Top 5 Crypto Lending Platforms In 2024 - A Comparison

This article aims to provide an updated review of the top 5 crypto lending platforms in 2024. While delving into the intricacies of each platform, we’ll evaluate key criteria such as security, interest rates, supported cryptocurrencies, user experience, and customer support.

Cryptocurrency lending platforms enable users to borrow crypto assets either from the platform or from other lenders, who have staked assets in exchange for interest; hence providing an alternative avenue for both investors and borrowers to maximize the utility of their crypto holdings.

However, before choosing a platform to access loans, it is important to identify the best platforms, their pros and cons, and why you should choose one instead of another.

This article aims to provide an updated review of the top 5 crypto lending platforms in 2024. While delving into the intricacies of each platform, we’ll evaluate key criteria such as security, interest rates, supported cryptocurrencies, user experience, and customer support. By doing so, you can gain proper insights and knowledge to make informed decisions in your crypto lending endeavors.

Overview of Crypto Lending Platforms

Crypto lending platforms work in two ways:

- Decentralized lending platforms require borrowers to deposit their crypto assets into smart contracts, which are then used as collateral to secure loans denominated in either cryptocurrency or fiat currency. Lenders, on the other hand, deposit their funds into lending pools, from which they earn interest on the loans extended to borrowers. Smart contracts govern the terms of the loan, including interest rates, loan duration, and collateral requirements, ensuring transparency and security throughout the lending process.

- Centralized lending platforms work somewhat differently, they provide protocols that allow users to lock up their tokens via staking, while promising them interest in the form of APY (Annual Percentage Yield). These platforms then lend out crypto assets to borrowers from the staked (locked up) tokens, requiring them to provide collateral, and also pay interest on the loan in the form of APR (Annual Percentage Returns).

While lenders in centralized systems may not directly lend out their assets, they equally expect APY, just like decentralized lenders.

How To Choose a Good Crypto Lending Platform

When evaluating crypto lending platforms, it's essential to consider a range of factors to ensure that you're making an informed decision that aligns with your financial goals and risk tolerance. Below, we outline key criteria that should be taken into account when selecting a crypto lending platform.

A. Security and Trustworthiness

Security is paramount when dealing with cryptocurrencies as their decentralized and pseudonymous nature makes them an easy target for hackers and malicious actors.

When assessing the security of a lending platform, look for platforms that employ robust security measures, such as multi-signature wallets, cold storage solutions, and regular security audits. Also, it is important to review the platform's history and reputation within the crypto community, paying attention to any past security incidents or breaches.

B. Interest Rates and Loan Terms

The interest rates offered by crypto lending platforms can vary significantly and directly impact the returns earned by lenders and the cost of borrowing for borrowers. Consider the following:

- Interest rates: It is important to consider a platform’s APR before committing to borrowing assets from it. By a general rule of thumb, APR rates that exceed 15% are too costly.

- Loan-to-value (LTV) ratio: Evaluate the platform's LTV ratio, which determines the maximum amount of borrowing allowed relative to the value of the collateral. A lower LTV ratio generally indicates a lower risk of default. A good lending platform should offer at least a 60% LTV ratio.

- Loan terms: Review the platform's loan terms, including minimum and maximum loan amounts, loan durations, and any applicable fees or penalties for early repayment.

C. Supported Cryptocurrencies

The range of cryptocurrencies supported by a lending platform can significantly impact its appeal and utility to users. Look for platforms that support a diverse range of cryptocurrencies, including popular assets like Bitcoin (BTC) and Ethereum (ETH), as well as stablecoins like USDT and USDC, and emerging altcoins.

Also, do well to be informed on the types of assets that can be used as collateral, because owning the asset to be used as collateral is as important as the asset being borrowed.

D. User Experience and Interface

A user-friendly interface and intuitive user experience can greatly enhance the usability of a lending platform and streamline the lending and borrowing process. Consider the following:

- Platform interface: Evaluate the platform's interface for ease of navigation, clarity of information, and accessibility across devices.

- Onboarding process: Assess the onboarding process for new users, including account registration, identity verification, and deposit/withdrawal procedures.

- Customer support: Research the platform's customer support options, including channels of communication, response times, and availability of support resources such as FAQs and tutorials.

Top 5 Crypto Lending Platforms - 2024 Updated

In this section, we'll delve into the top 5 crypto lending platforms of 2024, offering insights into their unique features, pros, and cons, as well as recent updates or developments.

