What are Flash Loans In Crypto Lending?

Flash loans are simply loans given to execute a transaction immediately and within the same transaction on the blockchain. This is made possible by smart contracts, which make the whole process automated. Smart contracts help automate the whole lending process, from borrowing to repayment

At the speed of light, many innovations are storming the world of blockchain and cryptocurrency, providing unending options for stakeholders.

Like many other blockchain/crypto sectors, lending is fast gaining ground, and where factors like collateral restrict crypto lending, flash loans save the day.

Unlike other types of crypto loans, which can be straightforward in execution, flash loans are not like that. Flash loans require a more technical understanding of technical DeFi terms. However, in this article, we have simplified the whole concept for you.

This article explains everything you need to know about flash loans.

What are Crypto Flash Loans?

Flash loans allow users to borrow large sums of cryptocurrency without requiring any collateral, as long as the loan is repaid within the same transaction.

Unlike traditional loans, where borrowers must provide collateral upfront and lenders assess creditworthiness, flash loans use smart contracts on blockchain networks like Ethereum. This means borrowers can programmatically access funds, execute financial transactions, and repay the loan in a single atomic transaction.

Flash loans first gained prominence with the rise of decentralized finance (DeFi) platforms, particularly on the Ethereum blockchain. The concept was popularized by Marble Protocol in 2018, which introduced the first implementation of flash loans on Ethereum. However, it was not until the explosive growth of DeFi in 2020 that flash loans became widely used within the ecosystem.

How Do Flash Loans Work?

Flash loans are simply loans given to execute a transaction immediately and within the same transaction on the blockchain. This is made possible by smart contracts, which make the whole process automated. Smart contracts help automate the whole lending process, from borrowing to repayment. In fact, the terms of the loan are also predetermined. Flash loans serve as leverage for investors who would like to profit within a single transaction.

Here’s how a flash loan works in simple steps;

- You apply for a flash loan

- For your transaction, you create a series of transactions, also known as arbitrary logic, which include sales, swaps, etc., that you hope will result in a profit. However, whatever these transactions are, the last transaction in that series must be the repayment of the loan.

- You repay the loan, repay the fee, and take your profit.

Features of Flash Loans

Instant Transactions

Flash loans are renowned for their instantaneous nature, allowing users to borrow and repay funds within the same transaction block on the blockchain. This rapid execution is made possible by smart contracts, which automate the borrowing and lending process. Unlike traditional loans that may require days for approval and settlement, flash loans enable borrowers to access liquidity instantly.

It allows for the swift execution of complex financial strategies, such as arbitrage, yield farming, and collateral swapping, without the need for upfront capital or collateral. This real-time access to liquidity enhances market efficiency and enables users to capitalize on temporary market inefficiencies or price disparities more effectively.

Lack of collateral requirement

One of the most distinctive features of flash loans is the absence of collateral requirements. Unlike other types of crypto lending that require the provision of collateral to secure the loan, flash loans rely solely on the borrower's ability to repay the borrowed funds within the same transaction block.

The lack of collateral requirements also reduces barriers to entry for borrowers, enabling a broader range of users to participate in DeFi activities.

Potential for arbitrage and speculation

Flash loans offer immense potential for arbitrage and speculation within the cryptocurrency markets. Arbitrage opportunities arise when there are price discrepancies between different trading platforms or liquidity pools, allowing traders to profit from the price differentials by buying low and selling high. Flash loans enable traders to capitalize on these opportunities instantly, leveraging borrowed funds to execute arbitrage trades within the same transaction block.

In addition to arbitrage, flash loans also enable speculation on various DeFi protocols, tokens, and assets. Traders can use flash loans to enter leveraged positions, participate in yield farming strategies, or engage in liquidity provision activities without the need for significant upfront capital.

Who Can Engage In Flash Loans?

Crypto flash loans can be quite technical, requiring a lot of speculation about how the markets will work and respond. Without a doubt, speculation requires a lot of technical knowledge and expertise which may not be available to newbies. As a result, the most successful flash loan applicants are experienced DeFi users. Also, only seasoned DeFi investors and traders who can speculate well and use the opportunity to arbitrage can execute flash loans.

The risk involved in flash loans is high, and the transactions could easily go wrong. Since speculation is required, the chances of success can be as low as it can be high. If a speculation goes wrong and traders are unable to make instant profits, then the entire transaction will roll back. The need for experience and technical expertise is glaring.

