Crypto Market Sentiment Warms Up, MCP Becomes New AI Track Direction|Cwallet Crypto Market Weekly Report

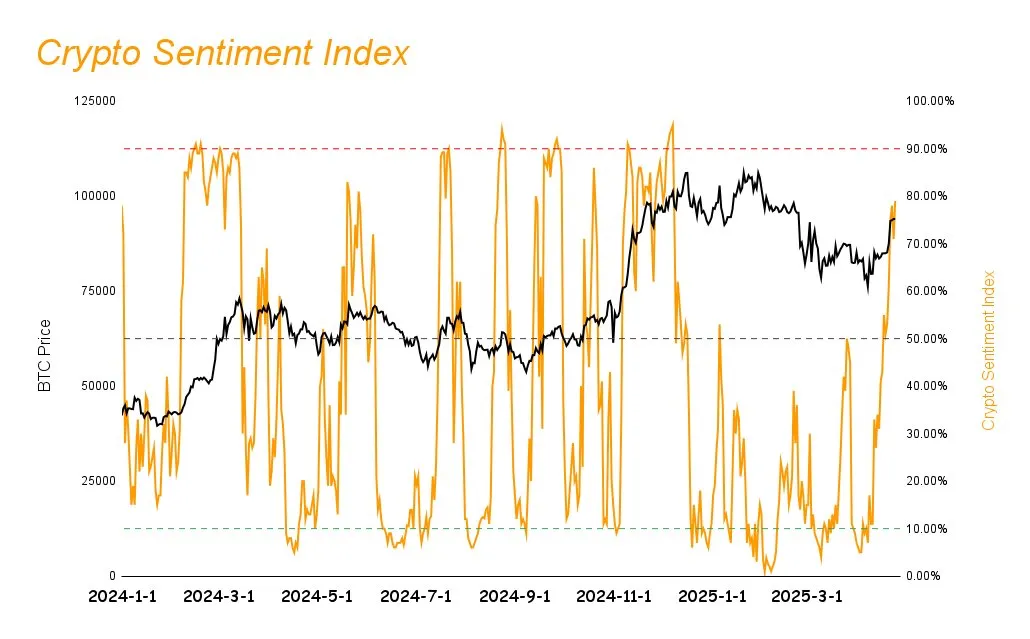

This week, the cryptocurrency market recorded a broad-based rebound, with major assets and altcoins showing significant gains. The Market Sentiment Index rose sharply from 55% to 79%, signaling a clear shift toward bullish positioning among investors.

Several macro catalysts contributed to this momentum. U.S. policy developments, including a softening of tariffs toward China and former President Trump’s affirmation to retain Fed Chairman Powell, helped ease economic uncertainty. In addition, the appointment of Paul Atkins, a crypto-friendly figure, as the new SEC Chairman improved market expectations for a more accommodating regulatory environment.

Meanwhile, the supply of stablecoins continued to grow, with USDT market capitalization reaching $145.7 billion and USDC climbing to $61.9 billion. This trend highlights the renewed participation of institutional capital, predominantly from U.S. sources, and reflects growing confidence in market liquidity conditions.

Despite the strong rally, broader macroeconomic risks—including recessionary pressures and tariff policy volatility—remain unresolved. For this reason, the current market uptrend should be seen as a technical recovery from prior oversold levels, rather than a definitive shift into a new long-term bull cycle.

Investment Opportunities and Emerging Risks Across Major Crypto Assets

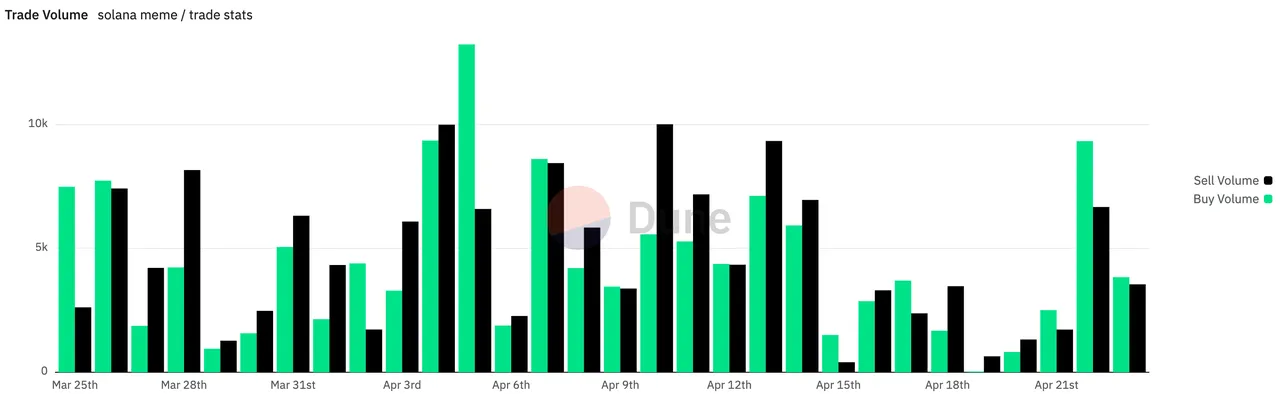

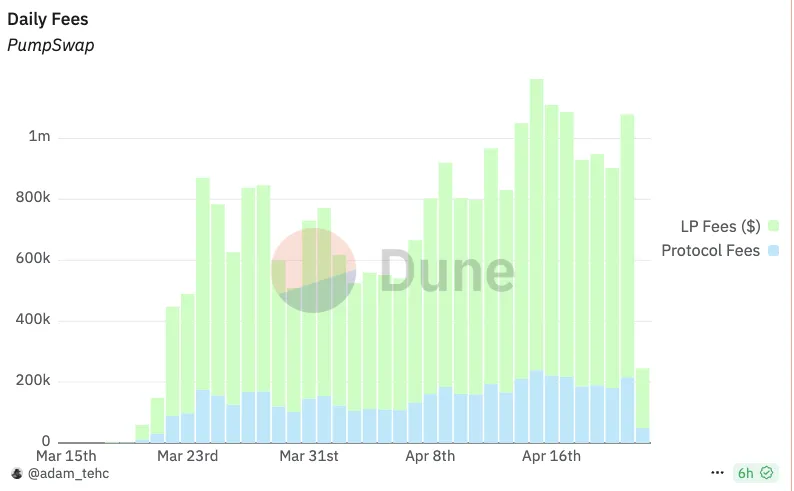

Solana has emerged as one of the week’s most dynamic performers, supported by both speculative and structural growth within its ecosystem. Trading volumes in Solana-based meme tokens witnessed a notable surge, with PumpSwap’s daily volumes consistently reaching between $300 million and $480 million. This level of activity accounted for up to 19% of total DEX volumes on the Solana network, signaling a healthy rebound in user engagement.

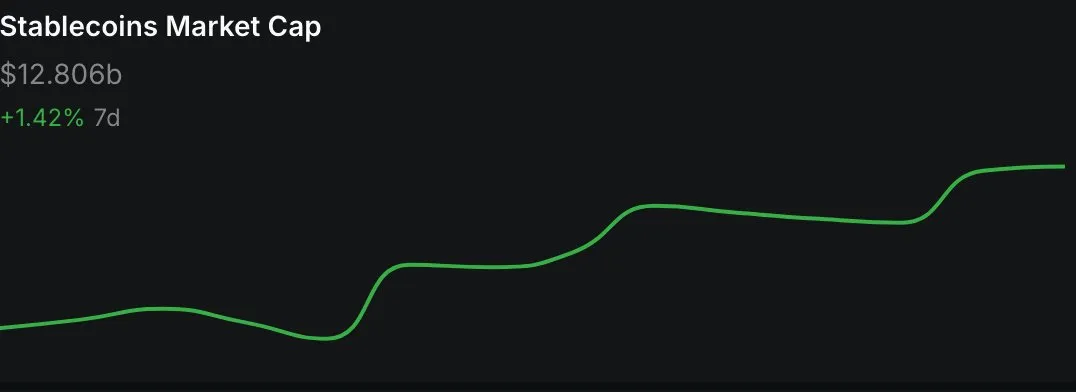

At the same time, stablecoin reserves on Solana surpassed $12.8 billion, setting a new all-time high and reinforcing the platform's position as a key player in decentralized finance. On the infrastructure side, the Solana Foundation introduced decentralization reforms by tightening delegation requirements for validators, aiming to strengthen network resilience and reduce reliance on Foundation-driven incentives.

Institutional interest in Solana has also intensified. SOL Strategies, a publicly listed Canadian investment firm, announced a $500 million convertible bond issuance to acquire SOL tokens, echoing strategies pioneered by MicroStrategy in the Bitcoin market. The combination of ecosystem vitality, liquidity expansion, governance reform, and institutional adoption places Solana in a strong position to sustain its upward momentum, particularly if macroeconomic conditions stabilize further.

The potential approval of a Solana spot ETF, now appearing more plausible under the leadership of SEC Chairman Paul Atkins, could serve as a significant medium-term catalyst for additional capital inflows into the SOL ecosystem.

Synthetix Rebuilds Confidence After sUSD Depegging Crisis

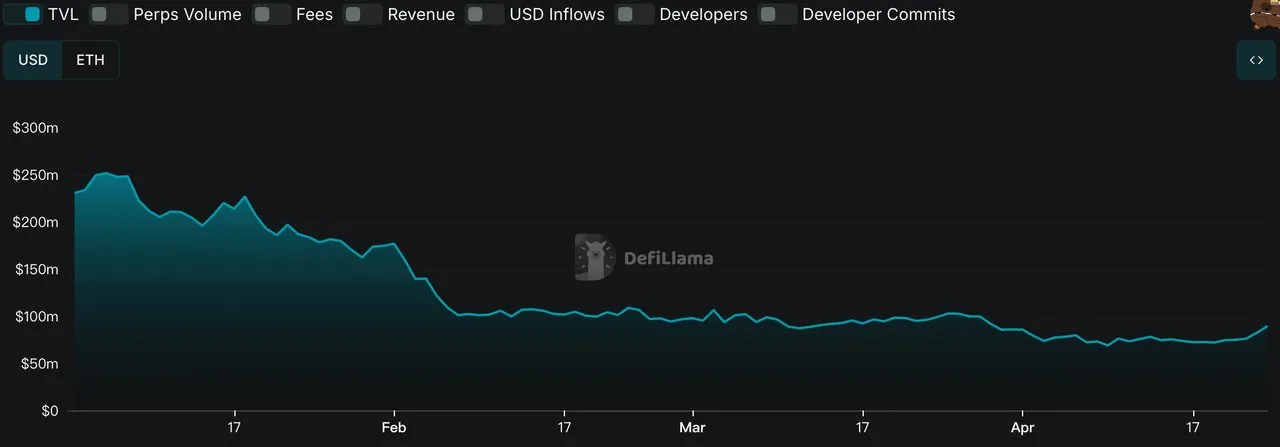

Synthetix faced a major market challenge earlier this month when its algorithmic stablecoin, sUSD, experienced a significant depegging event. Triggered by adjustments to the protocol’s debt management under the SIP-420 proposal, sUSD briefly traded as low as $0.68. This event severely impacted investor sentiment, dragging the price of SNX and reducing the project’s total value locked (TVL) to a low of $72.23 million.

To counter the crisis, Synthetix moved swiftly with a series of recovery measures. These included boosting sUSD/sUSDe LP yields on Convex to 49.18%, incentivizing sUSD deposits through the Infinex program, and offering new pledging incentives backed by a 5 million SNX allocation. Additional mechanisms to penalize undercollateralization and the launch of Perps V4 further strengthened the protocol's structural resilience.

These interventions have yielded tangible results. sUSD has recovered to $0.88, SNX has rebounded to $0.74, and TVL has climbed by 23.56% to $89.25 million. Although full restoration of investor confidence will likely require sUSD to re-anchor closer to $1, Synthetix's rapid and comprehensive response has significantly mitigated the impact of the crisis and paved the way for future growth opportunities.

Token Unlocks Create Downward Pressure for REZ and OMNI

While some sectors are regaining strength, caution remains warranted for projects facing significant token unlock events. Renzo, a liquidity re-staking protocol built on the EigenLayer ecosystem, is preparing for an unlock of 864 million REZ tokens on April 30, representing 8.64% of total supply. With circulating liquidity at only 21%, the market may struggle to absorb the newly released tokens, increasing the probability of short-term price declines.

Sentiment surrounding Ethereum staking-related protocols has weakened in recent months, further compounding risks for REZ. As major allocations from this unlock are destined for investment institutions and project teams, there is a heightened likelihood of aggressive sell-offs post-unlock.

Similarly, Omni Network is scheduled to unlock 16.63 million OMNI tokens on May 2, amounting to 16.64% of total supply. Given the project's subdued market presence and the relative underperformance of Layer-2 interoperability narratives, Omni may face significant difficulties absorbing the additional token supply. With the unlock set to effectively double the circulating supply, downside risks remain elevated.

In both cases, the timing and scale of upcoming unlocks suggest that caution is warranted when evaluating near-term opportunities in REZ and OMNI.

Market Sentiment Shifts Toward Optimism, But Macro Risks Remain

The substantial rise in the Market Sentiment Index to 79% underscores a notable improvement in investor psychology. This resurgence of optimism is closely linked to favorable regulatory signals and a temporary easing of macroeconomic tensions.

Nonetheless, broader risks—including the threat of a U.S. economic recession, potential deterioration in trade relationships, and tightening monetary policy—continue to loom over financial markets. For cryptocurrency investors, maintaining a flexible strategy that can adapt to changing macro conditions remains essential for sustainable portfolio performance.

