How To Effectively Profit From Trend Reversals In The Crypto Market

As the term “trend reversal” implies, it is a momentum shift in the price direction of an asset. A reversal is a change in the price direction of an asset. Hence, if a market is on an uptrend, a reversal would mean a change to a downtrend, and vice-versa.

Perhaps, one of the best experiences you can encounter as a trader is to take profits at the top or buy at the bottom, just before the start of a new bull run. It shows perfect timing of the market, and it is a worthy bragging right that sees you lock in the highest possible profit in the market. The crypto market, like other financial markets, moves in trends, and to time your entry to perfection, you must understand the concept of trend reversal because impeccable timing usually marks the difference between a big win and a smaller win or even a loss. Hence, being able to effectively decipher a reversal is important in making huge profits in a market.

What Is A Trend Reversal?

As the term “trend reversal” implies, it is a momentum shift in the price direction of an asset. A reversal is a change in the price direction of an asset. Hence, if a market is on an uptrend, a reversal would mean a change to a downtrend, and vice-versa. Knowing how to spot these effectively can mark a significant difference in your profits.

It is important to note that trend reversals can vary with time frames; for example, if you are observing the 15-minute chart, you may quickly note a reversal, but it may not be the same in the 4-hour time frame; this simply indicates that the short-term trend has reversed, but the long-term trend hasn’t. If the short-term trend. In the end, if the trend reversal is strong, it will become evident on the longer time-frame charts; however, if it is only a pullback, it will only be evident on the shorter time frames and only mildly existent on the longer time-frames.

What Is A Pullback?

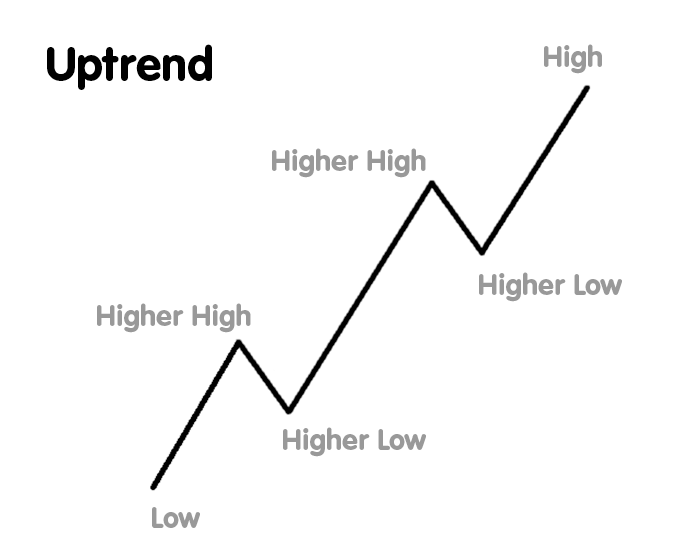

A pullback is a short-lived reversal within a trend that doesn’t alter the trend’s momentum. For example, an uptrend comprises higher highs and higher lows, making the market go up in a diagonal zig-zag movement.

These pullbacks create the higher lows before the market continues in its upward trend. However, when the new low is lower than a previous low, the uptrend will likely reverse downward. Pullbacks are potential reversals; however, a reversal isn’t confirmed until a lower low is created.

How To Predict A Trend Reversal

Identifying a trend reversal is good, but anticipating it before it happens is even better. If you can see it coming, then you can take advantage of the market early enough. When you anticipate a reversal from an uptrend early enough, you can easily lock in your profits and even open short positions on perpetual contracts; conversely, when you anticipate a reversal from a downtrend, you can buy assets earlier than many market players and maximize your ROI.

It is important to note that anticipating a trend reversal isn’t enough; excellent decision-making is just as important. Sometimes, going in too early upon a predicted reversal can backfire if it’s only a pullback; hence, it is generally advised to await confirmation. Some traders love to go on with their instincts and try to bet 90% of the market by going all in before a confirmation to get a bigger reward, but this also comes with a bigger risk. However, the safer bet is to await confirmation and allow the new trend to obey the existing support and resistance zones.

Traders use several tools to predict reversals; some use indicators, others focus on the convergence and divergence of trendlines, some others focus on observing patterns, and some use their judgment based on market momentum. No method is superior to the other, and in fact, they are all complementary; hence, having an idea about all can be beneficial in identifying reversals.

Common Reversal Patterns

Head and Shoulders & Inverse Head and Shoulders: Head and shoulders pattern uses the price action of a crypto asset to mimic a human body, as the price action starts from the left shoulder to the neckline and up to the head before reversing to the right side of the neckline and the right shoulder. A trader starts looking to anticipate the pattern as soon as the left side is completed, and the downward reversal is confirmed after the right shoulder is formed.

The opposite is the case for Inverse Head and shoulders patterns, where the trend reverses upwards.

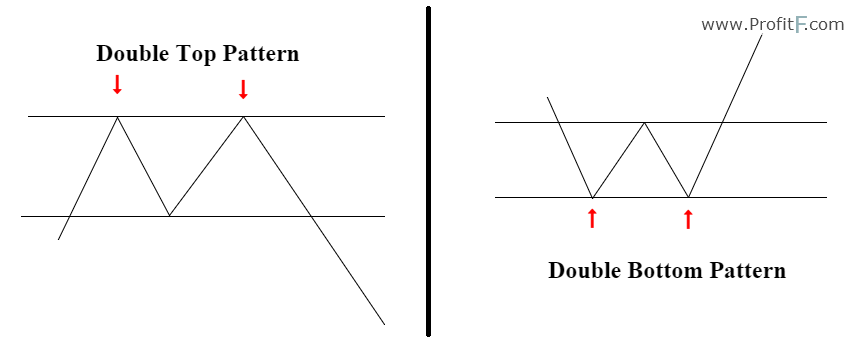

Double Tops and Bottoms: Double tops and bottoms work similarly to Head & shoulders and inverse head & shoulders. However, instead of mimicking the human head, the double top dubs an “M” pattern, where price action retraces towards support after reaching a resistance, before heading back to the resistance, and repeating the move. The trader anticipates the pattern as soon as the price movement returns toward the resistance and is confirmed when the price bounces for the second time.

The opposite is the case for the Double bottom pattern.

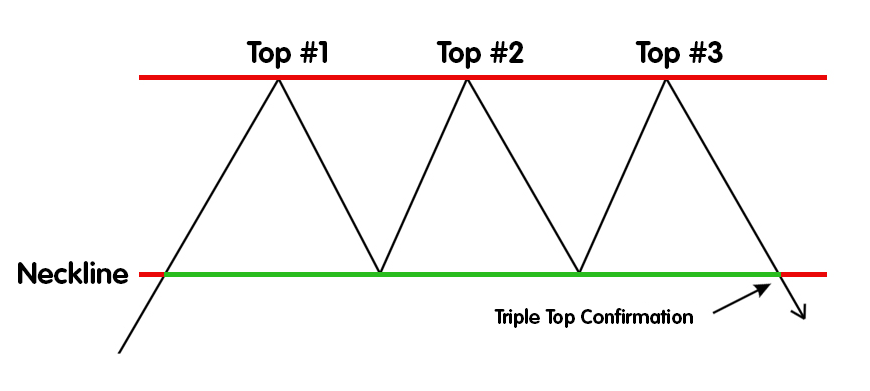

Triple Tops and Bottoms: Triple tops and bottoms work similarly to double tops and bottoms; however, it returns towards the resistance twice instead of once. The opposite is the case with triple bottoms.

Spike: A spike is similar to double bottoms and tops; however, it is single, forming a V shape or the inverse. The upward spike can be anticipated when price action has been uniformly moving higher before a candle “spikes.” At this point, the price action is expected to return the other way downwards. The pattern is anticipated at the point of the spike and confirmed immediately after new lows are formed.

The downward spike is the exact opposite.

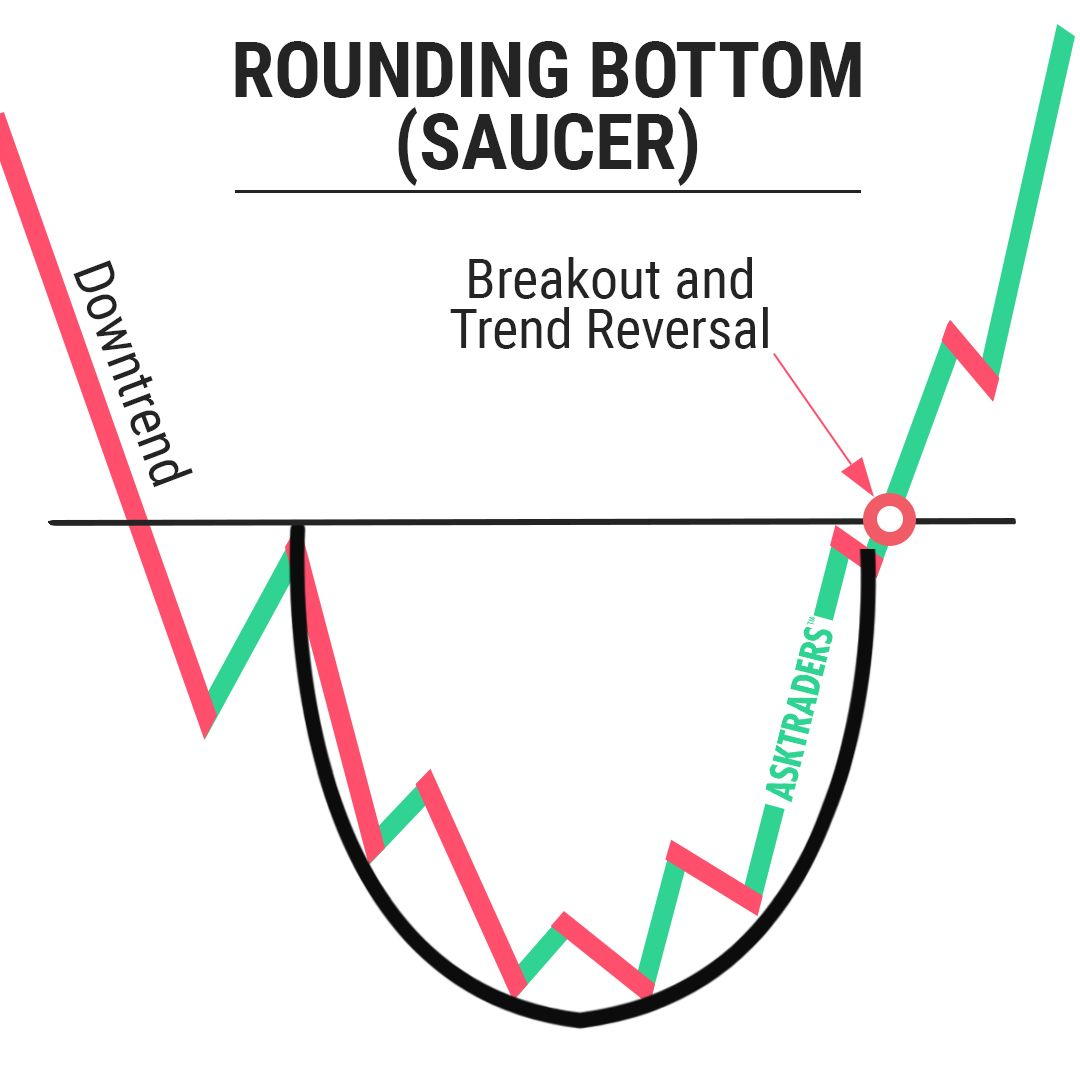

Rounding Bottom: This is a market pattern that forms an arc with the price action, indicating a prolonged downtrend, an accumulation period, and then a slow upward rally, which confirms the reversal. The reversal is anticipated at the point of accumulation and is confirmed after the new upward rally breaks some resistances.

Like all other patterns, it could happen in the opposite direction.

Common Reversal Indicators

Moving averages (MAs): The moving average is a technical analysis tool that compares the average price of an asset over a period; for example, the 20 MA estimates the average prices for the most recent 20 days; typically, the indicator line stays below the price in an uptrend and above the price in a downtrend; hence, if the moving average crosses over, moving above the price in an uptrend or vice-versa, then it may indicate a change in trend; alternatively, some traders utilize two moving averages simultaneously and judge trend reversals at their confluence.

Some other indicators that work similarly to moving averages include Bollinger bands, MACD, Donchian channels, etc.

Relative Strength Index (RSI): The relative strength index is the most common trend reversal indicator. It has an algorithm that computes gains and losses for a 14-day period to judge the strength of the asset being traded, marking it as oversold or overbought.

The chart runs from 0 – 100; when the RSI line is below 30, it signifies an oversold asset and anticipates an upward reversal; conversely, when the RSI line is above 70, it signifies an overbought asset signaling a downward trend reversal.

The stochastic oscillator also works similarly to the RSI by estimating price momentum and using it to determine if the asset is overbought or oversold.

Fibonacci Retracement Levels: The Fibonacci retracement levels predict support and resistance zones based on the Fibonacci sequence; it is useful in identifying trend reversals at a point where there isn’t much price history. Hence, traders can prepare for a reversal, even with limited historical information.

Conclusion

Even without relying on indicators and patterns, some expert traders can determine a loss of momentum in the market, and they seize the advantage to make profits; hence, it is important for traders and investors to double-check or even triple-check an anticipated reversal and also wait for a confirmation before making market decisions. Indeed, catching a trend reversal feels satisfying and fulfilling; however, it is important to remain safe and not rush into trades.

All the information above are for educative purposes and are not financial advice, you are advised to conduct due diligence before investing in volatile assets like cryptocurrency. For more beginner tips, as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet blog (previously CCTIP blog) and follow our social media communities: