Bitcoin's Next Catalyst: Why Arthur Hayes Isn't Betting on a $3.4M Price by 2028?

Arthur Hayes's new Bitcoin thesis is not based on on-chain activity, but on geopolitical competition between the U.S. and an "Eurasian bloc."

Key Takeaways

- Arthur Hayes's new Bitcoin thesis is not based on on-chain activity, but on geopolitical competition between the U.S. and an "Eurasian bloc."

- Bitcoin's next rally will be fueled by a "liquidity cocktail" from a dovish Fed and a potential injection of funds from the U.S. Treasury.

- Despite his bullish macro outlook, Hayes remains skeptical of Bitcoin's most extreme price projections, arguing that no outcome is certain in a rapidly evolving global landscape.

Arthur Hayes is known for his bold and often controversial predictions. The co-founder of BitMEX and a prominent market theorist, he has a track record of connecting macroeconomics with the crypto market's most significant moves.

His latest commentary revisits his long-term outlook for Bitcoin, but with a new twist that factors in the current political and economic climate.

While he still sees Bitcoin's future as undeniably bullish, he's now tempering his previous, more aggressive forecasts.

Hayes believes that by 2028, Bitcoin will be "significantly higher" than its current price of $113,000, but he's not convinced it will reach the astronomical $3.4 million that some models suggest.

This article will break down Hayes's new thesis and explain the macroeconomic and political forces he believes will drive Bitcoin's next major rally.

The New Catalyst for Money Printing to Win a Geopolitical Race

Hayes's latest prediction is not rooted in traditional market analysis, but in a new, geopolitical thesis. He argues that the primary driver for Bitcoin's future price will be the U.S.'s need to compete with a rising "Eurasian bloc", a powerful alliance of countries including Russia, China, India, and Iran. US money printing under the President Donald Trump administration will be what launches Bitcoin into the stratosphere in just three years, Hayes said.

His argument is that in order to win this new great game, the Trump administration will need to take extraordinary economic measures. These will include a renewed policy of aggressive money printing, which will serve to devalue the U.S. dollar in a way that fuels Bitcoin's growth.

According to Hayes, this new wave of printing will be a far more powerful catalyst than the simple capital controls that fueled his previous, more conservative forecast.

Why Not $3.4 Million? The Reality of a "Goldilocks" Scenario

While Hayes's model, based on historical credit growth, projects that Bitcoin could reach as high as $3.4 million by 2028, he remains a skeptic of his own model’s most extreme outcome.

He cites the following reasons:

- The Soft Landing: The "soft landing" of the global economy, as orchestrated by central banks, may not necessitate the kind of hyperinflationary credit expansion required to push Bitcoin to its highest valuation.

