Cwallet Recurring Buy: Automate and Diversify Your Crypto Investments

Build a disciplined, automated crypto strategy that works consistently here.

Crypto markets are highly volatile and subject to cycles of booms and corrections. For long-term investors, reacting to every price movement is both exhausting and risky. Many traders struggle to maintain consistency, often overthinking when to buy or how much to allocate.

To move beyond single-coin purchases and truly upgrade a crypto strategy, many traders are turning to Cwallet Recurring Buy's automated and diversified approach. This feature allows investors to automate recurring purchases while building multi-asset portfolios, turning market volatility into disciplined, long-term growth.

What Is Recurring Buy?

Recurring Buy is a strategy-driven, automated investment tool that helps traders purchase multiple cryptocurrencies at regular intervals according to a plan. Rather than reacting to every market fluctuation, investors can set up a plan once and let Cwallet handle the execution.

Key benefits include:

- Automation: Purchases are executed on schedule, reducing emotional decision-making.

- Diversification: Investors can allocate funds across multiple assets, from $BTC and $ETH to $SOL, $BNB, $XRP, and $TRX.

- Control: Flexible settings allow timing, allocation, and price boundaries to fit any investment strategy.

By combining these features, Recurring Buy transforms a simple recurring purchase into a structured, strategic approach to crypto investing.

Why Use Recurring Buy?

Single-asset DCA has its advantages, but it can leave portfolios overly concentrated and exposed to volatility. Meanwhile, manually timing trades across multiple coins is stressful and often counterproductive.

Recurring Buy solves these challenges:

- Mitigate risk through diversification: Spread investments across multiple assets to reduce exposure to any single token.

- Stay disciplined: Automation prevents impulsive decisions during market swings.

- Save time: No need to monitor the market constantly; the system follows the plan automatically.

Ultimately, Recurring Buy allows traders to treat market volatility as an opportunity, building consistent growth strategies instead of chasing every price move.

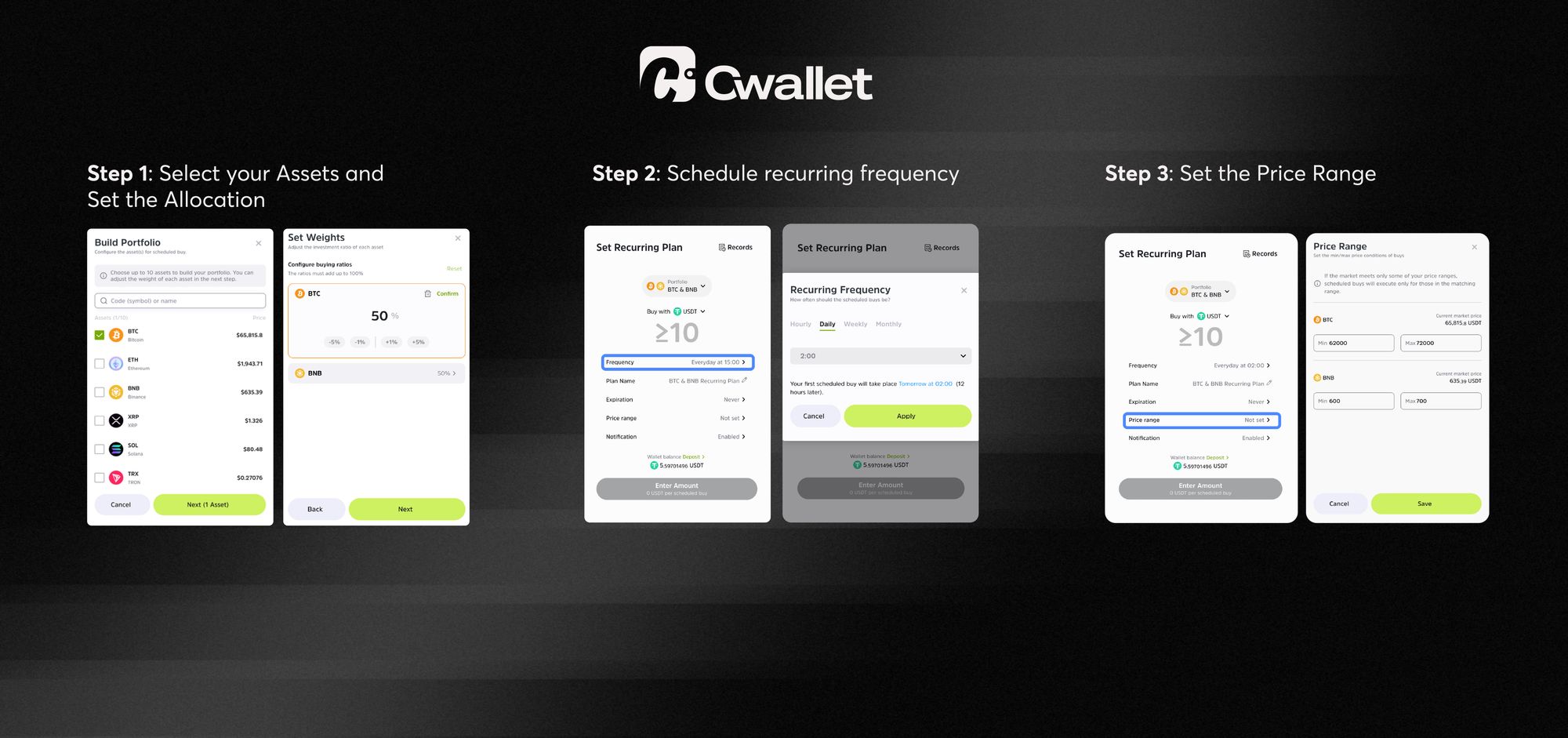

How Recurring Buying Works: Step-by-Step

Recurring Buy's value lies in its strategic execution, not just automation. Here’s how traders can make the most of it:

- Select your assets: Choose up to 10 cryptocurrencies to include in your portfolio.

- Set allocation weights: Define the percentage of investment for each asset to balance risk and potential returns.

- Schedule recurring purchases: Pick frequency and exact timing to fit your preferred strategy.

- Set price boundaries: Use Price Range settings to pause purchases if prices move outside your desired window.

- Choose plan duration and notifications: Decide between ongoing automation or a fixed end date, and enable notifications to stay informed.

- Monitor and adjust: Regularly review performance, rebalance allocations if needed, and refine strategy over time.

This approach keeps automation, risk management, and long-term strategy tightly integrated, letting traders focus on growth rather than repetitive manual tasks.

Who Can Benefit from Recurring Buy?

Recurring Buy is ideal for:

- Long-term holders seeking structured, disciplined investment

- Busy traders who want automated plans without constantly monitoring markets

- Beginners looking for a simple yet effective entry into crypto investing

- Portfolio-focused investors ready to upgrade from single-coin purchases to multi-asset strategies

By combining automation, diversification, and flexible control, Cwallet empowers traders to invest confidently while maintaining a long-term perspective.

Turning Volatility Into Opportunity

Turning volatility into opportunity is at the heart of disciplined crypto investing. Recurring Buy isn't about buying more frequently — it's about making consistent decisions that endure market cycles. By automating purchases and strategically diversifying a portfolio, investors can reduce stress, avoid emotional pitfalls, and build a plan that works through both bullish and bearish phases.

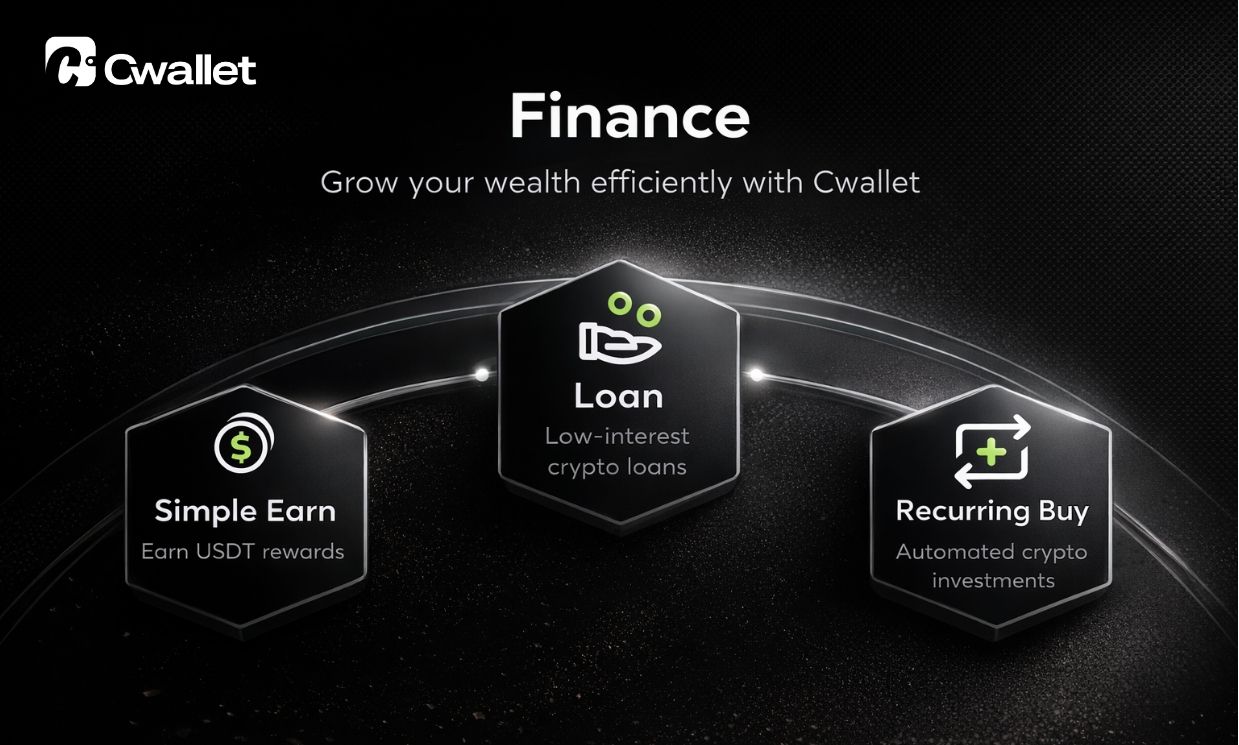

For those looking to expand their crypto financial strategy, Cwallet offers a broader set of tools: Earn lets assets grow through flexible staking, while Loan enables collateral-backed borrowing for liquidity needs. Together with Recurring Buy, these features form a complete ecosystem for structured, stress-free crypto wealth management.

Learn more about these tools in our guides: [Earn Guide] and [Loan Guide], and discover how each can complement your Recurring Buy strategy.

Cwallet: Your All-in-One Gateway to the Digital Economy

Cwallet is more than a crypto wallet, it is a complete ecosystem designed to make crypto trading accessible, intuitive, and rewarding. It transforms a wallet into your hub for securing assets and exploring market opportunities.

Move beyond simple asset management. Cwallet lets you trade smarter with Spot Trading, including Swap, Memecoins, and xStocks, and Futures Trading such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, all while keeping full control of your assets.Stay connected and share strategies instantly with your friends in Cwallet's built-in IM.Cwallet also integrates essential crypto services, allowing you to store, swap, and earn from your digital assets. With tools like the Cozy Card, mobile top-ups, and gift cards, digital assets gain real-world utility.Cwallet makes crypto not just a technology for the future, but a practical tool for today!

Official Link

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.