Cwallet Weekly Crypto Express | BTC Trapped in a Weak Range: Where Is the Real Support?

Bitcoin remains in a defensive market structure, trading between key cost-basis levels rather than trending.

Executive Summary (Week 06, 2026)

- Bitcoin remains in a defensive market structure, trading between key cost-basis levels rather than trending.

- Strong demand is emerging in the $60K–$72K range, but upside momentum remains limited.

- Large overhead supply between $82K–$97K and above $100K continues to cap recovery attempts.

- Short-term holders remain mostly underwater, reflecting fragile market confidence.

- Institutional treasury flows have turned negative, signaling broad risk-off behavior.

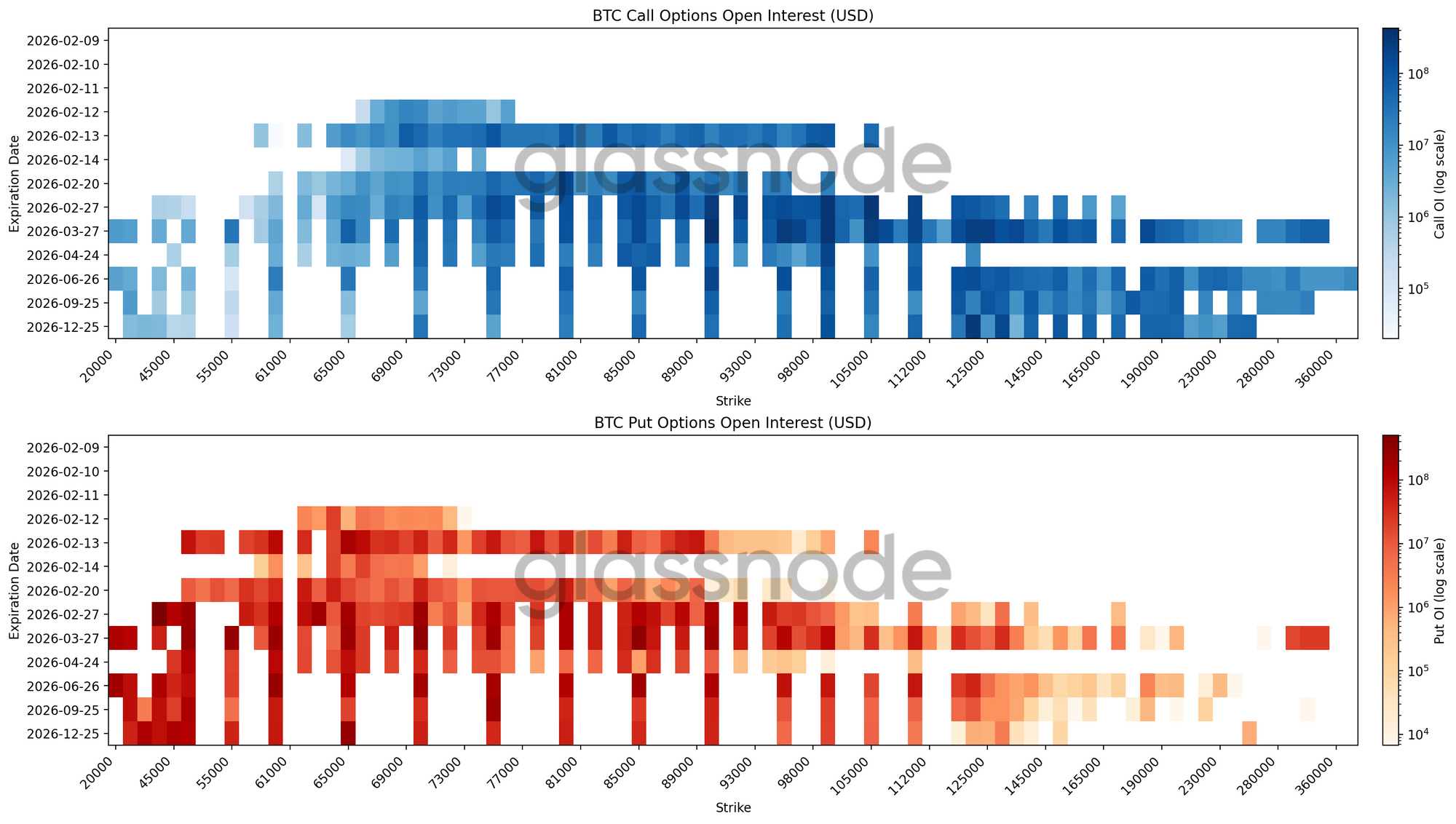

- Derivatives markets show elevated hedging demand and reduced leverage, pointing to persistent caution.

Market Update

Since the latest on-chain observations, Bitcoin has continued to trade within a low-volatility but fragile range, fluctuating around the mid-to-low $70K region. Recent price action confirms that the market is no longer in an expansion phase but instead operating within a reactive structure, where rallies are quickly met with selling and downside moves depend heavily on the strength of demand near the $60K–$72K support zone.

At the time of publishing, Bitcoin remains close to this demand corridor (see attached market chart for the latest price snapshot). Whether buyers continue to absorb sell pressure in this range will be critical in determining if the market stabilizes — or begins exploring lower levels.

A Market Defined by Structural Weakness

On-chain data shows that Bitcoin has transitioned into a third structural phase following its previous cycle high: a breakdown below the True Market Mean (~$79K) and a move toward lower support levels.

The current environment resembles early bear-market behavior seen in past cycles, where price oscillates between the True Market Mean (~$79K) and the Realized Price (~$55K). In this type of regime, markets often move sideways for extended periods as time is needed for new buyers to gradually absorb supply.

A meaningful trend shift would likely require either:

- A decisive reclaim of the ~$79K level, signaling renewed strength, or

- A major external shock that pushes price toward the $55K structural floor. Until then, range-bound behavior remains the most probable scenario.

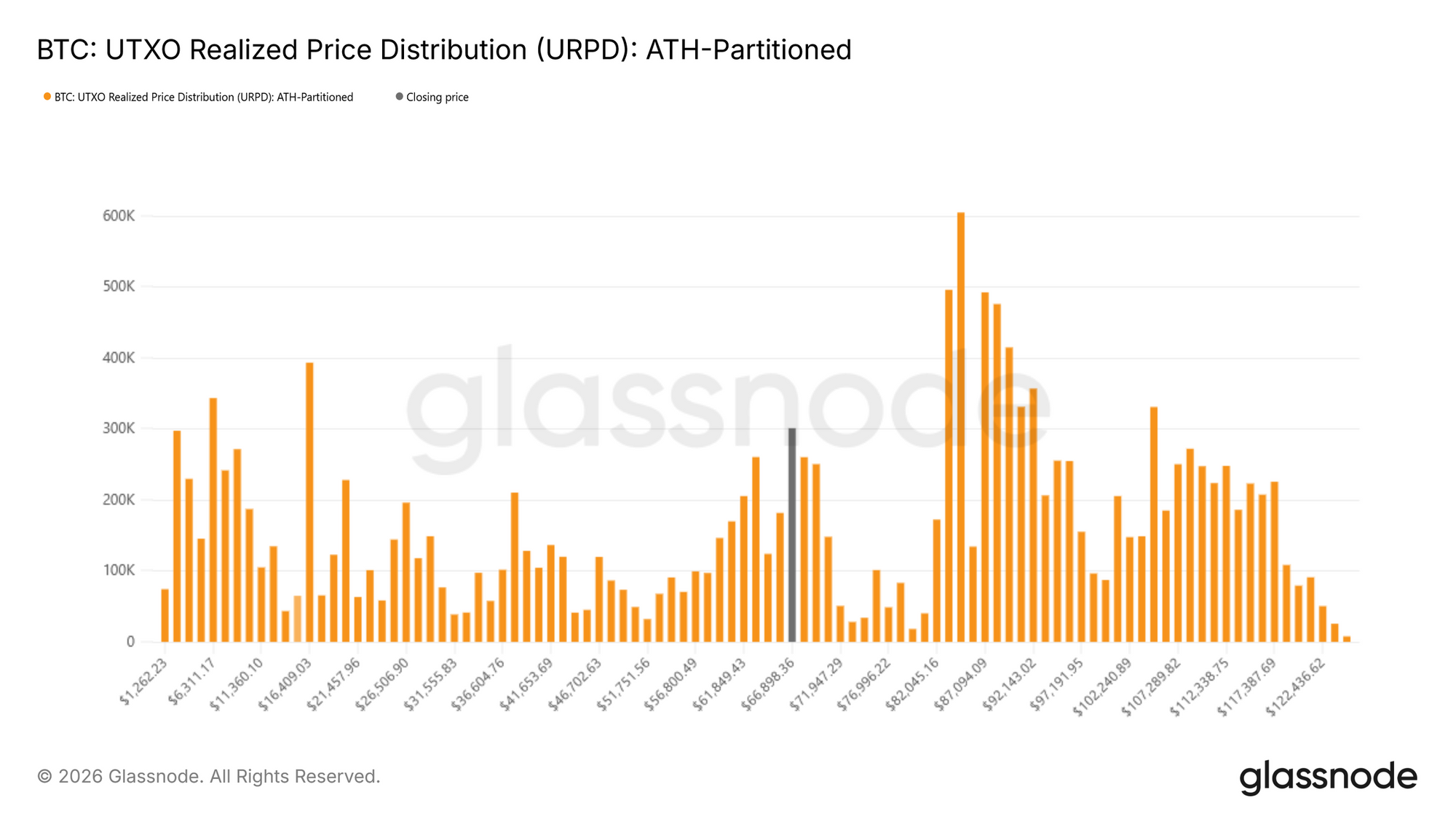

Demand Zone vs. Overhead Supply

The $60K–$72K range is emerging as a key battleground. This zone corresponds to a dense historical accumulation area, and repeated defenses suggest that buyers are willing to step in at these levels. If demand remains consistent here, it could form a foundation similar to previous accumulation phases that later supported strong rallies. However, the strength of this support ultimately depends on continued absorption.

At the same time, the market faces significant overhead resistance. Large supply clusters exist between:

- $82K–$97K

- $100K–$117K

Many investors in these ranges are currently holding unrealized losses, which means any recovery rally may trigger selling as participants attempt to exit at breakeven. This imbalance explains why recent rebounds have been short-lived.

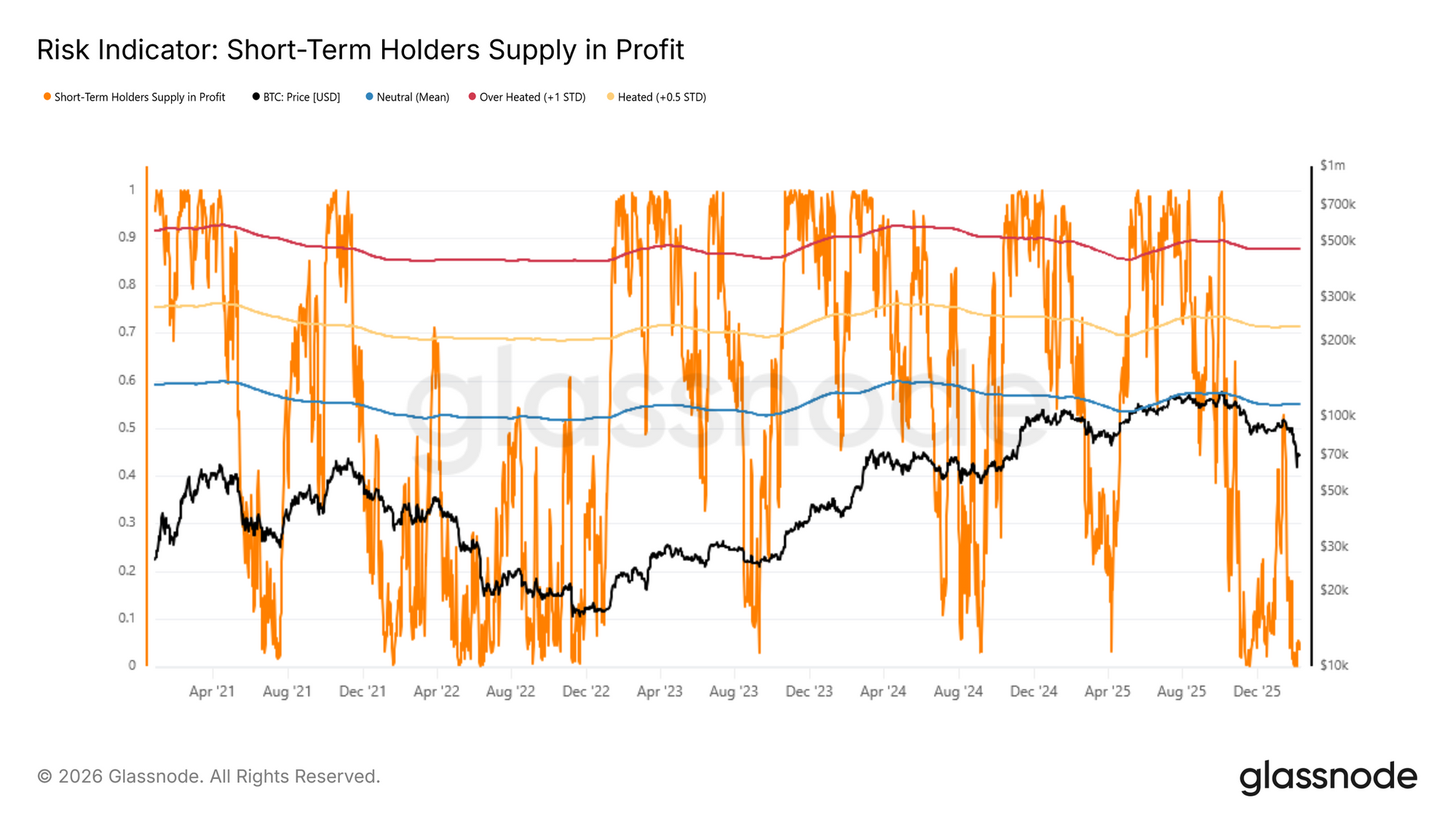

Fragile Short-Term Holder Conviction

Short-term holder profitability remains deeply negative, with most recent buyers underwater. Currently, only a small percentage of short-term supply is in profit, indicating weak conviction and limited momentum for sustained upside. In early-stage bear environments, rallies often stall when short-term holders use strength to reduce exposure — a pattern that remains relevant in the current market.

Institutional and Spot Demand Remain Weak

Off-chain data reinforces the defensive picture:

- Digital Asset Treasury flows have flipped into synchronized net outflows across ETFs, corporate, and sovereign holdings, signaling broad institutional de-risking.

- Spot volume spiked during the selloff but faded quickly, indicating reactive trading rather than sustained accumulation. This suggests that while the market is active during stress, new long-term demand has not yet returned.

