Aster in 2026: What Its Layer-1 Launch and RWA Expansion Mean for Traders

Aster's 2026 H1 roadmap plans a full Layer-1 mainnet, staking, governance, and expanded DeFi/RWA support — a major upgrade from its 2025 DEX-only roots.

Key Takeaways

- Aster's 2026 H1 roadmap plans a full Layer-1 mainnet, staking, governance, and expanded DeFi/RWA support — a major upgrade from its 2025 DEX-only roots.

- For the broader crypto space, this shift represents a move toward infrastructure-level platforms that combine trading, assets, and chain services in one ecosystem.

- For individuals, especially those diversifying across chains and asset types, using a multi-chain wallet like Cwallet is increasingly important to manage holdings, track activity, and reduce fragmentation.

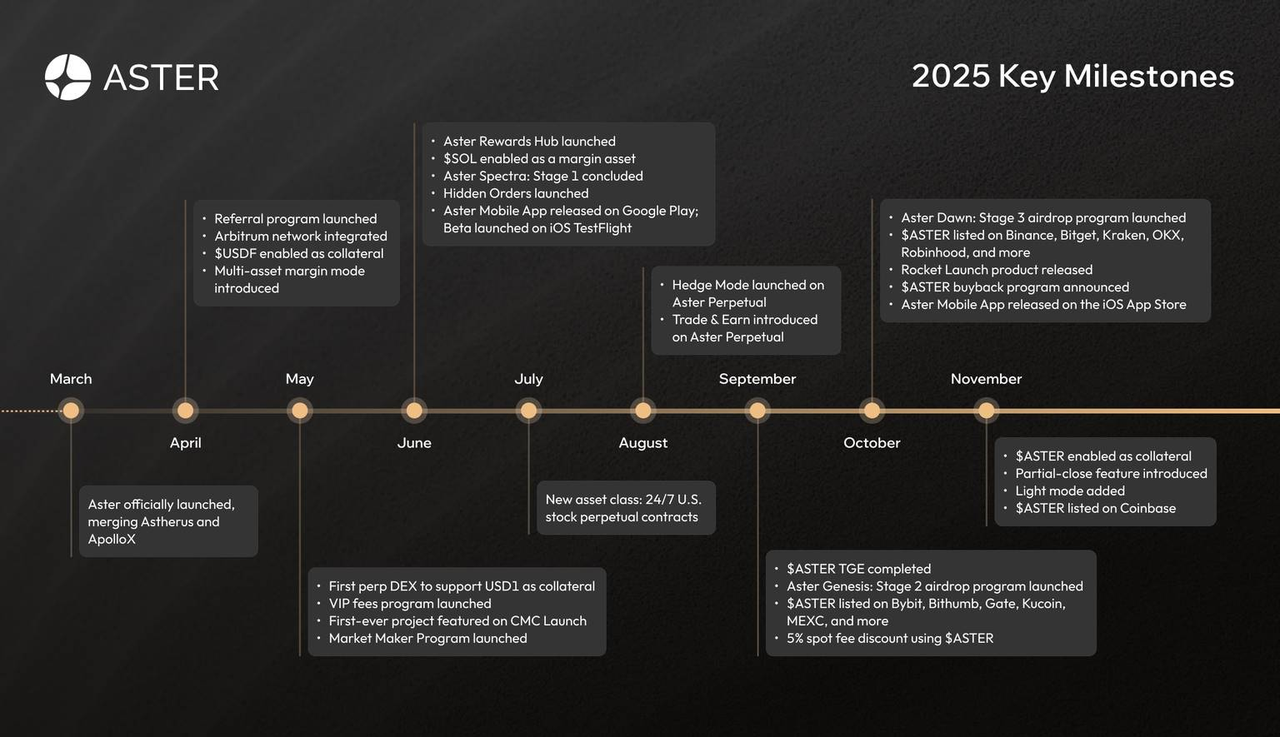

Aster recently published its milestone roadmap for 2025, signaling an ambitious shift from a standalone trading platform toward a full-fledged Layer-1 blockchain ecosystem in the first half of 2026. This roadmap outlines a series of major upgrades and new features — from Aster Chain's mainnet launch to staking, governance, and expanded DeFi capabilities.

