Cwallet Weekly Crypto Express | Bears in Control: Is BTC's Downtrend Intensifying?

Bitcoin has broken key support levels and is now trading below the True Market Mean, reflecting rising sell pressure.

Executive Summary (Week 05, 2026)

- Bitcoin has broken key support levels and is now trading below the True Market Mean, reflecting rising sell pressure.

- Short-term holders are increasingly vulnerable, with realized losses climbing as prices dip.

- Broader holder activity remains defensive, indicating a range-bound or weakening market structure.

- Spot flows and institutional demand remain soft, showing that buyers have yet to return in meaningful numbers.

- Derivatives markets reflect cautious positioning, with leverage subdued and option skew pointing to downside protection.

Market Update

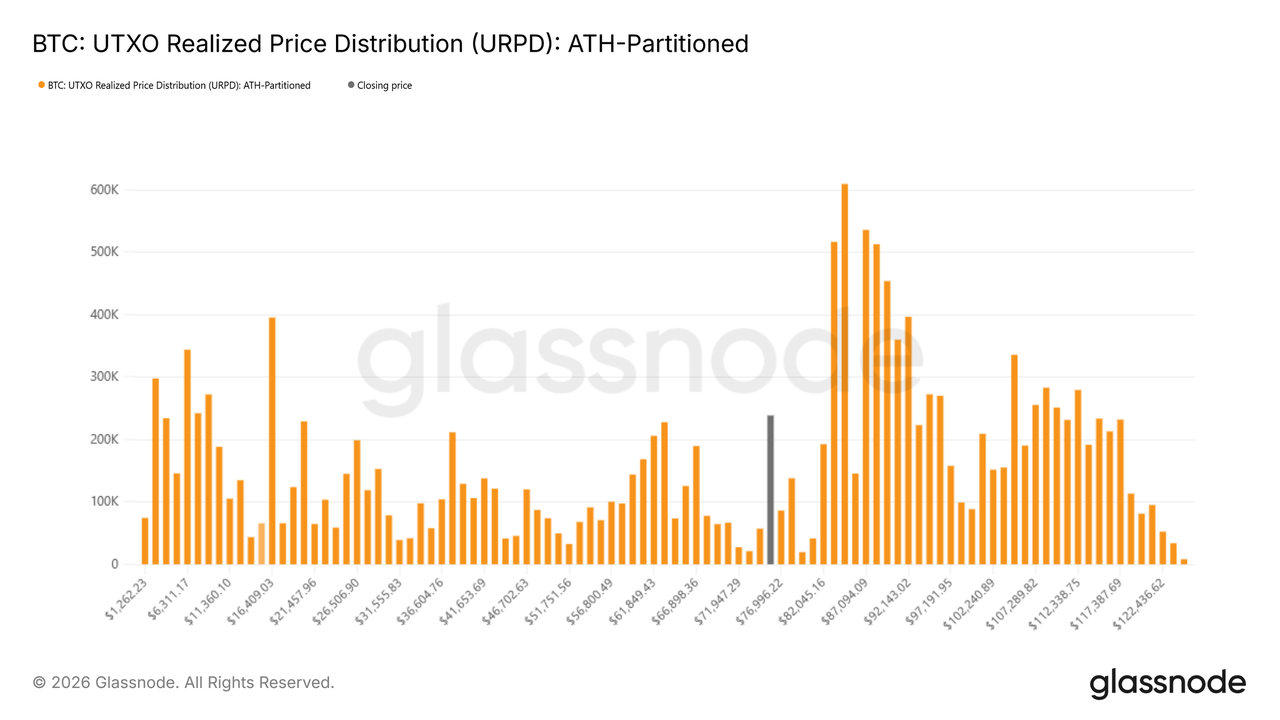

Since the initial on-chain observations in early February, Bitcoin has continued to face downward pressure, recently trading in the low $70K range. This decline confirms the structural stress highlighted in late January, as overhead supply and weak absorption created conditions for further selling. The break below the True Market Mean underscores the shift in market sentiment toward defensive behavior, while short-term holder fragility has amplified downside movements. As Bitcoin approaches lower support bands around $70–72K, the market remains sensitive to liquidity shifts, and renewed demand will be required to stabilize the trend.

