What is Loan-To-Value (LTV) Ratio In Crypto Lending?

It represents the ratio of the loan amount to the value of the collateral provided to secure the loan. For example, if a borrower pledges $10,000 worth of Bitcoin as collateral and receives a loan of $7,000, the LTV ratio would be 70%.

In finance, the term ‘risk’ is quite common. Whether being managed or avoided, whatever the case may be, risk is always an important consideration.

The loan-to-value (LTV) ratio is a fundamental metric used to assess the risk associated with lending against the value of an asset. In other words, it is a metric used by the lender to gauge how much he can loan a borrower, giving a particular collateral security.

In crypto lending, the LTV ratio determines the amount of cryptocurrency-backed loan, a borrower can obtain relative to the value of the collateral provided. It essentially represents the proportion of a loan's value compared to the value of the collateral securing it.

This article discusses, in detail, what “LTV ratio” is. Read on!

What is Crypto Lending?

Crypto lending is a financial service that allows individuals to borrow and lend digital currencies, or cryptocurrencies. Borrowers can obtain loans by providing digital assets, such as Bitcoin, Ethereum, or other cryptocurrencies, as collateral. Lenders, on the other hand, provide funds to borrowers in exchange for collateral, earning interest on the loaned amount.

Crypto lending platforms facilitate the borrowing and lending process by matching borrowers with lenders and managing loan agreements. These platforms typically set terms and conditions for loans, including interest rates, loan-to-value (LTV) ratios, and repayment schedules. Borrowers can use the borrowed funds for various purposes, including trading, investment, or hedging, while lenders earn interest on their deposited assets.

What is the LTV Ratio?

The Loan-to-Value (LTV) ratio is a key metric used in various lending industries, including crypto lending. It represents the ratio of the loan amount to the value of the collateral provided to secure the loan. For example, if a borrower pledges $10,000 worth of Bitcoin as collateral and receives a loan of $7,000, the LTV ratio would be 70%.

How the LTV Ratio is Calculated

The LTV ratio is calculated using the following formula:

For instance, if a borrower wants a loan of $5,000 and offers Bitcoin worth $10,000 as collateral, the LTV ratio would be:

LTV Ratio = $5,000 ÷ $10,000 × 100% = 50%

Factors Affecting LTV Ratio

Due to the huge importance of the LTV ratio, it is important to understand the factors that influence LTV ratio.

Volatility of Collateral:

The volatility of collateral is very important for crypto loans because cryptocurrencies are volatile in nature; it is possible that the given collateral drops in dollar value below the loaned amount before the due repayment date; hence, lenders often consider volatility of assets before accepting them as collateral.

Some cryptocurrencies are more volatile than others; higher cap cryptocurrencies are often less volatile than lower cap cryptocurrencies; hence, borrowers who intend to use higher cap cryptocurrencies like Bitcoin as collateral can enjoy better LTV ratios.

Stablecoins can also be used as collateral when applying for crypto loans; since they are inherently stable and do not suffer any volatility, lenders are inclined to hold on to them as better collateral securities.

As a rule of thumb, the higher the perceived volatility of an asset, the lower the LTV ratio offered by a lender, and vice-versa.

Type of Cryptocurrency:

Different cryptocurrencies are seen differently when it comes to using them as collateral for loans. Some cryptocurrencies are more popular and stable, while others are newer and not as widely accepted. This matters because it affects the LTV ratio.

For instance, meme coin might not be worth as much as a well-known cryptocurrency like Bitcoin or Ethereum. There are also stablecoins and altcoins, which are different types of cryptocurrencies. The LTV ratio depends on how accepted, volatile, and stable these cryptocurrencies are.

Usually, stablecoins and altcoins that are easy to trade and stable are preferred. This means you might get a higher LTV ratio if you use these types of cryptocurrencies as collateral because they're considered safer and more reliable.

Market Conditions:

When the market is bullish, lenders might feel more confident about giving out loans because they think they'll get their money back. So, they might offer higher Loan-to-Value (LTV) ratios, which means you can borrow more than ordinary.

But when the market is bearish, lenders get more cautious. They worry that if they give out too much money and the market goes down, they might not get their money back. So, they offer lower LTV ratios, which means you can't borrow as much compared to what you have in cryptocurrency. This way, they try to protect themselves from losing too much if things go south in the market.

Lender's Risk Appetite:

Every lending platform or company has its own way of dealing with risk. Some are more cautious and don't want to take big chances, so they offer lower LTV ratios. This means they won't let you borrow as much compared to the value of your collateral, like cryptocurrency. The main reason for doing this is that they fear the risk of losing money.

On the other hand, some platforms are more daring. They're willing to take bigger risks to attract more people who want to borrow money. So, they offer higher LTV ratios, letting you borrow more compared to what you have as collateral. Higher LTV ratios will likely bring in more borrowers and make their business grow faster.

So, depending on how much risk lenders are comfortable with, some lenders will try to play it safe while others will play it boldly.

Significance of LTV Ratio in Crypto Lending

Risk Management

The LTV ratio is a risk management tool in crypto lending. Lenders can determine the level of risk associated with a loan by assessing the ratio of the loan amount to the value of the collateral, A lower LTV ratio indicates a more conservative approach, as the loan is well collateralized and less susceptible to fluctuations in the collateral's value. On the other hand, a higher LTV ratio poses greater risk, as the collateral may not fully cover the loan amount in the event of a price decline.

Loan Approval Process

In the loan approval process, the LTV ratio plays a critical role in determining the eligibility of borrowers and the terms of the loan. Lenders typically set maximum LTV ratio limits based on their risk tolerance and the characteristics of the collateral. Borrowers must meet these requirements to qualify for a loan.

A lower LTV ratio may result in more favorable loan terms, such as lower interest rates or longer repayment periods, as it signifies lower risk for the lender. Conversely, borrowers seeking loans with higher LTV ratios may face stricter terms or higher interest rates to compensate for the increased risk. Lenders evaluate borrowers' collateral and calculate the LTV ratio to ensure that it falls within acceptable limits before approving a loan.

Where To Get a Crypto Loan?

You can get a crypto loan from either centralized or decentralized lenders. A centralized lending platform works just like a traditional bank, where a crypto company controlled by a private authority lends you tokens. On the other hand, decentralized lending platforms are managed via smart contracts and open-source networks where several users pool their assets together for other users to borrow from.

See Also: Comparative Analysis Between DeFi and CeFi Lending Platforms

Decentralized platforms employ smart contracts to automate processes, ensuring that each lender in the pool receives profits proportionate to their initial investment. For instance, if the entire pool carries a 10% interest rate, a lender who contributed 1,000 USDT would receive 100 USDT in profit, while a lender who contributed 500 USD would receive 50 USDT in profit.

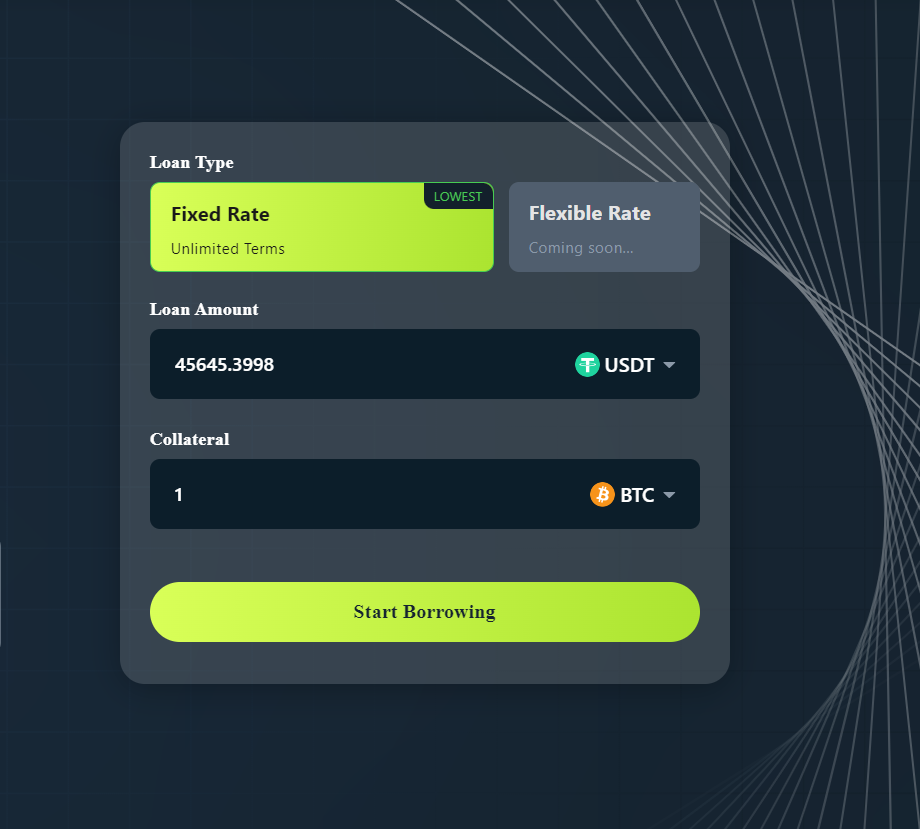

Instant Crypto Loans on Cwallet

Cwallet is a multifunctional crypto wallet, offering a crypto lending feature that allows users to secure loans against their crypto assets at very low interest rates.

This service combines the functionalities of a wallet with those of a comprehensive exchange platform, making it easy to own and manage crypto assets. Cwallet's crypto lending feature is designed to be cost-effective and user-friendly, accommodating diverse borrowing needs for both short and extended periods. Cwallet's approach prioritizes simplicity and accessibility, catering to users of all expertise levels.

Cwallet supports lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral, while enjoying a whopping 65% LTV ratio.

At a fixed Annual Percentage Rate of 13%, Cwallet offers the most competitive interest rates for borrowing in the market. The interest rate is calculated based on the hourly accrued interests. Also, you can decide to repay any amount at any time. Loans on Cwallet exist indefinitely without any borrowing term and as such do not become overdue.

End Note

With innovative platforms and services emerging to meet the growing demand for liquidity and financial services, everyone has more opportunities than ever to engage in crypto lending activities.

However, it's crucial to approach crypto lending with caution and diligence. While the potential benefits are enticing, the inherent risks, such as price volatility and platform security concerns, cannot be ignored. Therefore, it's essential to conduct thorough research, assess risk factors, and choose reputable platforms with robust security measures in place.

Interested in exploring crypto lending further? Consider using the newly launched Cwallet's crypto lending feature. With Cwallet, you can access a secure and user-friendly platform. Cwallet offers a reliable solution backed by advanced technology and a dedicated team committed to ensuring the safety and satisfaction of its users.

Sign up and take advantage of Cwallet's crypto lending feature today!