Big Tech's New Playbook: Naver Broadens Scope In Upbit Acquisition And Stablecoin Plans

The NAVER acquisition signals a global trend where Big Tech must acquire compliant infrastructure (Upbit) to scale in regulated crypto markets.

Key Takeaways

- The NAVER acquisition signals a global trend where Big Tech must acquire compliant infrastructure (Upbit) to scale in regulated crypto markets.

- The move is designed to control the Korean won stablecoin market and export that integrated financial system across Asia via the LINE network.

- The deal confirms the inevitable stratification of the crypto market, with powerful conglomerates consolidating essential retail liquidity.

A seismic event is reshaping the Asian crypto landscape: South Korean tech conglomerate NAVER (often dubbed the "Google of South Korea") has announced plans to acquire Dunamu, the operator of the country's largest crypto exchange, Upbit. This means South Korea's largest internet company will control the country's largest cryptocurrency exchange.

This transaction is far more than just a domestic merger. It is a potent signal of a global market trend: the strategic decision by traditional giants to buy—rather than build—compliant crypto infrastructure. This acquisition confirms that the race to control digital finance is entering a new era where Big Tech power is actively consolidating the on-ramps, and this acquisition is its latest, most expensive maneuver.

The Acquired Prize: Upbit's Market Moat and NAVER's Financial Ambition

The scale of this acquisition can only be understood by examining the market weight of both buyer and seller in the highly competitive Korean financial landscape.

Upbit: The Acquired Asset and Its Scarcity Value

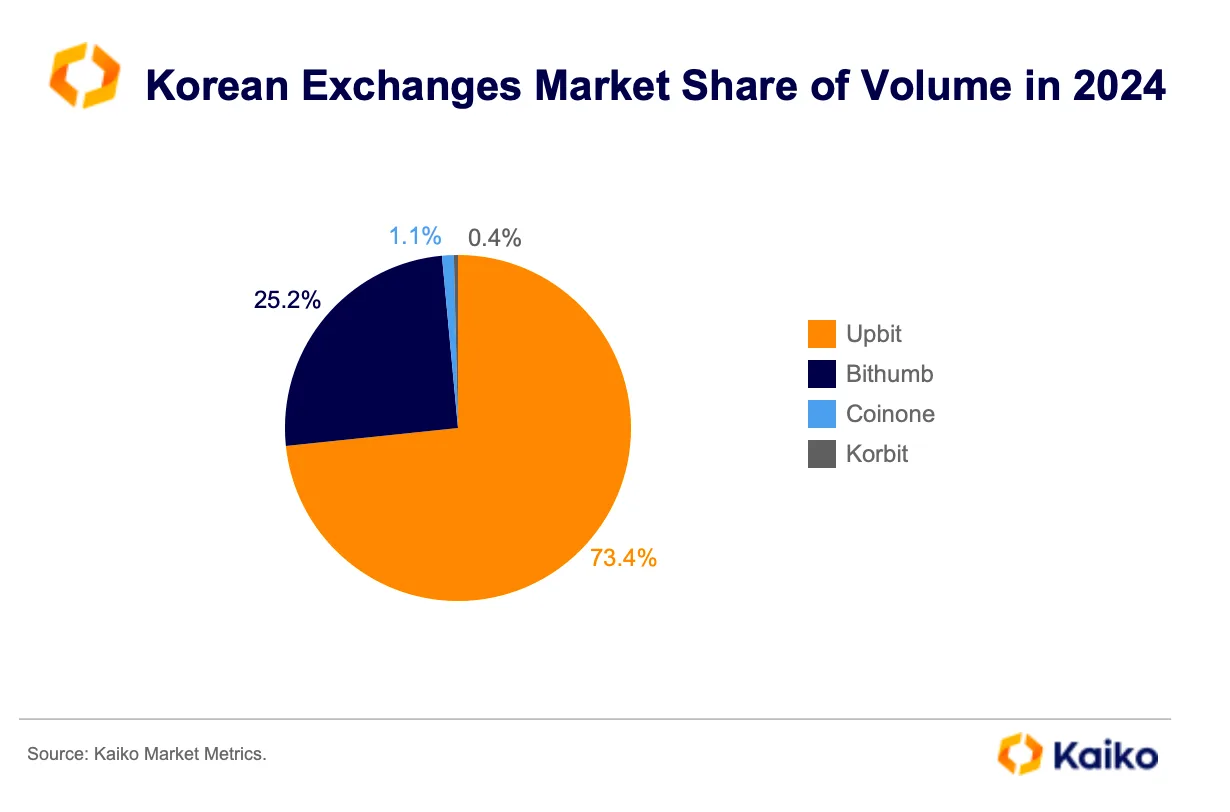

Upbit is the undisputed market leader in South Korea, a dominance that makes it an irreplaceable asset. Data confirms its absolute command over the South Korean crypto market, with the exchange operating at a staggering 73.4% of the country’s crypto trading volume. Its nearest competitor secures just over 25%. Acquiring Upbit is, therefore, synonymous with locking down the main entrance to the Korean crypto economy.

