bitcoin currently below $93K, it’s crucial to keep an eye on short-term holders' positions as they may drive the next market move. If they begin to sell, the market could see a more significant decline, while continued support from long-term holders might stabilize price action.

Derivatives Hint at Caution, Not Euphoria

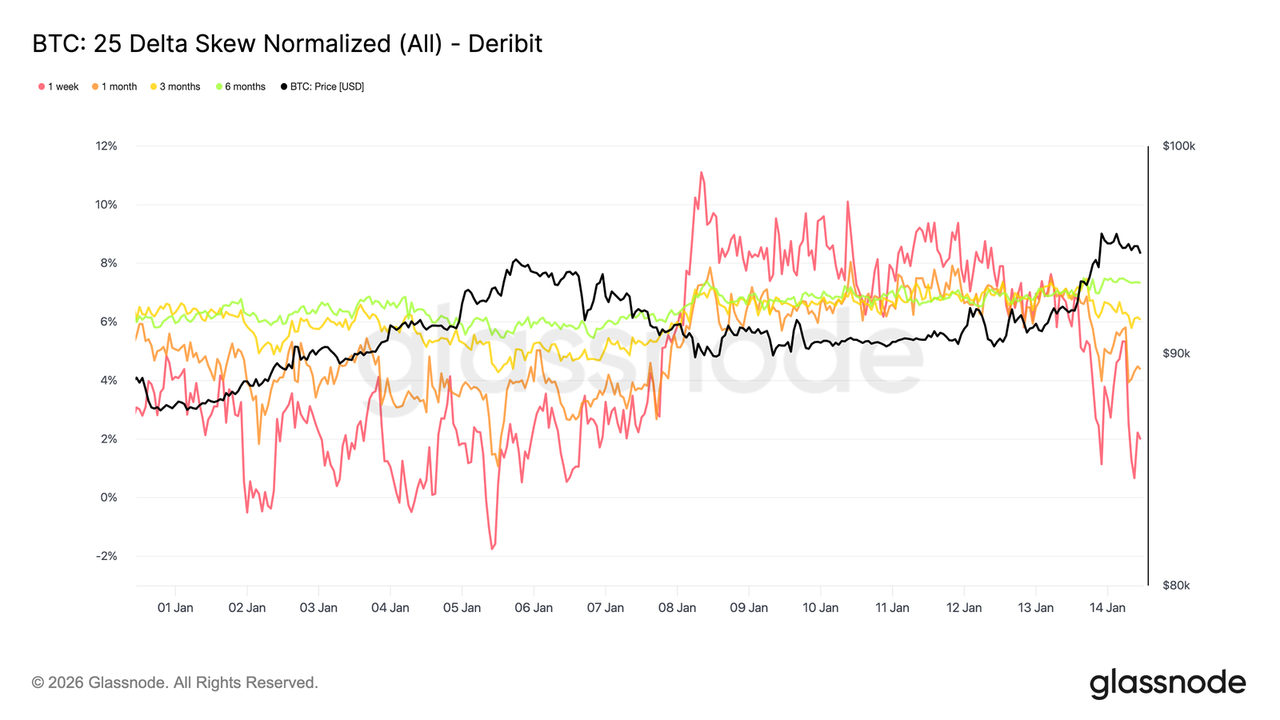

While the spot market shows some positive buying pressure, the derivatives market reflects a more cautious outlook. Traders in the derivatives market are not exhibiting extreme optimism despite the recent price increase, suggesting controlled risk.

- The leverage ratio remains moderate, with traders avoiding excessive leverage. This signals that the market is not yet fully committed to a sustained rally and that many participants are opting for more conservative positions.

- Volatility skew in options markets shows that many traders are hedging against potential downside risk, a move that indicates uncertainty in the market’s near-term direction.

This hedging activity suggests that market participants are prepared for both upside and downside, but not expecting an explosive move in either direction without more confirmation.

Traders in the derivatives markets are positioning themselves defensively. This cautious stance is consistent with the behavior of long-term holders, who are showing no immediate interest in liquidating their positions despite the price rise. For now, the market seems to be waiting for clearer signals before making major bets on price direction.

What This Means for Crypto Users

For most Cwallet users, this week's market presents both risks and opportunities. Here's what you should consider as Bitcoin navigates these critical levels:

- Market Direction Remains Unclear: Bitcoin's price is below the $93K resistance zone, and the market is struggling to break through. As price action enters a consolidation phase, it is critical to stay flexible and avoid making aggressive moves until a clearer trend emerges. A wait-and-see approach may be the best strategy in uncertain market conditions.

- Strategize with Flexibility: Risk management becomes even more important during periods of uncertainty. If you're holding positions, use Cwallet Spot trading features to adjust exposure. Instead of taking on large directional bets, consider swapping assets or staying liquid to avoid unnecessary risks. Flexibility is key to navigating the current market environment.

- Avoid FOMO (Fear of Missing Out): In the current market, there's no need to rush into decisions. With volatility low and the potential for overhead supply, waiting for more signals can help you avoid premature decisions. Keeping a watchful eye on market developments and adjusting when necessary can help minimize risk.

📖 Recommend: How FOMO Scams Trick Beginners in Crypto And How to Stay Safe

If you're looking for low-risk strategies, consider holding stablecoins or staying in liquid positions that can be easily adjusted. Cwallet's intuitive interface can help you manage your positions and remain agile as the market fluctuates.

Conclusion

Bitcoin is currently facing resistance after its recent rally, with the price falling below the key $93K level. This dip below the critical supply zone suggests a shift in market sentiment, with increased selling pressure from long-term holders. The market is now in a consolidation phase, and traders will need to remain cautious as Bitcoin tests support levels below this key zone. In this environment, risk management is paramount.

For Cwallet users, this is a time to stay flexible. Whether you're holding Bitcoin or other assets, adjusting positions based on market conditions and avoiding FOMO will be key to managing risk. Until a clear trend emerges, it's important to watch key support levels and stay prepared to react as the market continues to digest these important price levels.

Stay tuned for next week's Cwallet Weekly Crypto Express, where we'll continue to refine our analysis, offering you a clearer, more straightforward view of the market. As we move through 2026, expect more structured insights designed to help you navigate the crypto landscape with confidence and clarity.

Cwallet: Your All-in-One Crypto Solution

Cwallet allows you to store, trade, and manage 1,000+ cryptocurrencies across 60+ blockchains, offering flexibility for both Spot Trading and Futures Trading. With features like Perpetual Trading, Cozy Card, and more, Cwallet empowers you to make the most of your crypto journey

Official Links

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Crypto assets are volatile, and all investment decisions should be based on your own research (DYOR). Cwallet assumes no liability for any losses.