Bitcoin Crosses Previous All-Time High Price: Insights For Investors

There is no bigger confirmation of the presence of a bullish market than when Bitcoin sets a new all-time high price; in fact, in a bullish market, several new ATH prices will be set, as crypto prices keep surging

Bitcoin’s status as the index cryptocurrency, owning more than half of the entire crypto market’s capitalization, affords it huge regard, as its price movement ultimately decides the direction for other cryptocurrencies.

After about 18 months in a bullish run that started in March 2020, Bitcoin soared to an all-time high (ATH) price of $69,000 in November 2021, only to be followed by a tumultuous descent into a prolonged bearish phase throughout 2022 and much of 2023.

However, in a remarkable turn of events, the last quarter of 2023 brought about a glimmer of hope for crypto enthusiasts and investors as it signaled the beginning of a remarkable resurgence.

Fast forward to March 8th, 2024, and Bitcoin crossed the $69,000 mark and is now trading within the $71,000 to $72,000 range.

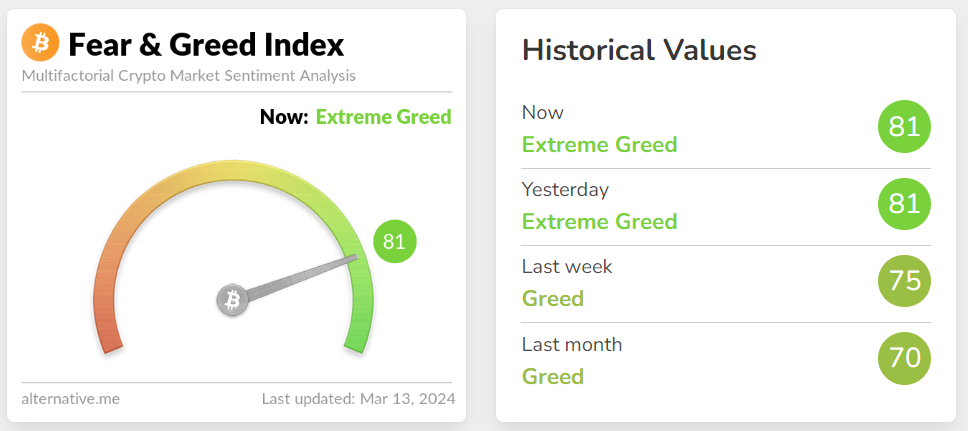

This resurgence confirms the existence of a new bull market, which draws greed into the crypto market; hence, as an investor or potential investor, it is important to understand the market cycles, and how to effectively take advantage of the fast-moving bullish run.

In this article, we delve into the journey of Bitcoin from its previous all-time high to the present, exploring the factors driving its resurgence, analyzing market dynamics, and providing essential guidance for investors seeking to capitalize on opportunities present in the new bullish run.

Bitcoin’s Price History And Market Cycles

According to several market analysts, the cryptocurrency market moves in 4-year cycles, where approximately 3 years are enjoyed in a bullish movement, while the 4th year in the cycle is accompanied by a bearish run.

This postulation has stayed true in previous market cycles (2008 - 2011, 2021 - 2015, 2016 - 2019, and 2020 - 2023).

Hence, it is expected that within 2024 to late 2025, or early 2026, Bitcoin will soar higher and set new ATH prices, before we’ll experience a new bearish run.

Most times, early investors take a break from their investments and begin to take profits, and this leads to a bearish run, among other contributing factors, which could include regulatory battles, an overall bearish financial market, etc.

Significance of Bitcoin Crossing The $69,000 Mark

There is no bigger confirmation of the presence of a bullish market than when Bitcoin sets a new all-time high price; in fact, in a bullish market, several new ATH prices will be set, as crypto prices keep surging. As a result, many altcoins will see huge investments as investors’ confidence will come alive, with increased greed and a high risk appetite, prompting proactive investment strategies.

Even noobs, who have no idea of cryptocurrency or how the crypto market works will develop interest because crypto-related posts pop up on their timelines, and will be interested in investing some bucks to gain from the market.

As more money is pumped into the market, the market becomes more volatile (in a positive direction), with investors’ perceptions and key narratives, like the next Bitcoin halving coming up in April, akin to driving market sentiments further positive.

This overall increase in optimism and positive market sentiments results in significant buying activity and overall excellent market behavior with a high chance of profit.

While Bitcoin's resurgence has captured the imagination of investors worldwide, it is not without its share of challenges and risks. Regulatory uncertainty, market manipulation, and cybersecurity threats loom large, giving room for pullbacks, and downward volatility, even amid a strong bullish run.

Moreover, the inherent volatility of the cryptocurrency market poses a significant risk for investors, as rapid price fluctuations can lead to substantial gains or losses in a matter of minutes. As the crypto market continues its ascent, investors must exercise caution and adopt risk management strategies to mitigate potential losses and protect their investment portfolios from undue exposure to market volatility.

Bull Market Insights For Investors

For investors, a bull market signifies not just a surge in prices, but also a wealth of opportunities waiting to be seized.

However, it is important to understand the intricacies of bull markets, and strategies that can help you as an investor effectively capitalize on the euphoria of bullish market conditions.

By understanding the underlying dynamics driving bullish sentiment, you can effectively identify key trends and opportunities, equipping you with the knowledge needed to thrive in a bull market environment.

Practice Risk Management

It is important to remember that trading and investing in financial markets pose significant risk, and to remain profitable, you must effectively manage your risk by:

- Diversifying Your Portfolio: As the saying goes, "don't put all your eggs in one basket." Diversification is a fundamental principle of prudent investing, and it holds true in the world of cryptocurrency. By spreading their investments across multiple asset classes, investors can reduce their exposure to idiosyncratic risk and increase their chances of achieving consistent returns over the long term.

Here are nine (9) ways you can classify crypto assets and effectively diversify. - Setting realistic profit and loss targets: It's not uncommon to get caught up in the euphoria of seeing assets multiply significantly in your wallet, and while reveling in the excitement of rapid price movements, you fail to take profits, and eventually lose it all to the market. Hence, it is important to set realistic profit targets, take profits, and reinvest when you can. Also, when an asset is underperforming, it is okay to cut losses short and move on, not stick with an underperforming asset due to sunk costs.

By establishing clear goals and sticking to them, you can avoid the pitfalls of emotional decision-making and stay profitable. - Enter and leave the market gradually, not at once: One high-risk strategy that many investors are guilty of is trying to perfectly time the market. Indeed, the market moves in cycles; however, even within a long bullish run, there are many potential pullbacks; hence, the safer strategy is to enter and leave the market gradually, by following buying strategies like dollar-cost averaging, and selling at different levels of profit targets.

Stay Informed About Regulatory Developments

One of the biggest challenges that crypto markets face is regulatory uncertainty. Every now and then, there is always a piece of bearish news that stems from regulatory bodies like the SEC cracking down on certain big guns within the crypto industry, and several new proposed laws.

Hence, it is important to stay informed, as regulatory news can greatly affect your portfolio, even more than technical analysis.

Develop A Long-Term Investment Perspective

While the allure of short-term gains may be tempting, adopting a long-term investment perspective is essential for sustainable wealth creation. Bitcoin's volatility may offer opportunities for quick profits, but it also poses significant risks for investors who lack the patience and discipline to weather market fluctuations.

By focusing on the fundamentals of Bitcoin's technology, adoption, and utility, investors can position themselves to capitalize on its long-term growth potential and minimize the impact of short-term market volatility.

End Note

The cryptocurrency market can be dramatic, as several factors can determine the price movement. Hece, to fully benefit from the bullish run, it is important to diversify your portfolio, buy and HODL for the long-term, and avoid short term trading, unless you’re supeer skilled in combining fundamental and technical data, to perfectly analyze the market.

Also, the importance of a secure crypto wallet cannot be underestimated. Your investments are only valid if they are secure. So, choose a custodial or non-custodial wallet from Cwallet today, and enjoy security borne from advanced encryption techniques, and secure storage, with a user-friendly interface and ZERO FEES!

The above information is only for educational purposes and should not be construed as financial advice. For more beginner tips as well as detailed guides on cryptocurrency and blockchain technology, do well to visit the Cwallet Blog and follow our social media communities: