Candlestick Charts: Definition and Basics Explained

A candlestick chart represents price movements over a specific time and is commonly displayed on trading charts. Each candlestick provides information about the opening, closing, and highest and lowest prices within that timeframe.

Candlestick charts are popular and wield significant power as a technical analysis tool in financial markets, including cryptocurrencies. They offer valuable insights into market sentiment, trends, and potential reversals. This comprehensive guide delves into the world of candlestick charts by exploring their definition, historical significance, interpretation techniques, and their crucial role in trading and investing.

Understanding Candlestick Charts: A Brief History

Candlestick charts have a rich history, tracing back to 18th-century Japan. Initially employed for analyzing rice contract prices, Homma Munehisa, a prominent Japanese rice trader, honed and popularized the technique. Today, these charts enjoy widespread usage across diverse financial markets.

What is a Candlestick Chart?

A candlestick chart represents price movements over a specific time and is commonly displayed on trading charts. Each candlestick provides information about the opening, closing, and highest and lowest prices within that timeframe. Traders analyze patterns formed by multiple candlesticks to make well-informed decisions.

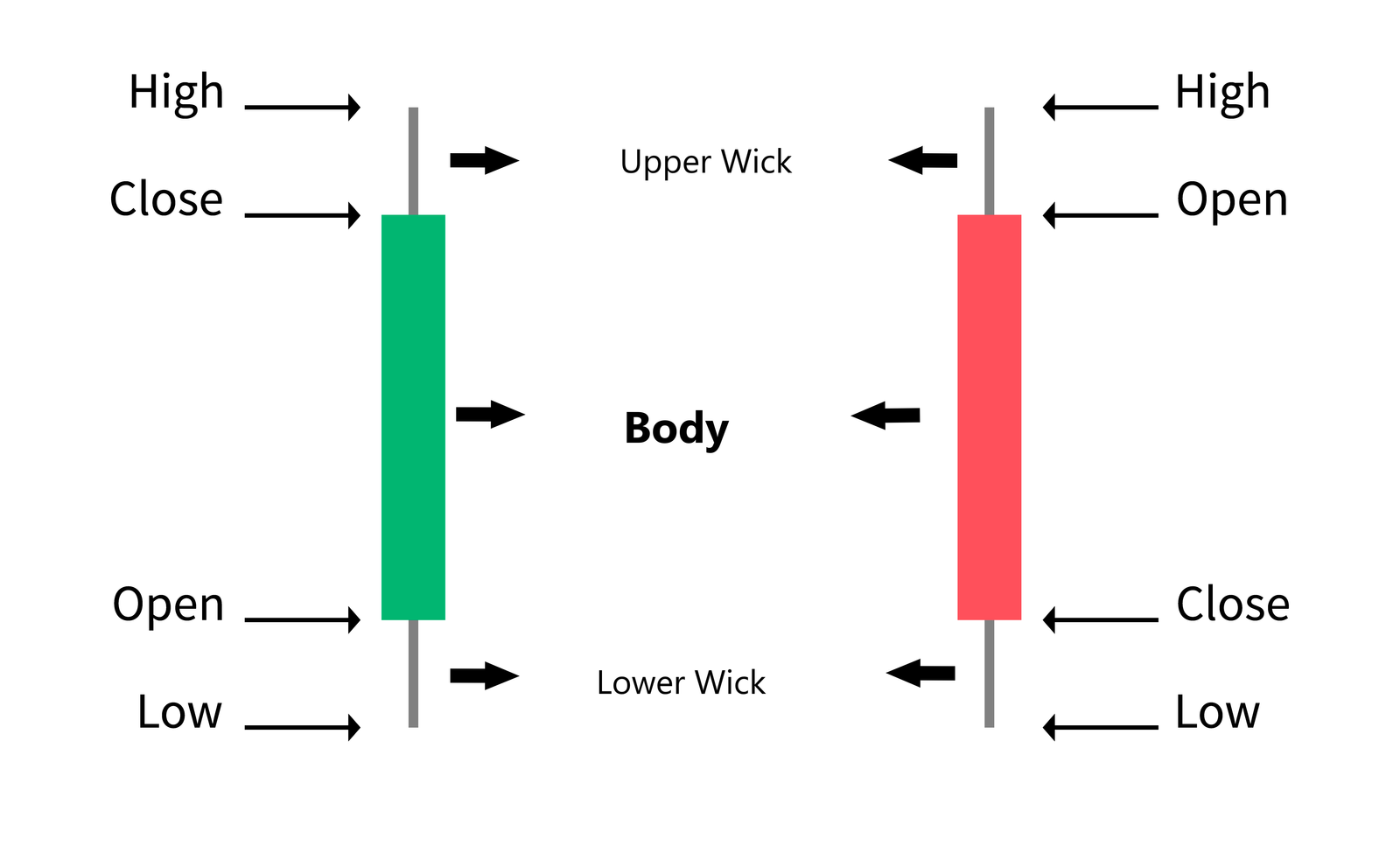

Key Components of a Candlestick

A single candlestick consists of the following components:

Body: The rectangular area between the open and closed prices is known as the body. When the close price exceeds the open price, filling or color the body is customary, indicating a bullish (positive) sentiment. Conversely, if the close price is lower than the open price, the body tends to be hollow or of a different color, representing a bearish (negative) sentiment.

Read More: Beginners' Guide Into Cryptocurrency Technical Analysis.

Wick (or Shadow): The thin lines extending above and below the body, representing the high and low prices during the period. The upper wick extends from the top of the body to the high price, while the lower wick extends from the bottom to the low price.

Reading Candlestick Patterns

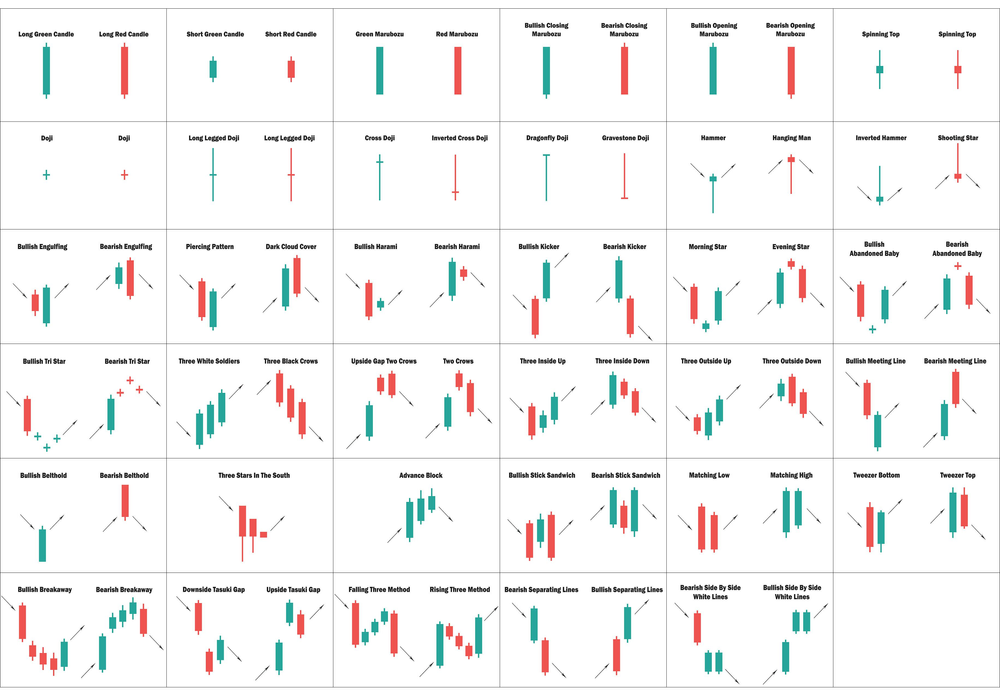

Candlestick patterns form when multiple candlesticks are arranged on a chart. These patterns offer valuable insights into market psychology and can indicate potential price movements. Let's explore some common candlestick patterns and their interpretations.

- Doji: A doji represents a state of indecision and uncertainty in the market, characterized by its small body. This candlestick pattern suggests a potential reversal when it appears after a significant uptrend or downtrend.

- Bullish Engulfing: The Bullish Engulfing pattern is characterized by a small bearish candle and a larger bullish candle. This pattern indicates the possibility of a reversal from a downtrend to an uptrend.

- Bearish Engulfing: The bearish engulfing pattern indicates a potential reversal from an uptrend to a downtrend. It is the opposite of the bullish engulfing pattern.

- Hammer: In technical analysis, a hammer is characterized by its small body and long lower wick. This pattern suggests that sellers exerted pressure, causing the price to decrease during the session. However, buyers quickly responded and pushed the price back up, indicating a potential bullish market sentiment.

- Shooting Star: In the trading world, a pattern known as the Shooting Star emerges, characterized by its small body and long upper wick. This pattern serves as a potential indication of bearishness, particularly following an uptrend.

- Morning Star: In the context of the Morning Star pattern, a potential reversal from a downtrend to an uptrend can be identified through a three-candlestick formation. This formation consists of a significant bearish candle followed by a smaller doji or spinning top and finally concluded with a large bullish candle.

- Evening Star: In chart patterns, a fascinating phenomenon is known as the Evening Star. It is a formidable counterpart to its early morning companion, the Morning Star. This intriguing pattern can signify a potential reversal from an uptrend to a downtrend.

The Significance of Candlestick Patterns

- The visualization of market sentiment is effectively conveyed through candlestick charts. These charts offer a visual representation that enables quick insights into the dominant forces within the market, revealing whether buyers or sellers hold control at any given time.

- Traders can utilize specific patterns to make informed predictions about future price movements and potential reversals. This ability allows them to anticipate the direction of market fluctuations.

- Traders often rely on candlestick patterns to accurately time their entry and exit points for various positions they hold.

- Candlestick patterns can validate existing trends or indicate potential changes in trend direction.

- In the realm of risk management, traders can effectively mitigate risks by developing an understanding of candlestick patterns. This knowledge empowers them to set precise stop-loss and take-profit levels, ultimately safeguarding their

Using Candlestick Charts in Crypto Trading

Cryptocurrency markets are notorious for their extreme price fluctuations. This makes candlestick charts an invaluable tool for crypto traders. Let's explore how these charts can be effectively utilized in crypto trading strategies.

- To identify trends in cryptocurrency prices, one can employ candlestick patterns. These patterns offer insight into both bullish and bearish trends.

- In cryptocurrency trading, it is crucial to identify the optimal moments for making purchases or sales. This can be achieved by analyzing candlestick patterns and observing price trends. By understanding these entry and exit points, traders can make informed decisions.

- When managing risk in trading, it is important to establish stop-loss and take-profit orders by analyzing support and resistance levels found through candlestick analysis.

- Continuously studying and recognizing candlestick patterns is crucial for making more informed trading decisions in pattern recognition.

How To Make The Most of Your Candlestick Analysis

It is important to make the most of your crypto analysis to make timely decisons in the crypto market. If your analysis tells you to buy or sell a coin at a particular price, it is important to execute your moves speedily, so that you don't miss out on your trades.

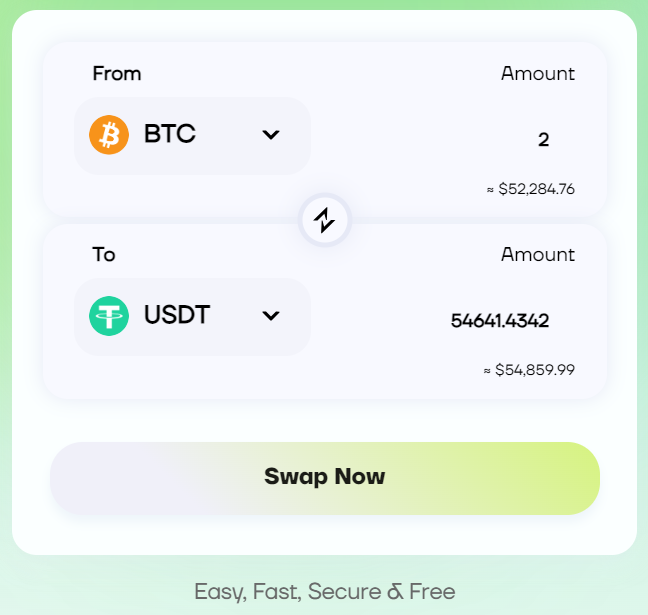

With Cwallet tools such as:

- Live charts for 800+ tokens

- Price alert bot on Telegram, and

- Zero-fee instant crypto swaps

you can be in charge of the crypto market, and make the most of your analysis in timely fashion.

Conclusion

Candlestick charts hold immense importance for traders and investors, enabling them to comprehend and anticipate price movements in cryptocurrency markets and other financial assets. By honing their ability to analyze and decipher candlestick patterns, traders can confidently strengthen their decision-making process and navigate the dynamic realm of cryptocurrency trading.

Cwallet presents itself as the ultimate wallet. It caters to individuals who desire a harmonious blend of centralized and decentralized features that allows traders to make proactive decisions following their analysis.

With price alert bots, zero-fee instant swaps, and a user-friendly interface, Cwallet empowers you to make the most of your analysis, get ahead of the market, and win in your crypto journey.