Struggling To Accept Global Payments? Try Crypto Invoice

Considering these challenges and struggles to receive invoice payments, what is the ideal method to seamlessly receive global payments? The short answer is: cryptocurrency! To get started, all you need is a cryptocurrency wallet.

Have you ever provided a service to a client, then various issues occurred when it came time to collect payment? Have you suffered business losses as a result of client payment delays?

Naturally, if you work in the service sector, you will most likely have problems with payments. And this could be very frustrating because, no matter the size of your business, you require cash flow from clients and business associates to cover operating expenses.

So, being a business owner who exports items to clients in different regions, receiving global payments is one of the challenges you could face in the international trade business. For one thing, you have to identify a strategy that works for you and your business and figure out an approach that fulfils your trade needs in the long term.

On the other hand, to receive payment for your exports to clients requires a legal document –invoice– between you and your clients. This invoice carries all the details of the goods, especially the purchase price and the expected payment date from the client. Interestingly, technological advancement made it possible to receive payments for goods swiftly. However, on the business side of it, they aren't as simple as you'd have to consider exchange rates, taxes, and other trade regulations. Therefore, this poses some challenges with receiving payment seamlessly.

Challenges Of Receiving Invoice Payments

One of the challenges of international invoicing is adhering to the client's country's tax legislation. For example, if you're in the US and agreed to be paid in US dollars from your Asian client, your invoice should state the currency as US dollars and the destination as Asia. Unfortunately, this means that your client would have to adhere to paying consumption tax on the goods, which would probably be deducted from the overall total amount to be paid. As a result, the expected amount gets reduced following the deduction based on the conversation rate and taxes incurred. However, how can you receive payments from international clients for your invoice services?

There are several ways you can receive payments from international clients. And depending on the agreement, you could state the payment method that is most convenient for you on the invoice. However, it's crucial to choose the right payment option to reduce the risk of nonpayment while still meeting the client's requirements. Among several ways you could accept payment from clients are;

Wire transfers

Wire transfers are regularly used by clients from abroad to pay for services. Therefore, you must provide some financial information on the invoice to facilitate the payment if you want to receive payments via wire transfers. Using this method, you give the customer specific routing instructions, including the receiving bank's name and address, SWIFT address, IBAN (international bank account number), etc.

However, the foreign exchange rate deducted from the total payment, which is always concealed in the transaction before it gets to you, might result in a short price, which is one of the disadvantages of receiving payments via wire transfer. Additionally, international transfers are costly and will most certainly be deducted from the normal amount.

Credit card payments

If you adopt a credit card as a payment method, you will be charged a merchant discount cost and a foreign exchange fee of up to 5% of the total transaction cost, which is spread between you and your client. Although using a credit card is easier than a wire transfer, the fees incurred during the transaction depend on the size of your invoice, which is detrimental to your business. Also, credit card payments are subject to fraudulent activities since the transactions are done over the internet. The transaction could be hijacked by an unknown hacker monitoring the trade.

Online payment gateways

Clients could also use online payment channels like Paypal, GooglePay, TransferWire, and others. However, because the processing fees associated with the platform increase with the amount involved in the transaction, these online platforms are best suited for receiving small amounts of money.

Although there are various options for receiving international invoice payments. However, each of these strategies has its own set of restrictions. Most importantly, you must consider your clients' country currency as well as specific other payment terms. However, clients in different countries have their own invoice payment terms and laws. And these payments are subject to several fees that take a reasonable percentage of your business funds.

Overcoming The International Invoice Payment Challenges

Considering these challenges and struggles to receive invoice payments, what is the ideal method to seamlessly receive global payments?

The short answer is cryptocurrency!

Cryptocurrency is a solution to traditional finance's challenges, the most significant of which is receiving cross-border payments. Using a crypto invoice, you may accept payments for your services from clients worldwide without worrying about exchange rates or the client's country's invoice payment terms and rules.

So, how do you use a crypto invoice to accept payment?

Receiving Payments With A Crypto Invoice

To get started, all you need is a cryptocurrency wallet. Your wallet will provide you with a deposit address you can send to your clients for payments. Interestingly, you can receive a crypto invoice payment with Cwallet. The Cwallet crypto invoice is the all-in-one business solution that makes it simple for you and your client to track the status of payments made on the invoices you send.

Receiving Payment With Cwallet

It is easy to get started using Cwallet. Unlike other wallets, you do not need to go through a lengthy registration or KYC verification process because all you need to do is add your mobile phone or third-party sites such as Twitter, Telegram, Discord, and Reddit.

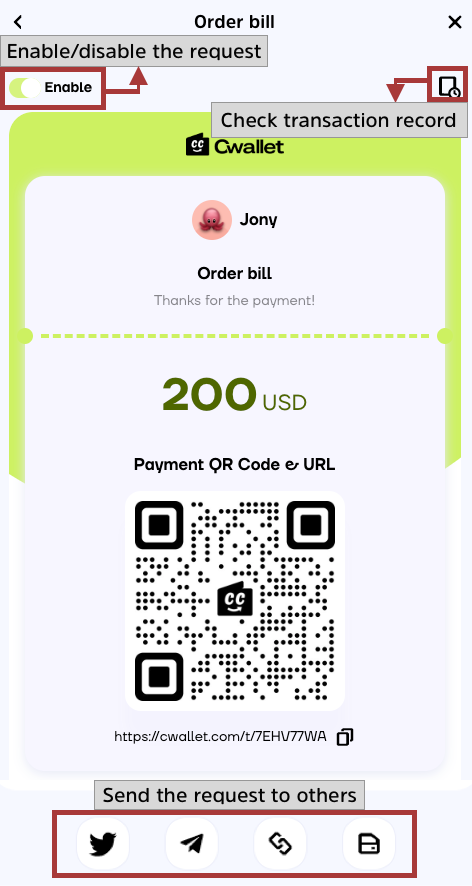

Once you have your Cwallet account, you can create an invoice using the 'Request' feature on cwallet. Fill in all the necessary information the invoice would have and include the money to be paid by your client.

With the Cwallet Request function, you can indicate the transaction's title, the currency for price standard, the amount, and the payment request description. Now you can send your crypto invoice to your client to receive payments without incurring any transaction cost.

On the other hand, Cwallet provides you with a link you can send to your clients to quickly pay with just one click. The link opens up a payment code that can be scanned with all the necessary information already imputed.

Finally, On the Cwallet dashboard, you can see all the requests you've made and the total income for each. You can also check each request code and transaction record. Accept international payment invoices easily with Cwallet and easily manage your requests!

Create a Cwallet account to begin receiving cryptocurrency invoice payments from your clients immediately without worrying about short payments or paying transaction costs.

Then, using Cwallet Request, make your invoice and collect your payment without delay.

Cwallet: The Multi-functional Crypto Wallet

Cwallet is a unique cryptocurrency wallet that combines custodial and non-custodial features. With the help of this combined on-chain and off-chain wallet, you can manage and trade over 800 cryptocurrencies in a single spot, providing security, simplicity, and flexibility.

The Cwallet meets individuals' and enterprises' complex crypto needs through a range of features such as the tip code, airdrop game, giveaway tool, mobile refills, bulk payment, request invoice, payment button, and so on. It is more than just a cryptocurrency wallet where users may send and receive funds, buy and sell, or hold and swap cryptocurrency.

Cwallet lowers the entry barrier for crypto usage. You can instantly create a cwallet account with your mobile number or third-party networks such as Twitter, Telegram, Discord, and Reddit.

What's more?

Cwallet does not charge any deposits, withdrawals, and token swap fees. Therefore, using Cwallet is absolutely FREE!

So, what are you waiting for?

Download the Cwallet NOW!