The $1.6 Billion Verdict: How Whale Accumulation Confirms Ethereum's Long-Term Strength?

The massive $1.6 Billion accumulation by institutional whales confirms their long-term conviction, easily absorbing the selling pressure from early contributors.

Key Takeaways

- The massive $1.6 Billion accumulation by institutional whales confirms their long-term conviction, easily absorbing the selling pressure from early contributors.

- Sophisticated capital is actively using any price weakness as a strategic entry point, reinforcing the view that Ethereum is an infrastructure holding.

- The buying solidifies the institutional consensus that ETH is the indispensable base layer for Web3 and DeFi, not merely a speculative asset.

- The event tells investors that current weakness is being treated by professional entities as a time for strategic accumulation, not capitulation.

The Ethereum market was recently gripped by a classic paradox: an Ethereum co-founder signaled a potential sale by moving $6 million worth of ETH to an exchange, a move that typically sparks fear. Yet, this ripple of insider distribution was immediately met by a $1.6 billion tidal wave of buying. Over the course of just two days, institutional whales aggressively accumulated Ether, utilizing the lower prices to deepen their positions.

This extreme disparity, a $6 million sell signal absorbed by a $1.6 billion vote of confidence, is the clearest indicator of the market's current structural strength.

This article dissects the capital flows to understand why sophisticated investors view this period of weakness as a strategic opportunity, not a time for capitulation.

The Conflict Between Insider Distribution and Institutional Accumulation

The recent price volatility in Ether provided a live stress test for the market's conviction, revealing two distinct and opposing flows of capital.

The Insider Sale: A Natural Distribution

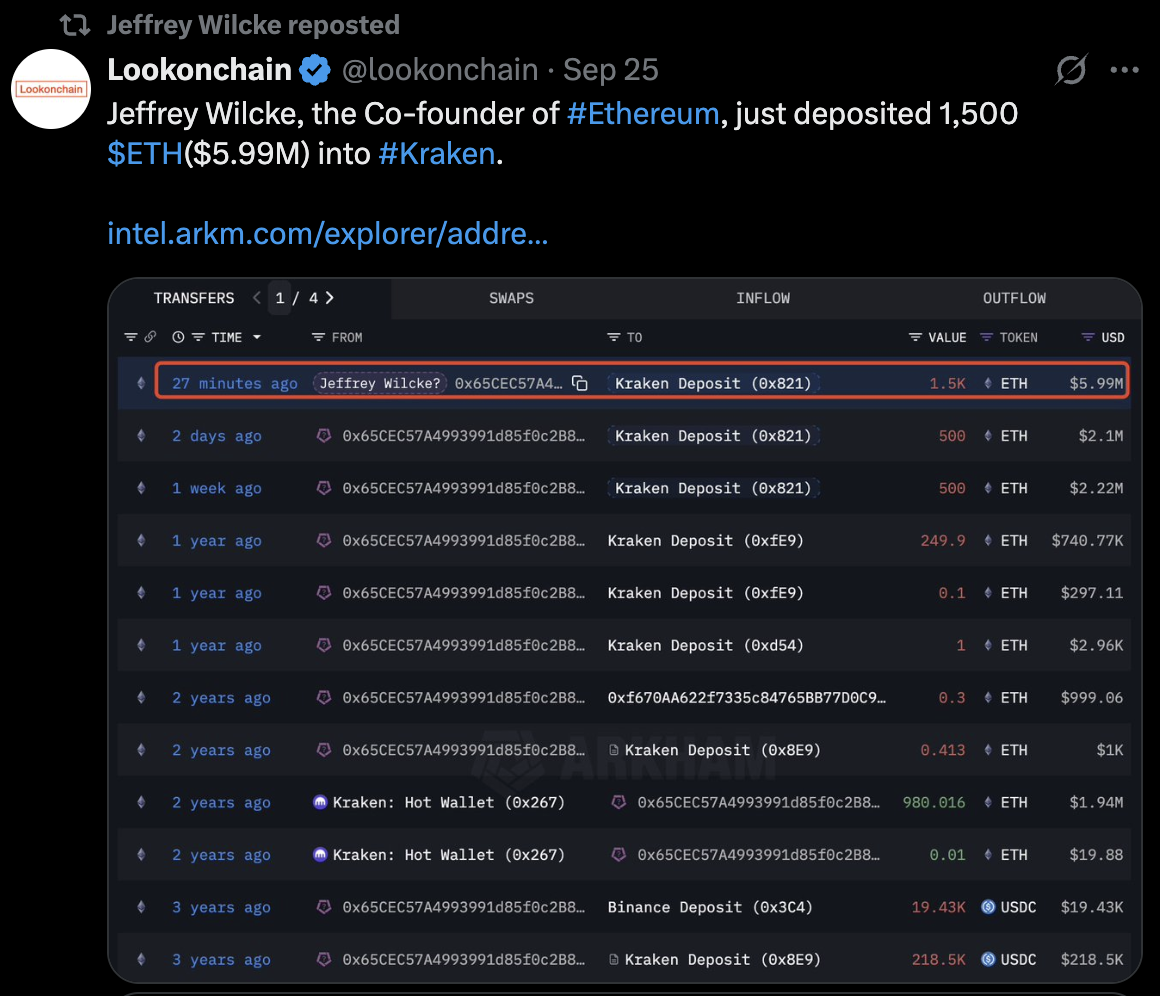

The initial catalyst for fear was the movement of 1,500 ETH (valued at approximately $6 million) by Ethereum co-founder Jeffrey Wilcke to the Kraken exchange.

This transfer, though small relative to the overall market, fueled speculation that an early stakeholder was seeking to monetize a portion of their holdings. While this distribution is a natural process, early participants taking profit, it generated a temporary selling narrative that contributed to the price dip.

The Whale Response: A $1.6 Billion Vote of Confidence

This early insider selling was immediately dwarfed by the strategic accumulation of large holders. At least 15 distinct wallets were tracked purchasing over 406,000 ETH, a total value of $1.6 billion, in the same two-day window. This aggressive accumulation was highly coordinated and was executed across multiple institutional venues, including Kraken, Galaxy Digital, and BitGo.

This disparity confirms that while early contributors may be distributing their supply, sophisticated institutional capital is strategically absorbing the distributed assets, seeing the dip as a high-value entry point.

Market Trend: The Structural Bet on Ethereum's Future

The $1.6 billion accumulation is more than just a large trade; it is a structural bet on the long-term fundamentals of the Ethereum ecosystem. This massive movement of capital confirms two key trends shaping the digital asset market.

Confidence in the Base Layer

The timing of the whale buying, occurring during a market dip and amidst general weakness, is crucial. This activity suggests that these large holders view any short-term price correction as a fleeting opportunity to acquire an indispensable asset at a discount.

They are reinforcing their conviction that Ethereum, as the dominant smart contract platform, will continue to form the critical base layer for Web3 and Decentralized Finance (DeFi). Their strategic accumulation treats ETH as infrastructure, not merely a highly speculative token.

The Institutional Demand Signal

The buying activity is not purely retail; it is fundamentally an institutional demand signal. This strategic accumulation points toward long-term portfolio allocation for dominance.

Large funds are securing their positions now because they understand that when market momentum returns, the supply available at these prices will be absorbed quickly.

The action of these sophisticated entities validates the thesis that ETH is a core, necessary holding for any fund seeking exposure to the future of the digital economy.

The recent capital flow event serves as a powerful case study in market conviction. The $6 million sale by an early contributor represents a natural process of profit-taking and distribution.

In sharp contrast, the $1.6 billion buy signal from institutional whales represents the immense, ongoing structural demand for Ethereum's future utility and market dominance. This trend confirms that the conviction of sophisticated capital easily outweighs the selling pressure from early participants.

For investors, the message is clear: any market weakness is being viewed by professional entities as a time for strategic accumulation, not capitulation.

Cwallet: Your Gateway to a New Era of Crypto Finance

The world of cryptocurrency moves fast, but managing your assets can be simple and secure!Cwallet gives you an intuitive, powerful crypto wallet to store, swap, earn, and spend over 1,000 cryptocurrencies across 60+ blockchains — all in one app.

Your assets, your control: With the Cozy Card, one of the most secure crypto wallet payment solutions, your digital assets gain real-world spending power, either online or offline.

Your trades, your way: From zero-fee Memecoins and xStocks to exciting, interactive crypto trading experiences like Trend Trade and Market Battle, making every trade easier and more enjoyable.

Your time, your efficiency: With practical tools like HR Management, Mobile Refills, and Gift Cards, skip the hassle and focus on what matters most.Join millions of users and redefine how you interact with crypto.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.