Market Sentiment Polarized: Will "Uptober's" Prophecy Be Fulfilled Amidst Macro Uncertainty?

The reliable historical "Uptober" rally is facing severe skepticism, triggered by a sudden $80 Billion market dipin late September.

Key Takeaways

- The reliable historical "Uptober" rally is facing severe skepticism, triggered by a sudden $80 Billion market dipin late September.

- The primary optimistic driver is the high probability of a Fed rate cut (easing cycle), which analysts see as the necessary liquidity fuel for the next surge.

- Any immediate rally faces a ceiling from institutional profit-takers and low implied volatility, suggesting gains may be muted and unsustainable.

- The market is currently in a delicate structural standoff, awaiting a confirmed monetary policy catalyst to determine the direction of the trend.

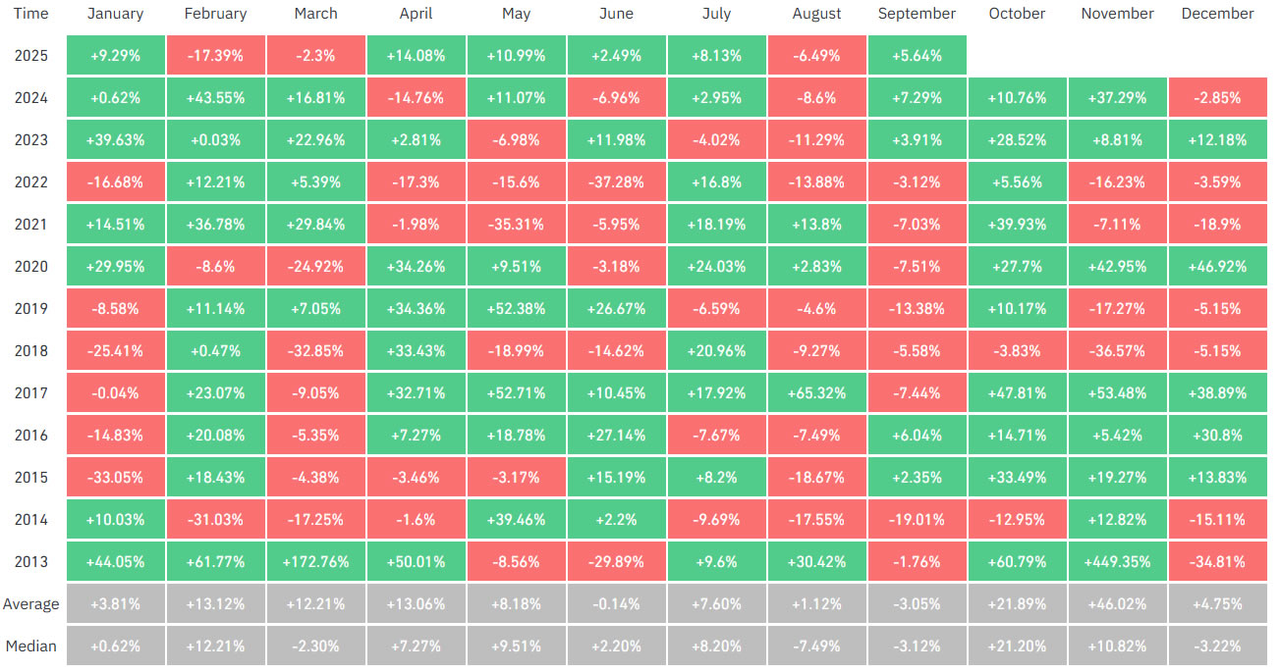

The month of October holds a unique status in the crypto world: it's affectionately known as "Uptober," the month of bullish conviction. Historically, Bitcoin has finished October in the green in 10 out of the last 12 years, making it one of the most reliably positive periods for the asset.

However, this famous historical pattern is facing a severe test. As September draws to a close, the market has begun to retreat, with total capitalization sinking by $80 billion in a matter of hours. This late-cycle dip, combined with persistent macro uncertainty, has created a polarized debate among crypto pundits: can the historical "Uptober" prophecy still hold true this year?

This article breaks down the key arguments from both the bullish and bearish camps to guide your perspective.

The Bull Case: Liquidity is the Fuel

The "Uptober" optimists believe that despite the recent market weakness, the structural tailwinds of monetary policy will soon overwhelm short-term selling pressure.

1. Aggressive Easing Cycle

The most significant argument hinges on the Federal Reserve. According to CME futures predictions, the probability of another Fed rate cut is currently at an exceptionally high rate (reported as high as 92% recently). This impending shift toward monetary easing is viewed as the "fuel" that drives all risk assets. As institutional liquidity returns to the market, crypto is positioned to benefit first.

2. TGA Liquidity Release

Further liquidity is expected from the U.S. Treasury. Analysts, including BitMEX co-founder Arthur Hayes, point to the filling of the Treasury General Account (TGA). Once the U.S. Treasury hits its target cash balance (which recently surged past $850 billion), that liquidity flows back into the banking system, potentially restarting the market’s aggressive growth phase.

3. Healthy Pre-Rally Shakeout

Some technical analysts view the recent price dip below key resistance levels as a necessary "shakeout." This liquidation event, which flushes out over-leveraged long positions, is seen as a healthy precursor, clearing the path for a more explosive and sustainable rally in October.

The Bear Case: Structural Limitations and Profit-Taking

While the macro arguments for liquidity are strong, not all analysts are convinced that the October surge will be as aggressive this year.

1. Muted Volatility and Profit Takers

The primary restraint is the presence of sustained profit-taking pressure. Insights teams, such as those at SignalPlus, caution that any immediate rebound may be "relatively muted."

They argue that the combination of very low implied volatility and strong sell orders near previous highs will cap any immediate upside. Longer-term institutional investors may lack the patience for aggressive new highs right now.

2. Macro Uncertainty Overriding History

Some industry leaders believe that the current level of macroeconomic uncertainty, including geopolitical risks and the lingering effects of inflation, is too significant for history alone to prevail.

They argue that the macro environment overrides historical precedent, suggesting a more conservative market sentiment will dominate.

3. The Broken September Pattern

Historically, "Uptober" is often preceded by a "Red September."

The fact that September was structurally resilient and did not see the typical deep dip means the market may have missed the required corrective phase needed to fuel a massive rebound. The absence of a deep sell-off might translate into a less vigorous bounce.

The Critical Watchpoints for October

The crypto market currently sits at a crucial inflection point, positioned between strong historical seasonality and clear macroeconomic resistance. The fate of "Uptober" rests on whether anticipated monetary policy shifts can overcome immediate selling pressure.

Investors should monitor two key catalysts closely:

- Federal Reserve Action: The actual confirmation of the rumored rate cut will be the definitive signal that breaks the market's current structural deadlock.

- Technical Support: Watching for the market’s defense of critical support levels (such as the recent 12-day low of $114,270) will indicate if buying demand is strong enough to resist further liquidation cascades.

The debate is fierce, but the evidence is clear: while macro liquidity favors the bullish case, structural selling pressure demands patience.

The "Uptober" remains a possibility, but only if a confirmed catalyst can definitively seize control of the market narrative.

Cwallet: Your Gateway to a New Era of Crypto Finance

The world of cryptocurrency moves fast, but managing your assets can be simple and secure!

Cwallet gives you an intuitive, powerful crypto wallet to store, swap, earn, and spend over 1,000 cryptocurrencies across 60+ blockchains — all in one app.

Your assets, your control: With the Cozy Card, one of the most secure crypto wallet payment solutions, your digital assets gain real-world spending power, either online or offline.

Your trades, your way: From zero-fee Memecoins and xStocks to exciting, interactive crypto trading experiences like Trend Trade and Market Battle, making every trade easier and more enjoyable.

Your time, your efficiency: With practical tools like HR Management, Mobile Refills, and Gift Cards, skip the hassle and focus on what matters most.Join millions of users and redefine how you interact with crypto.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: The content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.