My Firm Adopted Crypto To Pay Investors' Accounts And Saved 8% On Transaction Fees

My job as an investment firm is handling the distribution of investment proceeds to investors when it's time for payout...after due consultation & major reviews, I found Cwallet as a reputable crypto wallet with bulk payment functionality and other unique features.

Working in a financial institution can be difficult for various reasons, including handling clients' investments. However, what appears to be more challenging, though important, is the prompt distribution of profits to the various investors who entrust their money to the institution.

My job as a fund manager of an investment firm is handling the distribution of investment proceeds to investors when it's time for payout or when their fund is being requested. However, my job also entails ensuring the institution makes adequate profit by strictly cutting every unnecessary and avoidable expense to its bare minimum.

A Major Financial Concern For The Firm

Without a doubt, one aspect that affects the institution's financial book is the cost incurred during payouts. Payments are made in batches on several occasions and are sent based on the mode of payment and the investor's location. Also, funds are transferred for clients who want to switch or diversify their investments to other asset classes, such as real estate, precious metals, etc. As a result, the institution pays many transaction fees to carry out these various activities.

Of course, these fees cannot be entirely imposed on the investor because the institution serves as their custodian and receives a portion of their investment. Nonetheless, the department expects me to devise a better way to handle transactions that will save the institution money, as the total amount spent on transaction fees is equivalent to a worker's monthly take home.

Challenges With Using Regular Payment Methods

No matter how long a client's investment lasts, there will always be a payout day; in my case, the payout is monthly. Unfortunately, there are transaction fees associated with several payout methods. Especially for international investors, where their currency conversion rate has to be considered. However, there are several payment methods adopted by the institution:

Card Payments

Card payment is the most common way for investors to be paid. Especially since it was the same method used for their deposits. However, when making payments to investors, particularly those in other countries, the institution covers up to 5% of the total payout as a transaction fee. Indeed, these fees take a significant percentage of the institution's finances when calculated for bulk payments.

Wire transaction

Wire transfers are the most expensive mode requested by clients because, unlike local transfers, they do not take 2-5 working days to reflect in their accounts. However, the cost of transferring profits via wire transfer is $26 for individual domestic accounts and higher for international investors. Despite the high transaction fee, international transfers take 1-2 days to appear in investors' accounts.

E-wallet

E-wallets are digital bank accounts that serve as middlemen in processing money transfers. Investors received their payments through services like PayPal, Skrill, and Transferwise. However, a certain percentage of the total transaction amount, ranging from 1.9% to 3.4%, was charged for these services. As a result, the cost of using these services was not profitable or cost-effective for the institution.

As a result of the transaction fees incurred through these various methods, my department was tasked with proposing an alternative that did not require investors to pay the fees. So, as the institution's fund manager and department head, I began to research the financial ecosystem and the best approach to save money on transaction fees and waiting days for investors.

Thus, despite my initial skepticism about cryptocurrency, I discovered that the revolutionary technology is the only alternative to eliminating centralized authorities and the intermediaries who profit from processing payments through transaction fees. Notwithstanding, I took the time to research how cryptocurrency would ease my concerns and discovered some benefits to paying investors in digital currency.

Benefits Of Paying With Cryptocurrency

No transaction fees

It was fascinating to learn that using cryptocurrency eliminates the cost of payment processing. This was the institution's main concern, and after discovering that cryptocurrency transactions are done with little to no transaction fee, there was no better solution to investigate.

Fast transactions

Cryptocurrency payments are typically made almost instantly, if not on the same day. This eliminates the 1-5 working days waiting period required by traditional methods. As a result, investors would receive their payout almost immediately.

Eliminates Intermediaries

Intermediaries are one of the reasons transaction fees are high, as they profit from processing payments. However, cryptocurrency technology is based on decentralized peer-to-peer networks unaffiliated with any bank or intermediaries. As a result, payments are made without the involvement of financial institutions or other third-party, which also eliminates the need for processing fees.

As I presented my solution to the department, these advantages resonated with the firm's pain point, and using cryptocurrency for payout was without question. Unfortunately, finding a cryptocurrency wallet to handle these bulk payments was the only challenge.

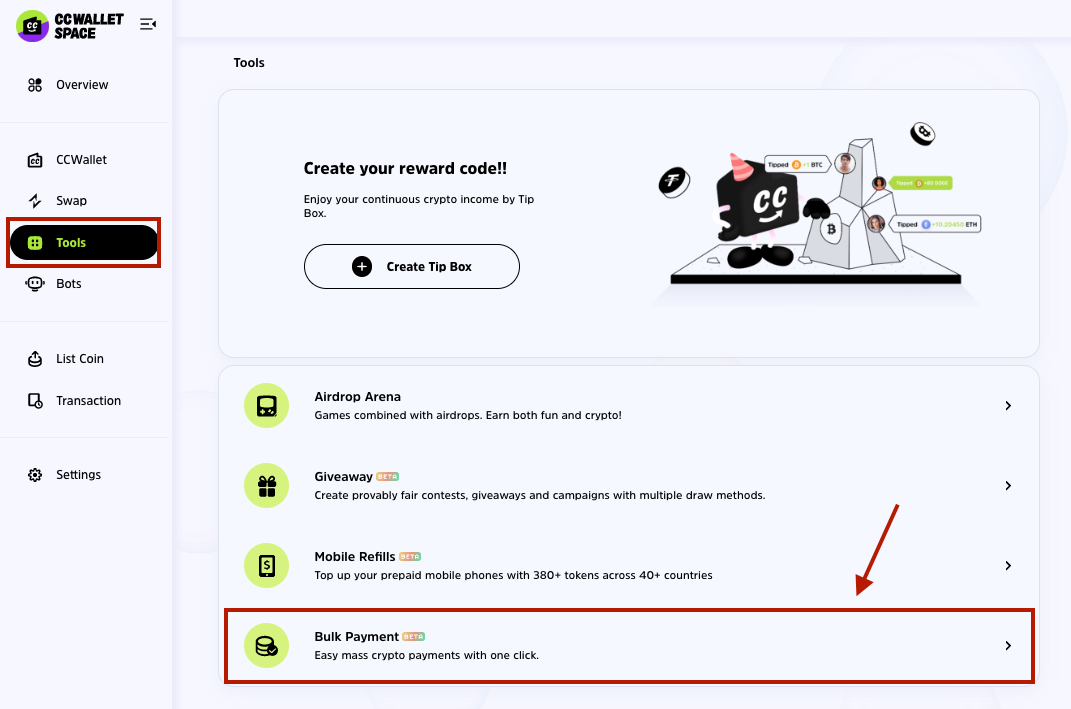

However, that lasted only a short time as, after due consultation and major reviews, I found Cwallet as a reputable crypto wallet with bulk payment functionality and other unique features. So, without requiring technical knowledge, the firm could utilize Cwallet bulk payments to pay investors without incurring any transaction costs.

Handling Payouts With Cwallet Bulk Payments

To process payments, all I needed was a Cwallet crypto account. And interestingly, there was no need for a lengthy registration procedure requiring the submission of the firm's legal documents because all I had to do was link the firm's social media platform. Furthermore, I could access the bulk payment features once the account was created. Therefore, using the Cwallet Bulk Payment Tool, I could easily and seamlessly pay investors anywhere in the world without incurring any cost.

The best part of using Cwallet is that investors can receive their pay without having a crypto wallet. Find out more about how to receive crypto without a wallet here.

So, on various payment days, I would upload the spreadsheet, which is usually a .CSV file containing their payment wallet address, amount, and other information, and choose the network and cryptocurrency for the bulk payment. That's it! It was extremely simple and quick and saved the department a significant amount of time.

Surprisingly, the department recorded an 8% decrease from what it usually incurs in transaction costs, which was good news as it strengthened the institution's finances. As a result, there was no turning back from using Cwallet bulk payments for processing.

Similarly, you can't go wrong with using Cwallet bulk payment to handle your bulk transactions. You can enjoy the Cwallet bulk payments with 3 main steps;

- Find the Bulk Payment Tool in your Cwallet.

- Fill out the payment information for your transaction. (Select the network and cryptocurrency, and fill out all the required information. You can also upload a CSV file for bulk payments, which is very convenient!)

- Pay for your bulk payment order. Done!

Follow this step-by-step process for a more detailed guide on setting up the bulk payment for your large transactions to achieve maximum results.

Another feature of the Cwallet bulk payment tool is that it automatically checks the uploaded CSV file for formatting errors and alerts you to the line where the error is found. You can review the details on the final payment page once all corrections and verification have been completed. That's all! It is extremely simple, quick, and will save you significant time.

Why You Should Choose Cwallet

Cwallet is a one-of-a-kind cryptocurrency wallet that combines custodial and non-custodial functionality. With the help of this combined on-chain and off-chain wallet, you can manage and trade over 800 cryptocurrencies in a single spot, providing security, simplicity, and flexibility.

Cwallet meets the complex crypto needs of individuals and businesses through various features such as the tip code, airdrop game, giveaway tool, mobile refills, bulk payment, request invoice, payment button, and so on. It is more than just a bitcoin wallet where users can send and receive money, buy and sell cryptocurrency, or hold and swap it.

Cwallet lowers the barrier to crypto usage by allowing you to create a cwallet account instantly using your mobile number or third-party networks such as Twitter, Telegram, Discord, and Reddit.

What's more?

Cwallet does not charge any deposits, withdrawals, and token swap fees. Therefore, using Cwallet is absolutely FREE!

So, what are you waiting for?

Download the Cwallet NOW!