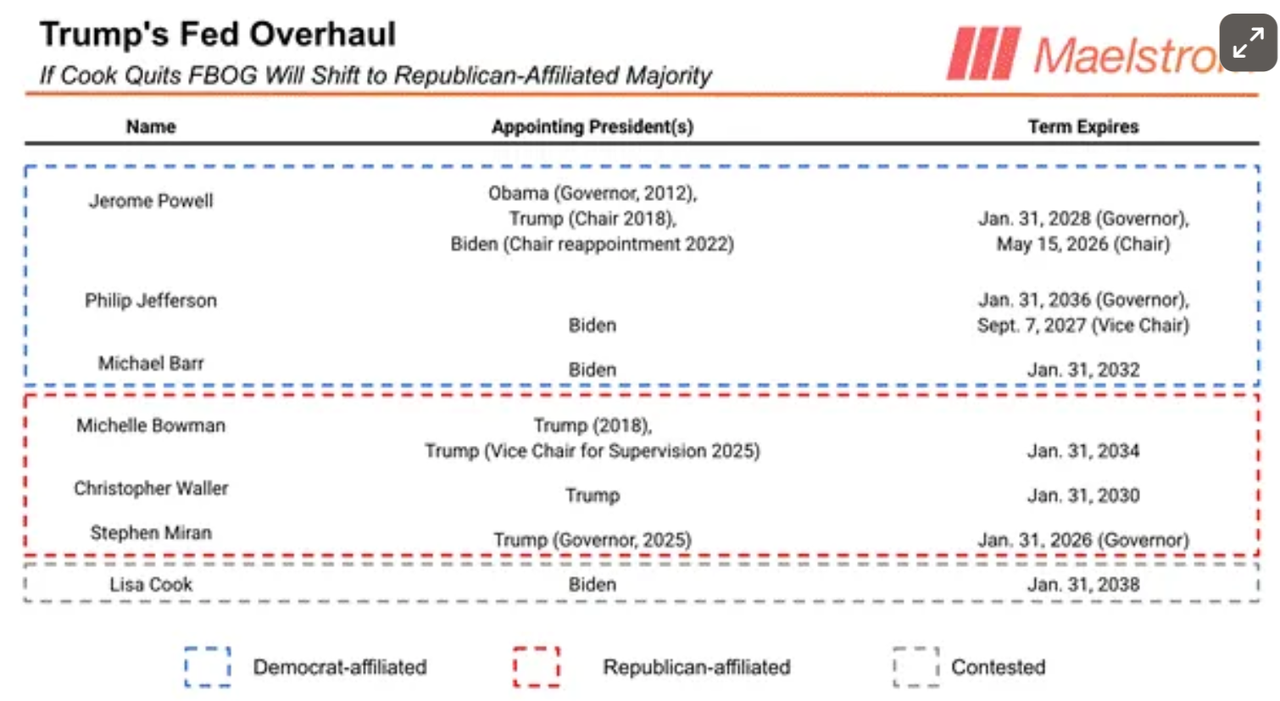

- The Fed’s Independence: He believes that the Federal Reserve will resist political pressure to devalue the currency as much as the Trump administration might desire.

- The "Black Swans": Unforeseen political or economic "black swan" events could disrupt the trajectory of growth, and no model can truly account for that.

The Market's Outlook and a Dovish Tilt

Hayes's commentary comes at a time when the market is already anticipating a more favorable macro environment for crypto. The general consensus points to a highly dovish Federal Reserve, with many analysts predicting an aggressive rate-cutting cycle starting in the near future. The market is now pricing in an almost certain rate cut in October, a move that would provide a significant liquidity injection.

This dovish monetary policy is likely to be amplified by another source of liquidity. Analysts are closely watching the U.S. Treasury General Account (TGA).

A combination of a dovish Fed and a potential TGA liquidity injection would create a powerful “liquidity cocktail,”providing a strong tailwind for risk assets like Bitcoin. This macroeconomic narrative gives more weight and context to Hayes's overall bullish prediction.

A New Blueprint for the Next Bitcoin Cycle

Arthur Hayes's updated prediction provides a new and compelling blueprint for Bitcoin's next market cycle. It moves beyond a simple technical forecast and connects Bitcoin's future directly to the high-stakes world of geopolitics and macroeconomic policy.

While he sees the future as bullish, his skepticism about the highest price projections is a reminder that even in the face of powerful macro trends, no outcome is certain. For investors, his analysis offers a valuable lesson: to understand Bitcoin's future, you must understand the global forces that govern the value of all money.

Cwallet: Your All-in-One Gateway to the Digital Economy

Cwallet is more than a crypto wallet; it's a complete ecosystem designed to make crypto trading accessible, intuitive, and rewarding. We've redefined what a wallet can be, transforming it into your ultimate hub for everything from securing your assets to exploring market opportunities.

Move beyond simple storage. Cwallet unlocks the power of smarter crypto trading right from your pocket.

With features like Trend Trade and Market Battle, we empower both new and experienced users to engage with the markets in dynamic ways. Dive into the action with real-time trading across 1,000+ cryptocurrencies and 60+ blockchains, all while maintaining full control of your assets. It’s the simplicity of a crypto app combined with the power of a pro-level trading platform.

We're building the bridge between the digital economy and your daily life. Cwallet seamlessly integrates essential crypto services, allowing you to easily store, swap, and earn from your digital assets. Looking ahead, our commitment to real-world utility continues with upcoming features like the Cozy Card, mobile top-ups, and gift cards.

Cwallet makes crypto not just a technology for the future, but a practical tool for today!

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: This content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.