Bitmine Buys $84M ETH: Is This the Market's Next Big Signal or a Risky Bet?

When Bitmine, a major institutional investor, made waves with their $84M Ethereum (ETH) purchase, many in the crypto space took notice.

Key Takeaways:

- Institutional demand for ETH is increasing, impacting short-term price dynamics and liquidity.

- Ethereum's growing importance among institutions could bring more long-term stability to the asset.

- Tools like Cwallet offer users a clear view of their ETH holdings and exposure, helping them stay ahead of the market.

When Bitmine, a major institutional investor, made waves with their $84M Ethereum (ETH) purchase, many in the crypto space took notice. But what does this huge buy mean for the market, and is it a sign of more bullish momentum — or a risky bet on Ethereum’s future? As the cryptocurrency market experiences dynamic shifts, moves like this by institutional investors shed light on where ETH might be headed next.

With market sentiment hanging in the balance, traders and investors alike are left wondering if Ethereum’s long-term value proposition is finally catching the eyes of the big players. The surge in institutional adoption is happening in tandem with an Ethereum network upgrade, signaling broader shifts. But what should retail investors and traders take away from this?

What Does Bitmine's $84M ETH Purchase Signal?

Bitmine's decision to buy $84 million worth of ETH is a substantial bet on the future of Ethereum and its role in the broader cryptocurrency market. This purchase highlights institutional demand for ETH, showing that large-scale investors are increasingly turning to Ethereum as a long-term store of value and a key component in the Web3 ecosystem.

When institutions like Bitmine step in, it generally indicates two things:

- Growing institutional confidence in Ethereum's scalability, use cases, and future potential.

- Increased liquidity, which could have significant implications for ETH's price movements.

For ETH holders and traders, this purchase suggests that Ethereum's price support could rise, particularly if institutional players continue to stockpile the asset.

However, the move also has its risks. As institutional buying creates more buy-side pressure, it could lead to an imbalance, where the short-term price becomes more volatile. Traders must keep a close eye on on-chain metrics and price action to understand how the market reacts in the wake of institutional buy-ins like this.

Why ETH Is Seeing More Institutional Adoption

The growing institutional interest in Ethereum is part of a broader trend of mainstream financial institutions embracing blockchain technology.

Ethereum's smart contract capabilities, decentralized finance (DeFi) ecosystem, and upcoming upgrades make it an attractive choice for investors who are looking to diversify their portfolios.

Ethereum has long been considered the backbone of the DeFi ecosystem, supporting decentralized exchanges (DEXs), decentralized apps (DApps), and tokenized assets. With these capabilities, institutional investors believe Ethereum has the infrastructure and utility to power Web3 and continue to be an important asset class in the future.

ETH's role in NFTs, DeFi, and emerging layer-2 solutions is becoming more clear, and the increased interest from companies like Bitmine reflects Ethereum's potential as a foundational asset for the future of the internet.

👀 Recommend: Are Layer 2s Ready for 2026? What Adoption and Liquidity Tell Us

What Traders Should Know About Ethereum's Price Dynamics

For ETH traders or hodlers, it's crucial to recognize that the market isn't simply about price charts — it's about managing exposure and risk across various positions. While institutional buying can often indicate bullish potential, it doesn’t always translate directly into price gains. Institutional investors typically take a longer view, and they're not as focused on short-term fluctuations.

In a market that's rapidly evolving, traders should keep in mind the following:

- Liquidity matters: As institutional players like Bitmine continue to buy into ETH, there will likely be increased liquidity in the market. This could lead to short-term price stability.

- Price volatility: Large institutional buys may also lead to price corrections as positions are rebalanced, so it’s important to monitor both technical levels and on-chain data.

- Long-term fundamentals: Short-term price action can often be driven by market sentiment or liquidity, but the underlying fundamentals of Ethereum — including network upgrades, decentralized finance (DeFi) applications, and Ethereum 2.0 — provide a strong basis for its future growth.

Where Cwallet Fits In: Managing Exposure During Market Shifts

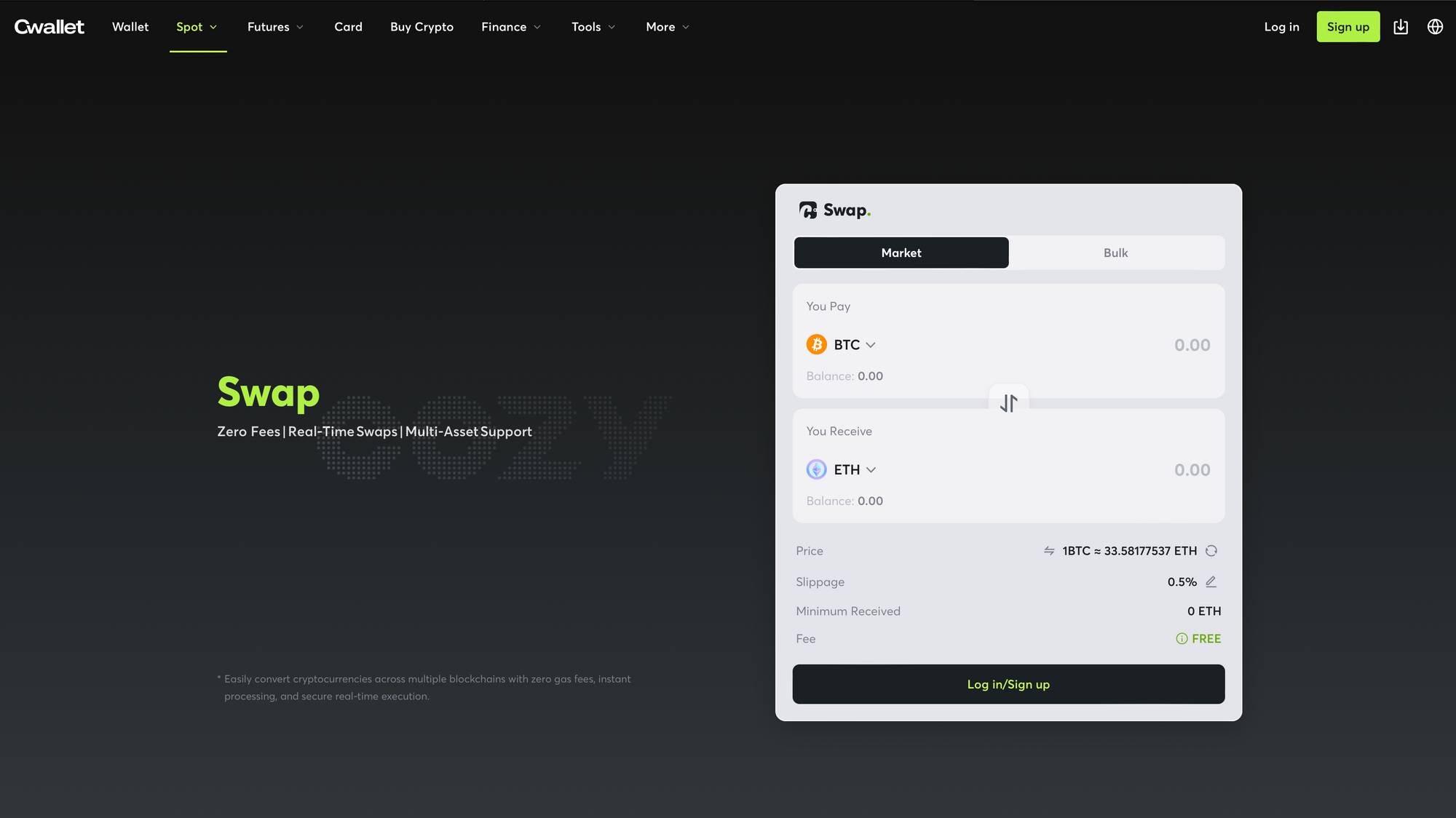

As Ethereu's institutional adoption grows and the market reacts to large purchases like Bitmine's $84M ETH buy, it becomes more important than ever for ETH traders and investors to maintain clear exposure to their holdings and manage their risk. Cwallet offers tools that help you do just that — by providing real-time insights into your holdings, swap functionality, and a clear overview of your exposure across multiple platforms.

Whether you’re holding ETH, swapping between different assets, or tracking your positions on Cwallet, the platform helps users keep their investments organized and aligned with their goals. With the volatile nature of the crypto market, tools like Cwallet ensure you’re not reacting emotionally to every price movement. Instead, you can stay focused on your long-term strategy.

Conclusion: What's Next for ETH and Crypto Markets?

Bitmine's purchase of $84M in ETH is a significant move that suggests continued institutional interest in Ethereum, and this could lead to increased price stability in the short term.

However, it also underscores the importance of understanding market liquidity, on-chain data, and managing exposure to avoid being swept up in the volatile swings of crypto markets.For retail traders, ETH's price action in the coming months will depend not only on institutional involvement but also on broader market sentiment.

As Ethereum continues to evolve with Ethereum 2.0 and layer-2 solutions, the asset is positioned for long-term growth — but short-term volatility remains part of the game.Whether you’re holding, swapping, or just exploring ETH trading, Cwallet offers the tools you need to manage your crypto positions effectively, giving you more clarity and control in a dynamic market.

Cwallet: Your Gateway to a New Era of Crypto Finance

The crypto world moves fast — managing your assets should stay simple and secure.

Cwallet is an intuitive all-in-one crypto wallet to store, swap, trade, earn, and spend 1,000+ cryptocurrencies across 60+ blockchains.

Your trades, your way: Cwallet supports both Spot Trading (Swap, Memecoins, and xStocks) and Futures Trading, such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, giving you flexible ways to engage with the market.

Your assets, your control: With the Cozy Card, one of the most secure crypto wallet payment solutions, your digital assets gain real-world spending power — online or offline.

Connect as you trade: Built-in IM lets users communicate and share insights directly within Cwallet.

Your time, your efficiency: With practical tools like HR Management, Mobile Refills, and Gift Cards, Cwallet helps you handle everyday needs with ease.

Join millions of users and redefine how you interact with crypto.

Official Link

Official Site: https://cwallet.com

X: https://x.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.