2025 Token Buybacks: Near $1.4 Billion Dominates Top 10 Projects

The $1.4 billion spent on token buybacks in 2025 sends a decisive mandate to the crypto market: the era of relying on hype and inflationary tokenomics is definitively over.

Key Takeaways:

- The $1.4 billion spent on token buybacks in 2025 sends a decisive mandate to the crypto market: the era of relying on hype and inflationary tokenomics is definitively over.

- Funding exhibits extreme centralization, with 92% of the $1.4 billion in buybacks flowing to the Top 10 projects, underscoring a severe "winner-take-all" dynamic.

- This market discipline creates stability but risks a bottleneck for radical innovation, as VCs now demand immediate profitability (Enterprise/RWA) rather than funding early-stage foundational ideas.

The crypto venture capital (VC) landscape is undergoing a structural transformation. The investment logic has decisively shifted from a speculative frenzy to an era of rational discipline, forcing projects to prove their financial viability. In this new environment, Token Buybacks have emerged as the dominant mechanism for projects to manage their tokenomics and return value to holders.

The scale of this trend is unprecedented, but highly concentrated. This article dissects the data behind the $1.4 billion spent on buybacks in 2025 so far, analyzing why an overwhelming 92% of that capital is now flowing to a handful of industry leaders. This concentration signals a profound "winner-take-all" market dynamic, rewarding only those protocols that have achieved verifiable profitability.

Token Buyback Summary: The New Financial Metric

Token buybacks, the practice of using protocol revenue to repurchase native tokens from the open market, have become the new "dividend" in the digital economy. This mechanism is the clearest proof that DeFi protocols are succeeding in capturing and returning tangible value to their holders.