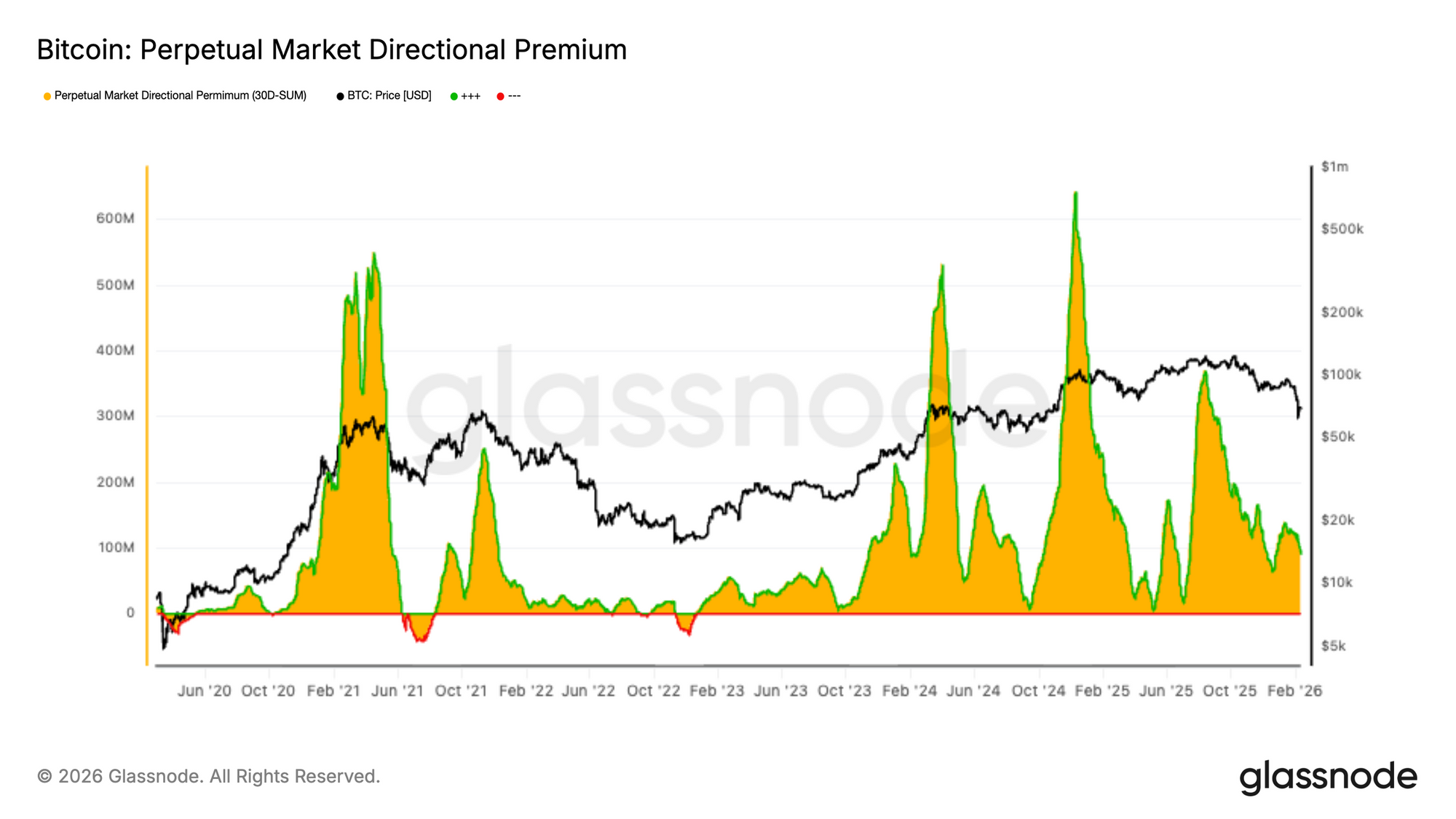

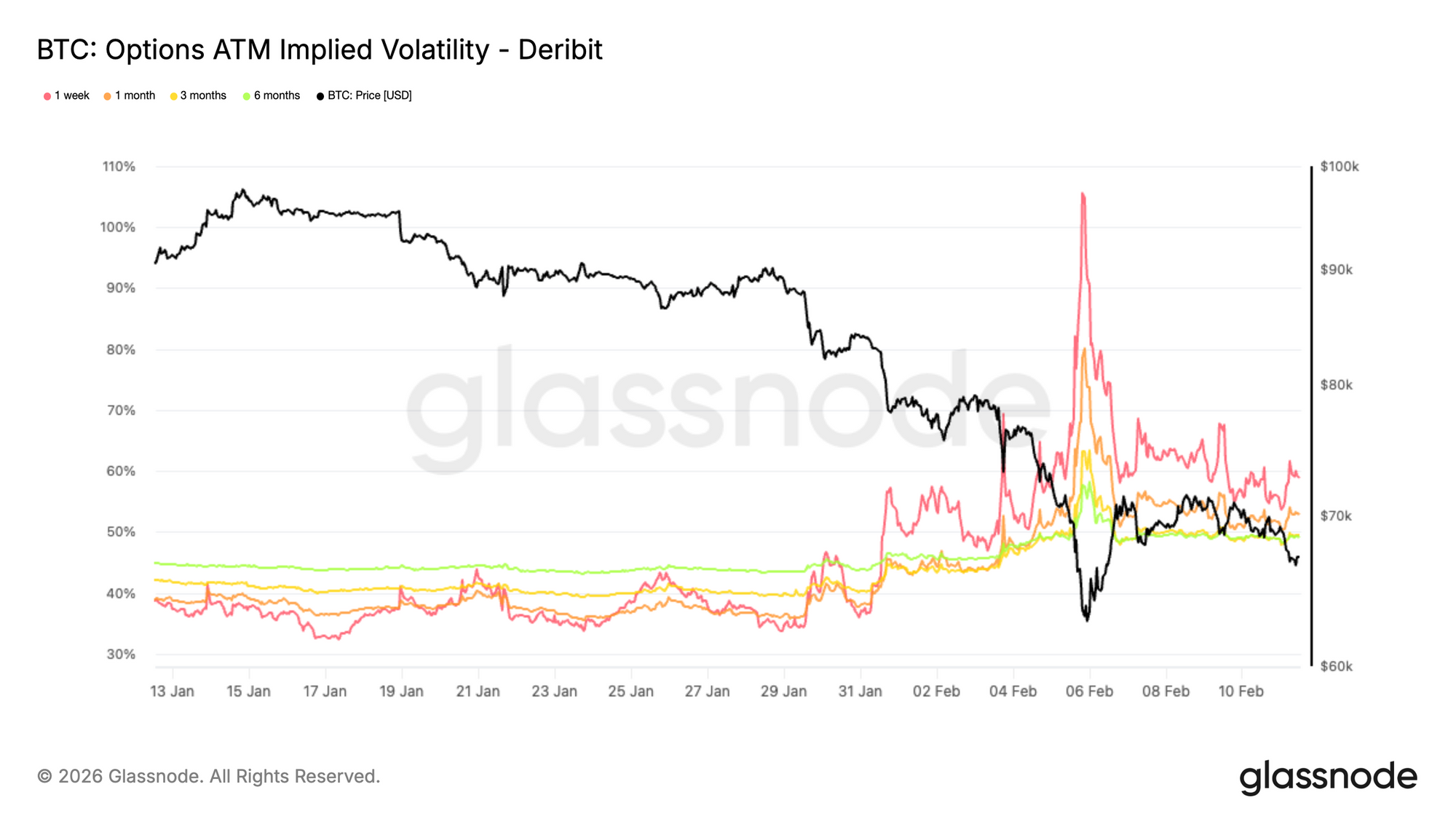

Derivatives Point to a High-Risk Environment

The derivatives market also reflects caution:

- Perpetual futures premiums have compressed toward neutral as leveraged traders step back.

- Implied volatility remains elevated across maturities, indicating expectations of continued uncertainty.

- Options skew shows strong demand for downside protection, with puts trading at a significant premium.

In addition, dealer positioning in a short-gamma environment may amplify price swings, making the market more reactive to both upside and downside moves.

What This Means for Crypto Users

For Cwallet users, the current environment highlights the importance of discipline and flexibility:

1. Expect Range Conditions

Bitcoin is currently trading within a structural corridor rather than a clear trend. Until either $79K is reclaimed or support breaks, range-bound behavior is likely to continue.

2. Prioritize Risk Management

With overhead supply limiting rallies and institutional demand weak, aggressive directional positioning carries higher risk. Using Cwallet Spot features to adjust exposure or maintain liquidity can help manage uncertainty.

3. Avoid Reactive Decisions

Recent volume patterns show that much of the market activity is driven by short-term reactions rather than conviction buying. Waiting for clearer structural signals may reduce the risk of entering premature positions.Maintaining flexibility and avoiding FOMO will be key while the market remains in a defensive phase.

💡 Recommend: How FOMO Scams Trick Beginners in Crypto And How to Stay Safe

Conclusion

Bitcoin is currently navigating a period of balance under pressure. Demand continues to absorb sell-side activity in the $60K–$72K range, but weak institutional flows, heavy overhead supply, and negative short-term holder profitability suggest that conviction remains fragile.

Until sustained spot demand returns and risk appetite improves, the market is likely to remain reactive, with volatility driven by positioning rather than broad expansion.For Cwallet users, this is a time to stay flexible, monitor key structural levels, and focus on disciplined risk management rather than chasing short-term moves.

Stay tuned for next week's Cwallet Weekly Crypto Express, where we’ll continue delivering structured, clearer market insights — helping users navigate 2026’s evolving crypto landscape with greater confidence and context.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, it's an all-in-one platform for secure crypto management and flexible trading.

Buy, swap, trade, earn, and spend 1,000+ cryptocurrencies across 60+ blockchains in one place. Spend your digital assets like cash with the Cozy Card, while tools like HR bulk management, mobile top-ups, and gift cards make everyday transactions smoother.We are evolving into a comprehensive crypto finance hub. From Spot Trading, including Swap, Memecoins, and xStocks, to Futures Trading such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, Cwallet supports different trading styles with clarity and control.

Plus, built-in IM keeps users connected with friends and informed directly within the trading experience.Join millions reimagining what a crypto wallet can do. Stay cozy, trade smart, and explore the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.