Cwallet Weekly Crypto Express | Bitcoin Slips to $75K: Is the Market Losing Momentum?

Bitcoin remains stuck near key on-chain cost basis levels, with support under pressure and conviction required to prevent further structural weakness.

Executive Summary (Week 04, 2026)

- Bitcoin remains stuck near key on-chain cost basis levels, with support under pressure and conviction required to prevent further structural weakness.

- Short-Term Holder conditions remain fragile, leaving recent buyers sensitive to price weakness.

- Broader holder behaviour is defensive, consistent with a regime driven by absorption rather than expansion.

- Liquidity continues to be the deciding factor for breakout continuation.

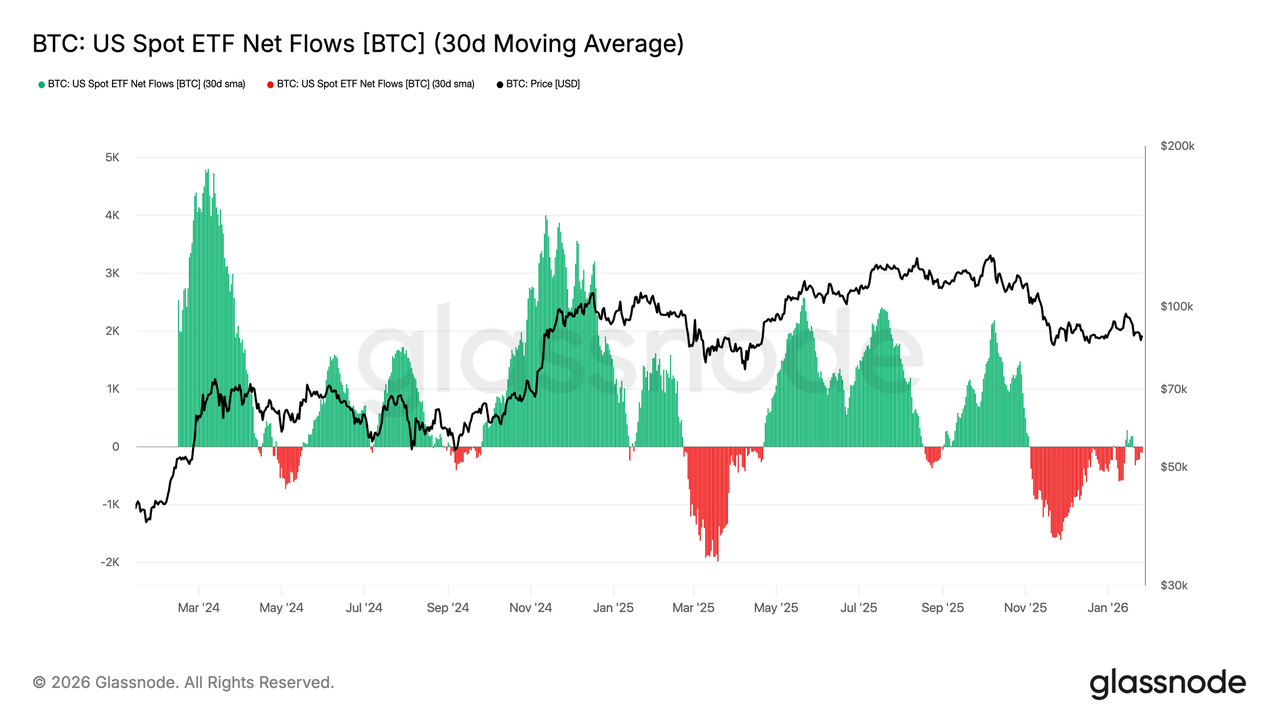

- Spot ETF outflows have softened, and marginal buy pressure is returning, though follow-through is still needed for trend confirmation.

Market Update

Since the original on-chain observations in late January, Bitcoin has experienced a significant pullback, with price trading near approximately $75,000 on 26th Feb, 2026.

This move shows that the overhead supply stress highlighted in the prior analysis was not absorbed, and selling pressure materialized as the price failed to reclaim key breakeven cost basis levels. In the current environment, support bands below $83,000 and $80,000 have become increasingly important as potential pivot zones for stabilization or further downside.

This recent price behavior reinforces the structural themes identified in the on-chain data, while also reflecting the broader shift in market sentiment toward caution amid weakening participation and softened breakout attempts.

Bitcoin Remains Under Structural Pressure

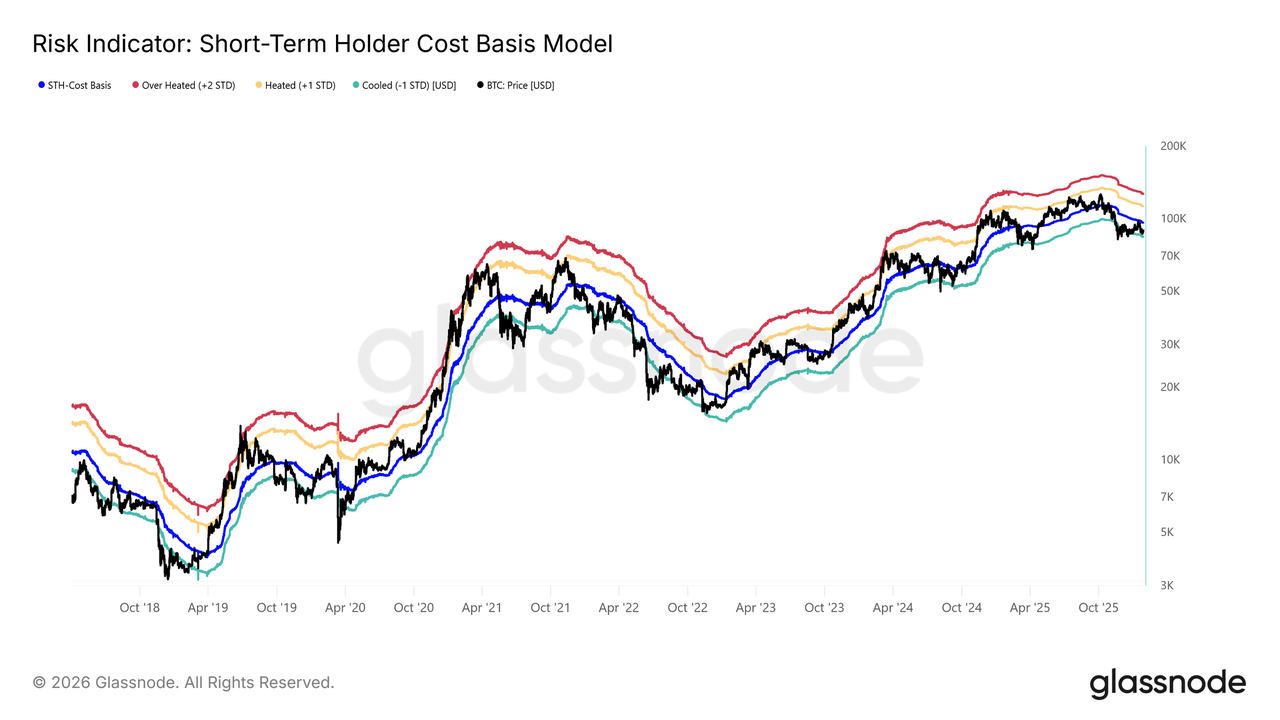

The late January analysis from Glassnode observed that Bitcoin failed to sustain a move above the Short-Term Holder cost basis (~$96.5K), and subsequently slipped back into a shallow pullback mode.

Historically, such failed breakouts at key cost basis levels are reminiscent of prior consolidation periods where upside momentum struggled to form lasting trend expansion. The analysis highlighted a critical support corridor in the vicinity of $83.4K to $80.7K, representing a near-term support band that, if broken, could open the door to deeper correction dynamics. The recent price action toward ~76K suggests that this downside risk is actively being tested, with the market now focusing on whether demand can stabilize near lower historical support or if the broader consolidation will continue.

In such structural regimes, price action tends to oscillate within a range until fresh demand arrives, rather than breaking sharply in one direction. The presence of unresolved overhead supply and the absence of persistent accumulation at higher levels create an environment where sell-side pressure can re-emerge even without aggressive distribution.