However, if you're relatively new to DeFi trading, you can start your crypto lending journey with collateralized loans – a type of crypto lending perfect for beginners and intermediate traders who do not understand the intricacies involved in smart contracts.

Uncollateralized loans are pretty common, and can be found on both DeFi and CeFi platforms like Cwallet.

Crypto Lending On Cwallet

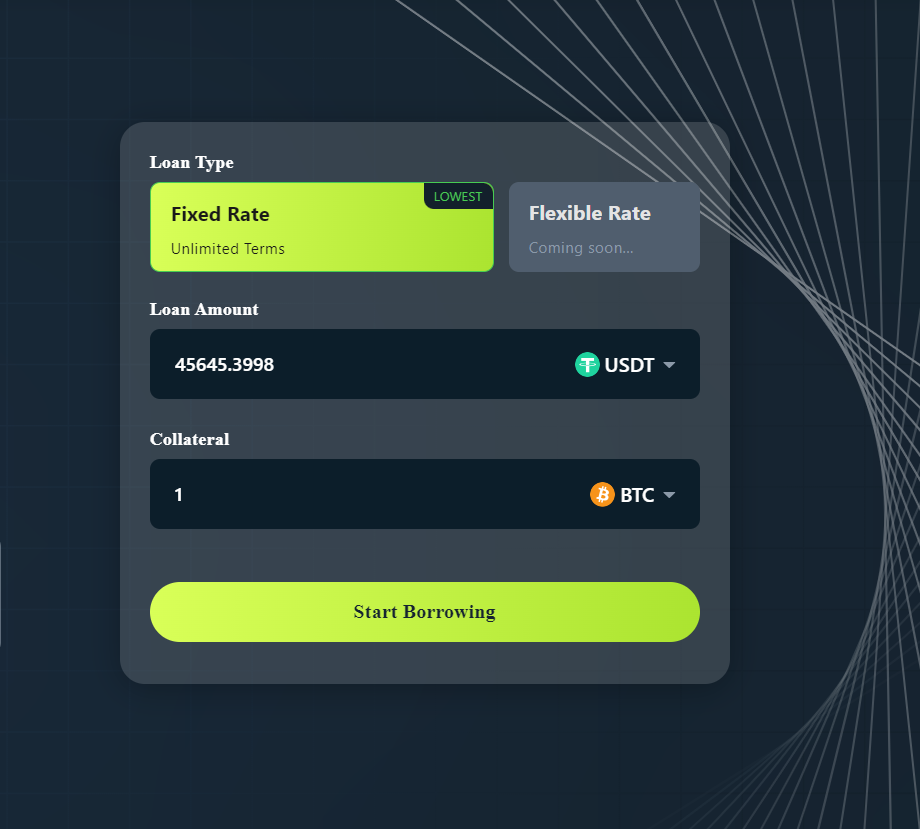

Cwallet is a multifunctional crypto wallet, offering a crypto lending feature that allows users to secure loans against their crypto assets at very low interest rates.

This service combines the functionalities of a wallet with those of a comprehensive exchange platform, making it easy to own and manage crypto assets. Cwallet's crypto lending feature is designed to be cost-effective and user-friendly, accommodating diverse borrowing needs for both short and extended periods. Cwallet's approach prioritizes simplicity and accessibility, catering to users of all expertise levels.

Cwallet supports lending in multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), allowing you to use 10+ common cryptocurrencies as your collateral, while enjoying a whopping 65% LTV ratio.

most competitive interest rates for borrowing in the market. The interest rate is calculated based on the hourly accrued interests. Also, you can decide to repay any amount at any time. Loans on Cwallet exist indefinitely without any borrowing term and as such do not become overdue.

End Note

All things considered, flash loans are an innovative move forward for decentralized finance, providing access to liquidity and financial innovation never before possible in the blockchain world. Flash loans are expected to have a bigger influence on how decentralized finance develops in the future as DeFi grows and changes.

As we look to the future, flash loans are poised to continue driving the innovation of DeFi, reshaping financial markets, and empowering individuals. Flash loans have the potential to pioneer a more inclusive, efficient, and resilient financial landscape for generations to come.

Flash loans require sufficient expertise to yield some returns. With speculations and a game of numbers, flash loans could easily flip badly causing a default in payments if speculations go wrong and investments don’t go as planned. As a result, collateralized loans are recommended for crypto traders/enthusiasts with limited technical knowledge.

Remember, Cwallet offers collateralized crypto loans at competitive rates. Get started with Cwallet today!