Risk Management In Crypto Trading: 3 Key Strategies

risk-reward ratio represents the relationship between the potential loss (risk) and the potential gain (reward) in a trade. It helps traders evaluate whether a particular trade is worth pursuing by assessing the balance between risk and potential profit.

The cryptocurrency market is a whirlwind of excitement and opportunity, but it's also known for its unpredictable and volatile nature. In the blink of an eye, fortunes can be made or lost. It's in this environment that effective risk management becomes not just a choice but a necessity for crypto traders.

Cryptocurrency trading is not for the faint of heart. The wild price swings and sudden market shifts can leave even the most seasoned traders scratching their heads. That's where risk management comes into play. Effective risk management strategies are essential to safeguard investments and navigate the turbulent crypto market. Without them, you're at the mercy of market forces, and the consequences can be dire.

In the following sections, we'll discuss three critical strategies for effective risk management in crypto trading

Strategies for Risk Management in Crypto Trading

There are a number of strategies to incorporate into your crypto trading strategy. However, the ones highlighted below are the most important:

Strategy 1: Investment Diversification

Diversification is a fundamental risk management strategy in the world of crypto trading. It involves spreading your investments across different assets rather than putting all your funds into a single cryptocurrency. The primary goal of diversification is to reduce the impact of a poor-performing asset on your overall portfolio.

Instead of going all-in on a single cryptocurrency, consider investing in a mix of well-established coins and tokens from various categories. This can include major cryptocurrencies like Bitcoin and Ethereum, as well as altcoins with promising use cases.

Thoroughly research the projects you intend to invest in. Look into their technology, team, community support, and long-term potential. Also, define a clear strategy for allocating your funds. Decide what percentage of your portfolio will be in Bitcoin, Ethereum, and other assets. A balanced approach can helpbvc mitigate risk.

Strategy 2: Estimating Risk-Reward Ratios Before Executing Trades

This risk-reward ratio represents the relationship between the potential loss (risk) and the potential gain (reward) in a trade. It helps traders evaluate whether a particular trade is worth pursuing by assessing the balance between risk and potential profit.

To calculate and assess the risk-reward ratio, consider the entry point, stop-loss level, and take-profit target. Here's how it works:

- Entry price: This is when you enter a trade.

2. Stop-Loss Level: The price at which you cut your losses if the trade goes against you.

3. Take-Profit Target: The price at which you plan to secure your profits.

The risk-reward ratio is calculated as (Entry Price - Stop-Loss) / (Take-Profit - Entry Price). For a favorable ratio, the potential reward should be significantly higher than the risk.

Your risk tolerance and profit targets are crucial in determining your risk-reward ratio. A trader with a higher risk tolerance may set a wider stop-loss, while one with a lower tolerance might opt for a tighter stop-loss.

With this in mind, you can set stop-loss orders, that automatically sell a specific cryptocurrency when its price reaches a certain level. Stop-loss orders act as a safety net, limiting potential losses by selling a cryptocurrency when its price drops, thereby preventing further depreciation.

Cryptocurrency markets operate around the clock, and traders may not always be available to monitor prices. Stop-loss orders work even when you're asleep or unavailable.

Strategy 3: Position Sizing

Effective risk management in crypto trading goes hand in hand with thoughtful position sizing. The size of your positions, in relation to your overall portfolio, can have a profound impact on your risk exposure. Position sizing is a method of determining how much of your total trading capital you allocate to a particular cryptocurrency trade. It involves calculating the ideal amount to invest in a way that mitigates potential losses while maximizing gains.

One widely followed rule in position sizing is the 20% rule. According to this principle, you should never risk more than 20% of your total trading capital on a single trade. By adhering to this rule, you ensure that even if a trade goes against you, it won't have a catastrophic impact on your portfolio.

This conservative approach to position sizing is a fundamental aspect of risk management. Position sizing works in harmony with diversification. When you spread your capital across a variety of cryptocurrencies and setting appropriate position sizes for each, you further reduce the risk of significant losses. Diversification safeguards your portfolio from the negative impact of a single asset's poor performance.

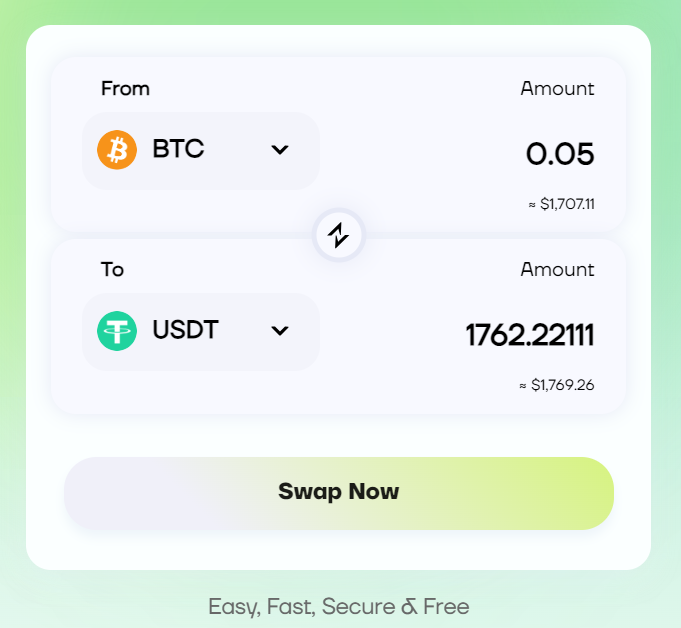

Enjoy Instant Crypto Swaps On Cwallet

Trading on exchanges offer you a wide pool of trading pairs to pick from. However, swapping tokens on exchanges may offer some drawbacks that adversely affect your trading strategy.

For example, trades on exchanges are fulfilled by an orderbook, which automatically matches buyers and sellers. Usually, this matching is done within a few seconds, and trades are immediately executed. However, if a Centralized exchange has low liquidity for a particular trading pair, your swap may be excessively delayed.

As a result, having the option of an "instant swap" can be beneficial. Some exchanges have instant swap options, while others don't. However, even without transferring your assets to an exchange, you can immediately swap them within your wallet, if your service provider permits.

Cwallet's built-in swap feature allows you to instantly swap your assets for free. In cases where you intend to conduct quick trades without needing to visit an exchange, Cwallet allows you to do just that.

Moreover, Cwallet's Swap is aggregated with over 15 exchanges, which helps ensure that there is always liquidity for your transactions.

End Note

As we've seen throughout this article, the crypto market can be unpredictable, and without a solid risk management strategy, your investments are susceptible to significant losses.

Whether you intend to use an exchange with an order book or execute instant swaps right from your crypto wallet, ensure that you follow safe practices to effectively manage risk and make your investments profitable!

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet Blog and follow our social communities on Twitter, Telegram, Reddit, and Discord.