Easy Guide To Getting A Crypto Loan With Cwallet

Unlocking the power of your digital assets through crypto loans with Cwallet can be a game-changer in your financial journey. Crypto loans offer a versatile solution for maximizing the potential of your digital investments.

Are you curious about unlocking the potential of your cryptocurrency holdings without selling them? Imagine having the power to access cash while still retaining your valuable digital assets. Welcome to the intriguing world of crypto loans, where you can borrow against your crypto assets to meet financial needs or investment opportunities.

Also Read: Top Tips for Improving Your Crypto Loan Application.

In this guide, we will delve into the ins and outs of crypto loans, covering everything from the borrowing process to the various types available. Discover step-by-step instructions on obtaining a crypto loan with Cwallet, gaining insights into different loan types, including their uses and risks. Stay tuned for a deep dive into the world of crypto lending, empowering you to make informed decisions and maximize the potential of your digital investments.

What is a Crypto Loan?

A crypto loan is a financial arrangement that allows individuals to borrow funds using their cryptocurrency holdings as collateral. It allows crypto holders to access liquidity without selling their digital assets, enabling them to benefit from potential future price appreciation. This innovative lending solution has gained popularity in the digital asset space, offering borrowers a convenient way to unlock the value of their crypto holdings.

Features of Crypto Loans

- Collateralized Borrowing: Crypto loans are secured by digital assets held by the borrower. The lender typically sets a required collateralization ratio, ensuring that the borrower's cryptocurrency adequately backs the loan.

- Lower Credit Requirements: Unlike traditional loans, crypto loans often do not require a credit check. The focus is primarily on the value of the collateral, making it accessible to a broader range of borrowers.

- Decentralized Nature: Many crypto loans are facilitated through decentralized lending platforms, eliminating the need for intermediaries such as banks. This decentralized structure offers increased transparency and security, as transactions are recorded on the blockchain.

- Flexibility of Loan Terms: Crypto loans have various options, allowing borrowers to customize their borrowing experience. They can choose the loan duration, interest rate, and repayment terms, providing greater flexibility than traditional lending systems.

Types of Crypto Loans

- Collateral Loans: This is the most common type of crypto loan. Borrowers pledge their digital assets as collateral and receive a loan based on a percentage of the asset's value. If the borrower fails to repay the loan, the lender retains the collateral.

- Margin Loans: Margin loans enable traders to leverage their crypto holdings for margin trading. Borrowers can amplify their trading positions by borrowing funds against their existing cryptocurrency holdings, potentially increasing their potential profits (or losses).

- Stablecoin Loans: Some platforms allow borrowers to receive loans in stablecoins, cryptocurrencies pegged to the value of a stable asset (usually a fiat currency like the US dollar). Stablecoin loans provide borrowers with a more stable borrowing experience, as the value of the borrowed funds remains relatively constant.

- Peer-to-Peer Loans: In this type of crypto loan, borrowers connect directly with individual lenders through peer-to-peer lending platforms. This lets borrowers negotiate loan terms directly and potentially receive more favourable interest rates.

Use Cases for Crypto Loans

- Liquidity Provision: Crypto loans allow individuals to access funds without selling their cryptocurrencies. This is particularly useful when holders believe their digital assets will appreciate over time.

- Short-Term Expenses: Borrowing against crypto holdings can help individuals cover short-term expenses, such as unexpected medical bills or home repairs, without disrupting long-term investment strategies.

- Leveraging Investment Opportunities: Margin loans offer traders the ability to amplify their positions and take advantage of potential market opportunities, increasing their potential profits.

- Tax Planning: Borrowing against crypto assets can help manage tax liabilities by avoiding capital gains tax that would have been incurred through selling digital assets.

Guide to Getting a Crypto Loan with Cwallet

Are you interested in leveraging your crypto assets to secure a loan? Cwallet offers a seamless and secure platform for obtaining a crypto loan. This guide will walk you through the entire process, from signing up to managing your loan. By following these instructions, you can effectively unlock the value of your crypto assets and explore the various types of crypto loans available. Let's dive in!