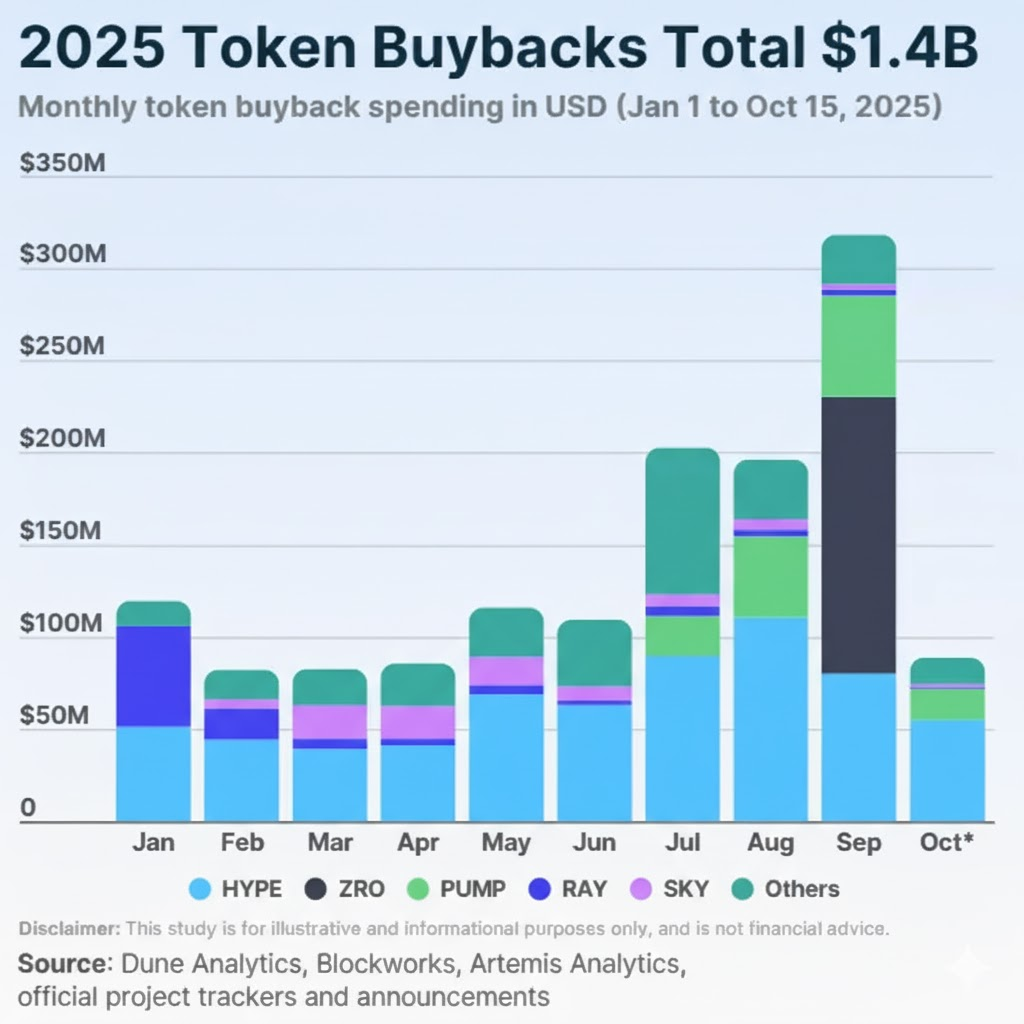

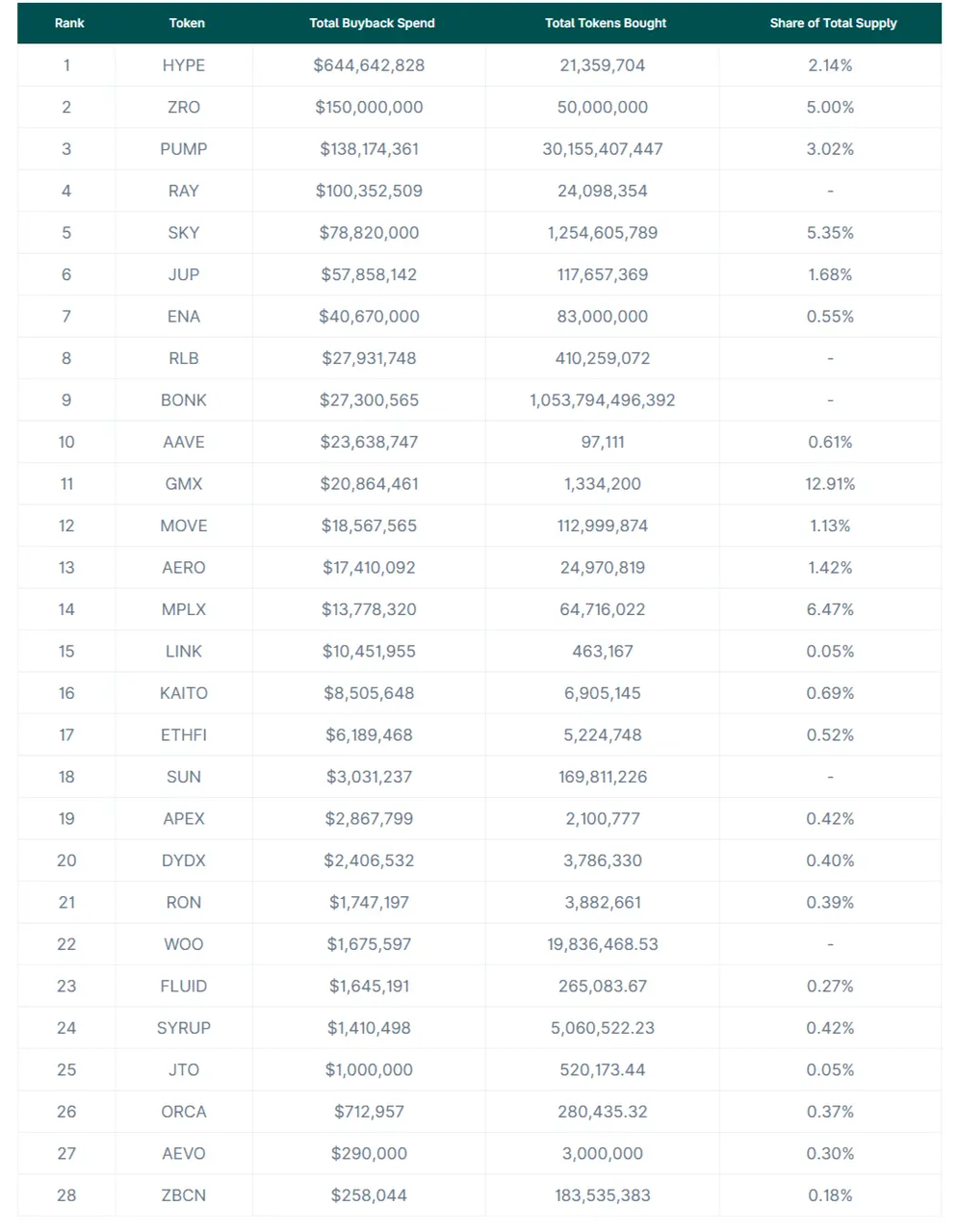

The sheer scale of this trend confirms its market importance: the total value of buybacks across recognized projects in 2025 has already exceeded $1.4 billion. This expenditure acts as a continuous, structural demand driver, directly reducing circulating supply or funding liquidity.The most critical insight from this data is the extreme concentration of capital: the top 10 projects alone account for 92% of this total expenditure.

