Are Layer 2s Ready for 2026? What Adoption and Liquidity Tell Us

Layer 2 adoption grew rapidly in 2025, but liquidity and decentralization challenges remain

Key Takeaways

- Layer 2 adoption grew rapidly in 2025, but liquidity and decentralization challenges remain

- TVL alone is no longer enough — liquidity quality matters more going into 2026

- As L2 ecosystems fragment, tools like Cwallet help users manage assets and navigate multi-chain environments more effectively

As crypto moves toward the end of 2025, one thing is clear: Layer 2 networks (L2s) are no longer just an experiment. They have become a core part of how users interact with blockchains — from trading and DeFi to NFTs and on-chain applications.

Over the past year, L2 adoption has accelerated, total value locked (TVL) has shifted across ecosystems, and debates around centralization vs decentralization have become louder. With 2026 approaching, investors and users are asking a simple question:

Are Layer 2s finally ready for the next phase of growth, or are new challenges emerging?

This article breaks down the 2026 Layer 2 outlook in a clear, non-technical way, helping Web3 beginners understand what has changed since 2025 and what really matters next.

What Are Layer 2s? A Quick Refresher

Layer 2s are blockchains built on top of existing Layer 1 networks (like Ethereum or Bitcoin) to improve speed, reduce fees, and handle more transactions.

Instead of every transaction being processed directly on the main chain, L2s bundle activity and settle it more efficiently. This approach has allowed crypto to scale without completely redesigning its base layer.

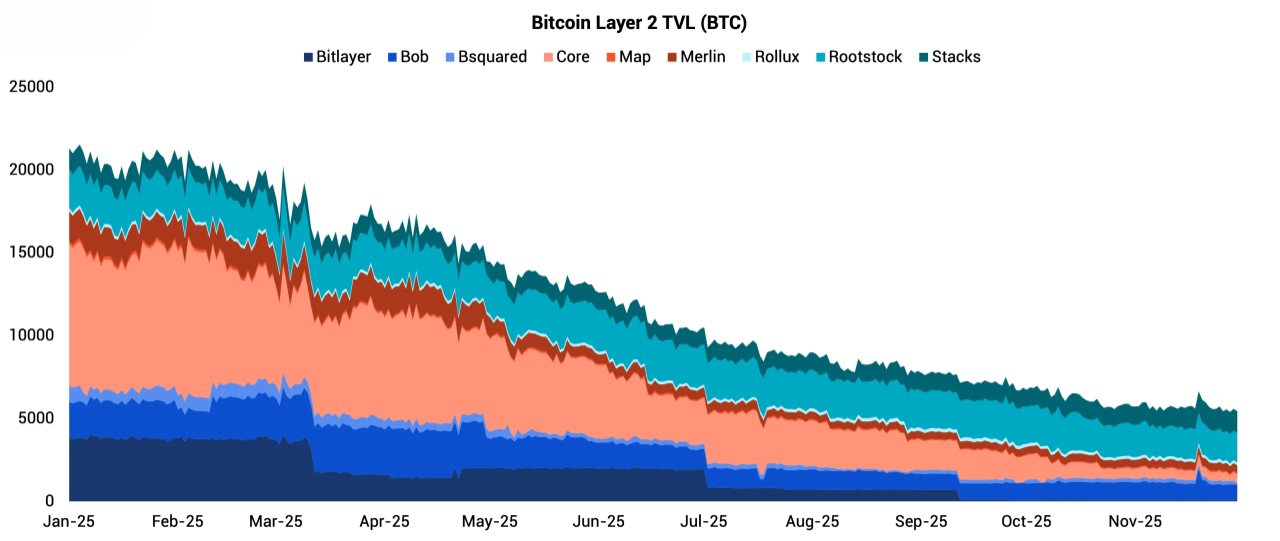

Today, most major L2 activity revolves around Ethereum — but Bitcoin-related Layer 2 experiments are also gaining attention.

👀 Related: Aster in 2026: What Its Layer-1 Launch and RWA Expansion Mean for Traders

L2 Adoption in 2025: Growth Came With Trade-Offs

Throughout 2025, L2 adoption surged. User activity, transaction counts, and application launches all increased. However, this growth revealed several important patterns:

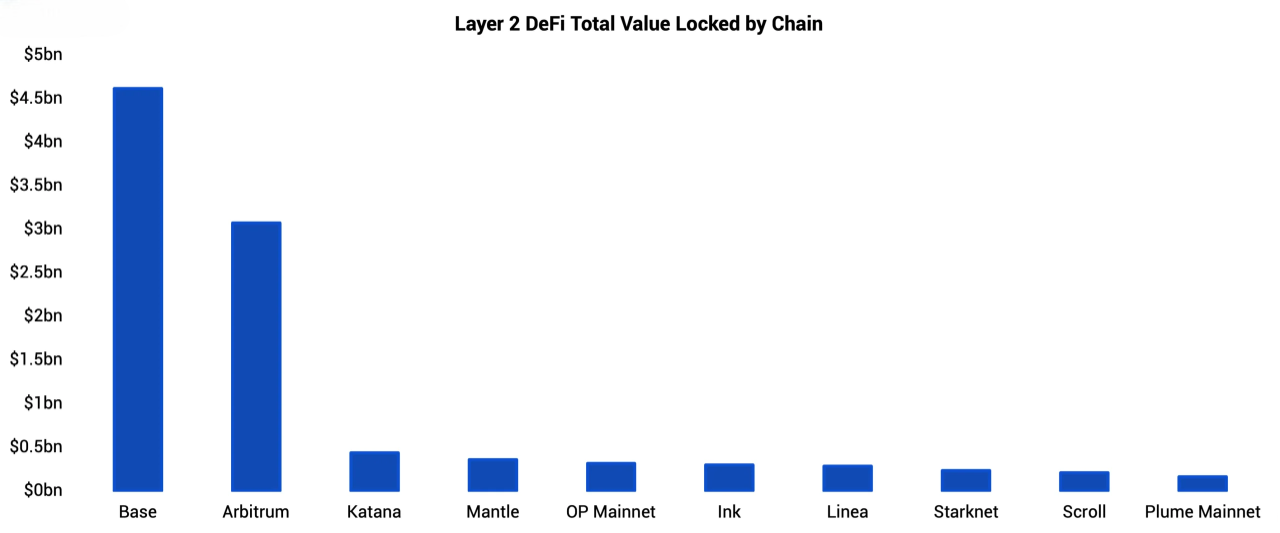

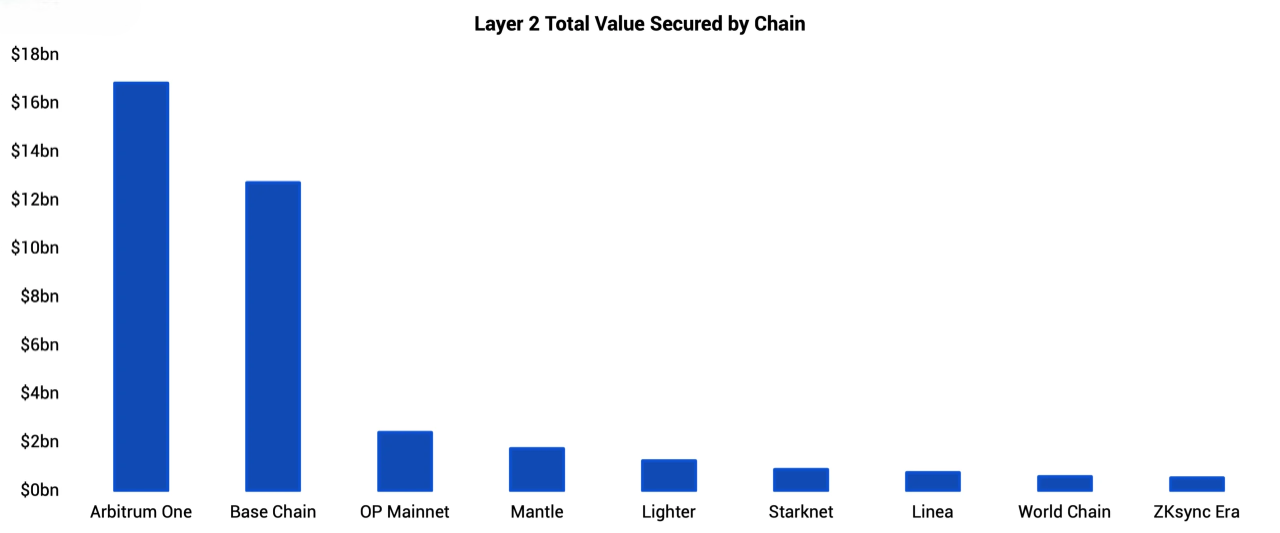

- Liquidity concentrated on a few dominant L2s, rather than spreading evenly

- TVL growth slowed on smaller networks, even as total L2 TVL remained high

- Many L2s relied heavily on centralized sequencers, raising decentralization concerns

In other words, Layer 2s succeeded at scaling — but not always at distributing power or liquidity evenly.

TVL and Liquidity: What the Numbers Are Really Saying

TVL (Total Value Locked) is often used as a headline metric, but by late 2025 it became less about raw numbers and more about liquidity quality.

Some L2s showed stable or growing TVL, yet liquidity was:

- Thin during volatile markets

- Highly dependent on incentives

- Quick to move when sentiment shifted

This matters because liquidity determines real usability — whether users can trade efficiently, enter and exit positions, or use DeFi protocols without heavy slippage.

As 2026 approaches, investors are paying closer attention to where liquidity stays during market stress, not just where it flows during bullish periods.

Centralization vs Decentralization: The Key L2 Debate

One of the biggest conversations around Layer 2s going into 2026 is centralization risk.

Many popular L2s still operate with:

- Centralized sequencers

- Limited validator participation

- Governance structures controlled by small groups

While this has helped performance and user experience, it raises long-term questions about trust, censorship resistance, and resilience.

In 2026, the L2s most likely to stand out will be those that can gradually decentralize without sacrificing usability — a difficult but necessary balance.

Bitcoin, MegaETH, and the Expanding L2 Narrative

Ethereum is not the only chain influencing the Layer 2 story.

- Bitcoin L2 discussions are evolving, especially around scalability and settlement layers

- New architectures like MegaETH are pushing performance boundaries and rethinking how execution environments work

These developments suggest that the Layer 2 concept itself is expanding — from a single solution into a multi-chain scaling framework.

For users, this means more choice — but also more complexity when navigating ecosystems.

What This Means for Users and Traders in 2026

As Layer 2s mature, the focus shifts from "Which L2 is fastest?" to:

- Where is liquidity stable?

- How decentralized is the network?

- Can users manage assets across multiple chains efficiently?

This is where tools matter. Platforms like Cwallet help users track assets across Layer 1s and Layer 2s, manage liquidity exposure, and trade without constantly jumping between ecosystems. As L2 fragmentation increases, having a unified view of assets becomes increasingly valuable.

Looking Ahead: The 2026 Layer 2 Reality

The Layer 2 story in 2026 won't be about explosive experimentation — it will be about consolidation, optimization, and trust.

Adoption is real. Liquidity is selective. And decentralization is no longer optional — it's the next test.For beginners stepping into Web3, understanding these shifts is more important than memorizing protocol names. Layer 2s are becoming infrastructure — and infrastructure shapes everything built on top of it.

Cwallet: Your Secure Command Center for New Crypto Finance

Cwallet is built on the vision that digital asset management should be secure, effortless, and entirely in your hands. It provides an all-in-one platform to manage your portfolio, supporting over 1,000 cryptocurrencies across 60+ major blockchains.

Cwallet makes crypto practical for today. The Cozy Card instantly transforms your holdings into a flexible payment solution for global, secure spending.

Trade your way: Cwallet offers Spot Trading including Swap, Memecoins, and xStocks, and Futures Trading such as Perpetual Trading, 1001X, Trend Trade, and Market Battle.

Stay connected: In-app IM chat lets you discuss strategies and follow the market in real time.

Cwallet also provides practical tools like HR Bulk Management and Mobile Top-ups, empowering you to manage your digital wealth with confidence.

Join millions who are transforming the way they manage their digital assets.

Official Link

Official Site: https://cwallet.com

Twitter: https://twitter.com/CwalletOfficial

Disclaimer

This content is strictly for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it an offer or solicitation to buy, sell, or hold any digital asset. Crypto assets involve high volatility and risks, and their value can fluctuate greatly. Readers must be aware of and adhere to the relevant local laws and regulations concerning digital assets in their specific jurisdiction, as product availability may vary. All investment decisions must be based on your own research (DYOR) and risk assessment. Some content herein may be generated or assisted by artificial intelligence (AI) tools. The author and platform assume no liability for investment losses.