Why the Uniswap Fee Revolution Sparked a 43% UNI Price Surge?

UNI, the native token of DEX giant Uniswap, surged by 43.7% in 24 hours on Tuesday, November 11, hitting a high near $10.

Key Takeaways

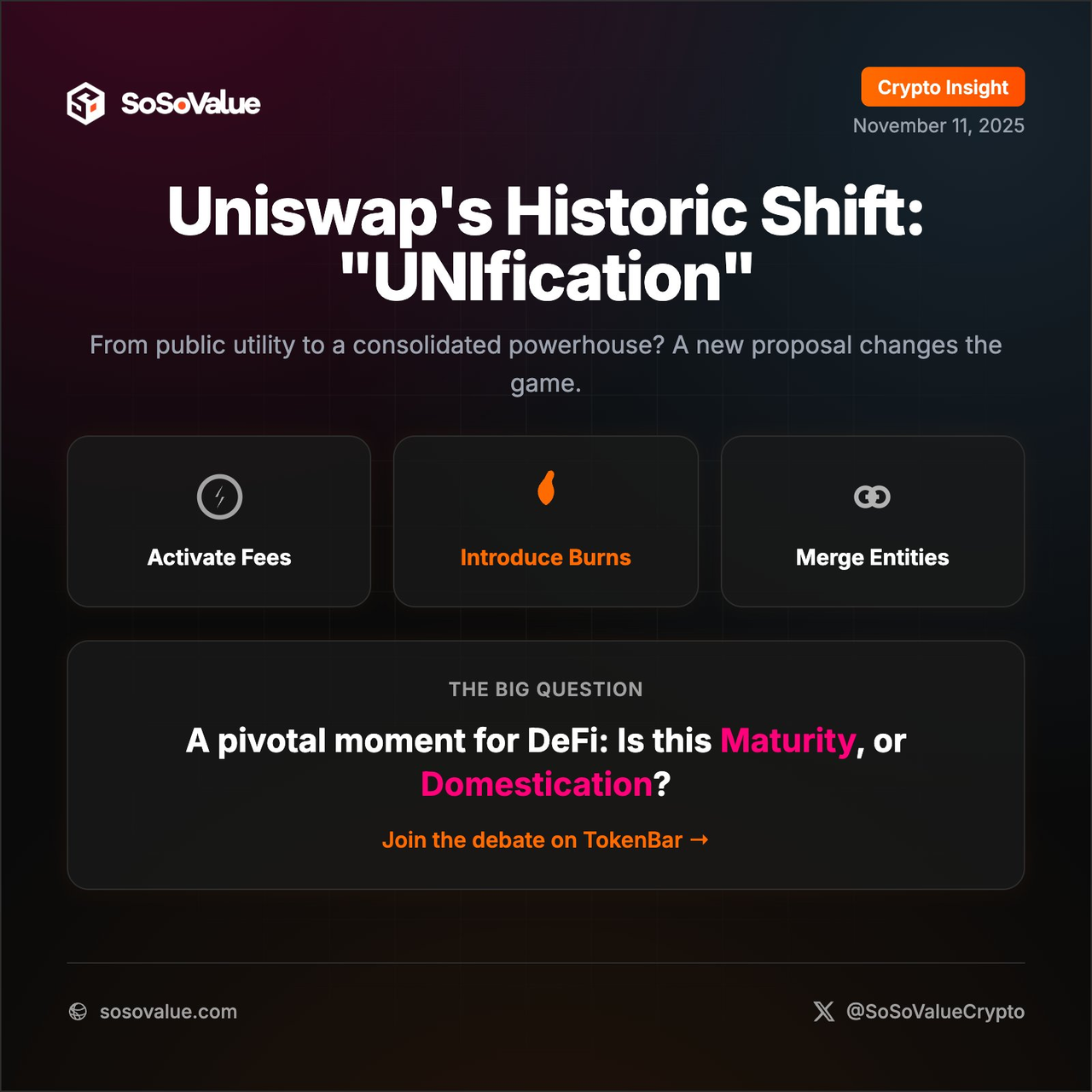

- The core Uniswap Governance Proposal aims to activate the protocol fee switch, dedicating the collected revenue to destroying (burning) UNI tokens.

- This shift in token economics created a strong deflationary expectation, directly fueling the massive 43% price surge earlier this week due to synchronized whale buying.

- The fee activation is set to reshape the DeFi landscape, as competitors argue the reduced incentives for Liquidity Providers (LPs) will benefit them.

A wave of excitement swept through the DeFi market earlier this week, leaving investors astonished by one key figure: UNI, the native token of DEX giant Uniswap, surged by 43.7% in 24 hours on Tuesday, November 11, hitting a high near $10.

This massive price move wasn't driven by general market momentum; it was a direct reaction to a crucial Uniswap Joint Governance Proposal. The proposal aims to fundamentally reshape UNI’s underlying economics by activating the protocol fee switch and using the revenue for token destruction.In this Market Trends report, we will break down the mechanics of the proposed tokenomics shift, analyze the sudden whale movement that drove the price, and evaluate how this single governance vote is set to redefine the entire DeFi competitive landscape.

UNI Tokenomics Revolution: The Shift from Governance to Value Accrual

The source of the price surge lies entirely in the proposed structural change to the UNI token itself. To truly understand this revolution, we must first look at what the token used to be.

The Old Model: Governance Only

Historically, the UNI token functioned almost purely as a governance token. While holders could vote on the future direction of the protocol, the protocol’s enormous trading fees were directed entirely to the Liquidity Providers (LPs). Crucially, the protocol itself—and thus the UNI token holders—captured zero direct financial value from the billions in trading volume processed. This limited the token’s inherent value.

The New Model: Deflationary Value Accrual

The UNification Proposal radically changes this dynamic, transforming UNI into a token with direct, deflationary value. This new model is built on two core mechanisms:

- Activating the Protocol Fee Switch: The first crucial step is enabling the dormant fee switch. This mechanism redirects a small percentage of trading fees—for example, $0.05\%$ of a transaction—away from LPs and towards the protocol itself. This move instantly provides the UNI protocol with its own significant, ongoing revenue stream.

- Committing Fees to Token Destruction: The second, and most powerful mechanism, is the destination of this new revenue. All collected protocol fees will be sent to a dedicated smart contract and can only be extracted to be destroyed (burned) as UNI tokens. This mandate creates a continuous, programmatic deflationary pressure on the total UNI supply, providing a compelling financial incentive for investors.

To further emphasize this new era, the proposal also recommends the one-time action of burning 100 million UNI tokens from the project's treasury. This massive retrospective burn signals a strong, structural commitment to supply reduction and confirms the deflationary era for UNI has officially begun.

Market Response: Whales, Inflows, and Competition

The proposed change immediately polarized the DeFi community, leading to rapid, high-volume action from institutional players and competitors alike as they positioned themselves for the new tokenomics era.

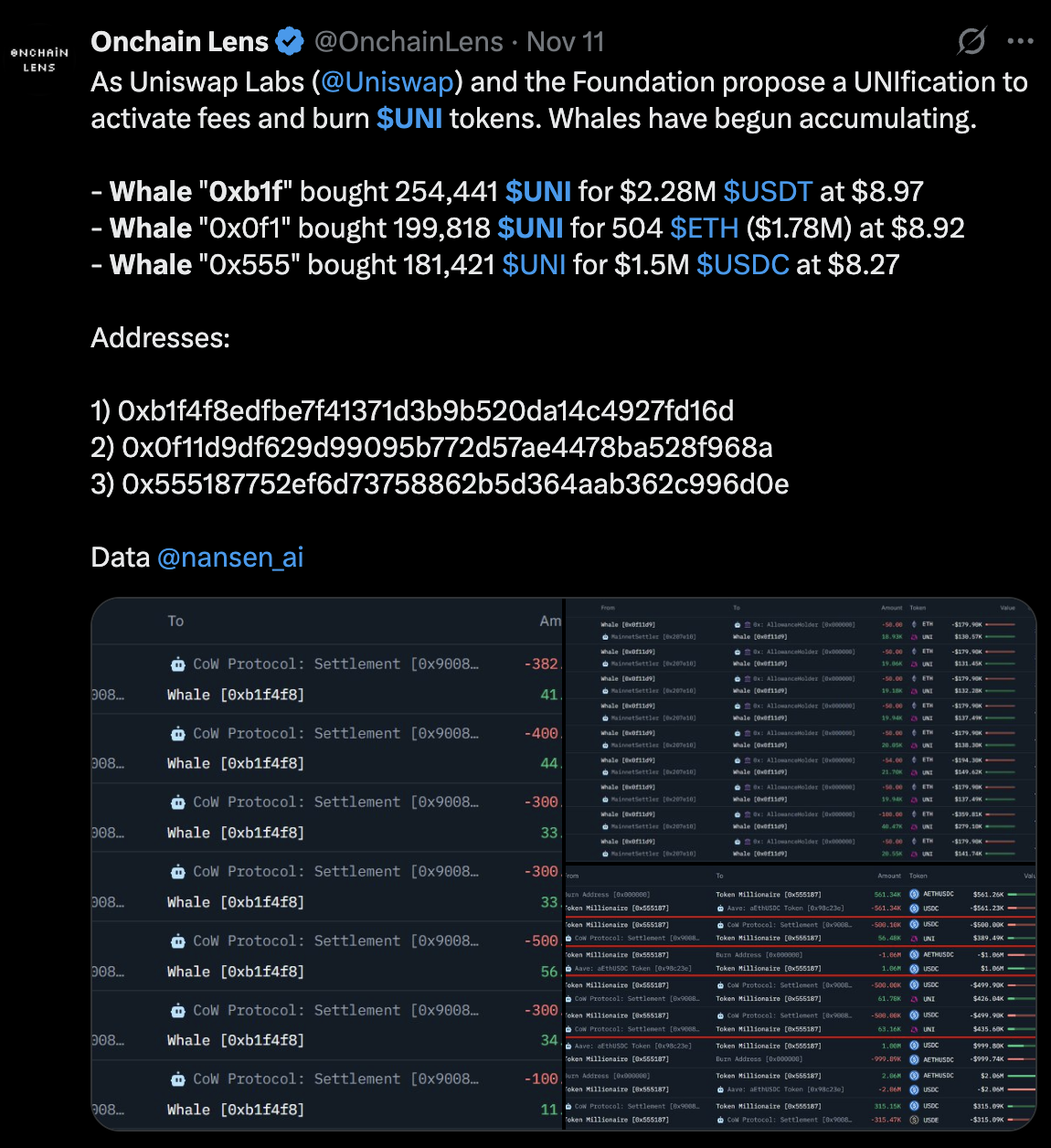

Whales Rush In

The prospect of a deflationary token model attracted huge demand. On-chain data immediately revealed several large investors, known as whales, aggressively buying up UNI:

One whale (address "0xb1f") quickly purchased 254,441 UNI using over $2.28 million USD. Another large investor used $1.78 million USD worth of Ethereum to acquire 199,818 UNI. This aggressive, synchronized buying behaviour was the primary force that pushed the price up by over 40% in a single day, indicating strong institutional conviction in the proposal's success.

Institutional Outflows and Selling Pressure

Despite the initial euphoria, not all major holders were buying. Shortly after the proposal was announced, a major UNI investment institution transferred over 2.8 million UNI (valued at approximately $27 million) to Coinbase Prime.

This massive institutional outflow serves as a critical counterpoint, suggesting that some large, early holders chose to take profit during the surge, creating necessary short-term selling pressure that the market had to absorb before continuing its upward trajectory.

Competitive Backlash from Rivals

The change immediately drew fire from competing Decentralized Exchanges (DEXs). The CEO of Dromos Labs (the team behind Aerodrome and Velodrome) called the proposal a "massive strategic blunder." Their argument is simple: by routing 0.05% of fees to the protocol, Uniswap is reducing the profitability for existing Liquidity Providers (LPs). Competitors believe this reduced incentive will cause liquidity to migrate to their platforms, potentially allowing them to capture significant market share.

Ecosystem Health and Future Outlook

Beyond the price surge and the market drama, the UNIfication Proposal is set to deliver structural benefits that will solidify Uniswap's long-term dominance.

Ecosystem Purification

Activating the fee switch will act as a powerful force for ecosystem purification. Analysts note that many fraudulent or malicious pools (like honeypots) rely on the zero-fee setting to operate profitably. Introducing a nominal protocol fee will make these illicit pools financially unsustainable, rapidly making Uniswap a significantly safer place to trade for all users.

Technical Price Targets and Trajectory

From a technical analysis perspective, the price action is strongly bullish. The 43% surge caused UNI to break key resistance levels, showing decisive market confidence. Analysts suggest the next major resistance target for UNI is around $12.50 USD. However, given the rapid movement, a brief price consolidation or healthy pullback to the reversal point around $7.81 USD remains a possibility before the next push higher.

Conclusion

The Uniswap Fee Revolution is the biggest DeFi story of the week because it confirms that governance can directly translate into immediate token value. By shifting its tokenomics from a governance-only model to a deflationary value-accrual model, Uniswap has set a new standard for DeFi protocols.For investors, the key lies in monitoring the next few weeks: Can the strong deflationary demand overcome the immediate selling pressure from profit-takers and the competitive risk posed by rivals? The outcome of this governance vote will determine not only UNI’s short-term trajectory toward the $12.50 target but also the future direction of decentralized exchange models across the entire crypto space.

Cwallet: Your Secure, All-in-One Gateway to Global Crypto Finance

Cwallet redefines the digital wallet, offering a unified, high-performance platform to manage your entire portfolio, supporting over 1,000 cryptocurrencies across 60+ global networks. We combine top-tier security with unmatched utility:

Financial Control: Go beyond holding. Engage in dynamic market action with zero-fee Memecoin/xStocks trading, or join the fun with interactive prediction tools like Trend Trade and Market Battle.

Real-World Power: Instantly unlock the spending potential of your assets. The Cozy Card transforms your crypto into a flexible payment solution, enabling secure, real-world transactions online and offline.

Practical Tools: Boost efficiency with integrated, unique services. Leverage HR Bulk Management for business needs, or utilize Gift Cards and Mobile Top-ups for everyday utility.

Cwallet is where security meets utility and innovation in one powerful application.

Join millions who are transforming the way they manage their digital wealth!

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.