On-Chain Dynamics: Fragility Amid Defensive Behaviour

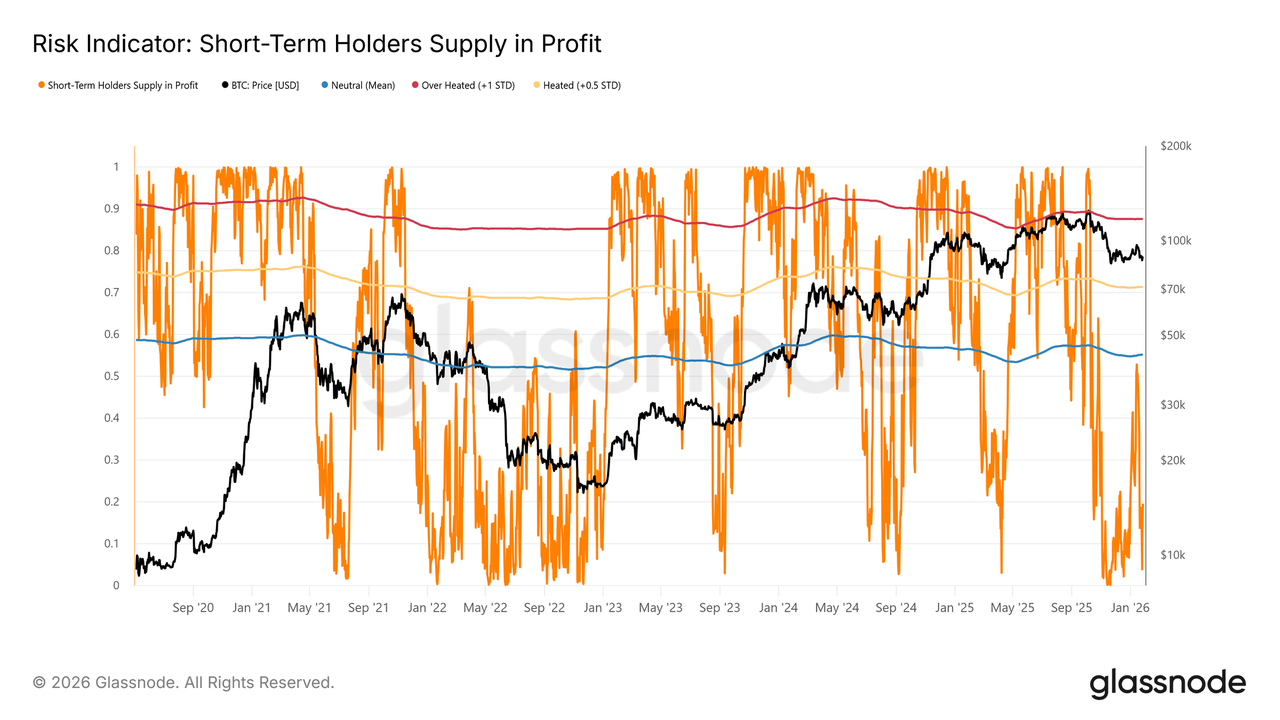

Analysis report notes that Short-Term Holders remain sensitive to losses, with a significant share of recently acquired supply still underwater. While widespread short-term holder capitulation has not occurred — with only about 19.5% of STH supply held at a loss — the sensitivity to price weakness remains a key factor amplifying defensive behaviour.

Meanwhile, more than 22% of circulating supply is currently held at a loss, a condition similar to past consolidation phases like Q1 2022 and Q2 2018, suggesting that broader holder cohorts also face ongoing discount pressure. These structures tend to suppress aggressive accumulation until price moves out of congested ranges and establishes clearer demand dominance.

On-chain signals remain more consistent with absorption and distribution balance rather than clear trend acceleration, meaning holders are neither aggressively selling nor aggressively accumulating — another hallmark of a range-bound market.

Off-Chain Insights: Spot and Derivatives Participation

Irrespective of pure on-chain supply stress, off-chain signals indicate some stabilizing flows. For example:

- Spot ETF flows have softened; the 30-day average drifted back near neutral after prolonged outflows, reducing mechanical sell pressure.

- Cumulative spot volume delta (CVD) bias has begun to improve, particularly on offshore venues such as Binance, hinting at marginal buy pressure.