Critically, the value of Upbit lies beyond its user base; it holds the most valuable and scarce asset in the Korean market: the necessary regulatory licenses and established real-name bank account channels. This regulatory moat is a proprietary piece of infrastructure that NAVER could not quickly build on its own.

NAVER: The Conglomerate's Final Financial Blueprint

NAVER is the technological heart of South Korea, often called the nation's equivalent of Google or Tencent, with a sprawling ecosystem covering search, AI, and global social platforms like LINE. The acquisition of Upbit is the final, strategic step in completing NAVER's vertical financial blueprint.

This integration allows NAVER to realize a seamless, end-to-end financial ecosystem. Once finalized, NAVER is poised to control the entire financial chain for its millions of users:

- Payment Infrastructure: Naver Pay

- Traditional Brokerage: Securities Plus

- Crypto Trading: Upbit

- The Future Asset: A planned Korean won-backed stablecoin

This vertical integration allows NAVER to provide a fully compliant, all-in-one financial journey, from fiat payments directly into crypto trading.

Why Big Tech Must Buy the Compliance Funnel?

This strategic acquisition by NAVER reflects a critical lesson for the global crypto market: to achieve true scale in regulated economies, Big Tech must acquire compliance, not just build code. This transaction is a necessity driven by strategic urgency, not a matter of convenience.

1. The Scarcity of the Regulatory Moat

The primary reason NAVER must buy, rather than build, its own exchange is the scarcity of the compliance channel. The Korean government imposes strict standards, meaning the necessary regulatory licenses and established real-name bank account channels are a proprietary asset that cannot be replicated quickly. Upbit’s infrastructure is a ready-made, functional "compliance funnel" that allows NAVER to secure its path past years of uncertain and costly regulatory application processes.

2. Enabling Vertical Integration

The acquisition directly enables NAVER's vision for a comprehensive financial ecosystem. By controlling Upbit, NAVER gains the final component needed to achieve full vertical integration: they connect their existing services—Naver Pay (fiat on-ramp) and Securities Plus (traditional brokerage)—directly to the volatile world of crypto trading. This complete control over the customer journey removes regulatory friction and immediately accelerates their entire strategic business plan, paving the way for the launch of their planned Won stablecoin.

Strategic Endgame: The Stablecoin Goal and Regional Ambition

This acquisition is the foundation for NAVER's ultimate strategic endgame: controlling the issuance of the Korean won stablecoin and leveraging that control for regional expansion.

By securing Upbit, NAVER ensures its new stablecoin will have immediate, deep liquidity and widespread consumer trust in the local market.

This vertically integrated model is explicitly designed for export: the goal is to package the compliant exchange, the payment platform, and the new stablecoin, and then deploy it across Asia using LINE's 200 million-strong user network.

This reflects a clear strategic ambition to define how digital finance and cross-border payments are executed across the entire region.

The NAVER-Upbit acquisition is more than a major deal; it is a template for the future of crypto in regulated economies. This event signals a clear trend: the independent growth of small crypto enterprises is being curtailed. The market is quickly stratifying into layers, with compliant, resource-heavy traditional conglomerates controlling the vital choke points of institutional and retail liquidity.

The “Korean model”—characterized by swift, resource-intensive integration—reflects a global reality: the future of finance lies in the hands of those who can command both technology and regulatory legitimacy.

Cwallet: Your Gateway to a New Era of Crypto Finance

The world of cryptocurrency moves fast, but managing your assets can be simple and secure!Cwallet gives you an intuitive, powerful crypto wallet to store, swap, earn, and spend over 1,000 cryptocurrencies across 60+ blockchains — all in one app.

Your assets, your control: With the Cozy Card, one of the most secure crypto wallet payment solutions, your digital assets gain real-world spending power, either online or offline.

Your trades, your way: From zero-fee Memecoins and xStocks to exciting, interactive crypto trading experiences like Trend Trade and Market Battle, making every trade easier and more enjoyable.

Your time, your efficiency: With practical tools like HR Management, Mobile Refills, and Gift Cards, skip the hassle and focus on what matters most.

Join millions of users and redefine how you interact with crypto.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.