Cryptocurrency Investment: When is The Best Time to Buy?

Determining the best time to buy cryptocurrencies necessitates a combination of market analysis and an understanding of broader economic factors.

Cryptocurrency has evolved from a basic investment instrument to a popular financial tool, revolutionizing how we handle money, approach investments, and conduct daily financial transactions. With its decentralized nature and potential for big returns, many crypto enthusiasts see it as an appealing choice for accumulating wealth and profit.

Investing in cryptocurrencies can be difficult due to their volatile nature. Thus, there is no perfect way to predict or analyze if a specific crypto asset will experience a huge pump or dump within a given time frame. Because of the speculative nature of cryptocurrencies, investors have made enormous returns in a short amount of time by getting in early on a project. Still, they have also lost all of their wealth by picking a crypto asset at the wrong time (during a bad market).

As a result of the cryptocurrency market's volatility, a basic question arises: when is the best time to invest or acquire an asset? Addressing this question is difficult since it necessitates an understanding of market patterns, external influences, and individual investing objectives. However, unlike other financial instruments such as the stock market, the cryptocurrency market is always open for trade 24/7 all year round, with no exceptions for holidays, making determining the ideal time to buy a crypto asset a difficult endeavor.

With cryptocurrency available for trading across the world 24 hours a day, this study attempts to provide insight into the variables determining the best times to acquire cryptocurrency, guiding both beginners and seasoned investors in making informed decisions.

When is The Best Time to Buy Cryptocurrency?

Using Price Correction

Determining the best time to buy cryptocurrencies necessitates a combination of market analysis and an understanding of broader economic factors. Historically, some of the best crypto buying opportunities have been after major price corrections. For example, after reaching an all-time high above $20,000 in December 2017, Bitcoin saw a significant dip in value, falling to roughly $3,200 by December 2018. Those who bought at the bottom made much money as the price skyrocketed beyond $60,000 by early 2021.

Using the Fear and Greed Index

The "Fear and Greed Index" for Bitcoin and other major cryptocurrencies is another important metric. When the index reaches the "extreme fear" zone, it frequently indicates a market sell-off, which may present a purchasing opportunity. When the index is in the "extreme greed" phase, the market may be overbought, indicating that a correction is imminent.

Using Global Economy

It is also vital to keep an eye on the broader economic scene. Economic downturns or unstable fiat currencies have historically spurred Bitcoin's popularity. For example, during Venezuela's economic crisis, when hyperinflation reached 1,698,488% in 2018, there was a significant increase in Bitcoin trade volumes as citizens sought alternative stores of wealth.

When is the Best Time of Day to Buy Cryptocurrency?

Unlike traditional stock markets, cryptocurrency is traded around the clock. However, there is more activity at different times of the day. The greatest trading volumes for cryptocurrencies have historically occurred between 11:00 and 15:00 UTC. This period coincides with both European and North American trading hours, resulting in increased liquidity and potentially better prices.

Also, trading volume is up significantly during Asian trading hours, specifically between 01:00 and 08:00 UTC, particularly for cryptocurrencies with a substantial market presence in countries such as South Korea and Japan. However, it is important to realize that bigger volumes do not always imply cheaper prices. During high-volume periods, substantial price movements, both up and down, are common.

When is the Best Time of the Month to Buy Cryptocurrency?

If we look at data from the last few years, we can see that the end of the month and the start of a new month often see more activity in the crypto market. Several factors could account for this:

Salary and Paydays: When people receive their monthly paychecks, a portion is frequently invested in cryptocurrencies.

Contract Expirations: Many cryptocurrencies-related financial products, including futures contracts, expire at the end of the month. Depending on the contract settlements, this may result in increased buying or selling activity.

A study of Bitcoin's monthly performance from 2011 to 2020 revealed that April and May typically had the highest average returns. While the precise causes of this pattern are unknown, likely theories include increased investment following the conclusion of tax season in countries such as the United States, as well as seasonal investing behaviors.

When is the Best Time of Year to Buy Cryptocurrency?

According to historical data, some times of the year are more advantageous for purchasing cryptocurrencies:

Post-Tax Season

Following tax season in the United States (which finishes in April), the price of various cryptocurrencies has typically risen. This could be attributable to American investors using their tax refunds and the release of selling pressures from individuals who previously sold cryptocurrency to pay tax liabilities.

Q4 to Q1 Transition

The shift from Q4 (particularly December) to Q1 is frequently regarded as a positive moment for cryptocurrencies. One factor could be the "January Effect," a stock market phenomenon in which assets receive a price increase in January. This could be because investors sell assets in December for tax purposes and then repurchase them in January. While this effect is fading in traditional markets, the cryptocurrency market, which is still in its infancy, has shown considerable January bullishness in certain years.

How to Buy Cryptocurrency Anytime

Knowing how to buy cryptocurrency is as important as knowing the best time to buy. To buy the cryptocurrency of your choice at any time, you need a crypto wallet. A crypto wallet is an essential tool in your cryptocurrency investment journey as it allows you to buy cryptocurrency anytime.

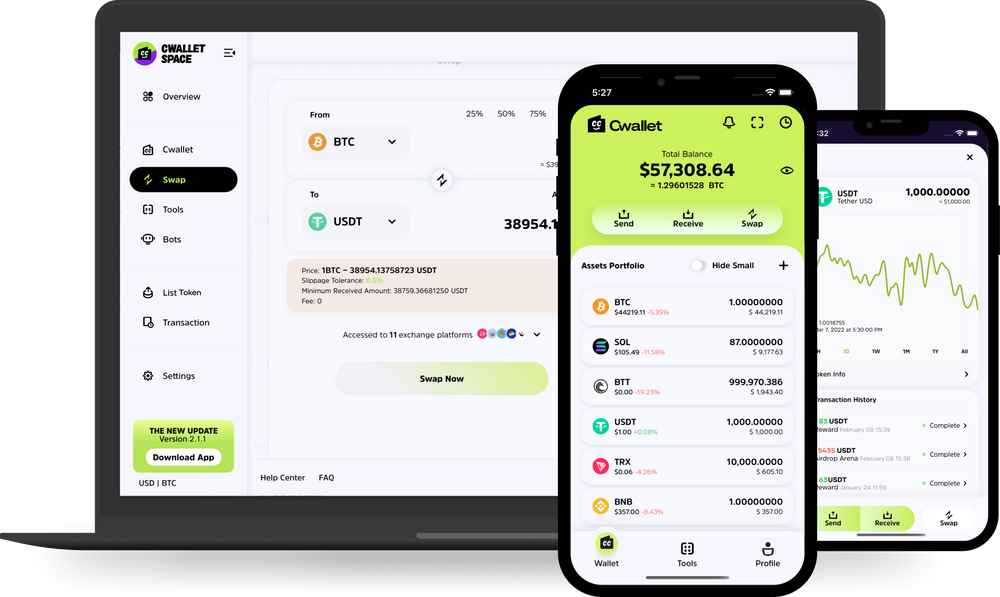

You can buy cryptocurrencies at any time on centralized and decentralized exchanges, as well as crypto wallet providers like Cwallet, which makes it easy to buy cryptocurrencies at any time, even without KYC verification. Cwallet is a unique cryptocurrency wallet that combines custodial and non-custodial features. This hybrid wallet combines on-chain and off-chain wallets, allowing you to manage and trade over 800 cryptocurrencies in a single spot while maintaining security, simplicity, and flexibility.

Cwallet lets you quickly deposit, withdraw, and swap cryptocurrency at the lowest possible cost. Tokens can also be exchanged for the 800+ cryptocurrencies accessible on Cwallet. Cwallet has the lowest transaction costs for cross-chain and "on-chain" swaps. As a result, you can freely swap these tokens within your wallet!

Cwallet's price charts are updated in real-time, allowing you to receive real-time updates on the top cryptocurrencies to invest in with Cwallet.

Get your free instant wallet now and start investing!

Conclusion

Deciding the best moment to invest in cryptocurrency is no simple task. The volatile nature of the market, coupled with myriad external influences, means there's no one-size-fits-all answer. However, by studying market trends, being aware of global events, and aligning investments with personal goals and risk tolerance, investors can enhance their chances of success. While there's no crystal ball to predict future values, an informed approach, backed by diligent research, can guide one toward making more calculated investment decisions in the cryptocurrency market.