Crypto OTC Trading Vs. P2P Trading: A Comparison Guide

Crypto OTC (Over-The-Counter) Trading and P2P (Peer-to-Peer) Trading are two separate techniques of purchasing and selling cryptocurrencies, catering to different types of investors and transaction needs.

Cryptocurrency trading models vary to accommodate the needs of users, with some providing total control and others giving the exchange control. Among crypto enthusiasts are two of the most popular trading models –Over-the-counter and Peer-to-peer trading.

Crypto OTC (Over-The-Counter) Trading and P2P (Peer-to-Peer) Trading are two separate techniques of purchasing and selling cryptocurrencies, catering to different types of investors and transaction needs. While traditional financial markets have long used these strategies, their adaptation to the realm of cryptocurrency introduced new elements.

OTC trading is often preferred by individuals dealing in huge volumes who want discretion and direct bargaining expertise. P2P trading, on the other hand, appeals to a larger audience by providing a more accessible platform for a wide range of market players, from casual traders to those doing smaller and individual transactions.

This comparative guide will go into the subtleties of these trading models, outlining how they function in the crypto ecosystem, the types of investors they attract, and the unique benefits and problems they provide.

What is OTC Trading?

Over-the-counter trading is exchanging financial products such as stocks, bonds, commodities, or cryptocurrency between two parties without using a centralized exchange. This type of trading occurs within dealer networks rather than on a centralized, public platform.

The greatest distinguishing element of OTC trading is its discreetness; deals are not posted publicly, providing greater privacy. This is especially tempting to large traders or institutional investors who want to make huge transactions without significantly affecting market prices. Prices in OTC trading can be negotiated, resulting in better rates for larger orders.

While it provides greater freedom and anonymity, it also demands a higher level of confidence between trading partners because there is less regulation than in conventional exchanges. OTC trading is a frequent activity in the financial sector, and it is especially useful for people who want to trade huge amounts without attracting too much notice or creating market price fluctuations.

What is P2P Trading?

Peer-to-peer trading is the practice of buying and selling cryptocurrencies directly between users, without the need for a typical centralized exchange. This method allows users to trade digital currency with one another through a platform that links buyers and sellers. One of the primary aspects of peer-to-peer trading is its flexibility; users can choose their trading partners and actively negotiate rates. This frequently incorporates several payment options, ranging from bank transfers to cash payments, making it adaptable and convenient.

To maintain transaction security, most P2P systems provide an escrow service. When a deal is initiated, the platform places the Bitcoin in escrow and only releases the cryptocurrency to the buyer's wallet when the seller verifies receipt of the payment.

P2P trade is common in areas with limited access to traditional banks and a significant demand for alternative payment options. It is also popular among individuals who desire privacy, as it provides greater anonymity than centralized exchanges. However, users must exercise caution and be aware of possible risks such as fraud and do due diligence on their trade partners.

Crypto OTC Trading Vs. P2P Trading:

1. Accessibility

OTC Trading

OTC trading is usually more exclusive. It primarily targets institutional investors, high-net-worth individuals, and experienced traders. The entry barriers are higher, sometimes requiring substantial funds. This exclusivity comes from the necessity to handle big transactions, which are the hallmarks of OTC trading.

P2P Trading

In contrast, peer-to-peer trading is more democratic and available to a larger audience. It's a popular choice among individual investors and those new to the cryptocurrency space. P2P platforms often have lower entry barriers, making them appropriate for people who do not have access to huge sums of money.

2. Transaction Size

OTC Trading

OTC trading is linked with large transaction volumes. It is designed to manage large trades without adversely influencing the cryptocurrency's market price. This feature makes it a popular choice among those wishing to perform huge deals discreetly.

P2P Trading

Conversely, P2P trading is better suited to smaller transactions. While bigger trades can be conducted, P2P systems are primarily used for small to medium-sized transactions. This size limit is related to the nature of individual investors and the liquidity accessible on these platforms.

3. Privacy

OTC Trading

Privacy is an essential part of OTC trading. Transactions are carried out away from the public view, ensuring a high level of confidentiality. This seclusion is especially valuable for people who want to avoid the market impact that significant deals might have when made public.

P2P Trading

P2P trading provides some anonymity, but not as much as OTC trading does. While transactions are between people, they frequently take place on platforms that demand some type of identification verification, limiting the level of anonymity.

4. Pricing

OTC Trading

OTC trading pricing is negotiated directly between the parties concerned. This negotiation can result in discounted rates, particularly for big transactions, and reduces slippage - the gap between expected and executed prices.

P2P Trading

P2P trading enables sellers to determine their pricing, resulting in a broader range of rates than centralized exchanges. Pricing can be irregular, reflecting the unique character of each trade and bargaining opportunity.

5. Security

OTC Trading

OTC trades are typically secured through the reputation and reliability of the broker facilitating the transaction. The added layer of a broker can offer enhanced security, though the trustworthiness of the broker is crucial.

P2P Trading

The security of P2P trading is dependent on the precautions implemented by the platform and its members. While several sites provide escrow services, the risk of scams can be higher. Users must take caution and due diligence while selecting trade partners.

