Crypto Payments For Health Insurance: How Prospects Became Paying Clients

..after extensive research & recommendations from various financial experts, crypto was proposed to me as a solution to the company's payment issues. I was more concerned about how it would solve the organization's problem & help me meet my monthly targets without being particularly interested in ..

Life's uncertainty is unprecedented. As a result, several organizations advocate insurance policies for everyone to protect themselves from any life uncertainty, such as an accident, theft, natural disaster, or terminal illness. Aside from the compulsory insurance mandated by law, everyone must have at least one insurance safeguarding them for unforeseen events.

While many people believe they don't need all types of insurance because it seems like a bad investment to purchase policies they may never use, everyone must have health insurance. Knowing the value of health insurance, my company places the burden on making sure people buy the health insurance options on me. As a result, for anyone who purchases the insurance, the company takes responsibility for their risk of financial loss due to illness or other medical issues.

Marketing The Company’s Services

Getting clients for the insurance felt like a walk in the park; everyone would love someone else taking up their hospital bills. However, the more likely an event will occur for an insurance company, the more money we will need to pool from many clients.

Unfortunately, in addition to the difficulty in convincing and marketing insurance products and services to consumers, the company faced a significant challenge in receiving monthly premium payments from new and existing policyholders. While charging premiums is how the organization makes money, it becomes problematic when many policyholders have difficulty making payments.

Various Payment Challenges

These payment difficulties affect retail customers and corporate institutions that pay their employees' insurance regularly. Payments for insurance coverage should ideally be made monthly, but corporate institutions save money by paying annually. This, however, only partially eliminates the transaction costs that retail consumers and corporate institutions face.

Nonetheless, customers typically link their flexible spending account (FSA) or health savings account (HSA) to the company payment processor and pay their monthly premium directly or through their employers. Therefore, customers could either make payments on the company website or the company could debit their bank accounts directly.

Except for corporate institutions that pay on behalf of their employees, most clients prefer to make their monthly payments without having them automatically deducted by the company. As a result, payments are typically made through the organization's websites. But unfortunately, the payment options were a primary concern for customers, especially those making their first premium.

Card payments linked to bank accounts or e-wallet platforms such as PayPal, Skrill, and others were available on the company's website. Unfortunately, these platforms are third-party payment gateways that charge high transaction fees, typically turning off clients, particularly new prospects.

Sadly, these fees often discourage potential customers because they see insurance as an investment they may never use. As a result, insurance products and services sales fell dramatically, as payment options were a major concern.

This impacted the company's revenue and put me in a sticky situation because I had a monthly target of new prospects to ensure they became paying clients for the company. With this in mind, I began to seek alternative ways to get prospects to pay for the insurance services, a payment method that addressed the situation.

Cwallet All-in-one Payment Solution

However, after extensive research and recommendations from various financial experts, cryptocurrency was proposed to me as a solution to the company's payment issues. I was more concerned about how it would solve the organization's problem and help me meet my monthly targets without being particularly interested in understanding how it worked. As a result, I was introduced to Cwallet as an all-in-one payment solution. Cwallet was the best solution because it included features that prospects were looking for. For example,

- It accepts multiple currencies.

- It has a user interface and experience that is simple and convenient

- It is a device compatible with various mobile and desktop operating system

The best feature, which attracts potential customers the most, is that all of their payments would be processed without cost because Cwallet does not charge transaction fees.

