How To Easily Swap Crypto Assets in Your Wallet?

Many people see cryptocurrencies as investments; we all hope to make handsome returns on our investments. As a result, it is common for investors to swap underperforming tokens for ones that have substantial ROI prospects.

Almost every investor has experienced a scenario where they watch some cryptocurrencies they don't own; continually appreciating! It's pretty frustrating to see how your friends, colleagues, and other people around you have made huge profits from assets you do not own.

Or, maybe you're tired of how much inflation has eaten away at your assets while other cryptocurrencies are currently seeing a meteoric rise in price and market capitalization, providing investors with enormous profit possibilities. Of course, it is only standard that you want to swap those assets for profitable ones.

You're determined to swap those unprofitable assets, and rightly so!

Ultimately, many people see cryptocurrencies as investments; we all hope to make handsome returns on our investments. As a result, it is common for investors to swap underperforming tokens for ones that have substantial ROI prospects.

Oh! Are you in Profit? It Doesn't matter. You can still Swap Crypto Assets!

Some investors do not swap assets due to a loss. Instead, they may have made decent returns from holding an asset and want to cash in on those profits to fiat currency or to invest them in seemingly undervalued tokens to make profits.

It is common for investors who want to take profits to first swap their tokens to stable coins like USDT, BUSD, and USDC before selling these stable coins for their preferred fiat currencies.

On the other hand, some investors swap one crypto asset for another, hoping to make returns from the new token. For example, an investor could swap BTC for ETH.

Reasons Why People Swap Crypto Assets:

· Portfolio Diversification: One of the essential advantages of a well-balanced crypto wallet is its diversity. Investing in various assets will protect you from the crypto market's volatility. Keeping some reserves in stablecoins also gives you the impression that you aren't putting all your eggs in one basket.

· Profiting from Market Volatility: The constant fluctuation in cryptocurrency market prices is another reason people swap coins. If the price of a crypto asset has lately increased significantly, you may wish to lock in those profits before the market corrects itself.

For example, after your assets have risen significantly, you can swap your assets to a stable coin like USDT, allowing you to avoid market correction and possibly buy back assets at lower prices.

Where to Swap Crypto Assets?

Depending on where your assets are located, you can swap crypto assets using CEXs, DEXs, custodial wallets, or non-custodial wallets. However, choosing the right platform to conduct the swap will depend on how easy and cheap the trade will be.

Swapping on Centralized Exchanges/Custodial Wallets

Centralized exchanges (CEX) all have custodial wallets; you aren't provided a private key to secure your wallet when you keep your assets in a centralized exchange. Instead, the CEX takes the responsibility of securing your assets.

In the same vein, when you keep your assets in a custodial wallet, you have outsourced the responsibility of securing your wallet to a third party. However, NOT all Custodial wallets are associated with Centralized Exchanges.

Compared with DEXs and non-custodial wallets, it is convenient and cheap to deposit, withdraw, trade, and carry out transactions on CEXs and custodial wallets.

Similarly, swapping assets is easy and cheap on CEXs and custodial wallets, with obvious advantages over DEXs and non-custodial wallets. They include:

· Speedy Transactions: Centralized exchanges and custodial wallets usually provide higher liquidity for your swaps. Also, thanks to the data center's power, they generally allow faster operations.

· Cheap Cross-Chain Swaps: Regardless of the blockchain network you want to Swap to/from, it is easy and cheap with CEXs and custodial wallets. For example, you can swap an ERC-20 token for a BEP-20 token in short and simple steps, whereas performing similar operations on a DEX will require you to bridge the ERC-20 token, all by yourself, before swapping. This costs time and money.

· Easy to Operate: Ultimately, Operating on CEXs and Custodial wallets is easy, as they require little technical knowledge, they have easy-to-operate interfaces, and they provide support services.

Decentralized Exchanges/Non-Custodial Wallets

Swapping on DEXs and non-custodial wallets affords you a secure and transparent marketplace with no intermediaries, eliminating the third-party policy of CEXs and custodial wallets, substituting them with self-executing smart contracts to help simplify the exchange process.

The major advantage DEXs and non-custodial wallets afford you is the sovereignty to manage your transactions. For example, when swapping assets on a DEX, you can manage your maximum slippage tolerance to ensure that you get the best value for the assets you're swapping. Slippage occurs due to volatility, but since you manage your trades on DEXs, you can set a slippage tolerance as low as 0.1%. Conversely, if you were swapping on a CEX, they would determine all these for you.

Nevertheless, if you aren't familiar with the techniques of slippages and frontrunning, managing your transactions may not necessarily be an advantage.

Some drawbacks are associated with using DEXs and non-custodial wallets for swap operations. They include:

· Requires Technical Know-How: DEXs and non-custodial wallets may be difficult to navigate, requiring expertise to perform operations. Conversely, a beginner can easily use CEXs to perform swaps and other operations.

· Delayed Transactions: DEXs typically have lower trading volumes; as a result, you may not quickly find supply or demand for the asset you wish to swap. This exposes you to the risk of volatility.

· Limited to On-chain Transactions: Swapping on DEXs is attached with limitations mainly because DEXs are associated with different blockchain networks. For example, Uniswap for ERC-20 and Pancakeswap for BEP-20. As a result, you cannot directly swap ERC-20 to BEP-20; to do this, you need to bridge tokens first, which will cost time and money.

Weighing them side by side, we can summarize them as follows.

CEXs & Custodial wallets vs. DEXs and Non-custodial wallets.

|

S/N |

Centralized

Exchanges/Custodial Wallets |

Decentralized

Exchanges/Non-custodial wallets |

|

1. |

Easy to

operate, requiring little technical expertise. |

Requires

technical knowledge |

|

2. |

Transactions

are managed by a third-party |

There is no

intermediary |

|

3. |

High trading

volumes and liquidity |

Trading

volumes and liquidity is significantly lower |

|

4. |

Transactions

are fast |

Transactions

are often delayed, exposing you to volatility. |

|

5. |

Cross-chain

swaps are easy and cheap |

Cross-chain

swaps are strenuous and expensive |

How To Swap Tokens on CCTIP?

CCTIP provides the cheapest and easiest way to swap cryptocurrencies, regardless of whether they are on the same blockchain network or not.

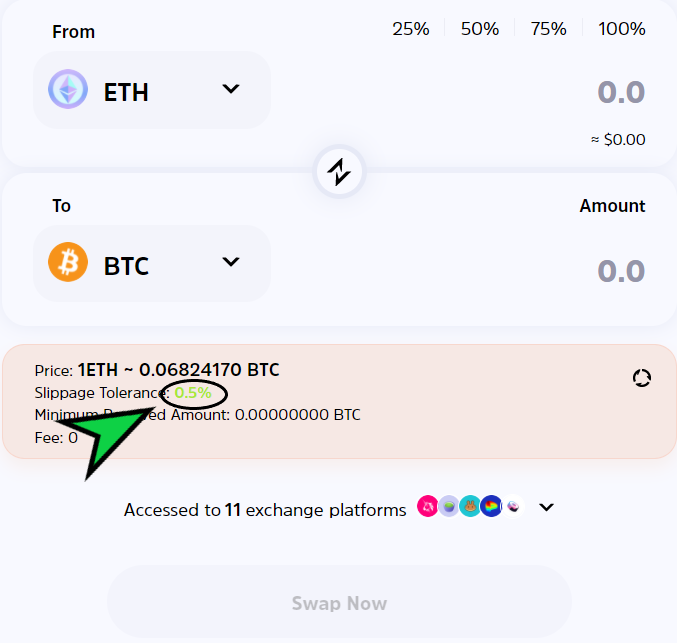

Despite being a custodial wallet, you can set a comfortable slippage tolerance to manage your transaction.

So, you have the best of both worlds!

Swapping cryptocurrencies on CCTIP can be done in three easy steps.

Step 1: Log in to your account and access your wallet space

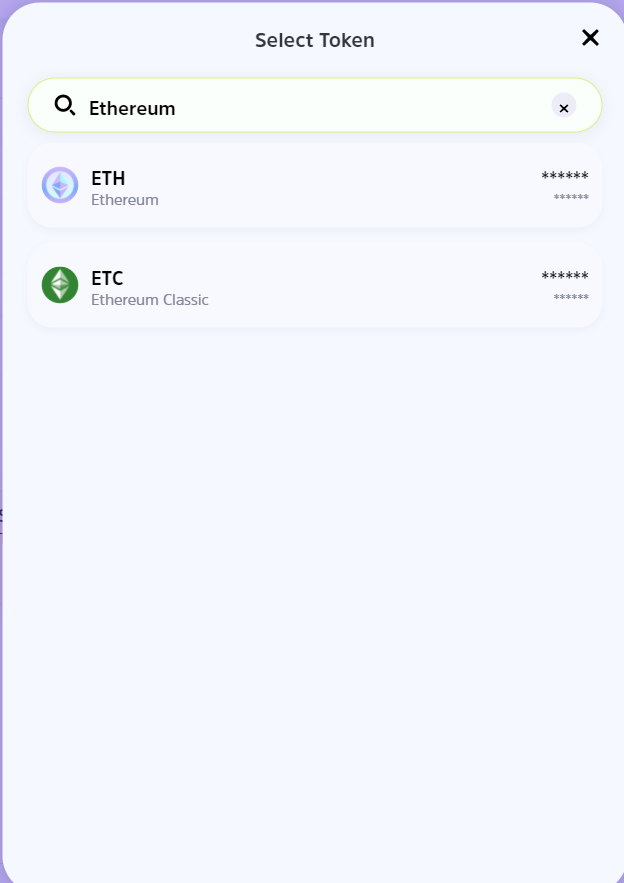

Step 2: Select swap, and choose the coins you want to swap.

(Assuming you want to swap some ETH tokens to BTC, you will select the option "From," and then search for ETH)

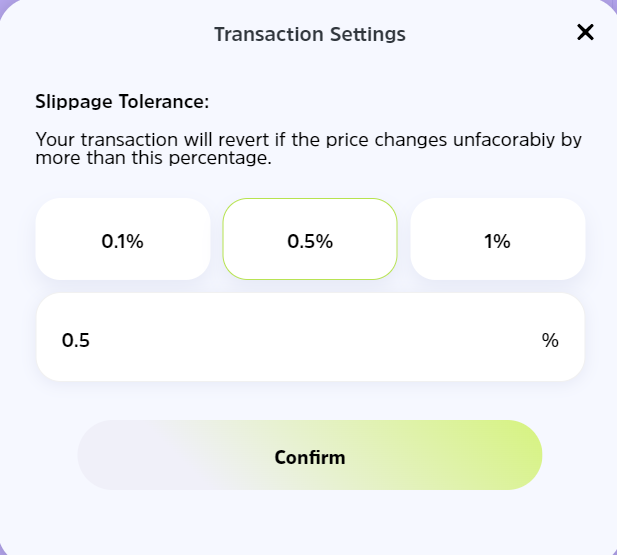

Step 3: Choose transaction settings.

You can now set your preferred slippage tolerance after selecting the desired tokens you want to swap to and from.

Click on the given slippage tolerance, and you will be redirected to a settings page.

Choose your settings and confirm them.

N.B. If you don't understand slippages and frontrunning, kindly leave the slippage tolerance at the recommended 0.5%.

After completing all three steps, you can click on "Swap Now." Your swap will be completed in seconds.

You can also toggle the assets you are swapping to/from with the exchange button, as shown below.

Remember, whether you're swapping assets on the same chain or doing a cross-chain swap, CCTip assures you of highly cheap transactions in record time.

Closing Thoughts

Always do your research before swapping one asset for another. Also, beware of FOMO, as you could be buying an asset at its peak, leading to losses!

More importantly, stay updated with information on social media and crypto communities. You can join the CCTip community to enjoy giveaways and tips.

Be sure to open a CCTip account today to enjoy these benefits in addition to cheap transactions while sending or swapping cryptocurrencies.