Step 1: Explore the Cwallet Platform

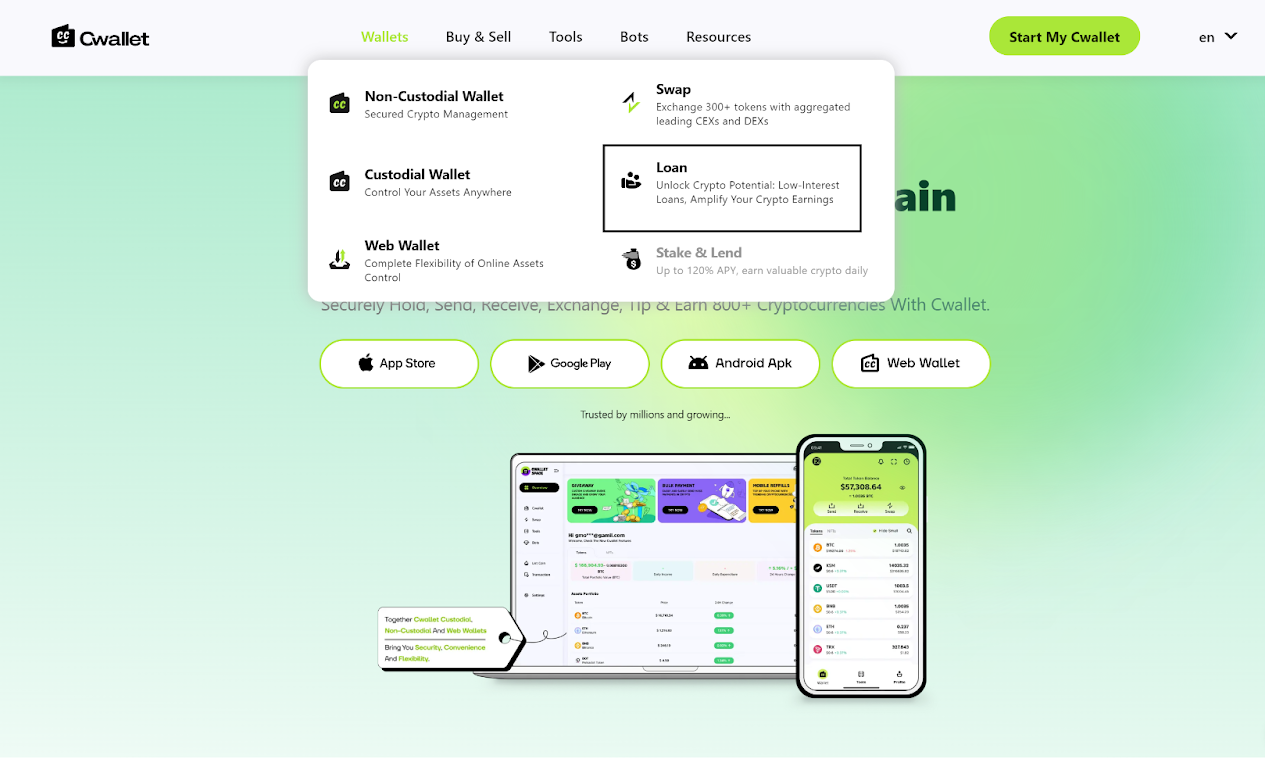

- Visit the Cwallet website and familiarize yourself with the platform.

- Review the types of wallets offered, such as Non-Custodial, Custodial, and Web Wallet, to understand where your crypto assets will be managed.

Step 2: Sign Up and Set Up Your Wallet

- Click on the "Start My Cwallet" button to create an account.

- Follow the prompts to set up your preferred wallet type. You may need to download the app from the App Store, Google Play, or directly as an Android APK, or you can use the Web Wallet.

Step 3: Deposit Crypto into Your Wallet

- Once your account and wallet are ready, deposit the cryptocurrency you want to use as collateral for the loan.

- Ensure you have a sufficient amount, considering the loan-to-value (LTV) ratio requirements.

