Cwallet Weekly Crypto Express | BTC Anchored By Demand, But Lacks Conviction

Bitcoin remains in a structurally fragile range, pressured by rising unrealized losses, elevated realized loss realization, and significant profit-taking by long-term holders.

Executive Summary

- Bitcoin remains in a structurally fragile range, pressured by rising unrealized losses, elevated realized loss realization, and significant profit-taking by long-term holders. Despite this, patient demand has kept price anchored above the True Market Mean.

- The market’s inability to reclaim key thresholds, particularly the 0.75 quantile and the STH Cost Basis, reflects persistent sell pressure from both recent top buyers and seasoned holders. A near-term retest of these levels is possible if seller exhaustion emerges.

- Off-chain indicators remain weak. ETF flows are negative, spot liquidity is thin, and futures positioning shows little speculative conviction, leaving price more sensitive to macro catalysts.

- Options markets reveal defensive positioning, with traders bidding short-dated IV, accumulating both wings, and showing consistent demand for downside protection. The surface signals short-term caution but more balanced sentiment across longer maturities.

- With the FOMC meeting as the final major catalyst of the year, implied volatility is expected to decay into late December. Market direction hinges on whether liquidity improves and sellers relent, or whether the current time-driven bearish pressure persists.

On-Chain Insights

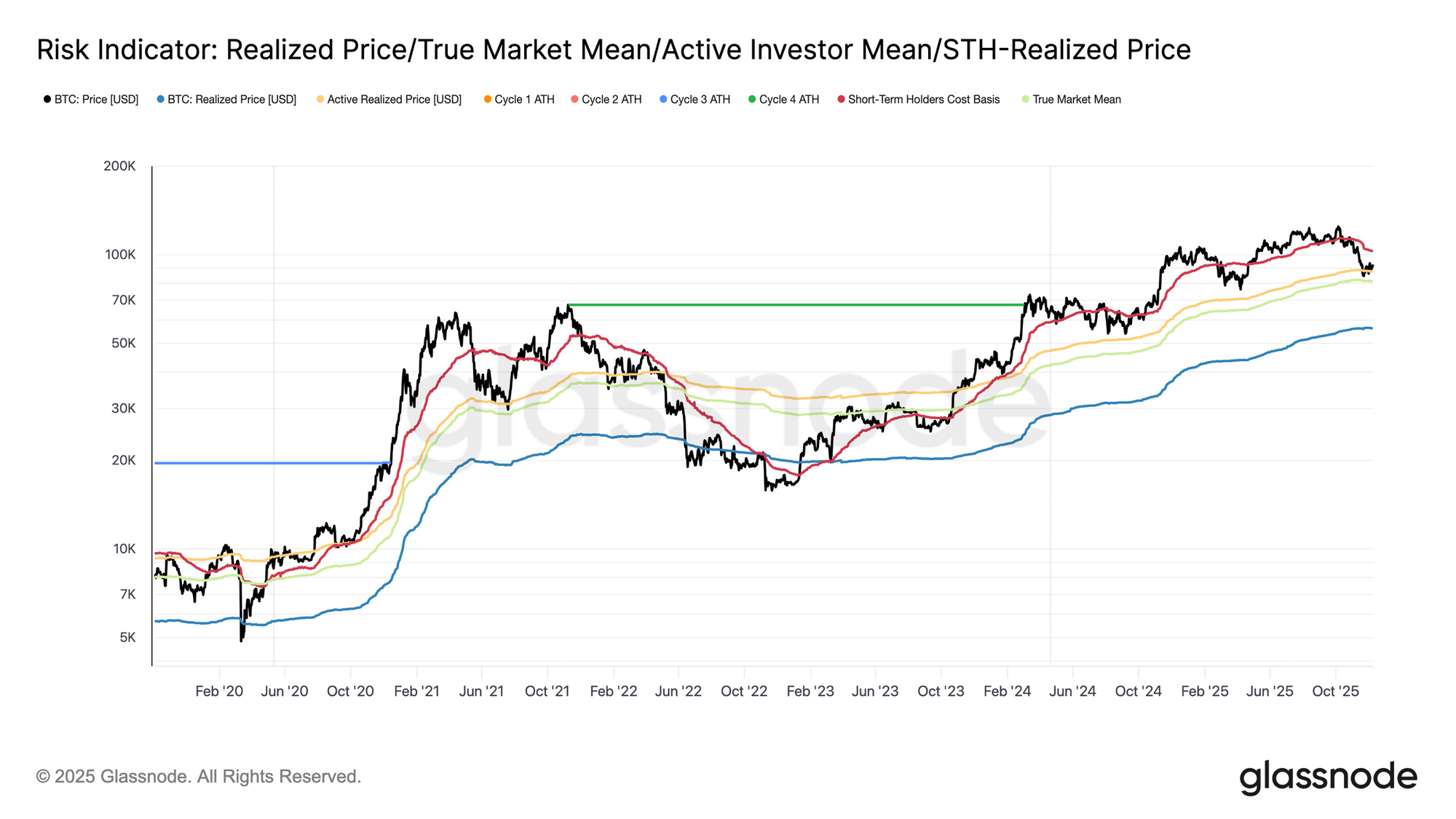

Bitcoin enters the week still confined within a structurally fragile range, bounded by the STH-Cost Basis at $102.7k and the True Market Mean at $81.3k. Last week, we underscored weakening on-chain conditions, thinning demand, and a cautious derivatives landscape that collectively echo the early-2022 setup.

Although price has held marginally above the True Market Mean, unrealized losses continue to expand, realized losses are rising, and spending by long-term investors remains elevated. The key upper thresholds to reclaim are the 0.75 cost-basis quantile at $95k, followed by the STH-Cost Basis. Until then, the True Market Mean remains the most probable bottom-formation zone, barring a new macro shock.

Time Works Against the Bulls

Remaining in a mild bearish phase reflects the tension between modest capital inflows and persistent sell pressure from top buyers. As the market holds within a weak but bounded range, time becomes a negative force, making unrealized losses harder for investors to endure and increasing the likelihood of loss realization.

The Relative Unrealized Loss (30D-SMA) has climbed to 4.4% after nearly two years below 2%, marking a shift from a euphoric phase to one of elevated stress and uncertainty. This hesitation now defines the range, and resolving it will require a renewed wave of liquidity and demand to rebuild confidence.

Losses Rising

This time-driven pressure is further evident in spending behavior. Even as Bitcoin has rebounded from the November 22 low to roughly $92.7k, the 30D-SMA Entity-Adjusted Realized Loss has continued climbing, reaching $555 million per day, the highest level since the FTX collapse.

Such elevated loss realization during a moderate price recovery reflects mounting frustration among top buyers who are capitulating into strength rather than holding through the rebound.

Holding Back the Reversal

Rising realized losses are further anchoring the recovery, especially as they coincide with a surge in realized profit from seasoned investors. During the recent bounce, >1-year holders increased their realized profit (30D-SMA) above $1B per day, peaking at a new ATH of over $1.3B. Together, these two forces—time-driven capitulation by top buyers and heavy profit-taking by long-term holders ,explain why the market continues to struggle reclaiming the STH-Cost Basis.

Yet, despite this significant sell pressure, price has stabilized and even slightly recovered above the True Market Mean, signalling persistent and patient demand absorbing distribution. In the short term, if seller exhaustion begins to emerge, this underlying buy pressure could drive a retest of the 0.75 quantile (~$95k) and potentially the STH-Cost Basis.

Off-Chain Insights

ETF Woes

Turning to spot markets, US Bitcoin ETFs logged another quiet week, with the 3-day average of net flows remaining consistently below zero. This extends the cooling trend that began in late November and marks a clear departure from the robust inflow regime that supported price appreciation earlier in the year. Redemptions have been steady across several major issuers, underscoring a more risk-averse stance among institutional allocators as broader market conditions remain unsettled.

As a result, the spot market is operating with a thinner demand buffer, reducing immediate buy-side support and leaving price more vulnerable to macro catalysts and volatility shocks.

Liquidity Remains Subdued

In parallel with softer ETF flows, Bitcoin’s spot relative volume continues to sit near the lower bound of its 30-day range. Trading activity has weakened through November and into December, mirroring the price decline and signalling a retreat in market participation. The contraction in volume reflects a more defensive positioning across the board, with fewer liquidity-driven flows available to absorb volatility or sustain directional moves.

With spot markets running quieter, attention now turns to the upcoming FOMC meeting, which could act as a catalyst for renewed participation depending on the policy tone.

Futures Ghost Town

Extending this theme of muted participation, futures markets also show limited appetite for leverage, with Open Interest failing to meaningfully rebuild and funding rates pinned near neutral. These dynamics highlight a derivatives environment defined more by caution than conviction.

Across perpetual markets, funding hovered around zero to slightly negative during the week, underscoring the continued retreat in speculative long positioning. Traders remain balanced or defensive, contributing little directional pressure via leverage.

With derivatives activity subdued, price discovery tilts more heavily toward spot flows and macro catalysts rather than speculative expansion.

Conclusion

Bitcoin continues to trade within a structurally fragile environment where rising unrealized losses, elevated realized loss realization, and heavy profit-taking from long-term holders collectively anchor price action. Despite this persistent sell pressure, demand remains sufficiently resilient to keep price above the True Market Mean, suggesting patient buyers are still absorbing distribution. A short-term push toward the 0.75 quantile or even the STH Cost Basis remains possible if seller exhaustion begins to surface.

Off-chain conditions echo this cautious tone. ETF flows remain negative, spot liquidity is subdued, and futures markets lack speculative engagement. Options markets reinforce a defensive posture, with traders accumulating volatility, bidding short-dated downside protection, and positioning for a near-term volatility event ahead of the FOMC meeting.

Taken together, market structure suggests a weak but stable range, held up by patient demand yet constrained by persistent sell pressure. The short-term path hinges on whether liquidity improves and sellers relent, while the longer-term outlook depends on the market’s ability to reclaim key cost-basis thresholds and shift out of this time-driven, psychologically taxing phase.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet, more than a wallet, is your all-in-one gateway to secure crypto management and dynamic trading.In one powerful platform, you can store, swap, earn, and spend over 1,000+ cryptocurrencies across 60+ blockchains. Spend your digital assets like cash with the Cozy Card, while extra tools such as HR bulk management, mobile top-ups, and gift cards make every transaction smoother.

We're leveling up into a comprehensive financial hub — from zero-fee Memecoins and xStocks trading to fast, interactive price-prediction trades like Trend Trade and Market Battle, making crypto trading more accessible, engaging, and fun!

Join millions already reimagining what a crypto wallet can do. Stay cozy, trade smart, and embrace the future of Web3 finance.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.