After a busy 2025, during which Aster merged older platforms, completed a token generation event (TGE), listed on multiple centralized exchanges (CEX), and launched features like “Hedge Mode” and “Trade & Earn,” the 2026 roadmap seems to mark a transition to building infrastructure, token utility, and a sustainable ecosystem.

In this article, we'll explore what Aster's plans could mean for crypto investors, and which trends are worth watching as 2026 approaches.

What's Coming in Early 2026: Core Upgrades and New Features

According to the roadmap, Aster's upcoming plans include:

- Layer-1 mainnet launch (Q1 2026)

The debut of Aster Chain L1, designed to power all on-chain activity and support future development.

- Developer tools & fiat on-/off-ramps

Aster Code (for developers), and support for fiat deposits and withdrawals are scheduled alongside the mainnet launch.

- Staking & On-chain Governance (Q2 2026)

ASTER holders will be able to stake tokens, participate in governance, and shape the network's future.

- “Smart-money” Tools & Social Trading

Tools enabling users to follow top traders' strategies or replicate trades are planned — potentially opening up trading strategies to less-experienced users.

- Real-World Asset (RWA) Expansion & Perp Market Upgrades

Before the end of 2025, Aster plans an RWA upgrade, expanding stock perpetual markets, increasing liquidity, and broadening asset types beyond crypto.

- “Shield Mode” & TWAP Strategy Orders (late 2025)

Privacy-oriented high-leverage trading (“Shield Mode”) and TWAP order tools are scheduled for release as part of the transition to Layer-1.

Together, these updates aim to transform Aster from a leveraged DEX into a comprehensive blockchain, offering everything from DeFi, staking, governance, to real-world asset integration.

Why This Matters to the DeFi Space?

Aster's roadmap reflects a broader trend in crypto: platforms pushing from "single-function tools" toward full infrastructure layers. By launching its own Layer-1 chain, Aster signals it wants to be more than just a trading venue — it aims to become a foundational network for DeFi, tokenized assets (RWA), and future-proof decentralized applications.

If Aster successfully executes these plans, the impact could be significant:

- Lower fees and better performance for high-volume traders and DeFi users.

- More asset choices (stocks, RWA, synthetic assets) beyond just crypto.

- Growing ecosystems and liquidity as staking, governance, and smart-money tools attract new users and developers.

- Possibility for wider adoption especially among users seeking stablecoin / asset-backed exposure rather than pure crypto volatility.

What Crypto Users Should Do: Use Tools Like Cwallet to Stay Ahead

With so many moving parts and new features coming, managing crypto assets across multiple platforms and blockchains can get messy. That's where Cwallet becomes especially useful. As Aster evolves into a Layer-1 ecosystem, users may hold a mix of assets — from on-chain tokens (ASTER), RWAs, stablecoins, or even fiat on/off-ramp flows.

Cwallet helps by offering a unified interface to track assets, trades, and staking positions across chains and platforms. Whether you're experimenting with Aster's early features, staking ASTER, or diversifying assets across different networks, Cwallet simplifies your workflow — helping you stay organized and ready for whatever 2026 brings.

Cwallet: Your Gateway to a New Era of Crypto Finance

The crypto world moves fast — managing your assets should stay simple and secure. Cwallet is an intuitive all-in-one crypto wallet to store, swap, trade, earn, and spend 1,000+ cryptocurrencies across 60+ blockchains.

Your trades, your way: Cwallet supports both Spot Trading (Swap, Memecoins, and xStocks) and Futures Trading, such as Perpetual Trading, 1001X, Trend Trade, and Market Battle, giving you flexible ways to engage with the market.

Your assets, your control: With the Cozy Card, one of the most secure crypto wallet payment solutions, your digital assets gain real-world spending power — online or offline.

Connect as you trade: Built-in IM lets users communicate and share insights directly within Cwallet.

Your time, your efficiency: With practical tools like HR Management, Mobile Refills, and Gift Cards, Cwallet helps you handle everyday needs with ease.

Join millions of users and redefine how you interact with crypto.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.