How to Maximize Profits in a Crypto Bull Market

Capitalizing on the rising trend of a bull market needs more than participation; it necessitates a systematic strategy that is knowledgeable, disciplined, and flexible to market turbulence. This post will go over how you can maximize the potential of a crypto bull market.

A bull market is characterized by a sustained period of increasing prices and optimistic sentiment, often leading to widespread participation from both retail and institutional investors. This phenomenon typically unfolds against a backdrop of favorable macroeconomic indicators, technological advancements within the blockchain ecosystem, and increased mainstream acceptance of digital currencies.

During such periods, the possibility for enormous profits is significantly increased, attracting interest from around the world. Investors, encouraged by reports of exponential returns, come to the market, each hoping to carve out a piece of the growing riches.

However, capitalizing on this rising trend needs more than simply participation; it necessitates a systematic strategy that is knowledgeable, disciplined, and flexible to market turbulence. This post will go over how you can maximize the potential of a crypto bull market. Let’s dive in!

How to Maximize Profits in a Crypto Bull Market

1. Research and Selection

The foundation of maximizing profits in a crypto bull market begins with diligent research and selection of cryptocurrencies. Investing should be based on a thorough analysis of the coin's fundamentals, including its utility, underlying technology, team expertise, community support, and competitive advantage in the market. The goal is to identify cryptocurrencies that have a strong potential for growth and are also likely to sustain their value over the long term.

This involves examining the coin's market position, scrutinizing its whitepaper, understanding the problem it aims to solve, and evaluating its adoption trends. A cryptocurrency with a growing user base, partnerships with reputable companies, and integration into real-world applications signals a strong adoption trend, making it a potentially profitable investment.

2. Buy Early

Timing the market is notoriously challenging, yet entering the market early, before widespread recognition of a bull trend, can significantly enhance profit margins. This strategy often involves buying during the downturns of a bear market or at the initial signs of a bull market turnaround.

Historical market analysis shows that the greatest gains often accrue to those who invest when the market sentiment is still cautious or negative. By identifying early indicators of market recovery, such as increased trading volume, positive regulatory news, or breakthroughs in technology, investors can position themselves advantageously before the majority of the market catches on.

Related: How to Prepare for a Crypto Bull Run

3. Diversification

Diversification is a critical risk management strategy that involves spreading investments across a variety of cryptocurrencies. This approach minimizes the impact of poor performance by any single investment. Diversification in the crypto market should consider not only the different coins but also the various sectors within the blockchain ecosystem, such as finance (DeFi), entertainment (NFTs, gaming), and infrastructure (blockchain platforms, interoperability solutions). Including both established coins like Bitcoin and Ethereum, as well as promising new projects with the potential for high growth, can optimize the risk-reward ratio of your portfolio.

4. Set Profit Targets

One of the most efficient strategies to ensure profits in an unpredictable market is to set fixed profit targets for each investment. This method entails selling a portion of your assets when the price hits a predetermined level, resulting in profits.

Profit targets should be set based on reasonable expectations and rigorous market analysis, taking into account the cryptocurrency's past performance, market cycles, and possible future growth. Setting profit targets helps to overcome the psychological trap of greed, in which investors hang onto their holdings for too long, expecting bigger returns, only to see their unrealized profits disappear during a market collapse.

5. Use Stop Losses

Stop losses are an essential tool for protecting your investment from significant losses. This strategy involves setting a sell order at a specific price below your purchase price to automatically exit your position if the market moves against you. Stop losses can be particularly useful in the crypto market, known for its high volatility, as they help to lock in profits and limit losses. It's important to adjust stop-loss orders according to market conditions and not set them too close to the current price, to avoid being prematurely exited from your position due to normal market fluctuations.

6. Stay Informed

Staying informed about market news, trends, and analysis is crucial for making timely and informed investment decisions. The crypto market is influenced by a wide range of factors, including technological advancements, regulatory changes, macroeconomic trends, and market sentiment.

Regularly following reputable crypto news outlets, market analysis, and community discussions can provide insights into market dynamics and help anticipate future movements. Being well-informed also enables investors to react swiftly to market changes, taking advantage of new opportunities or avoiding potential pitfalls.

7. Avoid FOMO

The fear of missing out (FOMO) can lead to irrational investment decisions, such as buying at market peaks or investing in hyped projects without proper due diligence. FOMO is driven by emotional reactions to seeing others make significant profits, leading to a fear of missing out on similar gains.

It's important to resist the urge to make impulsive decisions based on the success of others or the fear of missing out on potential profits. Instead, investment decisions should always be grounded in research, risk assessment, and a clear investment strategy. Avoiding FOMO and sticking to a disciplined investment approach is essential for long-term success in the crypto market.

Also Read: 5 Top Strategies to Make Profit in a Crypto Bull Market

Maximizing Your Crypto Profits With Cwallet

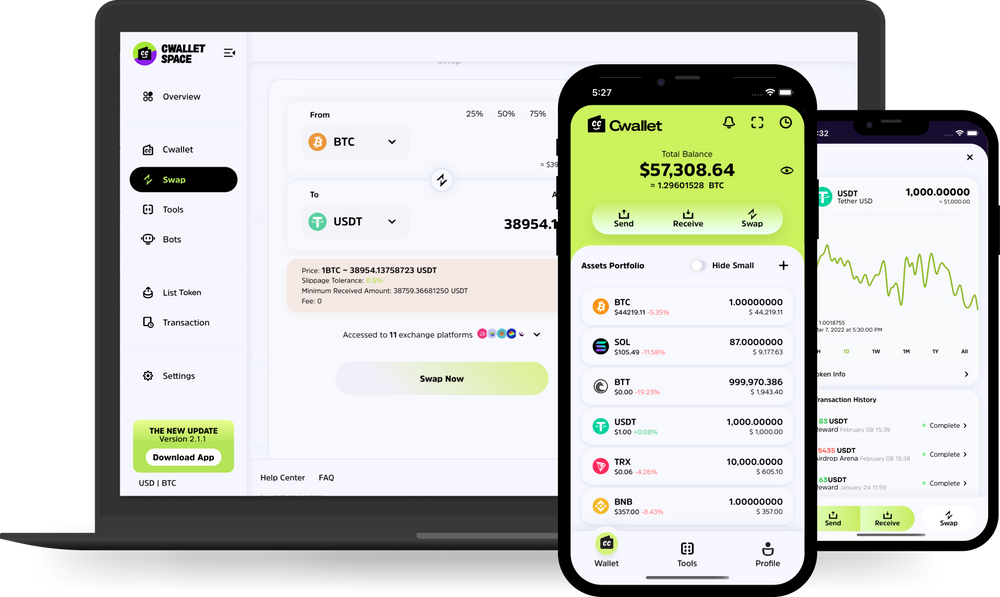

Maximizing your crypto profits during a bull market can be significantly enhanced with tools like Cwallet, a comprehensive crypto wallet and trading platform. Cwallet offers an integrated environment for both seasoned and novice investors, providing a seamless experience for research, selection, and diversification of your cryptocurrency portfolio. Its user-friendly interface allows for real-time tracking of market trends, enabling investors to buy early into promising cryptocurrencies with strong fundamentals.

One of the key features of Cwallet is its ability to set profit targets and stop losses directly within the platform, a crucial strategy for securing gains and minimizing losses. This aligns perfectly with the need for strategic investment planning, allowing users to automatically lock in profits or protect against downturns without constantly monitoring the market.

Depending on your investing strategy, Cwallet allows you to store your bull run gains in either a custodial or non-custodial crypto wallet, providing you the option of selecting a crypto wallet category based on your familiarity with the environment and the amount of control you desire over your investment. You can have the best of both worlds with Cwallet.

Cwallet is a one-of-a-kind multi-functional wallet that combines centralized and decentralized features into a single software. This modern and user-friendly wallet fills the gap between Web 2.0 and Web 3.0 by offering a full toolbox to everyone. Cwallet allows you to store, buy, and exchange crypto assets on social networks by using bot-enabled features like tipping and community management. Cwallet's extensive range of supported cryptocurrencies means investors can easily diversify their holdings, mitigating risk while maximizing potential returns.

Furthermore, the platform keeps users informed of the latest crypto news and market analysis, helping them avoid FOMO-driven decisions and instead make informed, strategic investments. By leveraging Cwallet's comprehensive suite of tools, investors can navigate the complexities of the crypto bull market more effectively, positioning themselves for optimal profit realization.

Don't miss out on maximizing your crypto gains. Click here to create a Cwallet account Immediately!

Conclusion

Mastering the art of profit maximization in a crypto bull market hinges on strategic foresight, disciplined investment practices, and the effective use of technological tools. By rigorously applying principles of research, diversification, timely market entry, and risk management, investors can significantly enhance their potential for substantial returns. As the market evolves, staying informed and adaptable ensures that investors capitalize on short-term gains and solidify their standing for future opportunities, turning the volatility of the crypto market into a landscape of profitable ventures.