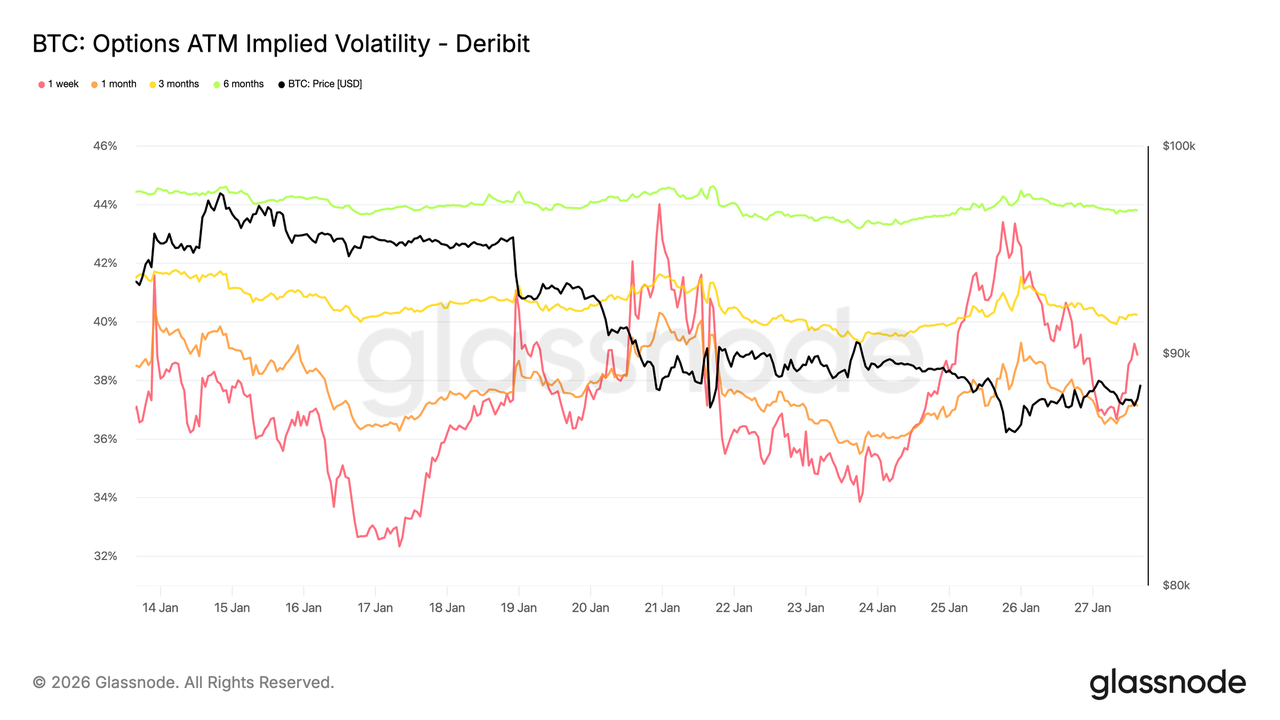

- Derivative markets remain cautious, with perpetual futures funding rates predominantly neutral and overall leverage subdued.

- Options markets show a bearish skew, hedging demand for downside protection yet without pricing in extreme drawdowns, indicating a defensive, measured approach among participants.

Taken together, these metrics suggest a market that acknowledges bearish risks but isn’t signaling imminent structural collapse — price behavior remains controlled rather than disorderly.

What This Means for Crypto Users

For most Cwallet users, the current environment continues to present a mix of risks and opportunities, set against a market that is consolidating and sensitive to liquidity dynamics:

- Market Direction Still Unclear:

Bitcoin's recent struggle to sustain above key cost basis levels, followed by a notable pullback, underscores that trend direction remains ambiguous. Range-bound behavior means that waiting for confirmed market structure shifts (e.g., sustained support holds or clear demand re-entry) may help avoid premature decisions in choppy conditions.

- Focus on Risk Awareness and Flexibility:

In this environment, greater emphasis on risk awareness and maintaining flexibility is important. Users may consider preserving liquidity, adjusting position exposure through spot trading or asset swaps, and avoiding large directional commitments when breakout signals are weak. This approach helps align exposure with evolving market conditions rather than attempting to forecast specific price moves.

- Observe Key Levels and Market Signals:

Monitoring how price interacts with historically significant support zones — such as those referenced near $80K and below — along with shifts in spot flows and volatility behavior, can offer meaningful context. A measured view of short-term fluctuations can help filter noise and create clearer perspectives over time.

By keeping broader structural context and recent price behavior in view, Cwallet users can stay grounded in risk awareness while remaining prepared for potential catalysts that may influence the next phase of market activity.

Conclusion

Bitcoin's price action this week reflects a market that continues to consolidate around critical on-chain levels, with persistent overhead supply and liquidity conditions shaping near-term outcomes.

The inability to sustain gains above key cost basis bands has allowed sell pressure to re-emerge, contributing to recent weakness as price tested lower support ranges.

Off-chain indicators suggest some stabilization in spot flows and ETF demand, but derivatives markets remain cautious and defensive. Taken together, the market appears poised between absorbing existing distribution and awaiting new demand signals to break out of its current range.

For Cwallet users, this highlights the importance of maintaining risk awareness, staying flexible, and observing evolving market cues instead of rushing into directional decisions. As the market digests these structural conditions, clarity in on-chain and liquidity dynamics will likely guide the next meaningful move.

Stay tuned for next week's Cwallet Weekly Crypto Express, where we will continue tracking evolving on-chain and market signals and delivering structured insights to help clarify market behavior as 2026 progresses.

Cwallet: Your Secure, All-in-One Gateway to Global Crypto Finance

Cwallet redefines the digital wallet, offering a unified, high-performance platform to manage your entire portfolio, supporting over 1,000 cryptocurrencies across 60+ global networks. We combine top-tier security with unmatched utility.

Financial Control: Go beyond holding. Engage in Spot Trading, including Swap, Memecoins, and xStocks, or explore Futures Trading, such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, for dynamic market action.

Real-World Power: Instantly unlock the spending potential of your assets. The Cozy Card transforms your crypto into a flexible payment solution for secure, real-world transactions online and offline.

Practical Tools: Boost efficiency with integrated services. Use HR Bulk Management for business needs, or Gift Cards and Mobile Top-ups for everyday utility.

Cwallet is where security, utility, and innovation come together in one powerful application.Join millions transforming the way they manage their digital wealth.

Official Link

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.