1. Aave (Best for Flash Loans)

Aave stands out as a pioneer in decentralized finance (DeFi) lending, offering a diverse range of innovative services tailored to the needs of crypto investors and borrowers. With its decentralized protocol, Aave connects borrowers and lenders directly, facilitating crypto loans backed by crypto across multiple blockchains, including Ethereum, Polygon, and Avalanche.

The platform's liquidity pool mechanism enables seamless transactions, with deposits accumulated to fund loans automatically based on smart contract rules. One of Aave's standout features is its support for flash loans, a tool designed for developers to execute complex transactions without the need for collateral, albeit with a requirement for technical proficiency. While flash loans may not be beginner-friendly, they offer unparalleled flexibility for sophisticated users seeking arbitrage opportunities and capital efficiency.

Pros:

- Low-interest rates for borrowers using Loan-to-Value (LTV) ratios.

- Wide range of supported markets across six blockchains, expanding borrowing options.

- Decentralized protocol ensures transparency and security.

Cons:

- Flash loans require technical expertise and may not be suitable for novice users.

- Cryptocurrency availability on the platform can fluctuate.

- Limited customer support and occasional smart contract vulnerabilities.

2. Binance (Best for Cryptocurrency Range)

Binance, a global leader in cryptocurrency exchange services, extends its reach into the lending arena with Binance Crypto Loans, offering borrowers access to over 180 cryptocurrency assets for collateralized loans at competitive interest rates. With both flexible-term and fixed-term loan options available, borrowers enjoy flexibility in loan structures to suit their needs.

The platform's security measures ensure the safety of user funds and data, providing peace of mind to borrowers engaging in loan transactions. While Binance offers a wide range of loanable crypto assets, borrowers must maintain adequate collateral levels to avoid liquidation fees, a consideration to bear in mind when managing loan positions.

Pros:

- Highly secure platform with a wide range of loanable crypto assets.

- Competitive interest rates and flexible loan terms.

- Streamlined loan approval process with robust security measures.

Cons:

- High collateral requirements to avoid liquidation fees.

- Limited flexibility in loan management for borrowers nearing liquidation thresholds.

C. Uniswap Flash Swaps (Best for Uncollateralized Loans)

Uniswap Flash Swaps cater primarily to tech-savvy traders in the decentralized finance (DeFi) space, offering uncollateralized loans for arbitrage trading opportunities facilitated by smart contract automation. With the ability to withdraw up to the full reserves of any ERC20 token on Uniswap, users can execute complex transactions without upfront capital requirements, provided they settle the transaction with corresponding pair tokens or a small fee by the end of the transaction.

Pros:

- Facilitates arbitrage trading without upfront capital requirements.

- Fast borrowing process via smart contracts with low-interest rates.

- Eliminates the need for collateral, enhancing capital efficiency for traders.

Cons:

- Requires technical expertise and familiarity with DeFi protocols.

- Limited customer support and potential smart contract risks.

4. YouHodler (Best Loan-To-Value Ratio)

YouHodler distinguishes itself as a crypto lending platform tailored to investors seeking quick access to liquidity, offering a high loan-to-value (LTV) ratio of up to 90% and supporting over 40 cryptocurrencies as collateral. With instant approval, no credit checks, and a range of collateral and loan currency options, YouHodler provides a convenient avenue for users to unlock the value of their crypto holdings.

Pros:

- High Loan-to-Value (LTV) ratio and support for 40+ crypto assets as collateral.

- Instant approval process with no C checks.

- Flexible repayment options, including fiat currency repayment.

Cons:

- Interest rates may be higher compared to other platforms.

- Users must maintain sufficient collateral levels to avoid liquidation risks.