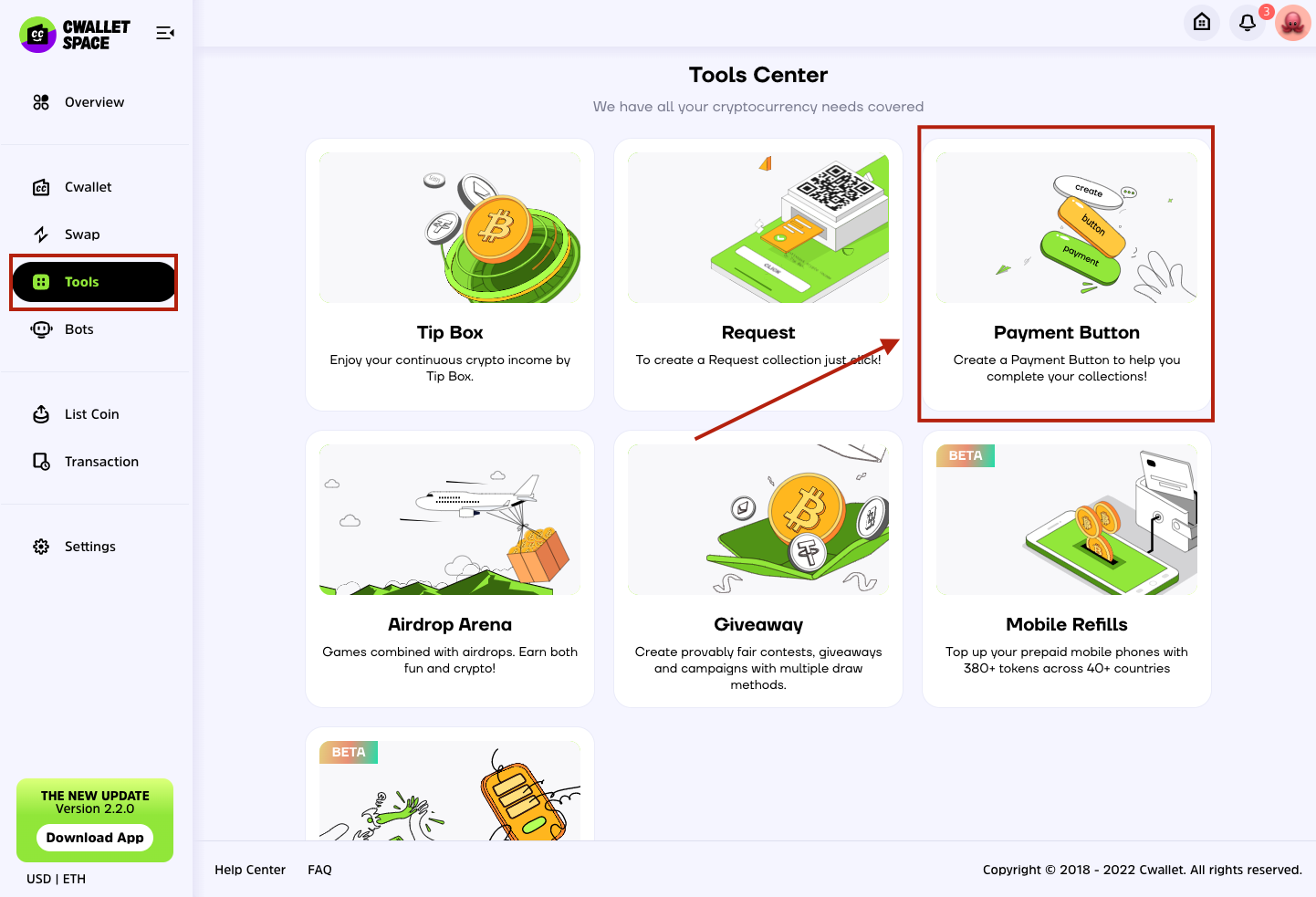

Interestingly, accepting crypto payments on the company's website was straightforward using Cwallet. All I had to do was add a crypto payment button on the webpage for clients to seamlessly make payments.

It only took a few minutes to create a payment button on Cwallet and insert the necessary code into the website's backend.

Using Cwallet made accepting crypto payments simple for my company, and it helped me meet my monthly targets without having to do too much. As a result, my prospects became paying customers, and the company sold more insurance services.

So, do you want to accept crypto payments for your business?

Create a Cwallet account immediately, then follow these steps to create a payment button and add it to your profile or website so that customers can pay for your products quickly and easily.

What's more?

Cwallet is a unique cryptocurrency wallet that combines custodial and non-custodial features. With the help of this combined on-chain and off-chain wallet, you can manage and trade over 800 cryptocurrencies in a single spot, providing security, simplicity, and flexibility.

Cwallet lowers the entry barrier for crypto usage. You can instantly create a cwallet account with your mobile number or third-party networks such as Twitter, Telegram, Discord, and Reddit.

Cwallet does not charge any deposits, withdrawals, and token swap fees. Therefore, using Cwallet is absolutely FREE!

So, what are you waiting for?

Download the Cwallet NOW!