Understanding Crypto Tips' Tax Implications: What You Need to Know

The Internal Revenue Service (IRS) considers cryptocurrency tips taxable income. Whether you are the provider or the receiver, the value of the tips you receive must be declared as taxable income

Cryptocurrency tips have grown in popularity in recent years, owing to the widespread usage of digital currencies and the emergence of social media platforms. Crypto tips, sometimes as tokens or digital assets, are provided as a form of gratitude or recognition for quality material, services, or contributions made online. From social media content creators to blockchain developers, individuals are increasingly getting crypto tips to engage with their audience and establish a feeling of community.

As the use of cryptocurrency tips grows in popularity, donors and recipients must understand the tax implications of these transactions. The Internal Revenue Service (IRS) considers cryptocurrencies to be property rather than currency, meaning that crypto tips are taxed the same way as other types of income. Understanding one's tax obligations improves compliance with tax rules, reduces the danger of penalties, and allows individuals to efficiently maximize their financial planning. Here, we will assist you in grasping the implications of crypto tips' tax to help you navigate the difficult world of crypto tax.

How Are Crypto Tips Classified By The IRS?

Cryptocurrencies have grown in popularity as a way to tip content creators, service providers, and community members. These digital tokens, however, are not tax-exempt. Understanding how digital currency tips are taxed is critical for donors and recipients to comply with IRS requirements and avoid penalties.

The Internal Revenue Service (IRS) considers cryptocurrency tips taxable income. Whether you are the provider or the receiver, the value of the tips you receive must be declared as taxable income. Crypto gifts, like regular tips, are considered a payment for services done and hence liable to taxation.

Because the IRS considers cryptocurrency property, any transaction, including tipping, might result in a taxable event. This means that if the value of the cryptocurrency has changed between the time it was purchased and the time it was used for tipping, there may be a capital gain or loss to report. According to the IRS, if you receive virtual currency as a bonafide gift, you will only recognize income once you sell, exchange, or otherwise dispose of it.

Crypto tips, like any other type of compensation or revenue, are normally categorized as taxable income. This means that when calculating the recipient's total taxable income for the year, the value of the digital currency received as a gift must be included.

Tax Obligations For Recipients of Crypto Tips

Understanding the implications for taxes while receiving Bitcoin tips, whether through online platforms like Cwallet crypto tip box or other means, is critical. Many countries, like the United States, tax cryptocurrencies as property rather than regular currency. As a result, recipients must declare and account for any cryptocurrency tips they get as income.

Recipients of crypto tips must keep detailed records of each tip they get, including the date, value at the time of receipt, and sender information (if available). These records will be required for tax filing and establishing conformity with tax regulations. The tax rate on cryptocurrency tips may vary depending on the jurisdiction and income level of the recipient. Furthermore, if the recipient keeps the cryptocurrency for an extended period before selling or trading it, any subsequent gains or losses may be subject to capital gains tax restrictions.

Why Should You Use Cwallet?

Accurate Record-Keeping

It is critical for tax compliance to keep proper records of any crypto tips received and given. Both givers and recipients should retain complete records of each crypto tip transaction, including the date, value, and purpose.

These records can assist givers in determining the intent of the transaction, whether it was a tip, a gift, or payment for services given. Receivers will need to keep reliable records to declare the correct value of the crypto tips received as income.

The IRS may require proof to verify stated income or deductions in the event of an audit. Keep accurate records to avoid underreporting income or incorrectly claiming deductions, which may result in penalties and interest.

Cwallet features a tip box feature, which allows authors to smoothly receive tips from followers, supporters, and well-wishers.

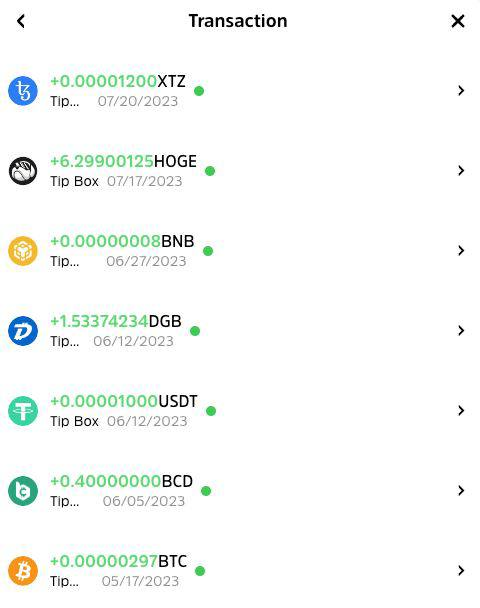

As seen above, you can effortlessly receive tips in many cryptocurrencies with the Cwallet crypto tip box, and with a clear history and details of dollar or fiat value received, you can easily estimate and file taxes properly.

Conclusion

Being knowledgable of tax implications in your jurisdiction is important to prevent potential problems, and stay compliant in an ever-changing regulatory context.

More importantly, keeping detailed records, getting professional guidance, and complying with tax rules will help you manage the complexities of crypto taxation and ensure a smooth and transparent financial journey in the digital asset market, whether you're a tipper or a recipient.

With the Cwallet Tip box, you can rest assured of accurate records that help you file taxes appropriately and avoid hassles. Sign up for a Cwallet account NOW!