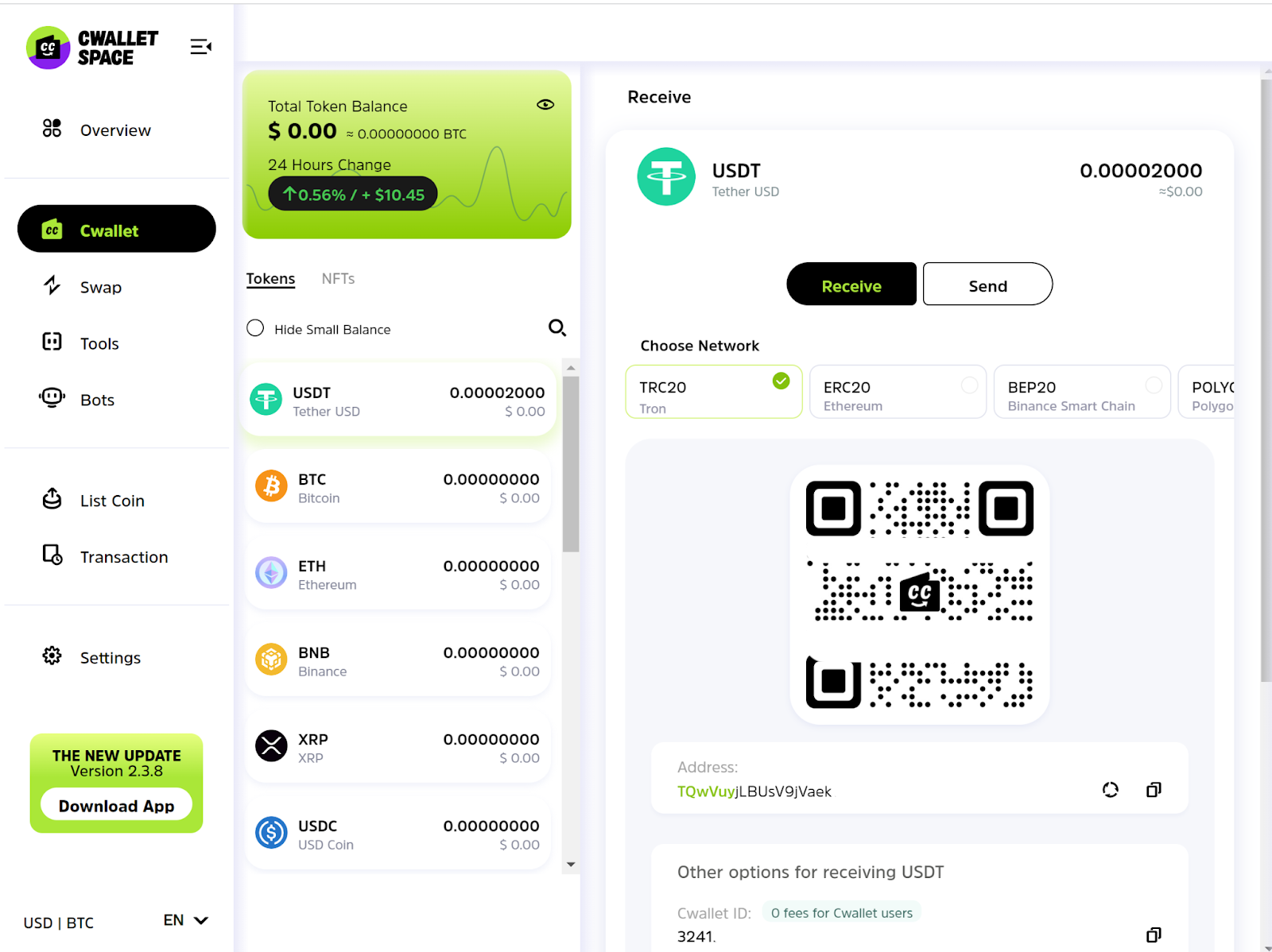

Use Cwallet to Facilitate Efficient OTC and P2P Trading

Cwallet offers a multifaceted platform that can significantly facilitate both OTC and P2P crypto trading, making it a valuable tool for traders and investors in the crypto space. Its unique combination of custodial and non-custodial wallet features provides users with both security and flexibility, catering to a wide range of trading needs.

For OTC trading, the security features of Cwallet are particularly beneficial. The platform employs advanced technologies such as Multi-Party Cloud Computing (MPCC) for keyless cryptographic custody and cloud-based encryption, ensuring the safety of digital assets. This level of security is crucial for large-scale OTC transactions, where substantial amounts of cryptocurrency are often exchanged.

Cwallet's user-friendly interface and support for over 900 cryptocurrencies across 50+ blockchain networks make it an ideal tool. It allows users to manage a wide range of crypto assets seamlessly, enhancing the P2P trading experience. The platform's support for various networks also means that traders can choose their preferred blockchain for transactions, offering greater flexibility and convenience.

Also, Cwallet's internal transfer system facilitates instant and free transactions between users, which is an essential feature for efficient P2P trading. This capability ensures rapid and cost-effective transfers, a key advantage in the often fast-paced world of crypto trading.

Cwallet is not just limited to wallet services; it also includes features like built-in swap functions with competitive exchange rates and a comprehensive price tracker. These tools are invaluable for both OTC and P2P traders, allowing them to make informed decisions based on real-time market data and execute trades efficiently within the app.

Cwallet's combination of security, flexibility, and a wide range of supported cryptocurrencies and networks makes it a powerful tool for facilitating efficient OTC and P2P trading in the cryptocurrency market.

Conclusion

Choosing between Crypto OTC and P2P trading depends on individual needs and preferences. OTC trading is ideal for large-scale, private, and secure transactions, often favored by institutional entities. P2P trading, on the other hand, offers accessibility and flexibility, appealing to individual investors and those dealing with smaller transaction sizes. Both methods play pivotal roles in the diverse ecosystem of cryptocurrency trading, each addressing specific market demands and trader profiles.

If you're a merchant looking to scale new heights, seize this opportunity. Visit Cwallet to sign up and be among the first to leverage the P2P feature. For more information, contact @Brian_Cwallet on Telegram or visit our website at Cwallet.com