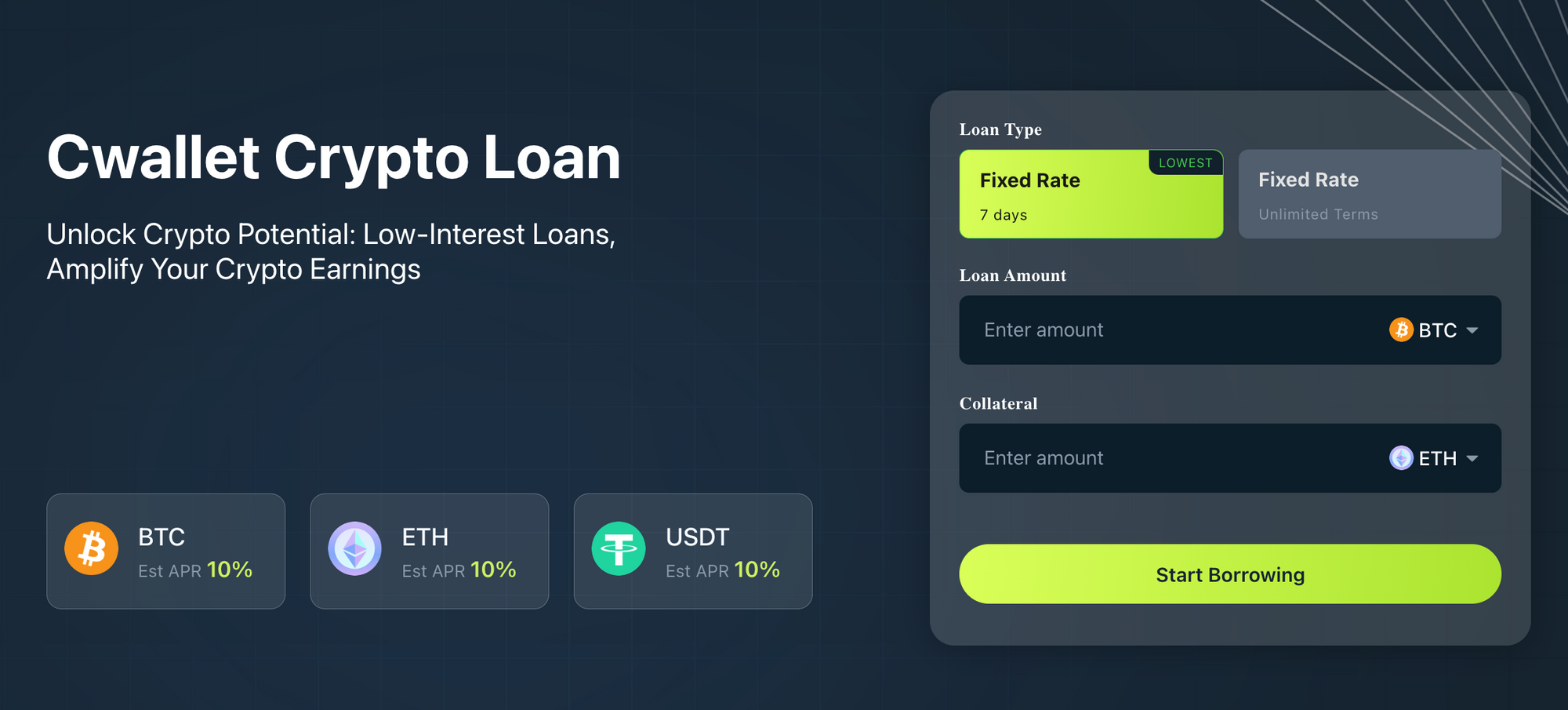

5. Cwallet (Overall Best)

Cwallet emerges as a compelling option for crypto loans, offering low-interest rates, an indefinite repayment term, and a competitive Loan-to-Value (LTV) ratio of 65%. With support for 10+ assets as collateral and transparent fee structures, Cwallet provides a user-friendly experience for borrowers seeking access to funds without the constraints of fixed repayment schedules.

Pros:

- Indefinite repayment term with fixed interest rates and no hidden fees.

- Competitive Loan-to-Value (LTV) ratio and support for multiple crypto assets.

- Transparent fee structures and user-friendly interface.

Cons:

- Limited range of supported cryptocurrencies, although plans for expansion are underway.

Comparison Between the Top 5 Crypto Lending Platforms In 2024

Final Takeaway

In this article, we have explored how crypto lending works and the best platforms to consider in 2024, providing an updated review of the top 5 crypto lending platforms.

From decentralized protocols to established exchanges and innovative CeFi platforms, each platform offers unique features and benefits tailored to the diverse needs of investors and borrowers in the digital asset space.

While each platform has its strengths and weaknesses, the overarching goal remains the same: to empower users with the tools and resources necessary to maximize the utility of their crypto assets and navigate the evolving landscape of decentralized finance.

It is clear that crypto lending will continue to play a pivotal role in reshaping the financial industry, offering new opportunities for crypto investors at both ends to make the best use of their assets either as collateral to access liquidity, or as stakes to earn passive income.

Make the most of your crypto holdings today! Get started with crypto loans on Cwallet!