Hyperliquid's Dominance and DEX Profitability

The buyback leaderboard is overwhelmingly dominated by the high-performance perpetual DEX, Hyperliquid.

- Scale: Hyperliquid has spent over $644 million on buybacks, representing a staggering 46% of the entire market's expenditure.

- Industry Significance: This massive scale proves that DeFi protocols—particularly those with efficient revenue models—have achieved sustainable profitability comparable to centralized entities.

Proportionate Value and Commitment

While measuring raw dollar value is important, a deeper analysis focuses on proportionate value and commitment. This metric assesses what percentage of a token's total supply a project removes from circulation, signaling the team's true long-term commitment to scarcity.

Not all buybacks are equal. Hyperliquid leads in total dollars spent, but projects like GMX and Metaplex have repurchased the highest proportion of their total circulating supply, in the range of 6.5% to 12.9%. This sustained, high-ratio buyback indicates a robust, long-term strategy focused on increasing scarcity for existing holders. For the astute investor, this proportional commitment is often a more reliable indicator of a protocol's health and its dedication to enhancing the token's value.

Proof of Concept: Where Does All the Revenue Come From?

The ability of top protocols to sustain multi-million dollar buybacks is the clearest proof that profitability is no longer exclusive to centralized exchanges (CEXs). The huge cash flow fueling these buybacks originates directly from user activity and trading fees, confirming that platforms like Hyperliquid have achieved phenomenal product-market fit. This validates the thesis that efficient, decentralized protocols are capable of generating substantial, sustainable external income.

This success creates a powerful economic cycle: the protocol takes genuine external revenue and funnels it back into the token, effectively creating continuous, positive pressure on the price. This discipline contrasts sharply with the early days of crypto, where many projects relied on inflationary token issuance and speculation alone.

Ultimately, the buyback mechanism serves as a direct, irrefutable demonstration of a protocol's value accrual strategy. It forces the market to reward protocols that generate real, external cash flow and use it to benefit token holders, rather than those relying merely on concept and market hype.

The Structural Trade-Off: Stability Versus Innovation

The phenomenon of massive token buybacks creates a critical structural trade-off for the wider ecosystem.

The Dual Impact of Consolidation

This shift brings stability but at the potential cost of spontaneity. On one hand, by consolidating capital around late-stage projects with verifiable revenue, the market matures. This results in fewer catastrophic project failures and a more sustainable flow of funds, aligning with the operational discipline of traditional finance.

On the other hand, this highly concentrated approach creates a structural challenge for the next wave of ideas. The high barrier to entry—the need for immediate, multi-million dollar profitability—means the next few years may see fewer truly novel experiments and disruptive, foundational ideas built from the ground up. The market's stability is being balanced against the speed of its next major creative leap.

Mandate for the Future

This trade-off forces a choice: the market is prioritizing financial security over ideological risk. For founders, the mandate is clear: they must demonstrate not just a concept, but governance and cash flow. For investors, this provides a clearer path to sustainable growth but requires accepting that innovation will be more incremental and costly in the years ahead.

The Final Mandate for Discipline

The $1.4 billion spent on token buybacks in 2025 sends a decisive mandate to the crypto market: the era of relying on hype and inflationary tokenomics is definitively over. The industry is rapidly maturing toward a model where verifiable profitability and disciplined execution are the only sustainable drivers of value.

This pivotal structural shift, the Great Pivot, comes with a necessary trade-off. While stability driven by concentrated capital reduces failures and matures the market structure, it simultaneously creates a bottleneck for radical, early-stage innovation.

For founders and investors, the mandate is clear: success is no longer about having the best idea; it is about demonstrating the financial viability and governance required to survive in a capital-concentrated environment. The future belongs to disciplined protocols that use their real cash flow to return value directly to their token holders.

Cwallet: Your Gateway to a New Era of Crypto Finance

The world of cryptocurrency moves fast, but managing your assets can be simple and secure!Cwallet gives you an intuitive, powerful crypto wallet to store, swap, earn, and spend over 1,000 cryptocurrencies across 60+ blockchains — all in one app.

Your assets, your control: With the Cozy Card, one of the most secure crypto wallet payment solutions, your digital assets gain real-world spending power, either online or offline.

Your trades, your way: From zero-fee Memecoins and xStocks to exciting, interactive crypto trading experiences like Trend Trade and Market Battle, making every trade easier and more enjoyable.

Your time, your efficiency: With practical tools like HR Management, Mobile Refills, and Gift Cards, skip the hassle and focus on what matters most.Join millions of users and redefine how you interact with crypto.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.