Bitcoin Under Structural Pressure

The Week 05 analysis emphasizes that Bitcoin has now entered a phase where bearish forces dominate. The failure to reclaim key cost basis levels, combined with increasing realized losses, signals a defensive market structure. Long-term holders are not aggressively selling, but weak spot demand leaves room for downward pressure to continue.

On-chain data shows that the Short-Term Holder (STH) cohort is particularly sensitive, with a significant share of recently acquired coins now underwater. This makes them prone to capitulation during minor corrections, which can amplify short-term volatility. Meanwhile, broader holder groups are maintaining positions, suggesting that any meaningful recovery will require fresh inflows rather than existing holders re-accumulating.

On-Chain Signals: Rising Selling Pressure

- Realized Losses Increasing: The proportion of coins sold at a loss has grown, indicating defensive sell behavior.

- Active Address and Transfer Activity Low: Market participation remains muted, confirming hesitancy among potential buyers.

- Critical Support Zones Testing: Price is now approaching historically significant support bands (~$70–$72K), which may act as short-term pivot points if demand stabilizes.Overall, these on-chain indicators point to a market in a stress phase, where defensive selling is present but aggressive liquidation is not yet widespread.

Derivatives & Market Sentiment

Off-chain metrics reinforce the cautious market stance:

- Spot Trading Volume Soft: 30-day averages remain low, suggesting limited buying pressure.

- Institutional Flows Weak: ETFs and corporate/sovereign funds show net outflows, indicating restrained participation.

- Perpetual Futures Funding Rates Neutral: Leverage remains moderate, and traders are avoiding large directional bets.

- Option Skew Points Downside Protection: Pricing in puts remains higher than calls, reflecting defensive sentiment without panic.

These indicators suggest the market is absorbing sell pressure but has yet to attract significant demand to trigger a durable rebound.

What This Means for Crypto Users

For Cwallet users, the current environment underscores the importance of flexibility, awareness, and risk management:

- Market Direction Remains Unclear: Bitcoin is below key cost levels and could continue testing support. Avoid aggressive directional bets until structural clarity emerges.

- Maintain Position Flexibility: Users may consider staying liquid, adjusting exposure via Cwallet Spot Trading, or using swaps to reduce risk while monitoring market developments.

- Focus on Defensive Management: Avoid FOMO-driven entry; observe support and demand signals, and consider strategies that allow quick adjustments as the market evolves.

By staying informed and patient, users can navigate this stress phase while minimizing exposure to unnecessary downside risk.

Conclusion

Bitcoin's market structure this week confirms that bears currently control near-term momentum. With price below the True Market Mean and short-term holders vulnerable, the market remains in a defensive, range-bound regime. While long-term holders are holding steady, weak spot flows and cautious derivatives positioning underscore the need for risk management.

For Cwallet users, the focus should remain on flexibility, observing key support levels, and maintaining defensive exposure. Until clear buying pressure returns or structural support is confirmed, market participants should exercise caution and rely on measured, informed strategies.

Stay tuned for next week's Cwallet Weekly Crypto Express, where we will continue delivering structured on-chain insights with clear context and actionable understanding to help users navigate market stress phases in 2026.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, it's an all-in-one platform for secure crypto management and flexible trading.Buy, swap, trade, earn, and spend 1,000+ cryptocurrencies across 60+ blockchains in one place. Spend your digital assets like cash with the Cozy Card, while tools like HR bulk management, mobile top-ups, and gift cards make everyday transactions smoother.We are evolving into a comprehensive crypto finance hub. From Spot Trading, including Swap, Memecoins, and xStocks, to Futures Trading such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, Cwallet supports different trading styles with clarity and control.Plus, built-in IM keeps users connected with friends and informed directly within the trading experience.Join millions reimagining what a crypto wallet can do. Stay cozy, trade smart, and explore the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.