Sector Highlights: MCP Emerges as a New Growth Narrative in Crypto x AI

Model Context Protocol (MCP), introduced by Anthropic, is gaining attention as a potential cornerstone for the next phase of AI and crypto integration. MCP aims to create standardized, secure, and real-time interfaces between large language models (LLMs) and external tools or data sources.

By leveraging a lightweight JSON-RPC 2.0 architecture, MCP enables seamless client-server communication through both Stdio (for low-latency local operations) and HTTP SSE (for remote real-time interactions). The protocol reduces computational complexity by up to 70% compared to traditional integration methods and enhances security by minimizing intermediate data exposure.

If successfully adopted, MCP could serve as a critical bridge linking AI models with decentralized systems, creating new opportunities for personalized, real-time, and efficient applications across various industries.

Notable MCP Ecosystem Projects

Several projects are already developing applications around MCP technology:

| Project | Focus | Token Status | Current Development |

|---|---|---|---|

| Dark | Trusted AI execution environment | Issued (DARK) | Early-stage rollout |

| SkyAI | Multi-chain AI infrastructure | Issued (SKYAI) | $43M market cap |

| Solix | Smart bandwidth sharing via DePIN | No token | Expansion in 63 countries |

| HighKey | DeFi arbitrage and analytics platform | Issued (HIGHKEY) | Micro-cap project |

| DeMCP | Secure MCP proxy services | No token | Development phase |

| UnifAI | Simplified task execution infrastructure | No token | Active points program |

While the MCP narrative presents promising technological foundations, the sector remains in its early development stage. The ultimate success of MCP-based projects will depend heavily on delivering scalable, practical solutions rather than relying solely on market enthusiasm.

Sector Performance: AI Continues to Lead While CeFi Lags Behind

AI-related tokens once again led weekly performance metrics, with assets such as TAO, RENDER, FET, WLD, and FARTCOIN delivering strong gains ranging from approximately 30% to over 50%. This reflects the market’s continuing preference for innovation-driven narratives.

In contrast, centralized finance (CeFi) tokens, including BNB, BGB, and OKB, posted modest gains around 2%, signaling relative stagnation in more mature sectors. The divergence highlights a clear shift in investor appetite toward sectors perceived as having higher future growth potential.

Data Source: SoSoValue

Key Macro Events to Watch That Could Influence Crypto Markets

Several important U.S. macroeconomic indicators scheduled for release next week may significantly impact broader risk sentiment:

U.S. Q1 real GDP annualized revision (April 30)

U.S. March Core PCE Price Index (April 30)

U.S. April ADP employment report (April 30)

U.S. April ISM Manufacturing PMI (May 1)

U.S. April Non-farm Payrolls and Unemployment Rate (May 2)

Considering the sensitivity of global markets to economic data, investors should prepare for potential volatility and adjust positioning accordingly.

Strategic Outlook: Navigating Recovery with Caution and Selectivity

The cryptocurrency market is exhibiting signs of recovery fueled by improved sentiment, easing regulatory concerns, and renewed liquidity inflows. Projects like Solana and Synthetix demonstrate strong fundamentals that could drive further gains if favorable conditions persist.

However, the presence of unresolved macroeconomic risks and the technical nature of the current rally suggest that strategic caution remains critical. Investors should prioritize high-quality projects with clear growth catalysts while remaining agile enough to respond to changing market dynamics. Balancing exposure and implementing robust risk management will be essential for navigating the next phase of the market cycle.

Cwallet: Your Gateway to a New Era of Crypto Finance

Cwallet is not just a crypto wallet; it's a comprehensive Web2.5 financial platform. We seamlessly integrate security, privacy, and convenience, laying the foundation for a transformative financial landscape. With Cwallet, you can securely hold, send, receive, swap, tip, and earn from over 60 blockchains and 1000+ cryptocurrencies — all within one powerful platform.

We aim to expand the rich applications of crypto. Our intuitive Telegram bot allows for effortless engagement in airdrops and fosters community connections through tipping and group management tools. Additionally, we offer $USDT earnings with a maximum APR of 10% and provide competitive loan services. We also offer the Cozy Card — your passport to global spending. This innovative card enables you to use your digital assets like cash, simplifying transactions worldwide and enhancing convenience through Apple Pay and Google Pay.

Furthermore, we provide additional toolkits, including HR bulk management system, mobile top-ups, gift cards, and more. With over 37 million users, Cwallet invites you to reimagine crypto. Stay cozy and step into the future of finance with us.

Offical Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial