How XRP's Price Action Is a Barometer for the Crypto Market's Regulatory Future?

XRP's price volatility is a real-time barometer for the entire crypto market's regulatory future.

Key Takeaway:

- XRP's price volatility is a real-time barometer for the entire crypto market's regulatory future.

- The lawsuit forged XRP a unique "regulatory moat," making legal clarity its greatest strategic asset.

- This certainty gives institutional investors the confidence to enter the market, turning compliance into a key driver of growth.

The recent price volatility of XRP has left many investors questioning its short-term trajectory. For a market segment often driven by hype and emotion, these moments can be a test of faith, forcing traders to scrutinize every technical indicator and market whisper.But what if this price action isn't a reflection of sentiment for just one token? What if it's a real-time barometer for the entire crypto industry's future? The legal saga between Ripple and the SEC, which has stretched on for years, has turned XRP into more than just a digital asset; it has become the focal point of a high-stakes legal battle that could define the regulatory landscape for all cryptocurrencies.

This article will dissect XRP's recent movements and connect them to a powerful, macro trend: the market's ongoing search for regulatory clarity.

Micro Analysis: A Closer Look at XRP's Price

A closer look at XRP's recent drop shows a clear mix of technical signals and shifting market sentiment. This was not just a random dip, but a correction driven by specific indicators.

Bearish Signs from Technical Charts

XRP's price action is now forming a classic descending triangle pattern, a signal that often precedes further drops.

- Key Support at $2.75: The article points out that if the price closes below the $2.75 support line, it could trigger a new wave of selling, with a potential target of $2.07. This represents a possible 26% decline.

- Loss of Momentum: The price has fallen below its 50-day and 100-day moving averages, which is a bearish sign. The Relative Strength Index (RSI) has also dropped from 50 to 39, confirming that selling momentum is increasing.

Market Sentiment and Historical Precedent

Beyond the charts, market sentiment provides another warning.

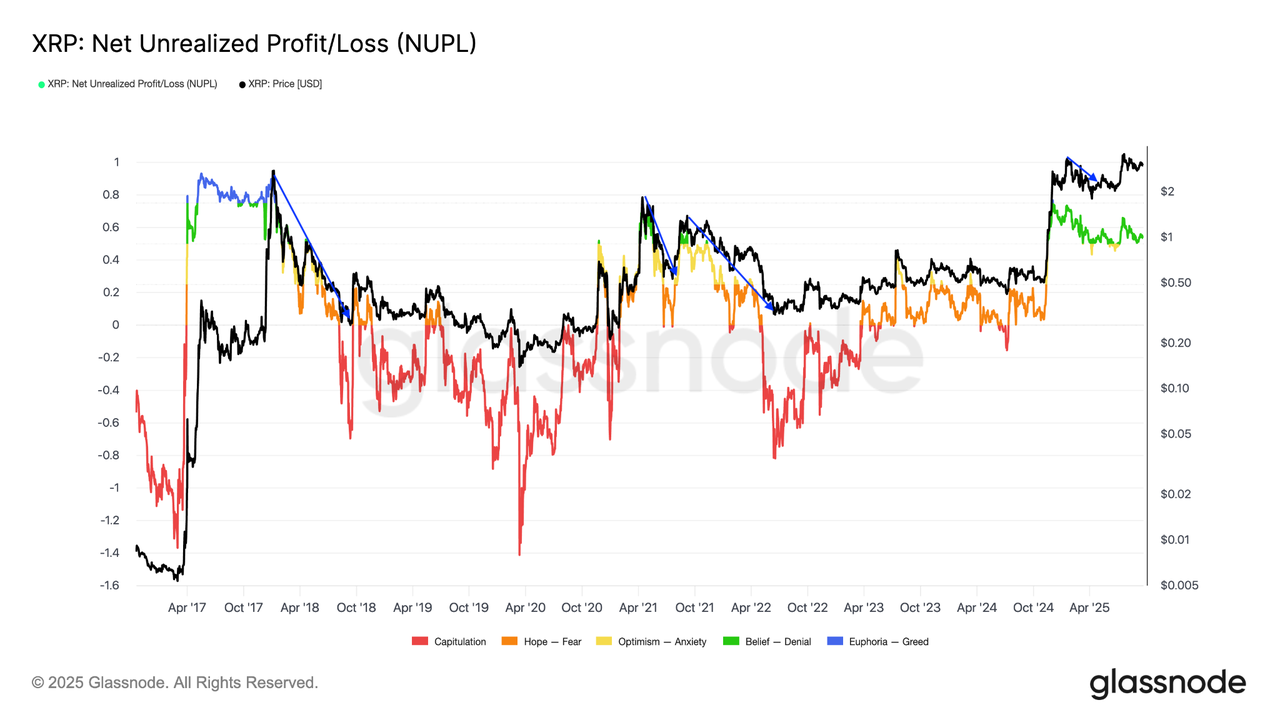

- Profit-Taking Pressure: The Net Unrealized Profit/Loss (NUPL) indicator shows that over 94% of the XRP supply is in profit. This high concentration of profitable holdings increases the likelihood of a major sell-off as investors take gains.

- History Rhymes: This situation has occurred before. Similar NUPL levels in 2017, 2021, and earlier in 2025 were all followed by significant price corrections. This suggests the recent dip was a long-awaited technical correction, not an accidental market panic.

Macro Insight: A Legal Battle Reshaping the Market

While a day trader might see a simple breakdown in a chart, an insights-driven investor sees something much larger: the market is pricing in the outcome of the legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC).

This high-stakes legal war, centered on the accusation that XRP was an unregistered security, has turned XRP into more than just a digital asset; it's a market-wide signal.

XRP's Unique Legal Moat

The core insight here is that the lawsuit, instead of destroying XRP, has forged its greatest strategic asset: a "regulatory moat."

The court's initial ruling that XRP, when sold on a public exchange, is not a security, was a landmark decision. It provided XRP with a unique legal identity that no other major token possesses. This has transformed it from a "regulatory nightmare" into a digital asset with a legally-validated status in the U.S.

The Price of Clarity

This regulatory clarity has a direct impact on capital flows. The legal victory has given institutional investors the certainty they need to enter the market, removing a major hurdle that had deterred them for years.

Consequently, XRP's price becomes a real-time reflection of the market's sentiment toward that legal certainty. Every piece of news, every appeal, and every regulatory filing is not just an event for Ripple; it's a market-wide signal.

Compliance as a Core Pillar for the Next Crypto Era

XRP's price volatility is a symptom of a much larger narrative, a narrative that is shaping the future of the entire industry.

The ongoing legal battle is a high-stakes, real-world case study for the entire crypto ecosystem. It demonstrates that in an environment of increasing regulatory scrutiny, a clear legal identity and a defined "regulatory moat" are not just advantages; they are essential pillars for long-term survival and institutional adoption.

Cwallet: Your Secure Command Center for New Crypto Finance

Cwallet is built on the vision that digital asset management should be secure, effortless, and entirely in your hands. It provides a fortified, all-in-one platform designed to secure your entire portfolio, supporting over 1,000 cryptocurrenciesacross 60+ major blockchains.

Cwallet is dedicated to making crypto practical for today, ensuring your digital wealth maintains real-world liquidity. The revolutionary Cozy Card instantly transforms your secure holdings into a flexible payment solution, enabling global, secure spending everywhere cards are accepted. This commitment extends to engaging trading tools, including zero-fee Memecoin/xStocks and interactive Trend Trade/Market Battle, allowing you to actively participate in the market.

Cwallet provides unparalleled utility, from HR Bulk Management for corporate efficiency to easy Mobile Top-ups, proving it's designed for every use case. Cwallet empowers you to navigate the future of finance with confidence and control.

Join millions who are transforming the way they manage their digital wealth.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer: This content is for informational purposes only and is not investment advice. Please invest wisely and at your own risk.