Step 4: Navigate to the Loan Section

- Go to the "Buy & Sell" section and select "Crypto Loan" or navigate directly to the loan feature on the platform.

- Analyze the available loan options, including fixed-rate terms and the estimated annual percentage rate (APR).

Step 5: Apply for a Crypto Loan

- Choose the loan type. Currently, Cwallet offers fixed-rate loans with the flexibility of unlimited terms. There is also a "Flexible Rate" option coming soon.

- Enter the loan amount you wish to borrow and the collateral you are willing to provide.

- Select your preferred currency for the loan amount and collateral. Options may include BTC, ETH, and USDT.

Step 6: Review Coins and Interest Rates

- Check the "Crypto Borrow Market" for the available cryptocurrencies and their respective interest rates.

- Cwallet displays the annualized interest rate for each crypto asset, allowing you to make an informed decision.

Step 7: Agree to Terms and Receive Loan

- Once you decide on the loan amount and collateral, agree to the loan terms provided by Cwallet.

- Click "Start Borrowing" or "Borrow" to initiate the loan process.

Step 8: Manage Your Loan

- After receiving the loan, you can manage it within the Cwallet platform.

- Keep track of interest accruals, repayment schedules, and any margin calls if the value of your collateral changes significantly.

Step 9: Repayment

- Repay the loan based on the agreed-upon schedule.

- Ensure timely payments to avoid penalties or liquidation of your collateral.

Step 10: Closing the Loan

- Your collateral will be returned once you've repaid the loan in full, including interest.

- Review your Cwallet account to confirm that the loan has been closed and your crypto assets are back in your control.

What to Look for While Taking a Crypto Loan

When considering borrowing against your crypto assets, it's crucial to carefully evaluate various factors to ensure you make the right decision. Here are some important considerations to keep in mind while taking a crypto loan:

Interest Rates

Interest rates play a significant role in determining the cost of borrowing. It's essential to compare interest rates offered by different crypto loan providers. Look for competitive rates that align with your financial goals and repayment capabilities. Remember that lower interest rates can save you money in the long run.

Loan Terms

Examine the loan terms and conditions before finalizing your decision. Consider the loan duration, repayment options, and flexibility. Some lenders allow early repayments without penalties, while others offer grace periods. Understanding these terms will help you choose a loan that suits your needs and financial situation.

Security Measures

Ensuring the safety of your crypto assets is paramount. Research the security measures employed by the crypto loan platform. Look for features like multi-signature wallets, custody options, and insurance coverage. A reputable platform should prioritize the protection of your assets against potential hacks or theft.

Reputation and Trustworthiness

Verify the credibility and trustworthiness of the crypto loan provider. Check user reviews, testimonials, and company history. Opt for well-established platforms with positive feedback and a solid track record. This will minimize the risk of fraudulent activities and provide peace of mind during borrowing.

Customer Support

Evaluate the quality of customer support offered by the crypto loan provider. Prompt and efficient customer service can address any concerns or issues arising during the loan process. Look for platforms that offer multiple communication channels, such as live chat, email, or phone support.

Loan Options and Flexibility

Assess the range of loan options available. Some platforms offer various types of crypto loans, allowing you to choose the one that best fits your financial needs. Consider factors like loan-to-value ratios, repayment schedules, and loan amounts offered. Flexibility in loan options can provide you with the desired financial flexibility.

Transparency and Compliance

Ensure the crypto loan platform adheres to regulatory guidelines and operates transparently. Look for platforms that provide clear information about their terms, fees, and policies. Transparency ensures that you completely understand the loan process, eliminating any surprises later on.

Final Thoughts

Unlocking the power of your digital assets through crypto loans with Cwallet can be a game-changer in your financial journey. Whether you're looking to meet short-term expenses, seize investment opportunities, or manage tax implications, crypto loans offer a versatile solution for maximizing the potential of your digital investments.

When evaluating crypto loan providers, remember to consider important factors such as interest rates, loan terms, security measures, reputation, customer support, loan options, transparency, and compliance. By prioritizing these considerations, you can ensure a smooth borrowing experience and safeguard your digital assets throughout the loan process.