How to Use AI for Cryptocurrency Investments and Portfolio Management

The integration of AI into cryptocurrency investments and portfolio management represents a significant advancement in financial technology.

The intersection of artificial intelligence (AI) and cryptocurrency investment has opened up new frontiers for investors and traders alike. By leveraging the predictive power and analytical capabilities of AI, individuals and institutions can enhance their approach to market analysis, portfolio management, and trading strategies.

Also Read: How Artificial Intelligence (AI) Can Revolutionize Crypto Investing

This post explores the multifaceted applications of AI in cryptocurrency investments, offering insights into market prediction, risk assessment, automated trading, and the continuous adaptation of investment strategies to dynamic market conditions. It serves as a comprehensive resource for anyone looking to harness AI's potential to make more informed decisions in the fast-paced world of cryptocurrency.

How to Use AI for Cryptocurrency Investments and Portfolio Management

1. Market Analysis and Prediction

The use of AI in market analysis and prediction represents a groundbreaking approach to understanding and forecasting the highly volatile cryptocurrency market. At the core of this process is the collection of vast amounts of historical market data, including price fluctuations, trading volumes, and even the sentiment expressed in social media and news articles. This data serves as the training set for sophisticated machine learning models, which are tasked with uncovering patterns and predicting future market movements.

Predictive modeling techniques such as ARIMA (AutoRegressive Integrated Moving Average) and LSTM (Long Short-Term Memory) networks have shown particular promise in deciphering the time-series data characteristic of financial markets. These models can capture the temporal dependencies and volatility of cryptocurrency prices, offering insights into future trends. Furthermore, convolutional neural networks, traditionally used in image recognition tasks, have been adapted to analyze sequential data, providing a novel approach to market prediction.

Related: Top Ways Crypto Investors Can Use ChatGPT for Market Analysis

Sentiment analysis, powered by natural language processing (NLP), plays a crucial role in gauging the market's emotional pulse. By analyzing the tone and sentiment of news articles, social media posts, and forum discussions, AI can assess the collective market sentiment, which often precedes market movements. This analysis adds a layer of qualitative data to the quantitative analysis provided by traditional models, offering a more holistic view of the market dynamics.

2. Portfolio Management

AI-driven portfolio management revolutionizes how investors approach risk and asset allocation in the cryptocurrency domain. By analyzing historical performance data and current market conditions, AI models can assess the risk associated with various cryptocurrencies. This assessment considers factors like volatility, market liquidity, and correlation with other assets in the portfolio. Such a comprehensive risk evaluation enables investors to make informed decisions, balancing potential returns against their risk tolerance.

The cornerstone of effective portfolio management is asset allocation. Here, AI employs sophisticated algorithms like mean-variance optimization, which seeks to maximize returns for a given level of risk, or Monte Carlo simulations, which explore a wide range of possible future scenarios to inform decision-making. These methods allow for the construction of diversified portfolios that can withstand market fluctuations and reduce the impact of individual asset volatility.

Rebalancing is another critical aspect to which AI contributes significantly. Over time, market movements can shift a portfolio away from its target allocation, necessitating adjustments to realign with the investor's goals. AI models can automate this rebalancing process, ensuring that portfolios maintain their strategic asset distribution. This automation not only optimizes performance but also reduces the emotional biases that often lead to suboptimal investment decisions.

3. Trading Bots and Automated Systems

The advent of AI-driven trading bots has transformed cryptocurrency trading into a round-the-clock operation, capitalizing on opportunities as soon as they arise. These bots operate based on algorithms that trigger trades when specific market conditions or thresholds are met, guided by the predictions and trends identified by AI models. The efficiency and speed of these automated systems far surpass human capabilities, enabling traders to execute strategies that would be impossible manually.

However, the success of algorithmic trading hinges on the accuracy of the underlying models and the quality of the backtesting process. Backtesting involves simulating trading strategies against historical data to evaluate their effectiveness before live deployment. This critical step helps identify potential issues and optimize strategies, minimizing risks and enhancing the likelihood of success.

4. Continuous Learning and Adaptation

The dynamic nature of the cryptocurrency market demands that AI models are not static but rather evolve through continuous learning and adaptation. As new data becomes available, models must be updated to reflect the latest market conditions. This ongoing refinement is crucial for maintaining the relevance and accuracy of predictions.

