Perp Trading with Cwallet | How to Use Advanced Charting Tools to Be a Pro. Trader

Mastering advanced charting tools can make a real difference.

If you've already started trading perpetual contracts on Cwallet, or if you're eager to take your trading skills to the next level, mastering advanced charting tools can make a real difference.

With Cwallet's integrated charting features, you can analyze trends, spot entry and exit points, and refine your trading strategies — all in one seamless platform.

So let's get started finding out how we can be armed with tools while trading perpetual contracts!

What Tools Are Available on Cwallet Perpetual Trading?

Cwallet's charting interface is powered by TradingView, giving you access to professional-grade tools without leaving the platform.

Some of the most commonly used indicators include:

- Bollinger Bands (BB)

Bands plotted above and below an asset's price that show how far the price moves from its average. This helps spot when an asset may be overbought (too high) or oversold (too low), giving clues about potential reversals.

- On Balance Volume (OBV)

Combines price changes with trading volume to indicate whether buyers or sellers dominate the market. A rising OBV suggests accumulation (buying), while a falling OBV shows distribution (selling).

- Moving Averages (MA)

A line representing the average price of an asset over a set period. It helps identify the overall trend: if the price is above the MA, the trend may be up; if below, the trend may be down.

- Keltner Channel

Volatility bands placed around a moving average to show trend direction and potential breakouts. When the price moves outside the channel, it can indicate strong momentum or a possible reversal.

- Additional indicators

Tools like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), Fibonacci retracement, and others help measure momentum, trend strength, and potential support/resistance levels, providing extra insight for trading decisions.

How to Use These Tools

Getting started with charting on Cwallet is straightforward:

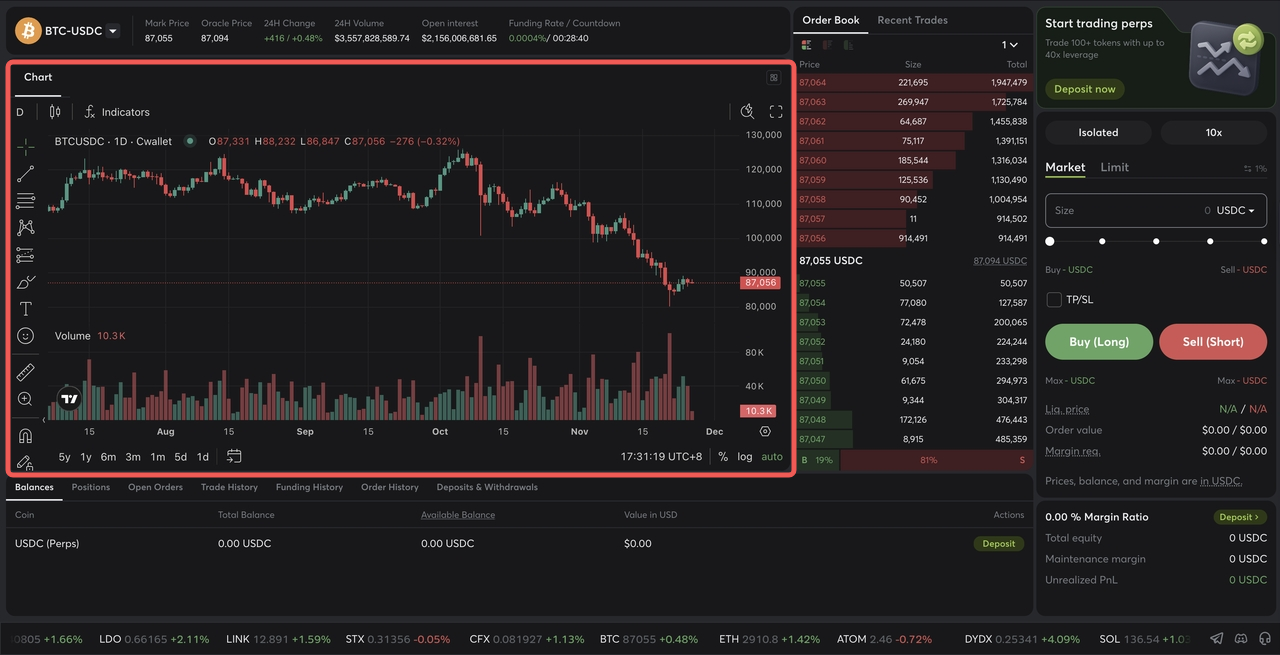

1. Accessing the Chart

Use Perpetual Futures to open the chart of any trading pair. Popular options include $BTC/USDC, $ETH/USDC, and other trending markets.

2. Customizing Candles and Timeframes

Set candlestick charts to intervals from one second up to one year, depending on your trading style. You can also switch to alternative chart types like Baseline charts or Heikin-Ashi, which help visualize trends more clearly.

3. Adding Indicators and Drawing Tools

Select indicators from the top toolbar dropdown. For annotations, trendlines, and other measurements, the left-hand toolbar offers over 90 drawing tools.

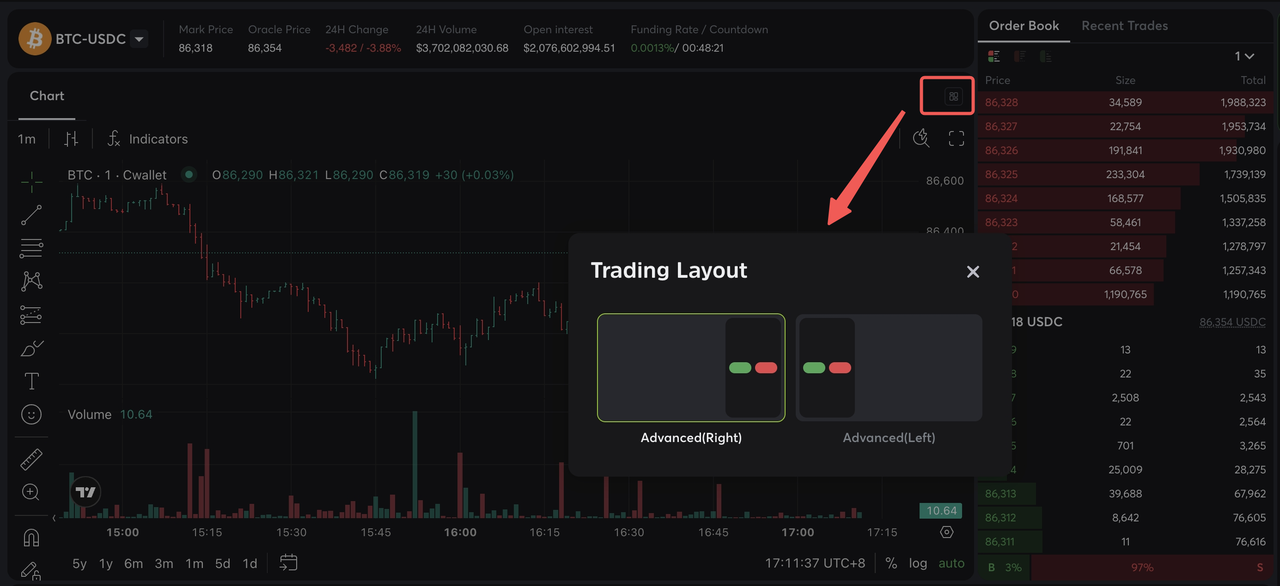

4. Dashboard Layout & Colors

You can adjust your layout and screen colors to match your preference, making analysis more comfortable and reducing visual fatigue.

5.Cross-Device Access

Cwallet's charting tools work the same whether you're on a desktop or mobile device, so you can monitor markets and manage positions anytime, anywhere.

Pros & Cons of Using Advanced Charts

Pros:

- Enhanced trend analysis and market insight

- Ability to set precise entry and exit points

- Supports multiple indicators and drawing tools

- Same functionality on website-Cwallet and App-Cwallet

Cons:

- Over-reliance on charts may lead to analysis paralysis

- Too many indicators can clutter the view and create conflicting signals

- Beginners may need time to understand each tool effectively

Tips to Get the Most Out of Cwallet Charts

- Start with one or two indicators before combining multiple tools.

- Practice using trendlines and annotations to track your strategies visually.

- Pair chart analysis with risk management, such as stop-loss and take-profit orders, to make informed trading decisions.

- Use your watchlist to focus on a few coins rather than trying to track the entire market.

Summary & Looking Ahead

Mastering advanced charting tools gives you more control and confidence when trading perpetual contracts on Cwallet. By using indicators like Bollinger Bands, Moving Averages, and Keltner Channels, and combining them with your own trading strategies, you can identify trends, entry points, and potential risks more effectively.

In the next article, we'll dive into risk management essentials for safer perpetual futures trading, helping you protect your capital while maximizing opportunities.

💪 Stay tuned to Cwallet Guides for step-by-step guides, trading tips, and pro strategies, designed to help beginners grow into confident traders.

Cwallet: Your All-in-One Crypto Solution

Cwallet allows you to store, trade, and manage 1,000+ cryptocurrencies across 60+ blockchains, offering flexibility for both Spot Trading and Futures Trading. With features like Perpetual Trading, Cozy Card, and more, Cwallet empowers you to make the most of your crypto journey

Official Links

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is for informational purposes only and does not constitute financial advice. Crypto assets are volatile, and all investment decisions should be based on your own research (DYOR). Cwallet assumes no liability for any losses.