What Are Undercollateralized Crypto Loans?

Undercollateralized crypto loans are a type of loan in the cryptocurrency market that does not require the borrower to provide collateral equal to or greater than the loan's value.

Undercollateralized crypto loans represent a significant shift from traditional financial practices, offering a unique approach to borrowing in the cryptocurrency market. Unlike traditional loans that require collateral exceeding the loan amount to mitigate risk, undercollateralized loans allow borrowers to secure funds with less collateral than the loan's value.

This financial innovation is particularly appealing in the crypto sector, where rapid asset value fluctuations and the desire to leverage investments make flexible lending solutions highly attractive.

By requiring less upfront collateral, these loans aim to increase accessibility and provide liquidity to those who might not have extensive crypto assets but possess a reliable financial history.

See Also: How Do Uncollateralized Loans Work In Crypto Lending?

What Are Undercollateralized Crypto Loans?

Undercollateralized crypto loans are a type of loan in the cryptocurrency market that does not require the borrower to provide collateral equal to or greater than the loan's value. This differs from more typical, overcollateralized crypto loans, in which borrowers must deposit collateral worth more than the loan amount to secure it, reducing the lender's risk. In other words, the borrower puts up less collateral than the amount they borrow.

This type of lending is riskier for lenders because it relies heavily on the borrower's creditworthiness and other factors, such as their reputation or a history of financial transactions. As a result, these loans are often facilitated through decentralized finance (DeFi) platforms that use complex algorithms and sometimes integrate decentralized identity or reputation systems to assess and manage the risks involved.

The appeal of undercollateralized loans lies in their accessibility, allowing borrowers who may not have sufficient collateral but have a reliable repayment history or strong credit profile to access funds. This can stimulate economic activity and financial inclusion by enabling more participants to leverage their future earning potential without upfront capital. However, the inherent risk also means higher interest rates or more stringent terms to compensate the lender for the increased risk exposure.

What Are the Risks Associated with Undercollateralized Crypto Loans?

1. Default Risk

The primary risk in undercollateralized loans is the increased likelihood of borrower default. Unlike traditional loans, where collateral exceeding the loan amount provides a safety net, undercollateralized loans do not fully cover the lender's exposure.

If the borrower's financial situation deteriorates or if they simply decide not to repay, the lender faces significant challenges in recouping the loan amount. In the volatile crypto market, the security provided by the collateral can quickly become inadequate, leading to losses for the lender.

2. Market Volatility

The cryptocurrency market is known for its high volatility, which can lead to rapid changes in the value of both the borrowed sums and the collateral. For undercollateralized loans, this volatility exacerbates the risk, as the value of the collateral may not be sufficient to cover the loan in a market downturn.

Lenders must be prepared for scenarios where the collateral loses value, potentially leading to a situation where the recovery through collateral liquidation does not satisfy the loan balance.

3. Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies remains underdeveloped and varies significantly by jurisdiction. This uncertainty can more acutely affect undercollateralized loans.

Changes in regulations could impact the operation of platforms facilitating these loans, alter the legal standing of crypto assets, or shift the enforceability of digital contracts. Such regulatory shifts can introduce complications in terms of legal recourse for lenders seeking to recover funds from delinquent borrowers, thereby increasing the risk of loss.

4. Operational and Technical Risks

Undercollateralized loans in the DeFi space rely on complex algorithms and smart contracts for their operation. These technological solutions are prone to bugs and vulnerabilities, which can be exploited by malicious actors or simply fail due to programming errors.

Again, the decentralization aspect means there is often no central authority to intervene in case of disputes or failures, making recovery efforts more complicated and uncertain.

Given these risks, undercollateralized loans in the crypto sphere demand a higher level of due diligence and risk management practices. Lenders often require more stringent credit assessments, may charge higher interest rates to compensate for the increased risk, and use sophisticated risk algorithms to manage their exposure.

Borrowers, on the other hand, need to be aware of the potentially steep penalties and stricter terms that accompany such loans. Both parties must navigate the complexities of the market and regulatory landscape carefully to mitigate the inherent risks associated with these innovative financial instruments.

How to Acquire Undercollateralized Crypto Loans with Cwallet

Cwallet is a one-stop crypto platform that integrates the basic functions of a cryptocurrency wallet with additional crucial features, such as a lending platform, to make cryptocurrency adoption simpler for everyone.

Cwallet offers a flexible, secure platform for crypto loans, including features like competitive interest rates and no borrowing term limits, allowing you to leverage your cryptocurrency holdings without selling them.

Cwallet supports lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral, while enjoying a whopping 65% LTV ratio.

Cwallet provides the most attractive interest rates for borrowing on the market, with a fixed annual percentage rate (APR) of 13%. The APR is calculated based on the hourly value, allowing you to return your loan at any time.

To acquire undercollateralized crypto loans with Cwallet, you need to follow several steps that ensure a smooth and secure transaction:

1. Sign Up and Set Up Your Wallet

Start by visiting the Cwallet website and setting up your wallet. Depending on your preference for security and convenience, you can choose from Non-Custodial, Custodial, or Web Wallet options.

2. Deposit Crypto into Your Wallet

Deposit the cryptocurrency you wish to use as collateral. Make sure the amount meets the loan-to-value (LTV) ratio requirements for the loan you are interested in.

3. Navigate to the Loan Section

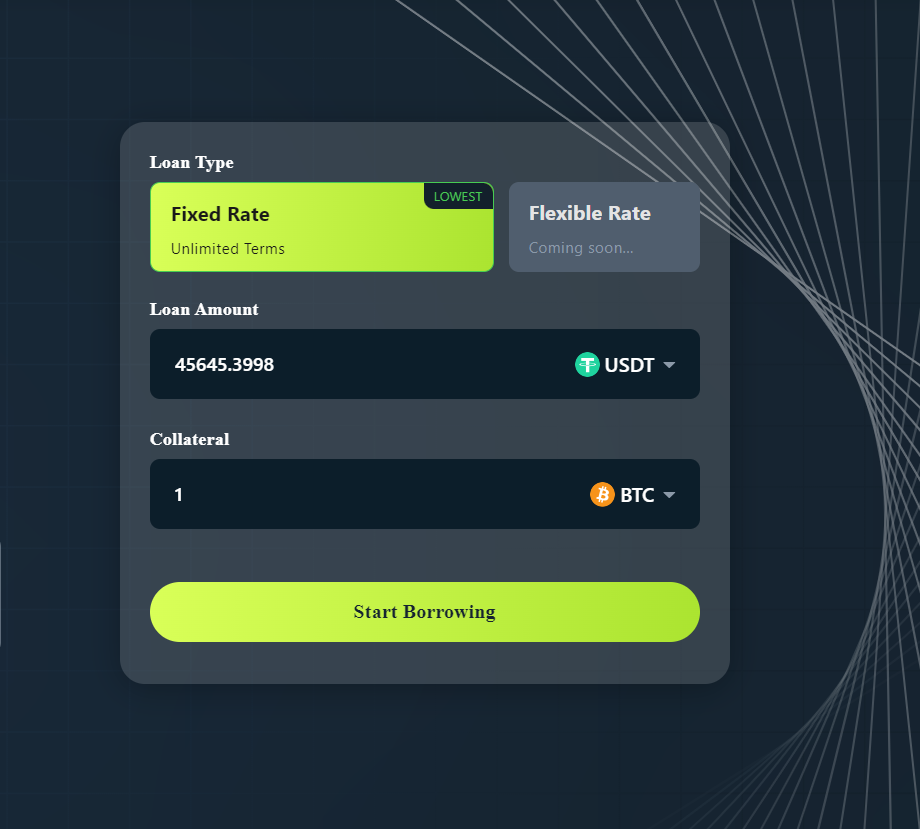

On the Cwallet platform, locate the 'Buy & Sell' section and select 'Crypto Loan' to view the available loan options, including fixed and flexible rate terms.

4. Apply for a Crypto Loan

Choose your loan type and enter the amount you wish to borrow and the collateral you are willing to provide. You can select from various cryptocurrencies like BTC, ETH, and USDT for both the loan amount and collateral.

5. Review and Accept Loan Terms

Review the terms provided by Cwallet, including interest rates and repayment schedules. If everything is satisfactory, agree to the terms and initiate the loan process.

6. Manage Your Loan

Once the loan is issued, you can manage it directly within the Cwallet platform, keeping track of interest accruals and repayment schedules. Repay the loan according to the agreed schedule to avoid penalties. Once fully repaid, your collateral will be released back to you.

Conclusion

Undercollateralized crypto loans present both opportunities and challenges within the finance sector. They extend the accessibility of funds to a broader range of borrowers, potentially driving innovation and investment within the cryptocurrency space. However, they also introduce heightened risks, primarily due to the volatile nature of digital assets and the reduced security net for lenders.

Get started with instant crypto loans today - click here to apply for a crypto loan with Cwallet