Adaptive algorithms, such as those based on reinforcement learning, represent the frontier of AI in cryptocurrency trading. These models learn from their actions, adjusting their trading strategies based on the rewards or returns they achieve. This self-improvement mechanism allows for the development of increasingly sophisticated and effective trading algorithms that can adapt to changing market dynamics.

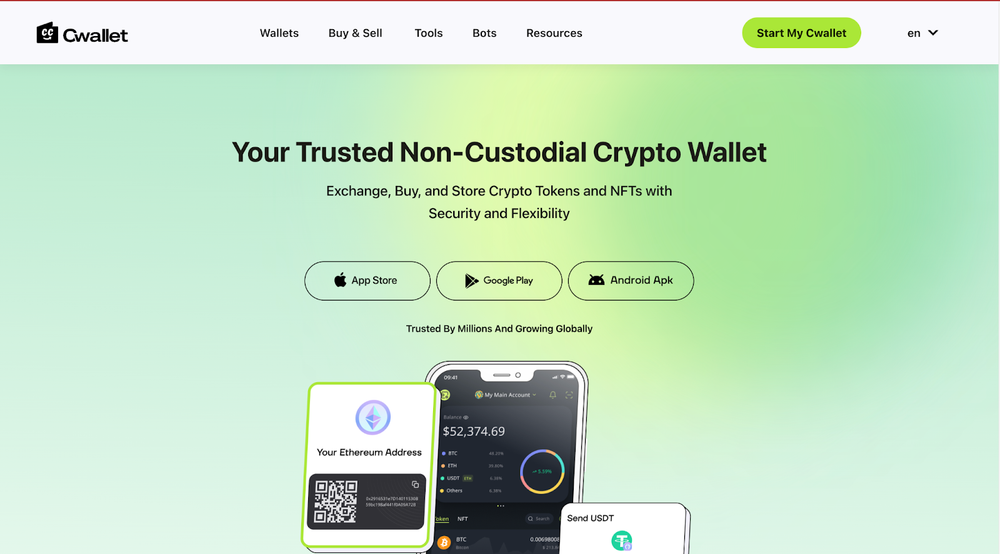

Using Cwallet for AI-Driven Cryptocurrency Management

Cwallet is a pivotal tool for cryptocurrency management, especially when leveraging AI for investment decisions and portfolio optimization. This platform provides a secure environment for storing, managing, and trading various cryptocurrencies, facilitating a seamless integration with AI technologies. By offering real-time data analytics and transaction capabilities, Cwallet is an invaluable resource for both novice and experienced investors. Its user-friendly interface simplifies the complex world of cryptocurrency, making it accessible to a broader audience while ensuring that seasoned traders have the advanced tools needed for sophisticated investment strategies.

The platform's robust API support enables the seamless integration of AI models and algorithms, allowing users to implement predictive analytics and automated trading bots directly within their Cwallet ecosystem. This integration is crucial for those looking to employ AI for market analysis, portfolio management, and algorithmic trading, as it allows for the real-time execution of AI-driven decisions.

Also, Cwallet's commitment to security ensures that these operations are conducted within a safe and reliable framework, safeguarding users' assets against the volatile nature of the cryptocurrency market. This combination of advanced functionality and security measures makes Cwallet an optimal choice for investors seeking to leverage AI for enhanced cryptocurrency management.

Beyond its technical capabilities, Cwallet promotes a community-oriented environment where users can share insights, strategies, and AI model outcomes. This collaborative aspect is particularly beneficial in the rapidly evolving crypto space, where shared knowledge can lead to more informed decisions and innovative approaches to investment. The ability to integrate AI-driven analytics and trading solutions with community feedback and expertise creates a dynamic ecosystem that supports continuous learning and adaptation.

Click here to create a Cwallet account immediately!

Conclusion

The integration of AI into cryptocurrency investments and portfolio management represents a significant advancement in financial technology. Through detailed market analysis, predictive modeling, and automated trading, AI provides investors with tools to navigate the volatile cryptocurrency market more effectively. However, success in this field requires not only a deep understanding of AI and financial principles but also a commitment to ongoing learning and adaptation.

For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet Blog and follow our social communities on Twitter, Telegram, Reddit, and Discord.