Cwallet Weekly Crypto Express | BTC Stalled by Record Overhead Supply

Bitcoin remains confined within a structurally fragile range, with recent rejection near $93k and a gradual drift lower toward $85.6k highlighting persistent overhead supply.

Executive Summary

- Bitcoin remains confined within a structurally fragile range, with recent rejection near $93k and a gradual drift lower toward $85.6k highlighting persistent overhead supply. Dense distribution between $93k–$120k continues to cap recovery attempts, while failure to reclaim the 0.75 quantile (~$95k) and the Short-Term Holder Cost Basis at $101.5k keeps upside momentum constrained.

- Despite sustained sell pressure, patient buyer demand has so far defended the True Market Mean near $81.3k, preventing a deeper breakdown. This balance reflects a market under time-driven stress, where rising unrealized and realized losses increase psychological pressure on investors.

- Spot demand remains selective and short-lived, with limited follow-through across major venues and no coordinated expansion in accumulation during recent pullbacks. Corporate treasury flows remain episodic, contributing to volatility but not providing consistent structural support.

- Futures markets continue to de-risk, with open interest trending lower and funding rates near neutral, signalling a lack of speculative conviction rather than forced deleveraging. Leverage is no longer driving downside, but neither is it supporting upside.

- Options markets reinforce a range-bound regime. Front-end volatility has compressed post-FOMC, downside risk remains priced but stable, and flows favour premium harvesting over directional bets, with large December expiries pinning price action into year-end.

On-Chain Insights

A Top-Heavy Overhang

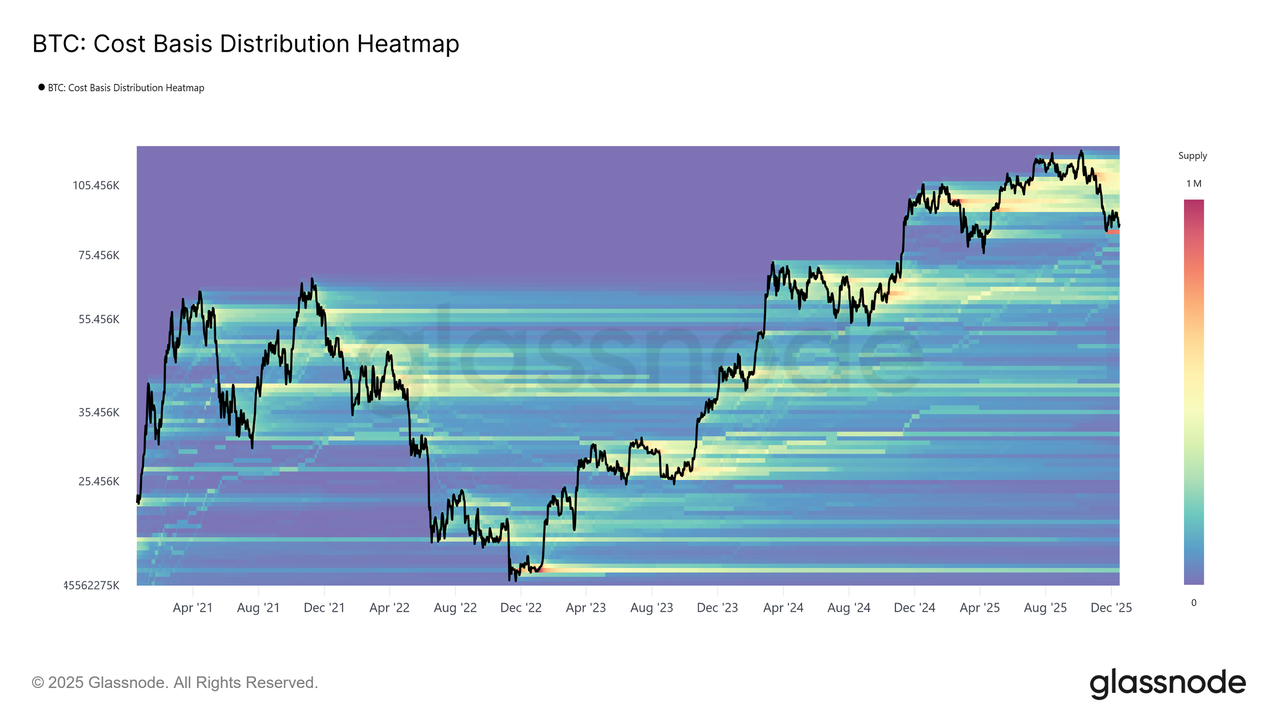

Price has now returned to levels last seen nearly one year ago, despite experiencing two major rallies during that period. This has left behind a dense supply cluster accumulated by top buyers in the $93k–$120k range. The resulting supply distribution reflects a top-heavy market structure where, similar to early 2022, recovery attempts are increasingly capped by overhead sell pressure, particularly in the early stages of a bearish phase.

As long as price remains below this range and fails to reclaim key thresholds, most notably the Short-Term Holder Cost Basis at $101.5k, the risk of further corrective downside continues to loom over the market.

Weighing the Overhang

To better contextualize the weight of this overhead supply, we can first assess the volume of coins currently held at a loss. The supply in loss has risen to 6.7 million BTC (7D-SMA), marking the highest level of loss-bearing supply observed in this cycle.

Persisting within the 6–7 million BTC range since mid-November, this pattern closely mirrors early transitional phases of prior cycles, where mounting investor frustration preceded a shift toward more pronounced bearish conditions and intensified capitulation at lower prices.

Maturing Losses

Building on the elevated share of supply held at a loss, time now emerges as the dominant source of market pressure. As shown in the chart below, of the 23.7% of circulating supply currently underwater, 10.2% is held by long-term holders and 13.5% by short-term holders. This distribution suggests that, much like in prior cycle transitions into deeper bearish regimes, loss-bearing supply accumulated by recent buyers is gradually maturing into the long-term holder cohort.

As this underwater supply endures a prolonged time-based stress test, investors with weaker conviction may increasingly capitulate at a loss, adding further sell-side pressure to the market.

Off-Chain Insights

Spot Demand Lacks Persistence

Spot market flows continue to reflect an uneven demand profile across major venues. Cumulative Volume Delta bias shows periodic bursts of buy-side activity, but these moves have failed to develop into sustained accumulation, particularly during recent price pullbacks. Coinbase spot CVD remains relatively constructive, indicating steadier participation from US-based investors, while Binance and aggregate exchange flows remain choppy and largely directionless.

This dispersion points to selective engagement rather than coordinated spot demand. Recent declines have not triggered a decisive expansion in positive CVD, suggesting that dip-buying remains tactical and short-term in nature. In the absence of sustained spot accumulation across venues, price action continues to rely more heavily on derivatives positioning and liquidity conditions rather than organic spot-led demand.

Front-End Volatility Fades

Following the derivatives de-risking, implied volatility has continued to compress at the front end after the FOMC, while longer-dated maturities have remained comparatively stable despite a modest decline. This configuration suggests traders are actively reducing exposure to near-term uncertainty rather than reassessing the broader volatility regime. Short-dated implied volatility is most sensitive to event risk, and when it falls, it typically reflects a deliberate decision to step back from immediate catalysts.

The current calm is therefore not accidental. Volatility is being sold into the market, pointing to positioning effects rather than disengagement or a lack of liquidity.

Conclusion

The market continues to trade within a fragile, time-sensitive structure, shaped by heavy overhead supply, rising loss realization, and fading demand persistence. Price rejection near $93k and the subsequent drift toward $85.6k reflect the dense supply accumulated between $93k–$120k, where prior top buyers continue to cap recovery attempts. As long as price remains below the 0.75 quantile (~$95k) and fails to reclaim the Short-Term Holder Cost Basis at $101.5k, upside progress is likely to remain constrained.

Despite this pressure, patient demand has so far defended the True Market Mean near $81.3k, preventing a deeper breakdown. Spot demand remains selective, corporate treasury flows episodic, and futures positioning continues to de-risk rather than rebuild conviction. Options markets reinforce this range-bound regime, with front-end volatility compressing, downside risk remaining priced but stable, and expiry-driven positioning pinning price action into late December.

In sum, Bitcoin remains caught between structural support near $81k and persistent sell pressure overhead. A meaningful shift will require either seller exhaustion above $95k or a renewed influx of liquidity capable of absorbing supply and reclaiming key cost-basis levels.

Cwallet: Your Secure, All-in-One Gateway to Global Crypto Finance

Cwallet redefines the digital wallet, offering a unified, high-performance platform to manage your entire portfolio, supporting over 1,000 cryptocurrencies across 60+ global networks. We combine top-tier security with unmatched utility.

Financial Control: Go beyond holding. Engage in Spot Trading, including Swap, Memecoins, and xStocks, or explore Futures Trading, such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, for dynamic market action.

Real-World Power: Instantly unlock the spending potential of your assets. The Cozy Card transforms your crypto into a flexible payment solution for secure, real-world transactions online and offline.

Practical Tools: Boost efficiency with integrated services. Use HR Bulk Management for business needs, or Gift Cards and Mobile Top-ups for everyday utility.

Cwallet is where security, utility, and innovation come together in one powerful application.Join millions transforming the way they manage their digital wealth.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.